UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 12, 2014

China Automotive Systems, Inc.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

000-33123 |

33-0885775 |

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

No. 1 Henglong

Road, Yu Qiao Development Zone

Shashi District,

Jing Zhou City

Hubei Province

The People’s

Republic of China

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including

area code (86) 27-8757 0027

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item

2.02 | Results

of Operations and Financial Condition |

On November 12, 2014, China Automotive

Systems, Inc. (the “Company”) issued a press release announcing financial results for the third quarter and nine months

ended September 30, 2014. The press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and in Exhibit

99.1 attached to this Form 8-K is furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section.

| Item

9.01 | Financial

Statements and Exhibits |

| Exhibit No |

|

Description |

| |

|

|

| 99.1 |

|

Press Release of China Automotive Systems, Inc., dated November 12, 2014. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

|

China Automotive Systems, Inc. |

| |

|

(Registrant) |

| |

|

|

|

| Date: November 13, 2014 |

|

By: |

/s/ Hanlin Chen |

| |

|

|

Hanlin Chen |

| |

|

|

Chairman |

EXHIBIT 99.1

China

Automotive Systems AGAIN ReportS

HIGHER QUARTERLY Sales

WUHAN, China, November 12, 2014 -- China

Automotive Systems, Inc. (“CAAS” or the “Company”) (NASDAQ: CAAS), a leading power steering components

and systems supplier in China, today announced its unaudited financial results for the third quarter and nine months ended September

30, 2014.

Third Quarter 2014 Highlights

| · | Net sales increased by 11.9% to a third-quarter record high of $101.7 million,

compared to $90.9 million in the third quarter of 2013. |

| · | Gross profit increased by 24.6% to $20.6 million, compared to $16.5 million

in the third quarter of 2013; gross margin was 20.2%, compared to 18.2% in the third quarter of 2013. |

| · | Net income attributable to parent company’s common shareholders was

$6.7 million, or diluted earnings per share of $0.24, compared to net income attributable to parent company’s common shareholders

of $8.6 million, or diluted earnings per share of $0.31. |

First Nine Months of 2014 Highlights

| · | Net sales increased by 15.9% to $331.5 million, compared to $286.0 million in the first nine months

of 2013. |

| · | Gross profit increased by 17.0% to $63.5 million, compared to $54.3 million in the first nine months

of 2013; gross margin was 19.2% in the first nine months of 2014, compared to 19.0% in the same period last year. |

| · | Operating margin was 10.6%, compared to 9.8% in the first nine months of 2013. |

| · | Diluted earnings per share attributable to parent company's common shareholders was $0.87, compared

to diluted earnings per share attributable to parent company's common shareholders of $0.70 in the first nine

months of 2013. |

| · | Cash and cash equivalents and short-term investments (excluding pledged deposits) were $84.8 million

as of September 30, 2014, compared to $89.5 million as of December 31, 2013. |

Mr. Qizhou Wu, chief executive

officer of CAAS, commented, “We are pleased to report record high sales for any third quarter in the Company's history.

Our 11.9% net sales growth far surpassed the 4.2% sales growth of the Chinese vehicle market in the third quarter as we

continue to capture market share. Despite the slowdown in the vehicle market, a number of our major customers achieved

significant growth. For examples, Dongfeng Peugeot Citroen Automobile's sales climbed by 30% and SAIC-GM-Wuling sales

increased by 14% for the nine months of 2014. We also captured market share as our research and development program continued to

create advanced steering products such as our growing line of electric power steering (EPS) products and updated

hydraulic steering products. Our advanced products are receiving strong acceptance from our customers, and they are leading

our sales growth, especially our mid-sized EPS products."

“During

the third quarter, we continued to grow market share in the North American market as we again expanded our relationship with Chrysler.

We are now supplying to the RAM 4500 and 5500 truck models through a new multi-year agreement, in addition to the RAM 2500 and

3500 trucks. With these additional RAM models, we are now supplying re-circulating ball (RCB) steering gears to all heavy-duty

trucks produced by Fiat Chrysler in North America. After winning Chrysler's 2013 Supplier of the Year Metallic award,

this new agreement is further acknowledgement of the global quality and performance of our steering products to supply Tier 1 vehicle

Original Equipment Manufacturers. We believe North America remains a growth market for us where we can continue to penetrate and

increase market share,” Mr. Wu concluded.

Mr. Jie Li, chief financial officer of

CAAS, commented, “Our strong financial condition provides the resources to support our current growth and positions CAAS

for sustainable future growth. We continue to enhance our research and development and augment our manufacturing efficiencies to

control unit costs as our scale increases. Our acquisition of the remaining minority interests in Jingzhou Henglong and Shashi

Jiulong will enhance our sales and earnings in the near term and give us greater control over their future operations.”

Third Quarter of 2014

In the third quarter of 2014, net sales

increased by 11.9% to a record third-quarter high of $101.7 million, compared to $90.9 million in the same quarter of 2013. The

net sales increase was mainly due to continued vehicle growth in the large Chinese vehicle market, with sales to SAIC-GM-Wuling

Automobile, Dongfeng Peugeot Citroen and others. We continue to expand our sales to Chrysler North America, which is our largest

single customer, with the recent new RAM agreement.

Gross profit increased by 24.6% to $20.6

million in the third quarter of 2014, compared to $16.5 million in the third quarter of 2013. The gross margin was 20.2% in the

third quarter of 2014, versus 18.2% in the third quarter of 2013. The increase in gross margin was mainly due to greater sales

of more advanced electric power steering ("EPS") units with a higher gross margin, and continued production efficiencies.

Gain on other sales was $1.1 million consisting

of net amount retained from the sales of materials and property, plant and equipment. For the third quarter of 2013, the gain on

other sales included $5.0 million from the sale of partial idle land use rights, which represented a pre-tax gain of $4.1 million

calculated based on the difference between the land's selling price and the net book value of the related land use rights.

Selling expenses rose by 42.3% to $3.7

million in the third quarter of 2014, compared to $2.6 million in the third quarter of 2013. Selling expenses represented 3.7%

of net sales in the third quarter of 2014, compared to 2.9% in the third quarter of 2013. The increased selling expenses were primarily

due to increases in transportation expenses and compensation to salesmen resulting from higher sales volume.

General and administrative expenses (“G&A

expenses”) increased by 32.1% to $3.7 million in the third quarter of 2014, compared to $2.8 million in the same quarter

of 2013. The increase in G&A expenses was due primarily to office facilities improvement expenses and higher compensation.

G&A expenses represented 3.7% of net sales in the third quarter of 2014 and 3.1% in the third quarter of 2013.

Research and development expenses (“R&D

expenses”) increased by 5.9% to $5.4 million in the third quarter of 2014, compared to $5.1 million in the third quarter

of 2013. The increase in R&D expenses was mainly due to the development and trial production of the Company's EPS and other

new products, as well as improvement in production molds and higher external technical support fees. R&D expenses represented

5.3% of net sales in the third quarter of 2014 compared with 5.6% in the third quarter of 2013.

Net financial income was $0.4 million in

the third quarter of 2014 compared to net financial income of $0.7 million in the third quarter of 2013.

Income from operations was $8.8 million

in the third quarter of 2014, compared to $11.0 million in the same quarter of 2013. The decrease was mainly due to no gain on

the sale of idle land use rights in the 2014 third quarter versus the gain of $4.1 million in the third quarter of 2013.

Income before income tax expenses and equity

in earnings of affiliated companies was $9.3 million in the third quarter of 2014, compared to $12.2 million in the third quarter

of 2013. The decrease in income before income tax expenses and equity in earnings of affiliated companies was mainly due to lower

operating and net financial income in the third quarter of 2014, compared with the third quarter of 2013.

Net income attributable to parent company’s

common shareholders was $6.7 million in the third quarter of 2014, compared to net income attributable to parent company’s

common shareholders of $8.6 million, including $2.8 million of net income from idle land sales in the corresponding quarter of

2013. Diluted earnings per share were $0.24 in the third quarter of 2014, compared to diluted earnings per share of $0.31, including

$0.10 from idle land sales in the third quarter of 2013.

The weighted average number of diluted

common shares outstanding was 28,063,661 in the third quarter of 2014, compared to 28,062,297 in the third quarter of 2013.

First Nine Months of 2014

Net sales for the first nine months of

2014 increased by 15.9% to a nine-month record high of $331.5 million, compared to $286.0 million in the first nine months of

2013. Nine-month gross profit was $63.5 million, compared to $54.3 million in the corresponding period last year. Nine-month gross

margin was 19.2%, compared to 19.0% for the corresponding period in 2013. For the nine months ended September 30, 2014, gain on

other sales amounted to $10.3 million, compared to $6.8 million for the same period of 2013. This increase of $3.5 million was

mainly due to the higher gain on the sales of land use rights in the second quarter of 2014. During the nine months ended September

30, 2014, CAAS sold its remaining land use rights for a gain of $7.5 million, compared with a $4.1 million gain for the same period

of last year. Income from operations increased by 24.8% to $35.1 million from $28.1 million in the first nine months of 2013.

Operating margin was 10.6%, compared to 9.8% for the corresponding period of 2013. Income before income tax expenses and equity

in earnings of affiliated companies increased 24.4% to $36.2 million from $29.1 million in the first nine months of 2013. Net

income attributable to parent company’s common shareholders increased 25.4% to $24.5 million from $19.5 million in the corresponding

period last year. Diluted earnings per share were $0.87 in the first nine months of 2014, compared to diluted earnings per share

of $0.70 for the corresponding period in 2013.

As of September 30, 2014, total cash and

cash equivalents and short-term investments (excluding pledged deposit) were $84.8 million, compared to $89.5 million as of December

31, 2013. Working capital was $152.4 million as of September 30, 2014, compared to $179.3 million as of December 31, 2013. Total

parent company stockholders' equity was $241.6 million as of September 30, 2014, compared to $226.7 million as of December 31,

2013.

Business Outlook

Management reiterated its revenue guidance

of 15% year-over-year growth for the full year 2014. This target is based on the Company’s current views on operating and

market conditions, which are subject to change.

Conference Call

Management will conduct a conference call

on November 12, 2014 at 8:00 A.M. EST/9:00 P.M. Beijing Time to discuss these results. A question and answer session will follow

management’s presentation. To participate, please call the following numbers 10 minutes before the call start time and ask

to be connected to the “China Automotive Systems” conference call:

Phone Number: +1-877-407-8031 (North America)

Phone Number: +1-201-689-8031 (International)

A telephone replay of the call will be

available after the conclusion of the conference call through 11:59 P.M. EST on December 12, 2014. The dial-in details for the

replay are:

U.S. Toll Free Number +1-877-660-6853

International dial-in number +1-201-612-7415

Use Conference ID “13594621”

to access the replay.

About China Automotive Systems, Inc.

Based in Hubei Province, the People's

Republic of China, China Automotive Systems, Inc. is a leading supplier of power steering components and systems to the Chinese

automotive industry, operating through eight Sino-foreign joint ventures. The Company offers a full range of steering system parts

for passenger automobiles and commercial vehicles. The Company currently offers four separate series of power steering with an

annual production capacity of over 4.0 million sets of steering gears, columns and steering hoses. Its customer base is comprised

of leading auto manufacturers, such as China FAW Group, Corp., Dongfeng Auto Group Co., Ltd., BYD Auto Company Limited, Beiqi

Foton Motor Co., Ltd. and Chery Automobile Co., Ltd. in China, and Chrysler Group LLC. in North America. For more information,

please visit: http://www.caasauto.com.

Forward-Looking Statements

This press release contains statements

that are "forward-looking statements" as defined under the Private Securities Litigation Reform Act of 1995. Forward-looking

statements represent our estimates and assumptions only as of the date of this press release. These forward-looking statements

include statements regarding the qualitative and quantitative effects of the accounting errors, the periods involved, the nature

of the Company's review and any anticipated conclusions of the Company or its management and other statements that are not historical

facts. Our actual results may differ materially from the results described in or anticipated by our forward-looking statements

due to certain risks and uncertainties. As a result, the Company's actual results could differ materially from those contained

in these forward-looking statements due to a number of factors, including those described under the heading "Risk Factors"

in the Company's Form 10-K annual report filed with the Securities and Exchange Commission on March 31, 2014, and the Company's

Form 10-Q quarterly report for the quarterly period ended June 30, 2014, filed with the Securities and Exchange Commission on

August 13, 2014, and in documents subsequently filed by the Company from time to time with the Securities and Exchange Commission.

We expressly disclaim any duty to provide updates to any forward-looking statements made in this press release, whether as a result

of new information, future events or otherwise.

For further information, please contact:

Jie Li

Chief Financial Officer

China Automotive Systems, Inc.

Email: jieli@chl.com.cn

Kevin Theiss

Investor Relations

Grayling

Tel: +1-646-284-9409

Email: kevin.theiss@grayling.com

(Tables Follow)

China Automotive Systems, Inc. and Subsidiaries

Condensed Unaudited Consolidated Balance

Sheets

(In thousands of USD unless otherwise

indicated)

| | |

September 30, 2014 | | |

December 31, 2013 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 41,569 | | |

$ | 53,979 | |

| | |

| | | |

| | |

| Pledged cash deposits | |

| 31,703 | | |

| 33,963 | |

| | |

| | | |

| | |

| Short-term investments | |

| 43,266 | | |

| 35,510 | |

| | |

| | | |

| | |

| Accounts and notes receivable, net - unrelated parties | |

| 281,620 | | |

| 267,639 | |

| | |

| | | |

| | |

| Accounts and notes receivable, net - related parties | |

| 22,253 | | |

| 17,194 | |

| | |

| | | |

| | |

| Advance payments and others - unrelated parties | |

| 2,073 | | |

| 3,156 | |

| | |

| | | |

| | |

| Advance payments and others - related parties | |

| 1,715 | | |

| 866 | |

| | |

| | | |

| | |

| Inventories | |

| 72,691 | | |

| 51,392 | |

| | |

| | | |

| | |

| Assets held for sale | |

| - | | |

| 925 | |

| | |

| | | |

| | |

| Current deferred tax assets | |

| 6,419 | | |

| 5,783 | |

| | |

| | | |

| | |

| Total current assets | |

| 503,309 | | |

| 470,407 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 81,710 | | |

| 80,018 | |

| | |

| | | |

| | |

| Intangible assets, net | |

| 1,572 | | |

| 686 | |

| | |

| | | |

| | |

| Other receivables, net - unrelated parties | |

| 1,892 | | |

| 252 | |

| | |

| | | |

| | |

| Other receivables, net - related parties | |

| 48 | | |

| 108 | |

| | |

| | | |

| | |

| Advance payment for property, plant and equipment - unrelated parties | |

| 3,912 | | |

| 3,488 | |

| | |

| | | |

| | |

| Advance payment for property, plant and equipment - related parties | |

| 2,391 | | |

| 2,097 | |

| | |

| | | |

| | |

| Long-term investments | |

| 3,660 | | |

| 4,023 | |

| | |

| | | |

| | |

| Goodwill | |

| 642 | | |

| - | |

| | |

| | | |

| | |

| Non-current deferred tax assets | |

| 4,760 | | |

| 4,528 | |

| | |

| | | |

| | |

| Total assets | |

$ | 603,896 | | |

$ | 565,607 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| | |

| | | |

| | |

| Bank and government loans | |

$ | 45,565 | | |

$ | 37,381 | |

| | |

| | | |

| | |

| Accounts and notes payable - unrelated parties | |

| 203,397 | | |

| 198,419 | |

| | |

| | | |

| | |

| Accounts and notes payable - related parties | |

| 3,837 | | |

| 4,634 | |

| | |

| | | |

| | |

| Customer deposits | |

| 2,979 | | |

| 1677 | |

| | |

| | | |

| | |

| Accrued payroll and related costs | |

| 6,568 | | |

| 7,052 | |

| | |

| | | |

| | |

| Accrued expenses and other payables | |

| 73,340 | | |

| 29,062 | |

| | |

| | | |

| | |

| Accrued pension costs | |

| 6,044 | | |

| 4,626 | |

| | |

| | | |

| | |

| Taxes payable | |

| 8,537 | | |

| 7,792 | |

| | |

| | | |

| | |

| Amounts due to shareholders/directors | |

| 376 | | |

| 312 | |

| | |

| | | |

| | |

| Current deferred tax liabilities | |

| 220 | | |

| 117 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 350,863 | | |

| 291,072 | |

| | |

| | | |

| | |

| Long-term liabilities: | |

| | | |

| | |

| | |

| | | |

| | |

| Advances payable | |

| 2,875 | | |

| 2,764 | |

| | |

| | | |

| | |

| Non-current deferred tax liabilities | |

| 329 | | |

| - | |

| | |

| | | |

| | |

| Total liabilities | |

$ | 354,067 | | |

$ | 293,836 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| | |

| | | |

| | |

Common stock, $0.0001 par value - Authorized - 80,000,000 shares;

Issued–28,260,302 and 28,260,302 shares as of September 30, 2014 and

December 31, 2013, respectively | |

$ | 3 | | |

$ | 3 | |

| | |

| | | |

| | |

| Additional paid-in capital | |

| 27,209 | | |

| 39,565 | |

| | |

| | | |

| | |

| Retained earnings- | |

| | | |

| | |

| | |

| | | |

| | |

| Appropriated | |

| 10,178 | | |

| 10,048 | |

| | |

| | | |

| | |

| Unappropriated | |

| 170,407 | | |

| 146,023 | |

| | |

| | | |

| | |

| Accumulated other comprehensive income | |

| 34,794 | | |

| 32,061 | |

| | |

| | | |

| | |

Treasury stock – 217,283 and 217,283 shares as of September 30, 2014 and

December 31, 2013, respectively | |

| (1,000 | ) | |

| (1,000 | ) |

| | |

| | | |

| | |

| Total parent company stockholders' equity | |

| 241,591 | | |

| 226,700 | |

| | |

| | | |

| | |

| Non-controlling interests | |

| 8,238 | | |

| 45,071 | |

| | |

| | | |

| | |

| Total stockholders' equity | |

| 249,829 | | |

| 271,771 | |

| | |

| | | |

| | |

| Total liabilities and stockholders'

equity | |

$ | 603,896 | | |

$ | 565,607 | |

China Automotive Systems, Inc. and Subsidiaries

Condensed Unaudited Consolidated Statements

of Operations and Comprehensive Income

(In

thousands of USD, except share and per share amounts)

| | |

Three Months Ended September 30, | |

| | |

2014 | | |

2013 | |

Net product sales, including $11,890 and $9,166 to related parties for the

three months ended September 30, 2014 and 2013 | |

$ | 101,735 | | |

$ | 90,919 | |

| | |

| | | |

| | |

Cost of products sold, including $6,069 and $10,500 purchased from related

parties for the three months ended September 30, 2014 and 2013 | |

| 81,152 | | |

| 74,394 | |

| | |

| | | |

| | |

| Gross profit | |

| 20,583 | | |

| 16,525 | |

| | |

| | | |

| | |

| Gain on other sales | |

| 1,132 | | |

| 5,030 | |

| | |

| | | |

| | |

| Less: Operating expenses | |

| | | |

| | |

| | |

| | | |

| | |

| Selling expenses | |

| 3,734 | | |

| 2,647 | |

| | |

| | | |

| | |

| General and administrative expenses | |

| 3,734 | | |

| 2,821 | |

| | |

| | | |

| | |

| Research and development expenses | |

| 5,441 | | |

| 5,117 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 12,909 | | |

| 10,585 | |

| | |

| | | |

| | |

| Income from operations | |

| 8,806 | | |

| 10,970 | |

| | |

| | | |

| | |

| Other income, net | |

| 113 | | |

| 499 | |

| | |

| | | |

| | |

| Financial income, net | |

| 412 | | |

| 689 | |

| | |

| | | |

| | |

| Income before income tax expenses and equity in earnings of affiliated companies | |

| 9,331 | | |

| 12,158 | |

| | |

| | | |

| | |

| Less: Income taxes | |

| 1,387 | | |

| 1,854 | |

| | |

| | | |

| | |

| Equity in earnings of affiliated companies | |

| 82 | | |

| 125 | |

| | |

| | | |

| | |

| Net income | |

| 8,026 | | |

| 10,429 | |

| | |

| | | |

| | |

| Net income attributable to non-controlling interests | |

| 1,293 | | |

| 1,805 | |

| | |

| | | |

| | |

| Net income attributable to parent company’s common shareholders | |

$ | 6,733 | | |

$ | 8,624 | |

| | |

| | | |

| | |

| Comprehensive income: | |

| | | |

| | |

| | |

| | | |

| | |

| Net income | |

$ | 8,026 | | |

$ | 10,429 | |

| | |

| | | |

| | |

| Other comprehensive income: | |

| | | |

| | |

| | |

| | | |

| | |

| Foreign currency translation gain, net of tax | |

| 9 | | |

| 1,218 | |

| | |

| | | |

| | |

| Comprehensive income | |

| 8,035 | | |

| 11,647 | |

| | |

| | | |

| | |

| Comprehensive income attributable to non-controlling interests | |

| 1,293 | | |

| 2,010 | |

| | |

| | | |

| | |

| Comprehensive income attributable to parent company | |

$ | 6,742 | | |

$ | 9,637 | |

| | |

| | | |

| | |

| Net income attributable to parent company’s common shareholders per share | |

| | | |

| | |

| | |

| | | |

| | |

| Basic – | |

$ | 0.24 | | |

$ | 0.31 | |

| | |

| | | |

| | |

| Diluted- | |

$ | 0.24 | | |

$ | 0.31 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding | |

| | | |

| | |

| | |

| | | |

| | |

| Basic | |

| 28,043,019 | | |

| 28,043,019 | |

| | |

| | | |

| | |

| Diluted | |

| 28,063,661 | | |

| 28,062,297 | |

China Automotive Systems, Inc. and Subsidiaries

Condensed Unaudited Consolidated Statements

of Operations and Comprehensive Income

(In

thousands of USD, except share and per share amounts)

| | |

Nine Months Ended September 30, | |

| | |

2014 | | |

2013 | |

Net product sales, including $38,627 and $26,344 to related parties for the

nine months ended September 30, 2014 and 2013 | |

$ | 331,517 | | |

$ | 285,971 | |

| | |

| | | |

| | |

Cost of products sold, including $20,721 and $23,171 purchased from related

parties for the nine months ended September 30, 2014 and 2013 | |

| 268,013 | | |

| 231,696 | |

| | |

| | | |

| | |

| Gross profit | |

| 63,504 | | |

| 54,275 | |

| | |

| | | |

| | |

| Gain on other sales | |

| 10,267 | | |

| 6,762 | |

| | |

| | | |

| | |

| Less: Operating expenses | |

| | | |

| | |

| | |

| | | |

| | |

| Selling expenses | |

| 11,104 | | |

| 9,611 | |

| | |

| | | |

| | |

| General and administrative expenses | |

| 11,056 | | |

| 10,164 | |

| | |

| | | |

| | |

| Research and development expenses | |

| 16,509 | | |

| 13,134 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 38,669 | | |

| 32,909 | |

| | |

| | | |

| | |

| Income from operations | |

| 35,102 | | |

| 28,128 | |

| | |

| | | |

| | |

| Other income, net | |

| 491 | | |

| 573 | |

| | |

| | | |

| | |

| Financial income, net | |

| 598 | | |

| 380 | |

| | |

| | | |

| | |

| Income before income tax expenses and equity in earnings of affiliated companies | |

| 36,191 | | |

| 29,081 | |

| | |

| | | |

| | |

| Less: Income taxes | |

| 6,488 | | |

| 5,172 | |

| | |

| | | |

| | |

| Equity in earnings of affiliated companies | |

| 220 | | |

| 251 | |

| | |

| | | |

| | |

| Net income | |

| 29,923 | | |

| 24,160 | |

| | |

| | | |

| | |

| Net income attributable to non-controlling interests | |

| 5,409 | | |

| 4,616 | |

| | |

| | | |

| | |

| Net income attributable to parent company’s common shareholders | |

$ | 24,514 | | |

$ | 19,544 | |

| | |

| | | |

| | |

| Comprehensive income: | |

| | | |

| | |

| | |

| | | |

| | |

| Net income | |

$ | 29,923 | | |

$ | 24,160 | |

| | |

| | | |

| | |

| Other comprehensive income (loss): | |

| | | |

| | |

| | |

| | | |

| | |

| Foreign currency translation gain (loss), net of tax | |

| (2,413 | ) | |

| 5,265 | |

| | |

| | | |

| | |

| Comprehensive income | |

| 27,510 | | |

| 29,425 | |

| | |

| | | |

| | |

| Comprehensive income attributable to non-controlling interests | |

| 5,006 | | |

| 5,507 | |

| | |

| | | |

| | |

| Comprehensive income attributable to parent company | |

$ | 22,504 | | |

$ | 23,918 | |

| | |

| | | |

| | |

| Net income attributable to parent company’s common shareholders per share | |

| | | |

| | |

| | |

| | | |

| | |

| Basic – | |

$ | 0.87 | | |

$ | 0.70 | |

| | |

| | | |

| | |

| Diluted- | |

$ | 0.87 | | |

$ | 0.70 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding | |

| | | |

| | |

| | |

| | | |

| | |

| Basic | |

| 28,043,019 | | |

| 28,043,019 | |

| | |

| | | |

| | |

| Diluted | |

| 28,063,846 | | |

| 28,054,008 | |

China Automotive

Systems, Inc. and Subsidiaries

Condensed Unaudited Consolidated Statements

of Cash Flows

(In thousands

of USD unless otherwise indicated)

| | |

Nine Months Ended September 30, | |

| | |

2014 | | |

2013 | |

| Cash flows from operating activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Net income | |

$ | 29,923 | | |

$ | 24,160 | |

| | |

| | | |

| | |

| Adjustments to reconcile net income from operations to net cash provided by operating activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Stock-based compensation | |

| 193 | | |

| 194 | |

| | |

| | | |

| | |

| Depreciation and amortization | |

| 11,592 | | |

| 10,964 | |

| | |

| | | |

| | |

| Increase (decrease) in allowance for doubtful accounts | |

| 177 | | |

| (139 | ) |

| | |

| | | |

| | |

| Inventory write downs | |

| 2,531 | | |

| 480 | |

| | |

| | | |

| | |

| Deferred income taxes | |

| (907 | ) | |

| (1,611 | ) |

| | |

| | | |

| | |

| Equity in earnings of affiliated companies | |

| (182 | ) | |

| (251 | ) |

| | |

| | | |

| | |

| Amortization of debt issue cost | |

| - | | |

| 58 | |

| | |

| | | |

| | |

| Gain on fixed assets disposals | |

| (7,500 | ) | |

| (4,288 | ) |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| | |

| | | |

| | |

| (Increase) decrease in: | |

| | | |

| | |

| | |

| | | |

| | |

| Pledged deposits | |

| 1,953 | | |

| 1,413 | |

| | |

| | | |

| | |

| Accounts and notes receivable | |

| (19,173 | ) | |

| (36,803 | ) |

| | |

| | | |

| | |

| Advance payments and others | |

| 328 | | |

| 465 | |

| | |

| | | |

| | |

| Inventories | |

| (17,449 | ) | |

| (9,076 | ) |

| | |

| | | |

| | |

| Increase (decrease) in: | |

| | | |

| | |

| | |

| | | |

| | |

| Accounts and notes payable | |

| 2,363 | | |

| 6,199 | |

| | |

| | | |

| | |

| Customer deposits | |

| 1,313 | | |

| 1,016 | |

| | |

| | | |

| | |

| Accrued payroll and related costs | |

| (423 | ) | |

| 514 | |

| | |

| | | |

| | |

| Accrued expenses and other payables | |

| 597 | | |

| 3,459 | |

| | |

| | | |

| | |

| Accrued pension costs | |

| 1,460 | | |

| 653 | |

| | |

| | | |

| | |

| Taxes payable | |

| 1,257 | | |

| 3,256 | |

| | |

| | | |

| | |

| Advances payable | |

| 8 | | |

| (32 | ) |

| | |

| | | |

| | |

| Net cash provided by operating activities | |

| 8,061 | | |

| 631 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Increase in other receivables | |

| (347 | ) | |

| 158 | |

| | |

| | | |

| | |

| Cash received from property, plant and equipment sales | |

| 6,994 | | |

| 6,282 | |

| | |

| | | |

| | |

| Payments to acquire property, plant and equipment | |

| (11,317 | ) | |

| (9,065 | ) |

| | |

| | | |

| | |

| Payments to acquire intangible assets | |

| (252 | ) | |

| (109 | ) |

| | |

| | | |

| | |

| Purchase of short-term investments | |

| (46,192 | ) | |

| (32,197 | ) |

| | |

| | | |

| | |

| Proceeds from maturities of short-term investments | |

| 38,115 | | |

| - | |

| | |

| | | |

| | |

| Acquisition of Fujian Qiaolong, net of cash acquired | |

| (2,976 | ) | |

| - | |

| | |

| | | |

| | |

| Dividend from investment under cost method | |

| - | | |

| 66 | |

| | |

| | | |

| | |

| Net cash used in investing activities | |

| (15,975 | ) | |

| (34,865 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Proceeds from government and bank loan | |

| 15,836 | | |

| 15,588 | |

| | |

| | | |

| | |

| Repayments of bank loan | |

| (9,590 | ) | |

| (14,758 | ) |

| | |

| | | |

| | |

| Dividends paid to the non-controlling interests | |

| (6,048 | ) | |

| (1,381 | ) |

| | |

| | | |

| | |

| Dividends paid to the shareholders of the Company’s common stock | |

| (4,291 | ) | |

| - | |

| | |

| | | |

| | |

| Increase (decrease) in amounts due to shareholders/directors | |

| 69 | | |

| (40 | ) |

| | |

| | | |

| | |

| Net cash used in financing activities | |

| (4,024 | ) | |

| (591 | ) |

| | |

| | | |

| | |

| Effects of exchange rate on cash and cash equivalents | |

| (472 | ) | |

| 1,878 | |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents | |

| (12,410 | ) | |

| (32,947 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents at beginning of period | |

| 53,979 | | |

| 87,649 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of period | |

$ | 41,569 | | |

$ | 54,702 | |

| | |

| | | |

| | |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

| | |

Nine Months Ended

September 30, | |

| | |

2014 | | |

2013 | |

| Cash paid for interest | |

$ | 893 | | |

$ | 972 | |

| | |

| | | |

| | |

| Cash paid for income taxes | |

| 3,459 | | |

| 4,217 | |

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING

ACTIVITIES:

| | |

Nine Months Ended

September 30, | |

| | |

2014 | | |

2013 | |

| Advance payments for acquiring property, plant and equipment | |

$ | 6,303 | | |

$ | 2,777 | |

| | |

| | | |

| | |

| Non-controlling interests arising as a result of acquisition of Fujian Qiaolong | |

| 2,793 | | |

| - | |

| | |

| | | |

| | |

| Payables for the acquisition of non-controlling interests of Henglong and Jiulong | |

| 37,314 | | |

| - | |

| | |

| | | |

| | |

| Account receivable for the sales of land use rights | |

| 1,890 | | |

| - | |

| | |

| | | |

| | |

| Dividends payable to the Company’s shareholders | |

| 757 | | |

| - | |

| | |

| | | |

| | |

| Dividends payable to non-controlling interests | |

| 4,063 | | |

| 86 | |

| | |

| | | |

| | |

| Dividends receivable from joint venture company | |

| 508 | | |

| - | |

SUPPLEMENTAL DISCLOSURE OF ACQUISITION

| | |

Nine Months Ended

September 30, | |

| | |

2014 | | |

2013 | |

| Purchase consideration settled in cash for Fujian Qiaolong | |

$ | (3,007 | ) | |

$ | - | |

| | |

| | | |

| | |

| Less: cash acquired | |

| 31 | | |

| - | |

| | |

| | | |

. | | |

| Investing cash outflow for acquisitions | |

$ | (2,976 | ) | |

$ | - | |

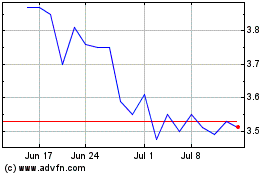

China Automotive Systems (NASDAQ:CAAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

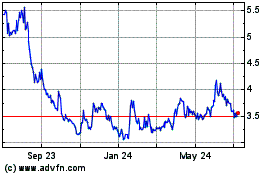

China Automotive Systems (NASDAQ:CAAS)

Historical Stock Chart

From Apr 2023 to Apr 2024