- Increases Dividend to $1.02 per share

in FY17

- Accelerates Stock Repurchase

Program

- Announces Additional $750M Stock

Repurchase Authorization

- Increases FY16 EPS by Approximately

$0.03 GAAP and $0.04 non-GAAP

CA Technologies (NASDAQ:CA) announced today that it intends to

increase the dividend per share in Fiscal Year 2017, subject to

quarterly board approval, to $1.02 per share for the year, or

$0.255 per share on a quarterly basis. This is up from the current

$1.00 per share annual dividend, or $0.25 per share on a quarterly

basis.

The company has accelerated its Common Stock Repurchase Program,

having agreed to repurchase 22 million shares of its Common Stock

from Careal Holding AG, its largest shareholder, in a private

transaction valued at $590 million (with an effective share

repurchase price of $26.81 per share).

The per share purchase price represents a 3% discount to the

10-trading day volume weighted average price for CA stock using a

reference date of November 5, 2015. The closing price of CA stock

on November 17, 2015 was $26.90. The transaction, which is expected

to close in the third quarter of Fiscal Year 2016, will be funded

from US cash on hand.

Careal Holding AG has disclosed that Martin Haefner, one of

Careal’s co-principals, will obtain approximately 37 million shares

of CA common stock from Careal to add to his personal investment

holdings.

This deal effectively concludes CA’s prior $1 billion stock

repurchase program, through which CA had repurchased approximately

11 million shares as of September 30, 2015. As a result, as part of

the company’s capital allocation strategy, CA’s board of directors

has authorized a new $750 million share repurchase program.

The impact of the accelerated share repurchase is expected to

benefit GAAP EPS by $0.03 and non-GAAP EPS by $0.04 in FY16.

“Our capital allocation strategy, which includes a new $750

million share buy-back authorization as well as an increasing

dividend, reflects our improved confidence in our business as we

look to the coming years,” said Rich Beckert, CFO, CA Technologies.

“The transaction with Careal provided us with the opportunity to

accelerate our share repurchase program at favorable prices, and

highlights our long-term strategy of returning capital to

shareholders.”

Careal used CA's share buyback program as an opportunity to

rebalance Careal’s assets as part of an overall reallocation.

Careal issued a statement today that “Careal Holding AG and its

shareholders remain the principal shareholders of CA Technologies…

they believe that CA Technologies will continue to grow and intend

to keep hold of their investments for the long term.”

About CA Technologies

CA Technologies (NASDAQ: CA) creates software that fuels

transformation for companies and enables them to seize the

opportunities of the application economy. Software is at the heart

of every business in every industry. From planning, to development,

to management and security, CA is working with companies worldwide

to change the way we live, transact, and communicate - across

mobile, private and public cloud, distributed and mainframe

environments. Learn more at www.ca.com.

Follow CA Technologies

- Twitter

- Social Media Page

- Press Releases

- Blogs

Non-GAAP Financial Measures

This news release includes certain financial measures that

exclude the impact of certain items and therefore have not been

calculated in accordance with U.S. generally accepted accounting

principles (GAAP). Non-GAAP metrics for diluted earnings per share

exclude the following items: share-based compensation expense;

non-cash amortization of purchased software and other intangible

assets; charges relating to rebalancing initiatives that are large

enough to require approval from the Company's Board of Directors,

and certain other gains and losses. The Company began expensing

costs for internally developed software where development efforts

commenced in the first quarter of fiscal 2014. Due to this change,

the Company also adds back capitalized internal software costs and

excludes amortization of internally developed software costs

previously capitalized from these non-GAAP metrics. These non-GAAP

financial measures may be different from non-GAAP financial

measures used by other companies. Non-GAAP financial measures

should not be considered as a substitute for, or superior to,

measures of financial performance prepared in accordance with GAAP.

By excluding these items, non-GAAP financial measures facilitate

management's internal comparisons to the Company's historical

operating results and cash flows, to competitors' operating results

and cash flows, and to estimates made by securities analysts.

Management uses these non-GAAP financial measures internally to

evaluate its performance and they are key variables in determining

management incentive compensation. The Company believes these

non-GAAP financial measures are useful to investors in allowing for

greater transparency of supplemental information used by management

in its financial and operational decision-making. In addition, the

Company has historically reported similar non-GAAP financial

measures to its investors and believes that the inclusion of

comparative numbers provides consistency in its financial

reporting.

Cautionary Statement Regarding Forward-Looking

Statements

The declaration and payment of future dividends is subject to

the determination of the Company's Board of Directors, in its sole

discretion, after considering various factors, including the

Company's financial condition, historical and forecast operating

results, and available cash flow, as well as any applicable laws

and contractual covenants and any other relevant factors. The

Company's practice regarding payment of dividends may be modified

at any time and from time to time.

Repurchases under the Company's stock repurchase program may be

made from time to time, subject to market conditions and other

factors, in the open market, through solicited or unsolicited

privately negotiated transactions or otherwise. The program does

not obligate the Company to acquire any particular amount of common

stock, and it may be modified or suspended at any time at the

Company's discretion. Certain statements in this communication

(such as statements containing the words "believes," "plans,"

"anticipates," "expects," "estimates," "targets" and similar

expressions relating to the future) constitute "forward-looking

statements" that are based upon the beliefs of, and assumptions

made by, the Company's management, as well as information currently

available to management. These forward-looking statements reflect

the Company's current views with respect to future events and are

subject to certain risks, uncertainties, and assumptions. A number

of important factors could cause actual results or events to differ

materially from those indicated by such forward-looking statements,

including: the ability to achieve success in the Company's strategy

by, among other things, enabling the Company's sales force to

accelerate growth of new product sales (at levels sufficient to

offset any decline in revenue in the Company's Mainframe Solutions

segment), improving the Company's brand, technology and innovation

awareness in the marketplace, ensuring the Company's offerings for

cloud computing, application development and IT operations

(DevOps), Software-as-a-Service (SaaS), and mobile device

management, as well as other new offerings, address the needs of a

rapidly changing market, while not adversely affecting the demand

for the Company's traditional products or its profitability to an

extent greater than anticipated, and effectively managing the

strategic shift in the Company's business model to develop more

easily installed software, provide additional SaaS offerings and

refocus the Company's professional services and education

engagements on those engagements that are connected to new product

sales, without affecting the Company's performance to an extent

greater than anticipated; the failure to innovate or adapt to

technological changes and introduce new software products and

services in a timely manner; competition in product and service

offerings and pricing; the ability of the Company's products to

remain compatible with ever-changing operating environments,

platforms or third party products; global economic factors or

political events beyond the Company's control and other business

and legal risks associated with non-U.S. operations; the failure to

expand partner programs; the ability to retain and attract

qualified professionals; general economic conditions and credit

constraints, or unfavorable economic conditions in a particular

region, industry or business sector; the ability to successfully

integrate acquired companies and products into the Company's

existing business; risks associated with sales to government

customers; breaches of the Company's data center, network, as well

as the Company's software products, and the IT environments of the

Company's vendors and customers; the ability to adequately manage,

evolve and protect the Company's information systems,

infrastructure and processes; fluctuations in foreign exchange

rates; discovery of errors or omissions in the Company's software

products or documentation and potential product liability claims;

the failure to protect the Company's intellectual property rights

and source code; the failure to renew large license transactions on

a satisfactory basis; access to software licensed from third

parties; risks associated with the use of software from open source

code sources; third-party claims of intellectual property

infringement or royalty payments; fluctuations in the number, terms

and duration of the Company's license agreements, as well as the

timing of orders from customers and channel partners; events or

circumstances that would require the Company to record an

impairment charge relating to the Company's goodwill or capitalized

software and other intangible assets balances; potential tax

liabilities; changes in market conditions or the Company's credit

ratings; the failure to effectively execute the Company's workforce

reductions, workforce rebalancing and facilities consolidations;

successful and secure outsourcing of various functions to third

parties; changes in generally accepted accounting principles; and

other factors described more fully in the Company's filings with

the Securities and Exchange Commission. Should one or more of these

risks or uncertainties occur, or should the Company's assumptions

prove incorrect, actual results may vary materially from those

described herein as believed, planned, anticipated, expected,

estimated, targeted or similarly expressed in a forward-looking

manner. The Company assumes no obligation to update the information

in this communication, except as otherwise required by law. Readers

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof.

Copyright © 2015 CA, Inc. All Rights Reserved. All other

trademarks, trade names, service marks, and logos referenced herein

belong to their respective companies.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151118005438/en/

CA TechnologiesSaswato Das, (646) 710 6690 – US ETCorporate

CommunicationsSaswato.Das@ca.comorTraci Tsuchiguchi, (650) 534 9814

– US PTInvestor RelationsTraci.Tsuchiguchi@ca.com

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

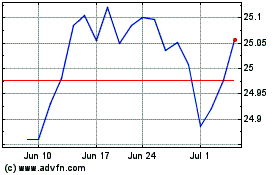

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024