Banorte strengthens Fraud Prevention with Next Generation Advanced Authentication Technology from CA Technologies

April 16 2015 - 9:15AM

Business Wire

Largest Mexican-controlled Bank is First in

Latin America to Offer Cardholders Convenience and Security with CA

SaaS-based Solutions

CA Technologies (NASDAQ:CA) and Grupo Financiero Banorte, S.A.B.

de C.V. (“GFNORTE”) (BMV: GFNORTEO) today announced that Banco

Mercantil del Norte, S.A. (“Banorte”), one of Mexico’s largest

financial institutions and a subsidiary of GFNorte, is implementing

CA Risk Analytics to better distinguish fraudulent transactions

from legitimate transactions and deliver a more secure and seamless

credit card user experience.

A long-time provider of strong authentication via the 3-D Secure

protocol and CA Transaction Manager, Banorte has further advanced

its authentication and fraud prevention capabilities using CA Risk

Analytics, a transparent, intelligent risk assessment and fraud

detection solution for 3D eCommerce transactions. CA Risk Analytics

offers advanced, statistical predictive models to assess the risk

of online, card-not-present (CNP) transactions.

CA Security solutions form the foundation of Banorte’s and Ixe´s

Compra Segura, a key initiative to improve the online payment

experience for its 1.7 million credit card customers, reduce

fraudulent use of cardholder credentials and provide its customers

a stronger credit card product with more benefits. The solution

provides a frictionless customer interface for authenticating

cardholders during the checkout process to help prevent credit card

fraud. In this way, more than 30,000 transactions are protected on

average every week, with more than the 40 percent of Banorte and

Ixe customers enrolled on Compra Segura.

“Security and convenience are the two critical demands from our

customers of our affiliate Banorte-Ixe Tarjetas S.A. de C.V. SOFOM

E.R. Since implementing CA Risk Analytics, we have seen a dramatic

decrease in transaction abandonment and improved the enrollment and

update process. We’ve more than tripled the number of enrolled

users, and also increased the authorization rate 15 percent,

requesting authentication for only one fourth of the transactions,”

said Manuel Romo, President of Products, Banorte. “The advanced

authentication capabilities from CA Technologies give us the

confidence that our customer transactions are secure while

providing the customer with a seamless user experience.”

CA Risk Analytics relies on neural network models powered by

machine learning techniques that capture data about individual user

actions. This helps distinguish legitimate from fraudulent

behavior. Optimized for 3-D Secure protocol, CA Risk Analytics

helps prevent CNP fraud by transparently assessing the risk of a

transaction in real-time.

“There is a need for a more advanced CNP fraud detection

strategy that goes beyond simply comparing the current transaction

to established fraud indicators. Using CA Risk Analytics can

provide a more accurate assessment of which transactions to

authenticate as legitimate and which transactions need to be

flagged as potentially fraud,” said Nick Craig, vice president,

Secure Payments, CA Technologies. “We have been working with

Banorte to implement and deploy the best secure online payment

solution.”

About Grupo Financiero Banorte, S.A.B. DE C.V.

(GFNORTE)

Grupo Financiero Banorte (GFNorte; BMV:GFNORTEO) is one of the

leading financial institutions in Mexico. After merging with Ixe,

it became the third largest in the country and the largest

financial group controlled by Mexican shareholders. Currently

serving 13 million customers all over the country through a network

of 1,300 branches, over 7,000 ATMs, over 5,300 banking

correspondents and more than 162,000 POS terminals. GFNorte offers

products and brokerage services, asset consulting, investment

companies, leasing and factoring, warehousing, insurance, pensions

and retirement savings. It runs the main Retirement Funds

Administrator in Mexico, Afore XXI Banorte, serving more than 17

million accounts. Banorte has a presence in southern Texas through

Inter National Bank, as well as in New Jersey and California

through money transfer companies Motran and Uniteller, and also in

New York, through Banorte Securities International. Banorte is one

of the banks with better asset quality indicators within the

Mexican financial system and possesses high levels of

capitalization and liquidity. Learn more at www.banorte.com.

About CA Technologies

CA Technologies (NASDAQ:CA) creates software that fuels

transformation for companies and enables them to seize the

opportunities of the application economy. Software is at the heart

of every business in every industry. From planning, to development,

to management and security, CA is working with companies worldwide

to change the way we live, transact, and communicate – across

mobile, private and public cloud, distributed and mainframe

environments. Learn more at www.ca.com.

Follow CA Technologies

- Twitter

- Social Media Page

- Press Releases

- Blogs

Legal Notices

Copyright © 2015 CA, Inc. All Rights Reserved. All trademarks,

trade names, service marks, and logos referenced herein belong to

their respective companies.

CA TechnologiesLeanne Agurkis,

407-620-2136Leanne.Agurkis@ca.comorBruno Rossini, +5511 98485

7496Bruno.Rossini@ca.com

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

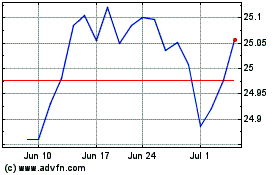

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024