Commodities Costs Have Restaurants Cutting Closer To The Bone

May 05 2011 - 10:10AM

Dow Jones News

After trimming the obvious fat, restaurant chains are now having

to cut closer to the bone as they look for ways to combat rising

food costs and preserve healthy margins while avoiding significant

price hikes.

"There's only so much low-hanging fruit. After that, you've

really got to strive to get the rest of it, so this year is going

to be a little tougher," said Alice LeBlanc, chief global supply

chain officer for AFC Enterprises Inc.'s (AFCE) Popeye's Louisiana

Kitchen.

Most restaurant chains are expecting their commodities costs to

rise as much as 4% this year, but can only afford to push prices up

enough to offset half of that without losing market share.

The fried chicken chain was able to trim about $16 million off

its costs in 2010, bringing franchisees one percentage point of

improvement in restaurant operating profit margins before rent

compared with the prior year.

Popeye's made its distribution more efficient by ensuring every

truckload was full and by negotiating longer-term contracts with

suppliers that are more beneficial to both parties. The fast food

chain also created a purchasing co-op to leverage its volume and

pay lower prices.

"No one would've anticipated what we've truly experienced this

year in commodities inflation, so it was incredible that we did

start with the cost cutting when we did," LeBlanc said.

Now, Popeye's is on to the little things.

"When we were making a lot of money, we didn't really think

about the little things, because who wants to think about cleaning

solution or bathroom products," LeBlanc said. "But now, every

little thing counts. It all adds up."

Darden Restaurants Inc. (DRI) Chief Operating Officer Andrew

Madsen says the operator of Olive Garden, Red Lobster and Longhorn

Steakhouse chains has four cost-saving projects underway to help

offset the elevated cost pressures.

The company is automating its supply chain; centralizing

restaurant facilities repair and maintenance programs; adopting

more sustainable restaurant operating practices for energy, water

and cleaning supplies usage; and implementing an in-restaurant

labor optimization program. Darden estimates these changes can save

it $110 million to $130 million.

"We want to use those savings to help protect our price point

accessibility and breadth of appeal of our brands, and not suffer

any margin dilution at all," Madsen said on a conference call.

DineEquity Inc. (DIN) Chief Executive Julia Stewart says

DineEquity continues working with franchisees at its Applebee's and

IHOP restaurant chains to find cost reductions that will help them

through these tough times.

Lately, at IHOP, it has implemented new tools that help with

food portioning to reduce waste, which in turn lowers food

costs.

"It's an ongoing effort, every month we look at options to cut

where we can," Stewart said. "Yes, we did already get the obvious

things, but as a restaurant operator, you'll never get me to say

there isn't another way to cut costs. You can always find a

way."

Cheesecake Factory Inc. (CAKE) says it's implementing $3 million

to $5 million in cost savings initiatives in the second half of the

year, as well as ongoing improvements in labor productivity.

Texas Roadhouse Inc. (TXRH) suffered a decline in its

restaurant-level margins, despite its same-store sales rising in

the first quarter with guest traffic up 4.2%, because the

restaurant refrained from raising menu prices to levels that would

fully offset its 3% commodities cost inflation.

To stick with its low prices, Texas Roadhouse Chief Financial

Officer Scott Colosi says the steakhouse has contracted out

expenses such as electric, gas, waste management and phones,

continually negotiating those contracts downward.

"We're always looking at our purchasing power to see what we can

do," Colosi said on a conference call. "And we continue to

challenge folks on the labor end, particularly, how early people

come in to start their shifts and when they leave, and we try to

match that up with the business."

Brinker International Inc. (EAT) Chief Financial Officer Guy

Constant says its Chili's bar and grill chain's "kitchen retrofit"

program, being rolled out now, optimizes the labor component of the

food preparation process, among other efficiencies. He expects it

to result in a noticeable reduction in labor and cost of sales

through reduced waste. It could also bring utility savings because

the new equipment is much more energy efficient, he added.

-By Annie Gasparro, Dow Jones Newswires; 212-416-2244;

annie.gasparro@dowjones.com

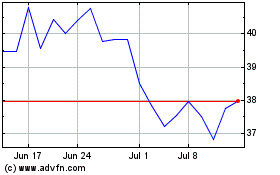

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

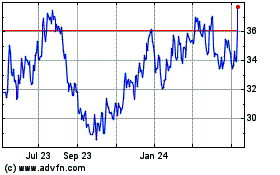

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Apr 2023 to Apr 2024