- Improving Sales Execution with

Positive Enterprise Solutions New Sales Performance and Continued

Financial Discipline

- First Quarter Revenue of $977

Million, Compared With $1,069 Million Last Year

- First Quarter GAAP EPS of $0.47,

Compared With $0.48 Last Year

- First Quarter Non-GAAP EPS of $0.64,

Compared With $0.65 Last Year

- First Quarter Cash Flow From

Continuing Operations of $188 Million, Compared With $166 Million

Last Year

- Hired Industry Veteran Ayman Sayed,

Former Senior Vice President of the Network Operating Systems Group

at Cisco, as Chief Product Officer

CA Technologies (NASDAQ:CA) today reported financial results for

its first quarter fiscal 2016, which ended June 30, 2015.

Mike Gregoire, CA Technologies Chief Executive Officer,

said:

"In the first quarter of 2016, we achieved a strong 41 percent

non-GAAP operating margin.* We continued to make progress in

achieving our long-term goals. While our overall first-quarter

total revenue and new sales declined year-over-year, I am quite

encouraged by the positive trend over the past three quarters in

enterprise solutions new sales growth rates. This was achieved

mainly from our Named and Growth accounts, which is proof that our

strategy is beginning to show impact.

"We have enhanced our internal development capabilities with the

acquisition of Rally Software, which closed earlier this month. We

will continue to focus on organic innovation but make strategic

acquisitions when they make sense. Rally adds to our portfolio an

award-winning, cloud-based agile development platform. Along with

Rally's transformation consultants and coaches, this positions CA

to become an industry leader in the fast growing Agile Application

Lifecycle Management market.

"Continuing our focus on product innovation, we today named

industry veteran Ayman Sayed, former senior vice president of the

Network Operating Systems Group at Cisco, as our chief product

officer. Ayman is a visionary technologist who has a demonstrated

track record of innovating at scale using modern platforms and

Agile methodologies. Last month, we also named Xbox co-founder

and Microsoft veteran Otto Berkes as CA's Chief Technology

Officer. I am confident that the partnership between Ayman and

Otto will accelerate our ability to bring meaningful products to

market.

"Looking at the rest of fiscal 2016, we will continue to focus

on execution, invest in key growth areas and push to deliver

long-term value for our shareholders."

* GAAP operating margin was 31 percent.

FINANCIAL OVERVIEW

(dollars in

millions, except share data)

First

Quarter FY16 vs. FY15 FY16

FY15 % Change

% ChangeCC**

Revenue $977 $1,069

(9)% (3)% GAAP Income from Continuing

Operations $207 $212

(2)% 14% Non-GAAP Income from

Continuing Operations* $283 $289

(2)% 8% GAAP Diluted EPS from

Continuing Operations $0.47 $0.48

(2)% 15% Non-GAAP Diluted

EPS from Continuing Operations* $0.64

$0.65 (2)% 9% Cash Flow

from Continuing Operations $188 $166

13% 38%

* Non-GAAP income and earnings per share are non-GAAP financial

measures, as noted in the discussion of non-GAAP results below. A

reconciliation of non-GAAP financial measures to their comparable

GAAP financial measures is included in the tables following this

news release.**CC: Constant Currency

REVENUE AND BOOKINGS

(dollars in

millions)

First Quarter FY16 vs.

FY15 FY16 %

ofTotal FY15

% ofTotal

%Change %Change

CC** North America Revenue $652

67% $682 64%

(4)% (4)% International Revenue

$325 33% $387

36% (16)%

0% Total Revenue $977

$1,069

(9)% (3)%

North America Bookings $451

68% $459 63%

(2)% (1)% International

Bookings $211 32%

$265 37% (20)%

(8)% Total Bookings $662

$724

(9)% (3)%

Current Revenue Backlog $3,042

$3,402

(11)% (3)% Total

Revenue Backlog $6,278

$7,330

(14)% (7)%

**CC: Constant Currency

- Total revenue

declined primarily as a result of an unfavorable foreign

exchange effect of $65 million and, to a lesser extent, a decrease

in subscription and maintenance revenue.

- Total bookings were lower primarily due

to an unfavorable foreign exchange effect and, to a lesser extent,

a decrease in renewals in our Mainframe Solutions business.

- The Company executed a total of 6

license agreements with incremental contract values in excess of

$10 million each, for an aggregate contract value of $214 million.

During the first quarter of fiscal 2015, the Company executed a

total of 8 license agreements with incremental contract values in

excess of $10 million each, for an aggregate contract value of $330

million.

- The weighted average duration of

subscription and maintenance bookings for the quarter was 3.45

years, compared with 3.60 years for the same period in fiscal

2015.

EXPENSES AND MARGIN

(dollars in

millions)

First Quarter FY16 vs.

FY15 FY16 FY15

%Change

%Change CC** GAAP

Operating Expenses Before Interest and Income Taxes $673

$756 (11)%

(8)% Operating Income Before Interest and Income Taxes

$304 $313 (3)%

12% Operating Margin 31%

29%

Effective Tax Rate 29.8% 29.1%

Non-GAAP*

Operating Expenses Before Interest and Income Taxes $572

$642 (11)%

(7)% Operating Income Before Interest and Income Taxes

$405 $427 (5)%

4% Operating Margin 41%

40%

Effective Tax Rate 28.5% 30.0%

*A reconciliation of non-GAAP financial measures to their

comparable GAAP financial measures is included in the tables

following this news release. Year-over-year non-GAAP results

exclude purchased software and other intangibles amortization,

share-based compensation, capitalization (an add-back) and

amortization of internal software costs, Board approved workforce

rebalancing initiatives and certain other gains and losses. The

results also include gains and losses on hedges that mature within

the quarter, but exclude gains and losses on hedges that do not

mature within the quarter.**CC: Constant Currency

- GAAP and non-GAAP first quarter

operating expenses were favorably affected by foreign exchange and

lower personnel-related expenses.

SELECTED HIGHLIGHTS FROM THE QUARTER

- Customer traction for CA Technologies

innovations continued in the quarter.

- CA Project and Portfolio Management (CA

PPM) high profile wins included a competitive replacement with

Delta Air Lines, which is leveraging CA’s solution to automate the

vast number of complex business process across a multitude of

different internal organizations.

- CA Secure Cloud, CA’s identity and

access management solution for managed service providers, has been

integrated into telecommunications giant BT’s new managed identity

service supporting cloud, on-premise and hybrid IT systems.

- A financial institution in the Europe,

Middle East and Africa region selected CA Capacity Manager to

ensure that the sizing and capacity of its IT infrastructure

matches the evolving business demands in a cost-effective and

timely manner.

- A large financial services provider

based in the United Kingdom selected CA Advanced Authentication

solution to enable a simplified and secure user experience and

mitigate security performance risk driving customer

experience.

- Solutions leadership:

- CA enhanced its internal development

capabilities by acquiring Rally Software Development Corp. (Rally),

a leading provider of Agile development software and services. The

deal closed earlier this month and complements our organic

innovation strategy.

- CA announced the integration of its CA

Release Automation solution with the Docker platform and the newest

release of its CA PPM solution.

- CA was designated a “Leader” in the

Gartner Magic Quadrant for IT Project and Portfolio Management

Software Applications, Worldwide (1).

- CA was positioned in the Leaders

Quadrant of the Gartner Magic Quadrant for Application Services

Governance for its API Management product (2).

SEGMENT INFORMATION

(dollars in

millions)

First Quarter FY16 vs.

FY15 Revenue

%Change

%Change CC**

Operating Margin FY16

FY15 FY16

FY15 Mainframe Solutions $560

$614 (9)%

(3)% 62% 62% Enterprise

Solutions $338 $368

(8)% (2)% 14%

12% Services $79

$87 (9)% (3)%

10% 6%

**CC: Constant Currency

- Mainframe Solutions revenue was lower

primarily due to an unfavorable foreign exchange effect of $38

million and, to a lesser extent, insufficient revenue from prior

period new sales. Operating margin was similar to a year ago.

- Enterprise Solutions revenue decreased

due to an unfavorable foreign exchange effect of $22 million and a

decrease in the percentage of Enterprise Solutions product sales

recognized on an up-front basis. Enterprise Solutions operating

margin increased primarily as a result of lower personnel-related

costs and other expenses.

- Services revenue decreased primarily

due to an unfavorable foreign exchange effect of $5 million and, to

a lesser extent, a decline in fiscal 2015 professional services

engagements. Operating margin for professional services increased

primarily due to a decrease in personnel-related costs as a result

of our prior period severance actions.

CASH FLOW FROM OPERATIONS

- Cash flow from operations for the first

quarter of fiscal 2016 was $188 million, versus $166 million in the

year ago period. Cash flow from operations increased compared

with the year-ago period primarily due to lower vendor

disbursements and payroll costs, and lower income tax payments

partially offset by a decline in cash collections.

- Cash flow was negatively affected by

foreign exchange. Excluding currency effects, collections would

have been positive.

CAPITAL STRUCTURE

- Cash, cash equivalents and investments

at June 30, 2015 were $2.816 billion.

- With $1.258 billion in total debt

outstanding and $139 million in notional pooling, the Company’s net

cash, cash equivalents and investments position was $1.419

billion.

- In the first quarter of fiscal 2016,

the Company repurchased 1.7 million shares of common stock for $50

million.

- As of June 30, 2015, the Company

is currently authorized to purchase $735 million of its common

stock under its current stock repurchase program.

- Effective July 1, 2015, the Company

entered into an agreement to repurchase $50 million of its common

stock to be delivered in September 2015.

- The Company distributed $110 million in

dividends to shareholders.

- The Company’s outstanding share count

at June 30, 2015 was 437 million.

LEADERSHIP

- The Company today named industry

veteran Ayman Sayed as chief product officer. Sayed most recently

served as senior vice president of the Network Operating Systems

Technology Group at Cisco, where he led the development of

networking operating software on which nearly every Cisco

networking product runs.

- The Company has hired Xbox co-founder

and Microsoft Corporation veteran Otto Berkes as chief technology

officer. Berkes most recently served as the chief technology

officer at HBO, where was responsible for the development of HBO

GO®, as well as all of the company’s technology efforts including

media production, internal business systems and technology

operations.

OUTLOOK FOR FISCAL YEAR 2016

The Company updated its fiscal 2016 outlook for revenue, GAAP

and non-GAAP diluted earnings per share from continuing operations,

full-year GAAP and non-GAAP operating margin. This guidance

includes the acquisition of Rally, which closed earlier this month,

and assumes no incremental material acquisitions. The following

outlook contains "forward-looking statements" (as defined

below).

The Company expects the following:

- Total revenue to change in a range of

minus 1 percent to flat in constant currency. Previous guidance was

to decrease 2 percent in constant currency. At June 30, 2015

exchange rates, this translates to reported revenue of $4.04

billion to $4.11 billion.

- GAAP diluted earnings per share from

continuing operations to increase in a range of 6 percent to 10

percent in constant currency. Previous guidance was to increase in

a range of 12 percent to 17 percent in constant currency. At

June 30, 2015 exchange rates, this translates to reported GAAP

diluted earnings per share from continuing operations of $1.72 to

$1.80.

- Non-GAAP diluted earnings per share

from continuing operations to increase in a range of 2 percent to 5

percent in constant currency, unchanged from previous guidance. At

June 30, 2015 exchange rates, this translates to reported

non-GAAP diluted earnings per share from continuing operations of

$2.37 to $2.44.

- Cash flow from continuing operations to

increase in the range of 2 percent to 7 percent in constant

currency, unchanged from previous guidance. At June 30, 2015

exchange rates, this translates to reported cash flow from

continuing operations of $0.98 billion to $1.03 billion.

The Company expects a full-year GAAP operating margin of 28

percent and non-GAAP operating margin of 38 percent, which

translates to a 2-point decrease and 1-point decrease from previous

guidance, respectively.

The Company also expects a full-year GAAP and non-GAAP effective

tax rate of between 28 percent and 29 percent, unchanged from

previous guidance.

The Company anticipates approximately 432 million shares

outstanding at fiscal 2016 year-end and weighted average diluted

shares outstanding of approximately 436 million for the fiscal

year.

Webcast

This news release and the accompanying tables should be read in

conjunction with additional content that is available on the

Company’s website, including a supplemental financial package, as

well as a conference call and webcast that the Company will host at

5:00 p.m. ET today to discuss its unaudited first quarter results.

The webcast will be archived on the website. Individuals can access

the webcast, as well as the press release and supplemental

financial information at http://ca.com/invest or can listen to the call at

1-877-561-2748. The international participant number is

1-720-545-0044.

(1) Gartner, Inc., “Magic Quadrant for IT Project and Portfolio

Management Software Applications, Worldwide,” Daniel B. Stang,

Robert A. Handler, Teresa Jones, May 20, 2015

(2) Gartner, Inc. "Magic Quadrant for Application Services

Governance," Paolo Malinverno April 9, 2015.

Gartner does not endorse any vendor, product or service depicted

in its research publications, and does not advise technology users

to select only those vendors with the highest ratings or other

designation. Gartner research publications consist of the opinions

of Gartner's research organization and should not be construed as

statements of fact. Gartner disclaims all warranties, expressed or

implied, with respect to this research, including any warranties of

merchantability or fitness for a particular purpose.

About CA Technologies

CA Technologies (NASDAQ: CA) creates software that fuels

transformation for companies and enables them to seize the

opportunities of the application economy. Software is at the heart

of every business in every industry. From planning, to development,

to management and security, CA is working with companies worldwide

to change the way we live, transact, and communicate - across

mobile, private and public cloud, distributed and mainframe

environments. Learn more at www.ca.com.

Follow CA Technologies

- Twitter

- Social Media

Page

- Press

Releases

- Blogs

Non-GAAP Financial Measures

This news release, the accompanying tables and the additional

content that is available on the Company's website, including a

supplemental financial package, include certain financial measures

that exclude the impact of certain items and therefore have not

been calculated in accordance with U.S. generally accepted

accounting principles (GAAP). Non-GAAP metrics for operating

expenses, operating income, operating margin, income from

continuing operations and diluted earnings per share exclude the

following items: share-based compensation expense; non-cash

amortization of purchased software and other intangible assets;

charges relating to rebalancing initiatives that are large enough

to require approval from the Company's Board of Directors, fiscal

2007 restructuring costs and certain other gains and losses, which

include the gains and losses since inception of hedges that mature

within the quarter, but exclude gains and losses of hedges that do

not mature within the quarter. The Company began expensing costs

for internally developed software where development efforts

commenced in the first quarter of fiscal 2014. As a result, product

development and enhancement expenses are expected to increase in

future periods as the amount capitalized for internally developed

software costs decreases. Due to this change, the Company also adds

back capitalized internal software costs and excludes amortization

of internally developed software costs previously capitalized from

these non-GAAP metrics. The effective tax rate on GAAP and non-GAAP

income from operations is the Company's provision for income taxes

expressed as a percentage of pre-tax GAAP and non-GAAP income from

continuing operations, respectively. These tax rates are determined

based on an estimated effective full year tax rate, with the

effective tax rate for GAAP generally including the impact of

discrete items in the period in which such items arise and the

effective tax rate for non-GAAP generally allocating the impact of

discrete items pro rata to the fiscal year's remaining reporting

periods. Adjusted cash flow from operations excludes payments

associated with the fiscal 2014 Board-approved rebalancing

initiative as described above, capitalized software development

costs as described above, and restructuring and other payments.

Free cash flow excludes purchases of property and equipment and

capitalized software development costs. The Company presents

constant currency information to provide a framework for assessing

how the Company's underlying businesses performed excluding the

effect of foreign currency rate fluctuations. To present this

information, current and comparative prior period results for

entities reporting in currencies other than U.S. dollars are

converted into U.S. dollars at the exchange rate in effect on the

last day of the Company's prior fiscal year (i.e., March 31, 2015,

March 31, 2014 and March 31, 2013, respectively). Constant currency

excludes the impacts from the Company's hedging program. The

constant currency calculation for annualized subscription and

maintenance bookings is calculated by dividing the subscription and

maintenance bookings in constant currency by the weighted average

subscription and maintenance duration in years. These non-GAAP

financial measures may be different from non-GAAP financial

measures used by other companies. Non-GAAP financial measures

should not be considered as a substitute for, or superior to,

measures of financial performance prepared in accordance with GAAP.

By excluding these items, non-GAAP financial measures facilitate

management's internal comparisons to the Company's historical

operating results and cash flows, to competitors' operating results

and cash flows, and to estimates made by securities analysts.

Management uses these non-GAAP financial measures internally to

evaluate its performance and they are key variables in determining

management incentive compensation. The Company believes these

non-GAAP financial measures are useful to investors in allowing for

greater transparency of supplemental information used by management

in its financial and operational decision-making. In addition, the

Company has historically reported similar non-GAAP financial

measures to its investors and believes that the inclusion of

comparative numbers provides consistency in its financial

reporting. Investors are encouraged to review the reconciliation of

the non-GAAP financial measures used in this news release to their

most directly comparable GAAP financial measures, which are

attached to this news release.

Cautionary Statement Regarding Forward-Looking

Statements

The declaration and payment of future dividends is subject to

the determination of the Company's Board of Directors, in its sole

discretion, after considering various factors, including the

Company's financial condition, historical and forecast operating

results, and available cash flow, as well as any applicable laws

and contractual covenants and any other relevant factors. The

Company's practice regarding payment of dividends may be modified

at any time and from time to time.

Repurchases under the Company's stock repurchase program are

expected to be made with cash on hand and may be made from time to

time, subject to market conditions and other factors, in the open

market, through solicited or unsolicited privately negotiated

transactions or otherwise. The program does not obligate the

Company to acquire any particular amount of common stock, and it

may be modified or suspended at any time at the Company's

discretion.

Certain statements in this communication (such as statements

containing the words "believes," "plans," "anticipates," "expects,"

"estimates," "targets" and similar expressions relating to the

future) constitute "forward-looking statements" that are based upon

the beliefs of, and assumptions made by, the Company's management,

as well as information currently available to management. These

forward-looking statements reflect the Company's current views with

respect to future events and are subject to certain risks,

uncertainties, and assumptions. A number of important factors could

cause actual results or events to differ materially from those

indicated by such forward-looking statements, including: the

ability to achieve success in the Company's strategy by, among

other things, enabling the Company's sales force to accelerate

growth of new product sales (at levels sufficient to offset any

decline in revenue in the Company's Mainframe Solutions segment),

improving the Company's brand, technology and innovation awareness

in the marketplace, ensuring the Company's offerings for cloud

computing, application development and IT operations (DevOps),

Software-as-a-Service (SaaS), and mobile device management, as well

as other new offerings, address the needs of a rapidly changing

market, while not adversely affecting the demand for the Company's

traditional products or its profitability to an extent greater than

anticipated, and effectively managing the strategic shift in the

Company's business model to develop more easily installed software,

provide additional SaaS offerings and refocus the Company's

professional services and education engagements on those

engagements that are connected to new product sales, without

affecting the Company's performance to an extent greater than

anticipated; the failure to innovate or adapt to technological

changes and introduce new software products and services in a

timely manner; competition in product and service offerings and

pricing; the ability of the Company's products to remain compatible

with ever-changing operating environments, platforms or third party

products; global economic factors or political events beyond the

Company's control; the failure to expand partner programs; the

ability to retain and attract qualified professionals; general

economic conditions and credit constraints, or unfavorable economic

conditions in a particular region, industry or business sector; the

ability to successfully integrate acquired companies and products

into the Company's existing business; risks associated with sales

to government customers; breaches of the Company's data center,

network, as well as the Company's software products, and the IT

environments of the Company's vendors and customers; the ability to

adequately manage, evolve and protect the Company's information

systems, infrastructure and processes; fluctuations in foreign

exchange rates; discovery of errors or omissions in the Company's

software products or documentation and potential product liability

claims; the failure to protect the Company's intellectual property

rights and source code; the failure to renew large license

transactions on a satisfactory basis; access to software licensed

from third parties; risks associated with the use of software from

open source code sources; third-party claims of intellectual

property infringement or royalty payments; fluctuations in the

number, terms and duration of the Company's license agreements, as

well as the timing of orders from customers and channel partners;

events or circumstances that would require the Company to record an

impairment charge relating to the Company's goodwill or capitalized

software and other intangible assets balances; potential tax

liabilities; changes in market conditions or the Company's credit

ratings; the failure to effectively execute the Company's workforce

reductions, workforce rebalancing and facilities consolidations;

successful and secure outsourcing of various functions to third

parties; changes in generally accepted accounting principles; and

other factors described more fully in the Company's filings with

the Securities and Exchange Commission. Should one or more of these

risks or uncertainties occur, or should the Company's assumptions

prove incorrect, actual results may vary materially from those

described herein as believed, planned, anticipated, expected,

estimated, targeted or similarly expressed in a forward-looking

manner. The Company assumes no obligation to update the information

in this communication, except as otherwise required by law. Readers

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof.

Copyright © 2015 CA, Inc. All Rights Reserved. All other

trademarks, trade names, service marks, and logos referenced herein

belong to their respective companies.

Table 1 CA Technologies Consolidated

Statements of Operations (unaudited) (in millions, except per

share amounts)

Three Months Ended

June 30,

Revenue:

2015

2014

Subscription and maintenance $ 836 $ 909 Professional services 79

87 Software fees and other 62

73

Total revenue $ 977 $

1,069

Expenses: Costs of licensing and

maintenance $ 66 $ 72 Cost of professional services 71 81

Amortization of capitalized software costs 60 67 Selling and

marketing 226 246 General and administrative 90 92 Product

development and enhancements 136 150 Depreciation and amortization

of other intangible assets 27 34 Other (gains) expenses, net

(3 ) 14

Total expenses before

interest and income taxes $ 673 $

756

Income from continuing operations before interest and

income taxes $ 304 $ 313 Interest expense, net

9 14

Income from continuing

operations before income taxes $ 295 $ 299 Income tax expense

88 87

Income

from continuing operations $ 207 $ 212 Income from discontinued

operations, net of income taxes $ 5 $

5

Net income $ 212 $

217

Basic income per common share: Income from

continuing operations $ 0.47 $ 0.48 Income from discontinued

operations 0.01

0.01

Net income $ 0.48 $

0.49

Basic weighted average shares used in computation 436

440

Diluted income per common share: Income from

continuing operations $ 0.47 $ 0.48 Income from discontinued

operations 0.01

0.01

Net income $ 0.48 $

0.49

Diluted weighted average shares used in computation 438

441 Results reflect the discontinued operations associated

with the CA ERwin Data Modeling and CA arcserve data protection

businesses.

Table 2 CA Technologies

Condensed Consolidated Balance Sheets (in millions)

June 30, March 31, 2015

2015 (unaudited) Cash and cash equivalents $ 2,816 $

2,804 Trade accounts receivable, net 432 652 Deferred

income taxes 335 318 Other current assets 162

213

Total current assets

$ 3,745 $ 3,987 Property and equipment, net $ 252 $ 252

Goodwill 5,817 5,806 Capitalized software and other intangible

assets, net 700 731 Deferred income taxes 88 92 Other noncurrent

assets, net 105

111

Total assets $ 10,707 $

10,979 Current portion of long-term

debt $ 8 $ 10 Deferred revenue (billed or collected) 2,040 2,114

Deferred income taxes 7 7 Other current liabilities

631 807

Total current

liabilities $ 2,686 $ 2,938 Long-term debt, net of

current portion $ 1,250 $ 1,253 Deferred income taxes 54 45

Deferred revenue (billed or collected) 720 863 Other noncurrent

liabilities 264

255

Total liabilities $ 4,974 $

5,354 Common stock $ 59 $ 59 Additional

paid-in capital 3,592 3,631 Retained earnings 6,323 6,221

Accumulated other comprehensive loss (386 ) (418 ) Treasury stock

(3,855 ) (3,868 )

Total stockholders’ equity $ 5,733 $

5,625

Total liabilities and stockholders’

equity $ 10,707 $ 10,979

Table 3 CA Technologies

Condensed Consolidated Statements of Cash Flows (unaudited)

(in millions) Three Months Ended

June 30,

2015

2014

Operating activities from continuing operations: Net income

$ 212 $ 217 Income from discontinued

operations (5 ) (5 )

Income from continuing operations $ 207 $ 212 Adjustments to

reconcile income from continuing operations to net cash provided by

operating activities: Depreciation and amortization 87 101 Deferred

income taxes (10 ) (20 ) Provision for bad debts 1 (1 ) Share-based

compensation expense 22 20 Asset impairments and other non-cash

items - 1 Foreign currency transaction losses 3 - Changes in other

operating assets and liabilities, net of effect of acquisitions:

Decrease in trade accounts receivable 228 251 Decrease in deferred

revenue (239 ) (285 ) Increase in taxes payable, net 27 17 Decrease

in accounts payable, accrued expenses and other (33 ) (30 )

Decrease in accrued salaries, wages and commissions (83 ) (97 )

Changes in other operating assets and liabilities

(22 ) (3 )

Net cash provided by

operating activities - continuing operations $

188 $ 166

Investing activities from

continuing operations: Acquisitions of businesses, net of cash

acquired, and purchased software $ (37 ) $ (11 ) Purchases of

property and equipment (13 )

(21 )

Net cash used in investing activities - continuing

operations $ (50 ) $ (32 )

Financing activities from continuing operations: Dividends

paid $ (110 ) $ (111 ) Purchases of common stock (50 ) (50 )

Notional pooling (repayments) borrowings, net (16 ) 11 Debt

repayments (5 ) (2 ) Exercise of common stock options 4 12 Other

financing activities (23 )

-

Net cash used in financing activities -

continuing operations $ (200 ) $ (140 ) Effect of exchange rate

changes on cash $ 69 $ 1

Net change in cash and cash equivalents - continuing

operations $ 7 $ (5 ) Cash provided by operating activities -

discontinued operations $ 5 $ 8

Net effect of discontinued operations on cash and cash

equivalents $ 5 $ 8

Increase in cash and cash equivalents $ 12 $ 3

Cash and

cash equivalents at beginning of period $ 2,804

$ 3,252

Cash and cash equivalents at

end of period $ 2,816 $

3,255 Results reflect the discontinued operations

associated with the CA ERwin Data Modeling and CA arcserve data

protection businesses.

Table

4 CA Technologies Operating Segments (unaudited)

(dollars in millions)

Three Months Ended June 30, 2015

MainframeSolutions (1)

EnterpriseSolutions (1)

Services (1) Total Revenue (2) $ 560 $

338 $ 79 $ 977 Expenses (3)

211 290

71 572

Segment profit $ 349 $ 48

$ 8 $ 405

Segment operating margin 62 % 14 % 10 % 41 %

Segment profit $ 405

Less: Purchased software

amortization 28 Other intangibles amortization 11 Internally

developed software products amortization 32 Share-based

compensation expense 22 Other expenses, net (4) 8 Interest expense,

net 9

Income from continuing

operations before income taxes $ 295

Three Months Ended June 30, 2014

MainframeSolutions (1)

EnterpriseSolutions (1)

Services (1) Total Revenue (2) $ 614 $ 368 $ 87 $ 1,069

Expenses (3) 235

325 82 642

Segment profit $ 379 $

43 $ 5 $ 427

Segment operating margin 62 % 12 % 6 % 40 %

Segment profit $ 427

Less: Purchased software

amortization 28 Other intangibles amortization 15 Internally

developed software products amortization 39 Share-based

compensation expense 20 Other expenses, net (4) 12 Interest

expense, net 14

Income from

continuing operations before income taxes $ 299

(1) The Company’s Mainframe Solutions and Enterprise

Solutions segments comprise its software business organized by the

nature of the Company’s software offerings and the platform on

which the products operate. The Services segment comprises product

implementation, consulting, customer education and customer

training, including those directly related to the Mainframe

Solutions and Enterprise Solutions software that the Company sells

to its customers. (2) The Company regularly enters into a

single arrangement with a customer that includes mainframe

solutions, enterprise solutions and services. The amount of

contract revenue assigned to operating segments is generally based

on the manner in which the proposal is made to the customer. The

software product revenue is assigned to the Mainframe Solutions and

Enterprise Solutions segments based on either: (1) a list price

allocation method (which allocates a discount in the total contract

price to the individual products in proportion to the list price of

the product); (2) allocations included within internal contract

approval documents; or (3) the value for individual software

products as stated in the customer contract. The price for the

implementation, consulting, education and training services is

separately stated in the contract and these amounts of contract

revenue are assigned to the Services segment. The contract value

assigned to each operating segment is then recognized in a manner

consistent with the revenue recognition policies the Company

applies to the customer contract for purposes of preparing the

Consolidated Financial Statements. (3) Segment expenses

include costs that are controllable by segment managers (i.e.,

direct costs) and, in the case of the Mainframe Solutions and

Enterprise Solutions segments, an allocation of shared and indirect

costs (i.e., allocated costs). Segment-specific direct costs

include a portion of selling and marketing costs, licensing and

maintenance costs, product development costs and general and

administrative costs. Allocated segment costs primarily include

indirect and non-segment specific direct selling and marketing

costs and general and administrative costs that are not directly

attributable to a specific segment. The basis for allocating shared

and indirect costs between the Mainframe Solutions and Enterprise

Solutions segments is dependent on the nature of the cost being

allocated and is either in proportion to segment revenues or in

proportion to the related direct cost category. Expenses for the

Services segment consist of cost of professional services and other

direct costs included within selling and marketing and general and

administrative expenses. There are no allocated or indirect costs

for the Services segment. (4) Other expenses, net consists

of costs associated with the FY2014 Board approved rebalancing

initiative (the Fiscal 2014 Plan), certain foreign exchange

derivative hedging gains and losses, and other miscellaneous costs.

Results reflect the discontinued operations associated with

the CA ERwin Data Modeling and CA arcserve data protection

businesses.

Table 5 CA Technologies

Constant Currency Summary (unaudited) (dollars in millions)

Three Months Ended June 30, 2015 2014

% Increase(Decrease)in $ US

% Increase(Decrease)in ConstantCurrency

(1)

Bookings $ 662 $ 724 (9

)% (3 )%

Revenue: North America $ 652 $ 682 (4 )% (4

)% International 325 387

(16 )% 0 % Total revenue $ 977 $ 1,069 (9 )% (3 )%

Revenue: Subscription and maintenance $ 836 $ 909 (8 )% (2

)% Professional services 79 87 (9 )% (3 )% Software fees and other

62 73 (15 )% (11 )% Total

revenue $ 977 $ 1,069 (9 )% (3 )%

Segment Revenue:

Mainframe solutions $ 560 $ 614 (9 )% (3 )% Enterprise solutions

338 368 (8 )% (2 )% Services 79 87 (9 )% (3 )%

Total

expenses before interest and income taxes: Total non-GAAP (2) $

572 $ 642 (11 )% (7 )% Total GAAP 673 756 (11 )% (8 )% (1)

Constant currency information is presented to provide a framework

for assessing how the Company's underlying businesses performed

excluding the effect of foreign currency rate fluctuations. To

present this information, current and comparative prior period

results for entities reporting in currencies other than U.S.

dollars are converted into U.S. dollars at the exchange rate in

effect on March 31, 2015, which was the last day of the prior

fiscal year. Constant currency excludes the impacts from the

Company's hedging program. (2) Refer to Table 7 for a

reconciliation of total expenses before interest and income taxes

to total non-GAAP operating expenses. Results reflect the

discontinued operations associated with the CA ERwin Data Modeling

and CA arcserve data protection businesses. Certain

non-material differences may arise versus actual from impact of

rounding.

Table 6 CA Technologies

Reconciliation of Select GAAP Measures to Non-GAAP Measures

(unaudited) (dollars in millions)

Three Months Ended

June 30,

2015

2014

GAAP net income $ 212 $ 217 GAAP income

from discontinued operations, net of income taxes

(5 ) (5 ) GAAP income from continuing

operations $ 207 $ 212 GAAP income tax expense 88 87 Interest

expense, net 9 14

GAAP income from continuing operations before interest and

income taxes $ 304 $ 313

GAAP operating margin (% of revenue) (1) 31 % 29 % Non-GAAP

adjustments to expenses: Costs of licensing and maintenance (2) $ 2

$ 1 Cost of professional services (2) 1 1 Amortization of

capitalized software costs (3) 60 67 Selling and marketing (2) 8 7

General and administrative (2) 7 6 Product development and

enhancements (2) 4 5 Depreciation and amortization of other

intangible assets (4) 11 15 Other expenses, net (5)

8 12 Total Non-GAAP

adjustment to operating expenses $ 101 $

114 Non-GAAP income from continuing operations

before interest and income taxes $ 405 $ 427 Non-GAAP operating

margin (% of revenue) (6) 41 % 40 % Interest expense, net 9

14 GAAP income tax expense 88 87 Non-GAAP adjustment to income tax

expense (7) 25 37

Non-GAAP income tax expense $ 113 $

124 Non-GAAP income from continuing operations

$ 283 $ 289 (1)

GAAP operating margin is calculated by dividing GAAP income from

continuing operations before interest and income taxes by total

revenue (refer to Table 1 for total revenue). (2) Non-GAAP

adjustment consists of share-based compensation. (3) For the

three month periods ending June 30, 2015 and 2014, non-GAAP

adjustment consists of $28 million and $28 million of purchased

software amortization and $32 million and $39 million of internally

developed software products amortization, respectively. (4)

Non-GAAP adjustment consists of other intangibles amortization.

(5) Non-GAAP adjustment consists of charges relating to the

FY2014 Board approved rebalancing initiative (the Fiscal 2014 Plan)

and certain other gains and losses, including gains and losses

since inception of hedges that mature within the quarter, but

excludes gains and losses of hedges that do not mature within the

quarter. (6) Non-GAAP operating margin is calculated by

dividing non-GAAP income from continuing operations before interest

and income taxes by total revenue (refer to Table 1 for total

revenue). (7) The full year non-GAAP income tax expense is

different from GAAP income tax expense because of the difference in

non-GAAP income from continuing operations before income taxes. On

an interim basis, this difference would also include a difference

in the impact of discrete and permanent items where for GAAP

purposes the effect is recorded in the period such items arise, but

for non-GAAP such items are recorded pro rata to the fiscal year's

remaining reporting periods. Refer to the discussion of

non-GAAP financial measures included in the accompanying press

release for additional information. Results reflect the

discontinued operations associated with the CA ERwin Data Modeling

and CA arcserve data protection businesses. Certain

non-material differences may arise versus actual from impact of

rounding.

Table 7 CA Technologies

Reconciliation of GAAP to Non-GAAP Operating Expenses and

Diluted Earnings per Share (unaudited) (in millions, except per

share amounts)

Three Months Ended

June 30,

Operating

Expenses

2015

2014

Total expenses before interest and income taxes $

673 $ 756 Non-GAAP operating

adjustments: Purchased software amortization 28 28 Other

intangibles amortization 11 15 Internally developed software

products amortization 32 39 Share-based compensation 22 20 Other

expenses, net (1) 8 12

Total non-GAAP operating adjustment $ 101 $

114 Total non-GAAP operating expenses $

572 $ 642 Three

Months Ended

June 30,

Diluted EPS from

Continuing Operations

2015

2014

GAAP diluted EPS from continuing operations $ 0.47 $ 0.48

Non-GAAP adjustments, net of taxes: Purchased software

amortization 0.05 0.04 Other intangibles amortization 0.02 0.03

Internally developed software products amortization 0.05 0.06

Share-based compensation 0.03 0.03 Other expenses, net (1) 0.01

0.02 Non-GAAP effective tax rate adjustments (2)

0.01 (0.01 ) Total non-GAAP adjustment

$ 0.17 $ 0.17 Non-GAAP

diluted EPS from continuing operations $ 0.64 $

0.65 (1) Other expenses, net consists

of costs associated with the FY2014 Board approved rebalancing

initiative (the Fiscal 2014 Plan), certain foreign exchange

derivative hedging gains and losses, and other miscellaneous costs.

(2) The non-GAAP effective tax rate is equal to the full

year GAAP effective tax rate, therefore no adjustment is required

on an annual basis. On an interim basis, the difference in non-GAAP

income tax expense and GAAP income tax expense relates to the

difference in non-GAAP income from continuing operations before

income taxes, and includes a difference in the impact of discrete

and permanent items where for GAAP purposes the effect is recorded

in the period such items arise but for non-GAAP purposes such items

are recorded pro rata to the fiscal year's remaining reporting

periods. Refer to the discussion of non-GAAP financial

measures included in the accompanying press release for additional

information. Results reflect the discontinued operations

associated with the CA ERwin Data Modeling and CA arcserve data

protection businesses. Certain non-material differences may

arise versus actual from impact of rounding.

Table

8 CA Technologies Effective Tax Rate

Reconciliation GAAP and Non-GAAP (unaudited) (dollars in

millions) Three

Months Ended

June 30,

2015

GAAP

Non-GAAP

Income from continuing operations before interest and income

taxes (1) $ 304 $ 405 Interest expense,

net 9 9

Income from continuing operations before income taxes $ 295 $ 396

Statutory tax rate 35 % 35 % Tax at statutory rate $

103 $ 139 Adjustments for discrete and permanent items (2)

(15 ) (26 ) Total tax expense $

88 $ 113 Effective tax rate (3) 29.8 % 28.5 % Three

Months Ended

June 30,

2014

GAAP

Non-GAAP

Income from continuing operations before interest and income

taxes (1) $ 313 $ 427 Interest expense, net 14

14 Income from continuing

operations before income taxes $ 299 $ 413 Statutory tax

rate 35 % 35 % Tax at statutory rate $ 105 $ 145 Adjustments

for discrete and permanent items (2) (18 )

(21 ) Total tax (benefit) expense $ 87 $ 124

Effective tax rate (3) 29.1 % 30.0 % (1) Refer to

Table 6 for a reconciliation of income from continuing operations

before interest and income taxes on a GAAP basis to income from

continuing operations before interest and income taxes on a

non-GAAP basis. (2) The effective tax rate for GAAP

generally includes the impact of discrete and permanent items in

the period such items arise, whereas the effective tax rate for

non-GAAP generally allocates the impact of such items pro rata to

the fiscal year's remaining reporting periods. (3) The

effective tax rate on GAAP and non-GAAP income from continuing

operations is the Company's provision for income taxes expressed as

a percentage of GAAP and non-GAAP income from continuing operations

before income taxes, respectively. The non-GAAP effective tax rate

is equal to the full year GAAP effective tax rate. On an interim

basis, the effective tax rates are determined based on an estimated

effective full year tax rate after the adjustments for the impacts

of certain discrete items (such as changes in tax rates,

reconciliations of tax returns to tax provisions and resolutions of

tax contingencies). Refer to the discussion of non-GAAP

financial measures included in the accompanying press release for

additional information. Results reflect the discontinued

operations associated with the CA ERwin Data Modeling and CA

arcserve data protection businesses. Certain non-material

differences may arise versus actual from impact of rounding.

Table 9 CA Technologies Reconciliation of

Projected GAAP Metrics to Projected Non-GAAP Metrics

(unaudited)

Fiscal Year Ending

Projected Diluted

EPS from Continuing Operations

March 31,

2016

Projected GAAP diluted EPS from continuing operations range

$ 1.72 to $ 1.80 Non-GAAP

adjustments, net of taxes: Purchased software amortization 0.26

0.25 Other intangibles amortization 0.06 0.06 Internally developed

software products amortization 0.18 0.18 Share-based compensation

0.15 0.15 Total non-GAAP

adjustment $ 0.65 $ 0.64

Projected non-GAAP diluted EPS from continuing operations range $

2.37 to $ 2.44 Fiscal

Year Ending

Projected Operating

Margin

March 31,

2016

Projected GAAP operating margin 28 % Non-GAAP

operating adjustments: Purchased software amortization 4 % Other

intangibles amortization 1 % Internally developed software products

amortization 3 % Share-based compensation 2 % Total

non-GAAP operating adjustment 10 % Projected

non-GAAP operating margin 38 % Refer to

the discussion of non-GAAP financial measures included in the

accompanying press release for additional information.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150723006537/en/

CA TechnologiesCorporate CommunicationsSaswato Das,

646-710-6690saswato.das@ca.comorJennifer Hallahan,

212-415-6924jennifer.hallahan@ca.comorInvestor

RelationsMichael Bauer, 212-415-6870michael.bauer@ca.comorTraci Tsuchiguchi,

650-534-9814traci.tsuchiguchi@ca.com

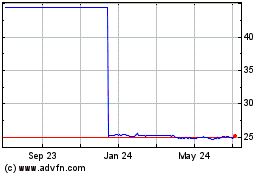

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

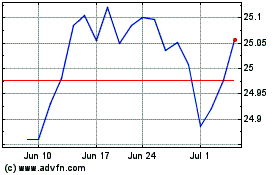

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024