Current Report Filing (8-k)

July 22 2015 - 4:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

July 20, 2015

THE CHEESECAKE FACTORY INCORPORATED

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

0-20574 |

|

51-0340466 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification

No.) |

26901 Malibu Hills Road

Calabasas Hills, California 91301

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code:

(818) 871-3000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14.d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

The following information is intended to be furnished under Item 2.02 of Form 8-K, “Results of Operations and Financial Condition.” This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this report, regardless of any general incorporation language in the filing.

In a press release dated July 22, 2015, The Cheesecake Factory Incorporated (the “Company”) reported financial results for the second quarter of fiscal 2015, which ended on June 30, 2015. Total revenues were $529.1 million in the second quarter of fiscal 2015 as compared to $496.4 million in the prior year second quarter. Net income and diluted net income per share were $34.7 million and $0.69, respectively, in the second quarter of fiscal 2015. The full text of the press release is furnished herewith as Exhibit 99.1 to this Report.

ITEM 8.01 OTHER EVENTS

On July 20, 2015, the Board of Directors of the Company declared a quarterly cash dividend to its stockholders. A dividend of $0.20 per share will be paid on August 18, 2015 to the stockholders of record at the close of business on August 5, 2015 of each share of the Company’s common stock. Future dividends, if any, will be subject to Board approval. On July 22, 2015, the Company included in its press release, attached hereto as Exhibit 99.1 and described in Item 2.02 above, an announcement of the declaration of the dividend. The full text of the press release is furnished as Exhibit 99.1 to this Report and is hereby incorporated by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

|

99.1 |

|

Press release dated July 22, 2015 entitled, “The Cheesecake Factory Reports Results for Second Quarter of Fiscal 2015” |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: July 22, 2015 |

THE CHEESECAKE FACTORY INCORPORATED |

|

|

|

|

|

|

|

|

By: |

/s/ W. Douglas Benn |

|

|

|

W. Douglas Benn |

|

|

|

Executive Vice President and Chief Financial Officer |

3

EXHIBIT INDEX

|

Exhibit |

|

Description |

|

99.1 |

|

Press release dated July 22, 2015 entitled, “The Cheesecake Factory Reports Results for Second Quarter of Fiscal 2015” |

4

EXHIBIT 99.1

PRESS RELEASE

|

FOR IMMEDIATE RELEASE |

Contact: Jill Peters |

|

|

(818) 871-3000 |

|

|

investorrelations@thecheesecakefactory.com |

THE CHEESECAKE FACTORY REPORTS RESULTS FOR

SECOND QUARTER OF FISCAL 2015

Company Announces 21 Percent Increase in Quarterly Dividend

Calabasas Hills, CA — July 22, 2015 — The Cheesecake Factory Incorporated (NASDAQ: CAKE) today reported financial results for the second quarter of fiscal 2015, which ended on June 30, 2015.

Total revenues were $529.1 million in the second quarter of fiscal 2015 as compared to $496.4 million in the prior year second quarter. Net income and diluted net income per share were $34.7 million and $0.69, respectively, in the second quarter of fiscal 2015.

Operating Results

Comparable restaurant sales at The Cheesecake Factory restaurants increased 2.8% in the second quarter of fiscal 2015.

“We delivered high quality results in the second quarter driven by a strong comparable sales increase at The Cheesecake Factory, marking our 22nd consecutive quarter of comparable sales gains and another in which we outperformed the industry by a solid margin,” said David Overton, Chairman and Chief Executive Officer.

“Our business is performing well across multiple dimensions. We are operating our restaurants effectively, improving in key areas such as food efficiency, and maintaining our high guest satisfaction scores. In addition, favorability in the cost areas that heavily impacted us last year contributed to significant margin expansion and growth in earnings per share. We are well positioned as we enter the second half of the year, with our newer restaurants performing well and our core business on solid ground,” continued Overton.

Development

The Company opened two The Cheesecake Factory restaurants and one Grand Lux Cafe restaurant during the second quarter of fiscal 2015. The Company continues to expect it will open as many as 11 Company-owned restaurants domestically in fiscal 2015.

26901 Malibu Hills Road, Calabasas Hills, CA 91301 · Telephone (818) 871-3000 · Fax (818) 871-3100

Internationally, the Company anticipates no change to as many as three planned restaurant openings in the Middle East and Mexico under licensing agreements in fiscal 2015, one of which opened earlier in the year in Mexico City.

Capital Allocation

The Company’s Board of Directors declared a quarterly cash dividend of $0.20 per share on the Company’s common stock, which equates to a 21% increase in the Company’s quarterly dividend. The dividend is payable on August 18, 2015 to shareholders of record at the close of business on August 5, 2015.

During the second quarter of fiscal 2015, the Company repurchased 77,340 shares of its common stock at a cost of $3.8 million. Year-to-date, the Company repurchased 1.7 million shares of its common stock at a cost of $84.2 million. The Company continues to expect that it will return its free cash flow to shareholders in fiscal 2015 in the form of dividends and share repurchases.

“Based on the confidence that we have in the strength of our Company, our prospects for continued global growth, and the significant level of cash that our business generates, we took another meaningful step forward with our dividend and in our ongoing commitment to increase total shareholder return,” concluded Overton.

Conference Call and Webcast

The Company will hold a conference call to review its results for the second quarter of fiscal 2015 today at 2:00 p.m. Pacific Time. The conference call will be webcast live on the Company’s website at investors.thecheesecakefactory.com and a replay of the webcast will be available through August 22, 2015.

About The Cheesecake Factory Incorporated

The Cheesecake Factory Incorporated created the upscale casual dining segment in 1978 with the introduction of its namesake concept. The Company, through its subsidiaries, owns and operates 192 full-service, casual dining restaurants throughout the U.S.A. and Puerto Rico, including 179 restaurants under The Cheesecake Factory® mark; 12 restaurants under the Grand Lux Cafe® mark; and one restaurant under the RockSugar Pan Asian Kitchen® mark. Internationally, nine The Cheesecake Factory® restaurants operate under licensing agreements. The Company’s bakery division operates two bakery production facilities, in Calabasas Hills, CA and Rocky Mount, NC, that produce quality cheesecakes and other baked products for its restaurants, international licensees and third-party bakery customers. In 2015, the Company was named to the FORTUNE Magazine “100 Best Companies to Work For®” list for the second consecutive year. To learn more about the Company, visit www.thecheesecakefactory.com.

FORTUNE and 100 Best Companies to Work For® are registered trademarks of Time Inc. and are used under license. From FORTUNE Magazine, March 15, 2015 ©2015 Time Inc. FORTUNE and Time Inc. are not affiliated with, and do not endorse products or services of, The Cheesecake Factory Incorporated.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements, including uncertainties related to the Company’s ability to: consistently deliver dependable comparable sales results over a sustained period of time; outperform the casual dining industry; leverage sales increases and manage flow through; improve its food efficiency and maintain high guest satisfaction scores; expand its operating margin and deliver earnings per share growth; open new restaurants that perform well; utilize capital effectively and continue to repurchase its common stock; realize opportunities for growth both domestically and internationally; continue to generate high levels of cash; and increase shareholder value. In addition, forward-looking statements made in the press release include uncertainties related to: factors outside of the Company’s control that impact consumer confidence and spending; current and future macroeconomic conditions; acceptance and success of The Cheesecake Factory in international markets; changes in unemployment rates; the economic health of the Company’s landlords and other tenants in retail centers in which its restaurants are located; the economic health of suppliers, licensees, vendors and other third parties providing goods or services to the Company; adverse weather conditions in regions in which the Company’s restaurants are located; factors that are under the control of government agencies, landlords and other third parties; and other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”), as set forth below. Investors are cautioned that forward-looking statements are not guarantees of future performance and that undue reliance should not be placed on such statements. Forward-looking statements speak only as of the dates on which they are made and the Company undertakes no obligation to publicly update or revise any forward-looking statements or to make any other forward-looking statements, whether as a result of new information, future events or otherwise, unless required to do so by securities laws. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s latest Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as filed with the SEC, which are available at www.sec.gov.

The Cheesecake Factory Incorporated and Subsidiaries

Consolidated Financial Statements

(unaudited; in thousands, except per share and statistical data)

|

|

|

13 Weeks Ended |

|

13 Weeks Ended |

|

26 Weeks Ended |

|

26 Weeks Ended |

|

|

|

|

June 30, 2015 |

|

July 1, 2014 |

|

June 30, 2015 |

|

July 1, 2014 |

|

|

Consolidated Statements of Operations |

|

Amounts |

|

Percent of

Revenue |

|

Amounts |

|

Percent of

Revenue |

|

Amounts |

|

Percent of

Revenue |

|

Amounts |

|

Percent of

Revenue |

|

|

Revenues |

|

$ |

529,107 |

|

100.0 |

% |

$ |

496,406 |

|

100.0 |

% |

$ |

1,047,080 |

|

100.0 |

% |

$ |

977,837 |

|

100.0 |

% |

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

126,623 |

|

23.9 |

% |

120,667 |

|

24.3 |

% |

253,235 |

|

24.2 |

% |

240,029 |

|

24.5 |

% |

|

Labor expenses |

|

168,495 |

|

31.8 |

% |

160,777 |

|

32.4 |

% |

339,664 |

|

32.5 |

% |

320,227 |

|

32.7 |

% |

|

Other operating costs and expenses |

|

123,675 |

|

23.4 |

% |

119,577 |

|

24.1 |

% |

247,110 |

|

23.6 |

% |

235,210 |

|

24.1 |

% |

|

General and administrative expenses |

|

35,345 |

|

6.7 |

% |

29,042 |

|

5.9 |

% |

68,420 |

|

6.5 |

% |

60,284 |

|

6.2 |

% |

|

Depreciation and amortization expenses |

|

21,158 |

|

4.0 |

% |

20,534 |

|

4.1 |

% |

42,335 |

|

4.0 |

% |

40,785 |

|

4.2 |

% |

|

Impairment of assets and lease terminations |

|

— |

|

— |

|

510 |

|

0.1 |

% |

— |

|

— |

|

696 |

|

0.1 |

% |

|

Preopening costs |

|

4,058 |

|

0.8 |

% |

2,608 |

|

0.5 |

% |

5,509 |

|

0.5 |

% |

4,842 |

|

0.5 |

% |

|

Total costs and expenses |

|

479,354 |

|

90.6 |

% |

453,715 |

|

91.4 |

% |

956,273 |

|

91.3 |

% |

902,073 |

|

92.3 |

% |

|

Income from operations |

|

49,753 |

|

9.4 |

% |

42,691 |

|

8.6 |

% |

90,807 |

|

8.7 |

% |

75,764 |

|

7.7 |

% |

|

Interest and other (expense)/income, net |

|

(1,432 |

) |

(0.3 |

)% |

(1,544 |

) |

(0.3 |

)% |

(3,327 |

) |

(0.3 |

)% |

(2,935 |

) |

(0.3 |

)% |

|

Income before income taxes |

|

48,321 |

|

9.1 |

% |

41,147 |

|

8.3 |

% |

87,480 |

|

8.4 |

% |

72,829 |

|

7.4 |

% |

|

Income tax provision |

|

13,597 |

|

2.5 |

% |

11,098 |

|

2.2 |

% |

24,333 |

|

2.4 |

% |

20,262 |

|

2.0 |

% |

|

Net income |

|

$ |

34,724 |

|

6.6 |

% |

$ |

30,049 |

|

6.1 |

% |

$ |

63,147 |

|

6.0 |

% |

$ |

52,567 |

|

5.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per share |

|

$ |

0.72 |

|

|

|

$ |

0.61 |

|

|

|

$ |

1.29 |

|

|

|

$ |

1.05 |

|

|

|

|

Basic weighted average shares outstanding |

|

48,451 |

|

|

|

49,349 |

|

|

|

48,838 |

|

|

|

50,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net income per share |

|

$ |

0.69 |

|

|

|

$ |

0.59 |

|

|

|

$ |

1.25 |

|

|

|

$ |

1.01 |

|

|

|

|

Diluted weighted average shares outstanding |

|

50,262 |

|

|

|

51,358 |

|

|

|

50,681 |

|

|

|

52,098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Segment Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Cheesecake Factory restaurants |

|

$ |

483,285 |

|

|

|

$ |

451,454 |

|

|

|

$ |

956,102 |

|

|

|

$ |

888,060 |

|

|

|

|

Other |

|

45,822 |

|

|

|

44,952 |

|

|

|

90,978 |

|

|

|

89,777 |

|

|

|

|

|

|

$ |

529,107 |

|

|

|

$ |

496,406 |

|

|

|

$ |

1,047,080 |

|

|

|

$ |

977,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Cheesecake Factory restaurants |

|

$ |

77,292 |

|

|

|

$ |

65,046 |

|

|

|

$ |

143,993 |

|

|

|

$ |

123,036 |

|

|

|

|

Other |

|

5,263 |

|

|

|

4,589 |

|

|

|

11,326 |

|

|

|

9,015 |

|

|

|

|

Corporate |

|

(32,802 |

) |

|

|

(26,944 |

) |

|

|

(64,512 |

) |

|

|

(56,287 |

) |

|

|

|

|

|

$ |

49,753 |

|

|

|

$ |

42,691 |

|

|

|

$ |

90,807 |

|

|

|

$ |

75,764 |

|

|

|

|

Selected Consolidated Balance Sheet Information |

|

June 30, 2015 |

|

December 30, 2014 |

|

|

|

|

Cash and cash equivalents |

|

$ |

61,548 |

|

$ |

58,018 |

|

|

|

|

Total assets |

|

1,174,790 |

|

1,176,452 |

|

|

|

|

Long-term debt |

|

25,000 |

|

— |

|

|

|

|

Total liabilities |

|

625,671 |

|

619,942 |

|

|

|

|

Stockholders’ equity |

|

549,119 |

|

556,510 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 Weeks Ended |

|

13 Weeks Ended |

|

26 Weeks Ended |

|

26 Weeks Ended |

|

|

Supplemental Information |

|

June 30, 2015 |

|

July 1, 2014 |

|

June 30, 2015 |

|

July 1, 2014 |

|

|

The Cheesecake Factory comparable restaurant sales |

|

2.8 |

% |

1.5 |

% |

3.5 |

% |

1.5 |

% |

|

Restaurants opened during period |

|

3 |

|

2 |

|

3 |

|

3 |

|

|

Restaurants open at period-end |

|

192 |

|

182 |

|

192 |

|

182 |

|

|

Restaurant operating weeks |

|

2,466 |

|

2,355 |

|

4,923 |

|

4,702 |

|

Reconciliation of Non-GAAP Results to GAAP Results

In addition to the results provided in accordance with Generally Accepted Accounting Principles (“GAAP”) in this press release, the Company is providing non-GAAP measurements which present net income and diluted net income per share excluding the impact of certain items.

The non-GAAP measurements are intended to supplement the presentation of the Company’s financial results in accordance with GAAP. The Company believes that the presentation of these items provides additional information to facilitate the comparison of past and present financial results.

|

|

|

13 Weeks Ended |

|

13 Weeks Ended |

|

26 Weeks Ended |

|

26 Weeks Ended |

|

|

|

|

June 30, 2015 |

|

July 1, 2014 |

|

June 30, 2015 |

|

July 1, 2014 |

|

|

|

|

(unaudited; in thousands, except per share data) |

|

|

Net income (GAAP) |

|

$ |

34,724 |

|

$ |

30,049 |

|

$ |

63,147 |

|

$ |

52,567 |

|

|

After-tax impact from: |

|

|

|

|

|

|

|

|

|

|

- Impairment of assets and lease terminations (1) |

|

— |

|

306 |

|

— |

|

418 |

|

|

Net income (non-GAAP) |

|

$ |

34,724 |

|

$ |

30,355 |

|

$ |

63,147 |

|

$ |

52,985 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net income per share (GAAP) |

|

$ |

0.69 |

|

$ |

0.59 |

|

$ |

1.25 |

|

$ |

1.01 |

|

|

After-tax impact from: |

|

|

|

|

|

|

|

|

|

|

- Impairment of assets and lease terminations |

|

— |

|

0.01 |

|

— |

|

0.01 |

|

|

Diluted net income per share (non-GAAP) (2) |

|

$ |

0.69 |

|

$ |

0.59 |

|

$ |

1.25 |

|

$ |

1.02 |

|

(1) The pre-tax amounts associated with these items in fiscal 2014 were $510 in the second quarter and $186 in the first quarter, and were recorded in impairment of assets and lease terminations.

(2) Diluted net income per share may not add due to rounding.

###

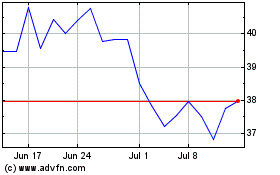

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

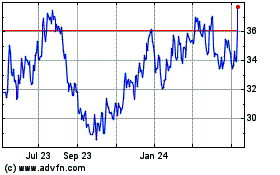

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Apr 2023 to Apr 2024