FOURTH CONSECUTIVE YEAR OF ORGANIC SALES

GROWTH

Regulatory News:

Carrefour (Paris:CA):

2015 full-year sales: €86.3bn, +5.3% ex petrol and at

constant exchange rates and +3.0% on an organic basis

- France: Continued growth, +5.3%

ex petrol and +1.1% on an organic basis

- All formats posted growth for the third

consecutive year, illustrating the dynamism of our multi-format

model

- DIA store conversions continue

- International: Growth of +5.3%

ex petrol at constant exchange rates and of +4.5% on an organic

basis

- Accelerating growth in Europe, notably

in Spain and Italy; all countries posted full-year like for like

growth

- Excellent performance in Latin America

in a more difficult environment

- Confirmation of growth in Taiwan,

continued roll-out of action plan in China

Q4 2015 sales: €22.4bn, +4.1% ex petrol and at constant

exchange rates, +2.4% on an organic basis

- France: Growth of +3.3% ex

petrol and of -0.3% on an organic basis

- International: Growth of +4.8%

at constant exchange rates ex petrol and acceleration of organic

growth at +4.5%

2015 Recurring Operating Income

- The group confirms that 2015 ROI will

be in line with expectations of €2.45bn

Q4 and full-year 2015 consolidated

sales inc. VAT

Fourth quarter 2015 Full-year 2015

Sales inc.

VAT (€m)

Organic

growth

Total variation

at constant

exch. rates

ex. petrol

Sales inc.

VAT (€m)

Organic

growth

Total variation

at constant

exch. rates

ex. petrol

France 10,663 -0.3% +3.3% 40,601 +1.1%

+5.3% International 11,768 +4.5% +4.8% 45,694

+4.5% +5.3%

Group 22,430 +2.4%

+4.1% 86,294 +3.0%

+5.3%

Total sales under banners including petrol in full-year 2015

reached €104.4bn at constant exchange rates, up +4.5% at constant

exchange rates. They stood at €26.9bn at constant exchange rates in

Q4 2015, up +2.7%.

FULL-YEAR 2015 SALES INC. VAT

France

Sales inc. VAT(€m)

Ex petrol Ex calendar LFL

Organic

growth

France 40,601 +1.3% +1.1%

Hypermarkets 21,369 +0.6% +0.8% Supermarkets 13,066 +1.9%

+1.3% Convenience and other formats 6,166 +2.7% +2.9%

In 2015, France posted organic growth of +1.1%, on top of

an already positive comparable basis of +1.2% in 2014 and of +1.3%

in 2013. All formats posted organic growth for the third

consecutive year.

International

Sales inc. VAT (€m) Ex petrol

Ex calendar LFL

Organic

growth

International 45,694 +3.3%

+4.5% Other European countries 22,127 +1.8% +1.2%

Latin America 16,107 +11.7% +15.7% Asia 7,459 -10.3%

-9.5%

Organic sales in international markets were up by +4.5%

in 2015. For the first time in seven years, Europe posted sales

growth. Sales in Latin America were up strongly, at +11.7%, as

Brazil posted further growth, with organic sales up by +12.6%. In

Asia, organic sales were down by 9.5%.

2015 FOURTH QUARTER SALES INC. VAT

France

Sales inc. VAT (€m) Ex petrol

Ex calendar LFL

Organic

growth

France 10,663 +0.2% -0.3%

Hypermarkets 5,835 -0.7% -0.5% Supermarkets 3,349 +1.5%

+0.6% Convenience and other formats 1,479 +1.1% -0.1%

In the fourth quarter, France posted further LFL growth

of +0.2% on the back of a high comparable base (+1.1%).

Sales at hypermarkets were down by 0.5% on an organic

basis. Non-food sales were impacted by particularly mild

temperatures, notably in December.

Sales at supermarkets rose by +0.6% on an organic basis.

LFL sales were up by +1.5% on top of a particularly challenging

comparable base of +2.6% in 2014 and +3.2% in 2013.

Sales in convenience and other formats confirmed their

momentum with a LFL rise of +1.1%.

International

Sales inc. VAT (€m) Ex petrol

Ex calendar LFL

Organic

growth

International 11,768 +3.6%

+4.5%

Other European countries 6,077 +2.2% +0.8% Latin America

4,091 +11.9% +15.9% Asia 1,599 -12.9% -11.7%

Sales in international markets rose by +4.5% on an

organic basis and by +3.6% on a LFL basis. The calendar effect was

a negative 0.1% in the quarter and currencies had an unfavorable

effect of 6.9%.

In Other European countries, organic sales were up by

+0.8%.

LFL sales in Spain were up by +2.5% on top of an already

positive comparable base in the fourth quarter of 2014.

Trends improved in Italy where LFL sales were up by

+3.5%. In Poland and in Romania1, they grew on an

already positive comparable base. They were down by 0.4% in

Belgium.

Organic sales in Latin America were up by +15.9%.

Currencies had an unfavorable effect of 22.2% due to the

depreciation of the Brazilian Real and Argentine Peso vs. the

euro.

In Brazil, organic sales were up by +13.5% (+8.5% LFL) on

an already high comparable base of +15.9%. All formats posted

remarkable growth. Organic sales in Argentina rose by

+23.3%, of which +22.3% LFL.

In Asia, organic sales were down by 11.7% and total sales

were down by 3.6% as the result of a positive currency effect of

+8.1%.

In China, in a context of slowing consumption, total

sales were down by 7.5%, and down 15.7% on an organic basis. In

line with our medium-term view, we are continuing to roll out our

action plan in the country. In Taiwan, sales rose for the

fourth consecutive quarter, by +4.2% on an organic basis and by

+2.6% LFL.

______________________

1 LFL sales in Romania are restated for the technical effect on

prices of the lower VAT rate.

Variation of 2015 full-year sales inc. VAT

Carrefour’s sales stood at €86,294m. The currency effect was

-1.0% and the impact of petrol prices was -1.6%, of which -2.9% in

France. The calendar effect was neutral.

Change at

current

exchange rates

inc. petrol

Change at

constant

exchange rates

inc. petrol

LFL inc. petrol

LFL ex petrol

ex calendar

France +2.4% +2.4% -1.0%

+1.3% Hypermarkets -1.4% -1.4% -1.6%

+0.6% Supermarkets -1.3% -1.3% -0.6% +1.9%

International

+3.1% +4.9% +3.2%

+3.3%

Other European countries +1.8%

+1.8% +1.2% +1.8% Spain +0.1%

+0.1% +1.2% +2.6% Italy +5.2% +5.2% +0.7% +0.8% Belgium -0.2% -0.2%

+1.0% +1.0%

Latin America +3.6% +15.5%

+11.7% +11.7% Brazil -4.3% +12.6% +8.2% +7.9%

Asia

+5.7% -9.2% -9.9%

-10.3% China +2.7% -12.3% -13.2% -13.5%

Group total +2.7%

+3.7% +1.2% +2.4%

Variation of 2015 fourth quarter sales

Carrefour’s sales stood at €22,430m. The currency effect was

-3.8% and the impact of petrol prices was -1.1%, of which -2.2% in

France. The calendar effect was -0.1%.

Change at

current

exchange

rates inc.

petrol

Change at

constant

exchange

rates inc.

petrol

LFL inc. petrol

LFL ex petrol

ex calendar

France +1.0% +1,0% -1.7%

+0.2% Hypermarkets -2.5% -2.5% -2.8%

-0.7% Supermarkets -0.9% -0.9% -0.1% +1.5%

International

-2.5% +4.6% +3.5%

+3.6%

Other European countries +0.5%

+0.7% +1.4% +2.2% Spain -0.5%

-0.5% +0.9% +2.5% Italy +3.1% +3.1% +3.0% +3.5% Belgium -1.0% -1.0%

-0.4% -0.4%

Latin America -6.2% +16.4%

+12.3% +11.9% Brazil -13.5% +14.3% +9.3% +8.5%

Asia

-3.6% -11.7% -12.8%

-12.9% China -7.5% -15.6% -16.7% -16.7%

Group total -0.8%

+3.0% +1.1% +2.1%

EXPANSION UNDER BANNERS – Q4 and full year 2015

In Q4 2015, Carrefour opened or acquired 282,000 gross sq. m.

Net of disposals or closures, the network added 179,000 sq. min the

quarter. Since the beginning of the year, the network has added

1,208,000 gross sq. m. (891,000 net sq. m.).

Thousands of sq. m.

Dec. 31,2014

Sept. 30, 2015

Openings/Store

enlargements

Acquisitions

Closures/

Store

reductions

Transfers

Total Q4

2015

change

Dec. 31, 2015

France 5,189 5,665 17 1 -14

3 5,668 Europe (ex Fr) 5,754 5,896 44 148 -50

142 6,039 Latin America 2,173 2,228 32 -2 30 2,258 Asia 2,758 2,745

27 -38 -11 2,734 Others1 761 813 15

15 828

Group 16,635 17,348

135 149 -104

179 17,526

STORE NETWORK UNDER BANNERS – Q4 and full year 2015

In Q4 2015, Carrefour opened or acquired 439 stores, principally

convenience stores (218). Net of disposals or closures, the network

added 238 stores in Q4 2015, bringing the total network to 12,296

stores at the end of December (+1,436 stores compared to 2014).

No. of stores

Dec. 31, 2014 Sept.

30, 2015 Openings

Acquisitions

Closures/

Disposals

Transfers

Total Q4

2015 change

Dec. 31,2015 Hypermarkets

1,447 1,471 18 4

-12 10

1,481 France 237 242

242 Europe (ex France) 477 482 6 4 -3 7 489

Latin America 291 299 5 5 304 Asia 375 374 4 -9 -5 369

Others1

67 74 3

3 77

Supermarkets 3,127

3,274 41 158

-31 20 188 3,462

France 960 981 1 1 20 22 1,003 Europe (ex France) 1,831 1,932 36

157 -29 164 2,096 Latin America 169 170 -2 -2 168 Asia 19 27 2 2 29

Others1 148 164 2

2 166

Convenience

6,111 7,141 201 17

-158 -20 40

7,181 France 3,673 4,326 51 -94 -20 -63 4,263 Europe (ex

France) 2, 035 2,390 121 17 -64 74 2,464 Latin America 370 384 20

20 404 Asia 0 3 5 5 8 Others1 33 38 4

4 42

Cash &

carry 175 172

172

France 143 142 142 Europe (ex France) 19 18 18 Others1 13

12

12

Group 10,860

12,058 260 179

-201 238 12,296

France 5,013 5,691 52 1 -94 -41 5,650 Europe (ex France) 4,362

4,822 163 178 -96 245 5,067 Latin America 830 853 25 -2 23 876 Asia

394 404 11 -9 2 406 Others1 261 288 9

9 297

_________________________

1 Maghreb, Middle East and Dominican Republic.

DEFINITIONS

LFL sales growth: Sales generated by stores opened for at

least twelve months, excluding temporary store closures, at

constant exchange rates.

Organic growth: LFL sales plus net openings over the past

twelve months, including temporary store closures, at constant

exchange rates.

Sales under banners: Total sales under banners including

sales by franchisees and international partnerships.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160114006397/en/

Investor Relations :Alessandra Girolami, Matthew Mellin,

Mathilde RodiéTel : +33 (0)1 41 04 28 83orShareholder RelationsTel

: +33 (0)805 902 902 (toll-free in France)orGroup CommunicationTel

: +33 (0)1 41 04 26 17

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

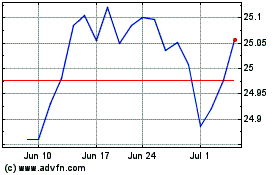

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024