- Second Quarter 2016 Total BioMarin

Revenue Increases 20.0% Y/Y to $300.1 million

BioMarin Pharmaceutical Inc. (NASDAQ:BMRN) today announced

financial results for the second quarter ended June 30, 2016. GAAP

net loss was $423.6 million, or $(2.61) per basic and diluted share

for the second quarter of 2016, compared to GAAP net loss of $82.0

million, or $(0.51) per basic and diluted share, for the second

quarter of 2015. The increased GAAP net loss compared to the prior

year quarter was primarily due to impairment and related charges,

net of tax, resulting from the termination of the Kyndrisa

development program in the second quarter.

Non-GAAP income was $16.1 million for the

quarter ended June 30, 2016, compared to non-GAAP loss of $5.8

million for the second quarter of 2015. The increase in non-GAAP

income compared to the prior year quarter was primarily due to

increased gross margins from strong Kuvan and Vimizim net product

revenues, partially offset by increased non-GAAP selling, general

and administrative expense for Vimizim and Kuvan, and non-GAAP

research and development expense.

Total BioMarin Revenue was $300.1 million for

the second quarter of 2016, an increase of 20.0% compared to the

same period in 2015. This strong result was driven by year over

year growth of 98.1% and 50.1% of Vimizim and Kuvan, respectively.

Vimizim net product revenue growth was driven primarily by robust

patient growth and in part by the timing of large orders from Latin

America and the Middle East. Kuvan revenue growth was driven by

patient increases in North America and strong sales in

international territories. Kuvan revenue from ex-North America

territories since BioMarin acquired worldwide rights in January

2016 contributed $22.0 million and revenues in North America

contributed $68.2 million in the quarter. Naglazyme patient growth

was 9.2% compared to a year ago. Naglazyme revenue in the second

quarter 2016 was lower than revenue in the second quarter 2015

primarily due to the timing of central government orders from Latin

America in 2015.

As of June 30, 2016, BioMarin had cash, cash

equivalents and investments totaling $704.9 million, as compared to

$1,018.3 million on December 31, 2015.

Commenting on the quarter, Jean-Jacques

Bienaimé, Chairman and Chief Executive Officer of BioMarin said,

“In the first half of 2016 we made tremendous progress moving our

development pipeline forward while driving our established

commercial business to record levels. The increase in Total

BioMarin Revenue guidance for 2016 is testament to the innovation

BioMarin provides patients, mostly children, with rare and

ultra-rare disorders. Prospects for new product launches in 2017

increased during the first half of the year due to positive data

readouts for Brineura and pegvaliase.”

Mr. Bienaimé continued, “We are pleased that

last week the U.S. Food and Drug Administration accepted for review

the submission of a Biologics License Application (BLA) for

Brineura, an investigational therapy to treat children with CLN2

disease, a form of Batten disease. With the Prescription Drug User

Fee Act (PDUFA) goal date for an approval decision of January 27,

2017, we are one step closer to potentially providing a treatment

option for this devastating childhood disease. We have also filed

the Marketing Authorization Application in Europe for Brineura. In

addition, at the World Federation of Hemophilia Congress last week,

we announced positive proof-of-concept data with our gene therapy

product candidate BMN 270 for hemophilia A and plans to start a

Phase 2b study in mid-2017. Also in the quarter at R&D Day, we

shared robust 12-month data with vosoritide for achondroplasia. If

the data from these programs continue to mature as we hope, we

believe that these product candidates could each ultimately drive a

billion dollars in annual revenue when commercialized.”

| Net Product Revenue (in

millions of U.S. dollars, unaudited) |

| |

|

|

|

|

|

|

| Total Revenue |

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2016 |

|

|

2015 |

|

|

$ Change |

|

|

% Change |

|

|

2016 |

|

|

2015 |

|

|

$ Change |

|

|

% Change |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Vimizim (1) |

|

$ |

106.8 |

|

|

$ |

53.9 |

|

|

$ |

52.9 |

|

|

|

98.1 |

% |

|

$ |

179.4 |

|

|

$ |

104.5 |

|

|

$ |

74.9 |

|

|

|

71.7 |

% |

| Naglazyme (1) |

|

|

78.4 |

|

|

|

111.1 |

|

|

|

(32.7 |

) |

|

|

(29.4 |

)% |

|

|

143.8 |

|

|

|

189.3 |

|

|

|

(45.5 |

) |

|

|

(24.0 |

)% |

| Kuvan (2) |

|

|

90.2 |

|

|

|

60.1 |

|

|

|

30.1 |

|

|

|

50.1 |

% |

|

|

166.9 |

|

|

|

110.3 |

|

|

|

56.6 |

|

|

|

51.3 |

% |

| Aldurazyme |

|

|

18.7 |

|

|

|

20.2 |

|

|

|

(1.5 |

) |

|

|

(7.4 |

)% |

|

|

35.1 |

|

|

|

38.4 |

|

|

|

(3.3 |

) |

|

|

(8.6 |

)% |

| Firdapse |

|

|

4.5 |

|

|

|

3.7 |

|

|

|

0.8 |

|

|

|

21.6 |

% |

|

|

8.7 |

|

|

|

7.8 |

|

|

|

0.9 |

|

|

|

11.5 |

% |

| Net

product revenues |

|

|

298.6 |

|

|

|

249.0 |

|

|

|

49.6 |

|

|

|

19.9 |

% |

|

|

533.9 |

|

|

|

450.3 |

|

|

|

83.6 |

|

|

|

18.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Collaborative agreement

revenues |

|

|

- |

|

|

|

0.3 |

|

|

|

(0.3 |

) |

|

|

|

|

|

|

0.2 |

|

|

|

0.7 |

|

|

|

(0.5 |

) |

|

|

|

|

| Royalty, license and

other revenues |

|

|

1.5 |

|

|

|

0.8 |

|

|

|

0.7 |

|

|

|

|

|

|

|

2.8 |

|

|

|

2.1 |

|

|

|

0.7 |

|

|

|

|

|

| Total

BioMarin revenues |

|

$ |

300.1 |

|

|

$ |

250.1 |

|

|

$ |

50.0 |

|

|

|

20.0 |

% |

|

$ |

536.9 |

|

|

$ |

453.1 |

|

|

$ |

83.8 |

|

|

|

18.5 |

% |

| |

| (1) Vimizim and Naglazyme

revenues experience quarterly fluctuations primarily due to the

timing of government ordering patterns in certain countries.

The Company does not believe these fluctuations reflect a change in

underlying demand. |

| (2) Growth in North America

contributed $68.2 million in the second quarter with an additional

$22.0 million coming from newly acquired ex-North American

territories. |

| |

|

Details of Net Product Revenue Attributable to

Aldurazyme |

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2016 |

|

|

2015 |

|

|

$ Change |

|

|

% Change |

|

|

2016 |

|

|

2015 |

|

|

$ Change |

|

|

% Change |

|

| Aldurazyme revenue

reported by Genzyme |

|

$ |

56.8 |

|

|

$ |

56.5 |

|

|

$ |

0.3 |

|

|

|

0.5 |

% |

|

$ |

109.6 |

|

|

$ |

109.9 |

|

|

$ |

(0.3 |

) |

|

|

(0.3 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three

Months Ended June 30, |

|

|

|

|

|

|

|

|

|

Six Months

Ended June 30, |

|

| |

|

2016 |

|

2015 |

|

$

Change |

|

|

|

|

|

|

|

|

|

2016 |

|

2015 |

|

$

Change |

| Royalties earned from Genzyme |

|

$ |

22.8 |

|

|

$ |

23.5 |

|

|

$ |

(0.7 |

) |

|

|

|

|

|

|

|

|

|

$ |

44.3 |

|

|

$ |

45.8 |

|

|

$ |

(1.5 |

) |

| Net product transfer revenues (3) |

|

|

(4.1 |

) |

|

|

(3.3 |

) |

|

|

(0.8 |

) |

|

|

|

|

|

|

|

|

|

|

(9.2 |

) |

|

|

(7.4 |

) |

|

|

(1.8 |

) |

| Total Aldurazyme net product revenues |

|

$ |

18.7 |

|

|

$ |

20.2 |

|

|

$ |

(1.5 |

) |

|

|

|

|

|

|

|

|

|

$ |

35.1 |

|

|

$ |

38.4 |

|

|

$ |

(3.3 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (3) To the extent units

shipped to third party customers by Genzyme exceed BioMarin

inventory transfers to Genzyme, BioMarin will record a decrease in

net product revenue from the royalty payable to BioMarin for the

amount of previously recognized product transfer revenue. If

BioMarin inventory transfers exceed units shipped to third party

customers by Genzyme, BioMarin will record incremental net product

transfer revenue for the period. Positive net product transfer

revenues result in the period if BioMarin transferred more units to

Genzyme than Genzyme sold to third-party customers. |

| |

Impairment of Intangible Assets and Related Charges and

Adjustments

During the three months ended June 30, 2016, the

Company incurred impairment charges and made other adjustments

related to the Kyndrisa and related exons and the reveglucosidase

alfa programs. In May 2016, the Company withdrew its Marketing

Authorization Application for the approval of Kyndrisa from the

European Medicines Agency. Additionally, in June 2016, the Company

discontinued the clinical and regulatory development program for

reveglucosidase alfa. Following these events, the Company

determined the IPR&D intangible assets related to these

programs were fully impaired, resulting in a total impairment

charge of $599.1 million. Additionally, the Company reversed the

contingent acquisition consideration liabilities as it was

determined that achievement of certain future regulatory and

commercial milestones associated with these programs was no longer

probable, resulting in a $64.9 million credit to Contingent

consideration expense for the period. Also related to the

impairment of the IPR&D assets, the Company reversed certain

deferred tax liabilities associated with the future amortization of

the IPR&D intangible assets, resulting in a $153.5 million

credit to the Benefit from income taxes for the period.

The following table summarizes the impact of

these impairments and related adjustments on the Company’s

Condensed Consolidated Statements of Operations for the three and

six months ended June 30, 2016 (in millions of U.S. dollars):

|

|

Kyndrisa |

|

|

Reveglucosidase alfa |

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment of intangible assets |

$ |

574.1 |

|

|

$ |

25.0 |

|

|

$ |

599.1 |

|

|

Contingent consideration expense |

|

(43.8 |

) |

|

|

(21.1 |

) |

|

|

(64.9 |

) |

| Benefit

from income taxes |

|

(143.5 |

) |

|

|

(10.0 |

) |

|

|

(153.5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

impact |

$ |

386.8 |

|

|

$ |

(6.1 |

) |

|

$ |

380.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Updated 2016 Financial

Guidance |

| |

|

|

|

|

| Revenue Guidance ($ in

millions) |

| |

|

|

|

|

| Item |

|

|

|

|

| |

|

Provided April

28, 2016 |

|

Updated August

4, 2016 |

| Total BioMarin Revenues |

|

$1,050 to $1,100 |

|

$1,100 to $1,150 |

| Vimizim Net Product Revenue |

|

$315 to $340 |

|

$340 to $360 |

| Naglazyme Net Product Revenue |

|

$290 to $320 |

|

Unchanged |

| Kuvan Net Product Revenue |

|

$320 to $350 |

|

$340 to $360 |

| |

|

|

|

|

| Select Income Statement Guidance ($

in millions, except percentages) |

| |

|

|

|

|

| Item |

|

|

|

|

| |

|

Provided April

28, 2016 |

|

Updated August

4, 2016 |

| Cost of Sales (% of Total Revenue) |

|

18.0% to 19.0% |

|

Unchanged |

| Selling, General and Admin. Expense |

|

$470 to $490 |

|

Unchanged |

| Research and Development Expense |

|

$680 to $720 |

|

$670 to $690 |

| GAAP Net Loss |

|

$(355) to $(385) |

|

$(620) to $(650) |

| non-GAAP Loss |

|

$(75) to $(100) |

|

$(30) to $(50) |

| |

|

|

|

|

Recent Key Program Updates

- BMN 270 gene therapy product for hemophilia A:

The Company is currently conducting a Phase 1/2

first-in-human, dose escalation study in severe hemophilia A

patients. A total of nine patients with severe hemophilia A have

received a single dose of BMN 270, seven of whom have been treated

at the highest dose of 6 x 1013 vector genomes (VG)/kilogram (kg),

and to date, post-treatment follow-up ranges from 12 to 28

weeks. To date, the study has demonstrated significant factor VIII

expression with a good safety profile. Last week at the World

Federation of Hemophilia Congress, the Company announced that as of

July 6th, 6 of 7 patients receiving the high dose of BMN 270 had

factor VIII levels above 50%, and the 7th was above 10%.

While the one patient who was above 10% and below 50% now appears

to have Factor VIII levels above 5%, all high dose patients

continue to be in the mild or better hemophilia A range.

With these interim results having established proof of concept for

BMN 270, BioMarin’s next step is to go into a Phase 2b study that

could potentially be registration enabling.

- Vosoritide for achondroplasia: The Company

provided an update at R&D Day April 20, 2016 on its Phase 2

study of vosoritide, an analog of C-type Natriuretic Peptide (CNP),

in children with achondroplasia, the most common form of dwarfism.

After 12 months of daily dosing at 15 µg/kg/day, the cohort 3

patients (n=10) experienced a 46% or 1.9 cm/year increase in mean

annualized growth velocity from baseline (p-value = 0.02).

These findings provide evidence of durability of effect consistent

with previously presented 6-month data for these patients, which

demonstrated an annualized increase of 50% or 2.0 cm/year in mean

annualized growth velocity. In addition, 6-month data for 12

patients who were initiated on a lower dose and switched to 15

µg/kg/day showed an increase of 65% or 2.3 cm/year in mean

annualized growth velocity from baseline (p-value = 0.002). The

Company expects to provide an update on 6-month data from the 4th

cohort of patients who received 30 µg/kg/day dose of vosoritide in

the second half of 2016 at a medical meeting. BioMarin plans to

initiate a Phase 3 study with Vosoritide by

year-end.

- Brineura (formerly known as Cerliponase alfa) for CLN2,

late-infantile form of Batten disease: On July 28th, 2016,

the Company announced that the U.S. Food and Drug Administration

(FDA) had accepted for review the submission of a Biologics License

Application (BLA) for Brineura, an investigational therapy to treat

children with CLN2 disease, a form of batten disease. The

Prescription Drug User Fee Act (PDUFA) goal date for a decision is

January 27, 2017. BioMarin also has submitted a Marketing

Authorization Application (MAA) to the European Medicines Agency

(EMA) for Brineura, and it is undergoing validation at the Agency.

The FDA granted Brineura Priority Review status, which is

designated to drugs that offer major advances in treatment or

provide a treatment where no adequate therapy exists. Brineura was

previously granted Orphan Drug Designation and Breakthrough Therapy

Designation by the FDA. (See BioMarin press release from July 27,

2016 for further details.)

- Pegvaliase for phenylketonuria (PKU): Pivotal

results for the Phase 3 PRISM-2 study (formerly referred to as

165-302) that pegvaliase met the primary endpoint of change in

blood Phe compared with placebo (p<0.0001) were announced March

21, 2016. The pegvaliase treated group maintained mean blood Phe

levels at 527.2 umol/L compared to their Randomized Discontinuation

Trial (RDT) baseline of 503.9 umol/L, whereas the placebo treated

group mean blood Phe levels increased to 1385.7 umol/L compared to

their RDT baseline of 536.0 umol/L. The treatment effect

demonstrated in this study represents an approximately 62%

improvement in blood Phe compared to placebo. Based on the

supportive data results, the Company plans to submit a BLA to the

FDA in the fourth quarter of 2016 or the first quarter of

2017.

Conference Call Details

BioMarin will host a conference call and webcast

to discuss second quarter 2016 financial results today, Thursday,

August 4, at 4:30 p.m. ET. This event can be accessed on the

investor section of the BioMarin website at www.BMRN.com.

U.S. / Canada Dial-in Number:

877.303.6313International Dial-in Number: 631.813.4734Conference

ID: 40166552

Replay Dial-in Number: 855.859.2056Replay

International Dial-in Number: 404.537.3406Conference ID:

40166552

About BioMarinBioMarin is a

global biotechnology company that develops and commercializes

innovative therapies for patients with serious and life-threatening

rare and ultra-rare genetic diseases. The company's portfolio

consists of five commercialized products and multiple clinical and

pre-clinical product candidates. For additional information, please

visit www.BMRN.com.

Forward-Looking StatementThis

press release contains forward-looking statements about the

business prospects of BioMarin Pharmaceutical Inc., including,

without limitation, statements about: the expectations of revenue

and expenses related to Vimizim, Naglazyme, Kuvan, Firdapse, and

Aldurazyme; the financial performance of BioMarin as a whole; the

timing of BioMarin's clinical trials; the continued clinical

development and commercialization of Vimizim, Naglazyme, Kuvan,

Firdapse, Aldurazyme and BioMarin’s product candidates; the

possible approval and commercialization of BioMarin's product

candidates; and actions by regulatory authorities. These

forward-looking statements are predictions and involve risks and

uncertainties such that actual results may differ materially from

these statements. These risks and uncertainties include, among

others: our success in the commercialization of Vimizim, Naglazyme,

Kuvan, and Firdapse; Genzyme Corporation's success in continuing

the commercialization of Aldurazyme; results and timing of current

and planned preclinical studies and clinical trials, our ability to

successfully manufacture our products and product candidates; the

content and timing of decisions by the U.S. Food and Drug

Administration, the European Commission and other regulatory

authorities concerning each of the described products and product

candidates; the market for each of these products; actual sales of

Vimizim, Naglazyme, Kuvan, Firdapse and Aldurazyme; and those

factors detailed in BioMarin's filings with the Securities and

Exchange Commission, including, without limitation, the factors

contained under the caption "Risk Factors" in BioMarin's 2015

Annual Report on Form 10-K, and the factors contained in BioMarin's

reports on Form 10-Q. Stockholders are urged not to place undue

reliance on forward-looking statements, which speak only as of the

date hereof. BioMarin is under no obligation, and expressly

disclaims any obligation to update or alter any forward-looking

statement, whether as a result of new information, future events or

otherwise.

BioMarin®, Naglazyme®, Kuvan®, Firdapse® and

Vimizim® are registered trademarks of BioMarin Pharmaceutical Inc.,

or its affiliates. BrineuraTM and KyndrisaTM are trademarks

of BioMarin Pharmaceutical Inc. Aldurazyme® is a registered

trademark of BioMarin/Genzyme LLC.

| BIOMARIN

PHARMACEUTICAL INC. |

| |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| June 30,

2016 and December 31, 2015 |

| (In

thousands of U.S. dollars, except share and per share

amounts) |

| |

| |

|

June 30, 2016 |

|

|

December 31, 2015(1) |

|

|

ASSETS |

|

(unaudited) |

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

305,969 |

|

|

$ |

397,040 |

|

| Short-term

investments |

|

|

197,318 |

|

|

|

195,579 |

|

| Accounts

receivable, net (allowance for doubtful accounts: $132 and

$93, at June 30, 2016 and December 31, 2015,

respectively) |

|

|

214,158 |

|

|

|

164,959 |

|

|

Inventory |

|

|

326,556 |

|

|

|

271,683 |

|

| Other

current assets |

|

|

61,945 |

|

|

|

60,378 |

|

| Total

current assets |

|

|

1,105,946 |

|

|

|

1,089,639 |

|

| Noncurrent assets: |

|

|

|

|

|

|

|

|

| Long-term

investments |

|

|

201,620 |

|

|

|

425,652 |

|

| Property,

plant and equipment, net |

|

|

724,494 |

|

|

|

704,207 |

|

| Intangible

assets, net |

|

|

568,966 |

|

|

|

683,996 |

|

|

Goodwill |

|

|

197,039 |

|

|

|

197,039 |

|

| Long-term

deferred tax assets |

|

|

266,182 |

|

|

|

220,191 |

|

| Other

assets |

|

|

23,057 |

|

|

|

408,644 |

|

| Total

assets |

|

$ |

3,087,304 |

|

|

$ |

3,729,368 |

|

|

LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable and accrued liabilities |

|

|

292,342 |

|

|

|

392,511 |

|

| Short-term

convertible debt, net |

|

|

24,420 |

|

|

|

— |

|

| Short-term

contingent acquisition consideration payable |

|

|

47,818 |

|

|

|

52,946 |

|

| Total

current liabilities |

|

|

364,580 |

|

|

|

445,457 |

|

| Noncurrent

liabilities: |

|

|

|

|

|

|

|

|

| Long-term convertible

debt |

|

|

645,685 |

|

|

|

662,286 |

|

| Long-term

contingent acquisition consideration payable |

|

|

120,151 |

|

|

|

32,663 |

|

| Long-term

deferred tax liabilities |

|

|

— |

|

|

|

143,527 |

|

| Other

long-term liabilities |

|

|

39,312 |

|

|

|

44,588 |

|

| Total

liabilities |

|

|

1,169,728 |

|

|

|

1,328,521 |

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Common

stock, $0.001 par value: 250,000,000 shares authorized at

June 30, 2016 and December 31, 2015: 163,282,081 and 161,526,044

shares issued and outstanding at June 30, 2016 and

December 31, 2015, respectively |

|

|

164 |

|

|

|

162 |

|

| Additional

paid-in capital |

|

|

3,458,124 |

|

|

|

3,414,837 |

|

| Company

common stock held by Nonqualified Deferred Compensation Plan |

|

|

(14,969 |

) |

|

|

(13,616 |

) |

| Accumulated

other comprehensive income |

|

|

4,528 |

|

|

|

21,033 |

|

| Accumulated

deficit |

|

|

(1,530,271 |

) |

|

|

(1,021,569 |

) |

| Total

stockholders’ equity |

|

|

1,917,576 |

|

|

|

2,400,847 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

3,087,304 |

|

|

$ |

3,729,368 |

|

| |

|

|

|

|

|

|

|

|

| (1)

December 31, 2015 balances were derived from the audited

Consolidated Financial Statements included in the Company's Annual

Report on Form 10-K for the year ended December 31, 2015, filed

with the U.S. Securities and Exchange Commission on February 29,

2016. |

| |

| BIOMARIN

PHARMACEUTICAL INC. |

| |

|

|

|

|

|

|

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

| Three and

Six Months Ended June 30, 2016 and 2015 |

| (In

thousands of U.S. dollars, except per share amounts) |

|

(Unaudited) |

| |

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

|

REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net product

revenues |

|

$ |

298,576 |

|

|

$ |

249,023 |

|

|

$ |

533,933 |

|

|

$ |

450,335 |

|

|

Collaborative agreement revenues |

|

|

— |

|

|

|

342 |

|

|

|

233 |

|

|

|

718 |

|

| Royalty,

license and other revenues |

|

|

1,555 |

|

|

|

770 |

|

|

|

2,701 |

|

|

|

2,002 |

|

| Total

revenues |

|

|

300,131 |

|

|

|

250,135 |

|

|

|

536,867 |

|

|

|

453,055 |

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

sales |

|

|

51,617 |

|

|

|

38,063 |

|

|

|

94,735 |

|

|

|

69,061 |

|

| Research and

development |

|

|

167,039 |

|

|

|

157,901 |

|

|

|

325,832 |

|

|

|

299,975 |

|

| Selling,

general and administrative |

|

|

109,577 |

|

|

|

101,514 |

|

|

|

214,877 |

|

|

|

194,320 |

|

| Intangible

asset amortization and contingent consideration |

|

|

(54,414 |

) |

|

|

16,945 |

|

|

|

(43,972 |

) |

|

|

19,847 |

|

| Impairment

of intangible assets |

|

|

599,118 |

|

|

|

— |

|

|

|

599,118 |

|

|

|

— |

|

| Total

operating expenses |

|

|

872,937 |

|

|

|

314,423 |

|

|

|

1,190,590 |

|

|

|

583,203 |

|

| LOSS FROM

OPERATIONS |

|

|

(572,806 |

) |

|

|

(64,288 |

) |

|

|

(653,723 |

) |

|

|

(130,148 |

) |

| Equity in the loss of

BioMarin/Genzyme LLC |

|

|

(135 |

) |

|

|

(203 |

) |

|

|

(270 |

) |

|

|

(353 |

) |

| Interest income |

|

|

1,357 |

|

|

|

1,023 |

|

|

|

2,928 |

|

|

|

1,706 |

|

| Interest expense |

|

|

(9,944 |

) |

|

|

(10,002 |

) |

|

|

(19,787 |

) |

|

|

(19,464 |

) |

| Debt conversion

expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(163 |

) |

| Other expense |

|

|

(1,417 |

) |

|

|

(9,073 |

) |

|

|

(1,219 |

) |

|

|

(8,824 |

) |

| LOSS BEFORE INCOME

TAXES |

|

|

(582,945 |

) |

|

|

(82,543 |

) |

|

|

(672,071 |

) |

|

|

(157,246 |

) |

| Benefit from income

taxes |

|

|

(159,385 |

) |

|

|

(554 |

) |

|

|

(163,369 |

) |

|

|

(7,756 |

) |

| NET

LOSS |

|

$ |

(423,560 |

) |

|

$ |

(81,989 |

) |

|

$ |

(508,702 |

) |

|

$ |

(149,490 |

) |

| NET LOSS PER

SHARE, BASIC AND DILUTED |

|

$ |

(2.61 |

) |

|

$ |

(0.51 |

) |

|

$ |

(3.14 |

) |

|

$ |

(0.94 |

) |

| Weighted average common

shares outstanding, basic and diluted |

|

|

162,587 |

|

|

|

160,406 |

|

|

|

162,067 |

|

|

|

159,017 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Information

The results presented in this press release for

the three and six months ended June 30, 2016 and 2015 include both

GAAP information and non-GAAP information. As used in this release,

non-GAAP information is based on reported GAAP net loss and the

guidance for full-year GAAP net loss before interest, income taxes,

depreciation and amortization and further adjusted to exclude

certain non-cash stock-based compensation expense, non-cash

contingent consideration expense and certain other specified items,

as detailed below. In addition, BioMarin includes in this press

release the effects of these non-GAAP adjustments on certain

components of GAAP net loss for each of the periods presented. In

this regard, non-GAAP information and its components, including

non-GAAP Cost of sales, non-GAAP Research and development expenses,

non-GAAP Selling, general and administrative expense, non-GAAP

intangible asset amortization and contingent consideration,

non-GAAP Other income (expense) and non-GAAP Provision for (benefit

from) income taxes are statement of operations line items prepared

on the same basis as, and therefore components of, the overall

non-GAAP measures.

BioMarin regularly uses both GAAP and non-GAAP

results and expectations internally to assess the Company’s core

operating performance, as support for budgeting and financial

planning purposes and to evaluate key business decisions. Because

the non-GAAP information and its components are important internal

measurements for BioMarin, the Company believes that providing this

information in conjunction with BioMarin’s GAAP information

enhances investors’ understanding because it provides additional

information regarding the performance of BioMarin’s core operating

results and business and development of its pipeline.

The non-GAAP information and its components are

not meant to be considered in isolation or as a substitute for

comparable GAAP measures and should be read in conjunction with the

consolidated financial information prepared in accordance with

GAAP. Investors should note that the non-GAAP information is not

prepared under any comprehensive set of accounting rules or

principles and does not reflect all of the amounts associated with

the Company’s results of operations as determined in accordance

with GAAP. Investors should also note that these non-GAAP measures

have no standardized meaning prescribed by GAAP and, therefore,

have limits in their usefulness to investors. In addition, from

time to time in the future there may be other items that the

Company may exclude for purposes of its non-GAAP measures;

likewise, the Company may in the future cease to exclude items that

it has historically excluded for purposes of its non-GAAP measures.

Because of the non-standardized definitions, the non-GAAP measure

as used by BioMarin in this press release and the accompanying

tables may be calculated differently from, and therefore may not be

directly comparable to, similarly titled measures used by other

companies.

The following table presents the reconciliation

of GAAP Net Loss to non-GAAP Income (Loss):

| Reconciliation of GAAP Net Loss to non-GAAP

Income (Loss) |

| (In millions of U.S. dollars) |

| (unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

|

Six Months Ended |

|

|

Year Ending |

| |

June 30, |

|

|

June 30, |

|

|

December 31, 2016 |

| |

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

|

Guidance |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net

Loss |

$ |

(423.6 |

) |

|

$ |

(82.0 |

) |

|

$ |

(508.7 |

) |

|

$ |

(149.5 |

) |

|

$(620.0) to $(650.0) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

expense, net |

|

8.6 |

|

|

|

9.0 |

|

|

|

16.9 |

|

|

|

17.8 |

|

|

35.0 |

| Benefit

from income taxes |

|

(159.4 |

) |

|

|

(0.6 |

) |

|

|

(163.4 |

) |

|

|

(7.8 |

) |

|

(195.0) - (215.0) |

|

Depreciation expense |

|

11.9 |

|

|

|

8.5 |

|

|

|

25.0 |

|

|

|

16.4 |

|

|

45.0 -

55.0 |

|

Amortization expense |

|

7.6 |

|

|

|

2.6 |

|

|

|

15.1 |

|

|

|

5.2 |

|

|

30.0 |

|

Stock-based compensation expense |

|

33.9 |

|

|

|

29.6 |

|

|

|

64.1 |

|

|

|

52.2 |

|

|

121.0

- 146.0 |

|

Contingent consideration expense (1) |

|

(62.0 |

) |

|

|

14.3 |

|

|

|

(59.1 |

) |

|

|

14.6 |

|

|

(50.0)

- (60.0) |

|

Acquisition expenses (2) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7.0 |

|

|

- |

|

Impairment charges (3) |

|

599.1 |

|

|

|

12.8 |

|

|

|

599.1 |

|

|

|

12.8 |

|

|

599.0 |

|

Restructuring charges (4) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

5.0 -

10.0 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| non-GAAP Income

(Loss) |

$ |

16.1 |

|

|

$ |

(5.8 |

) |

|

$ |

(11.0 |

) |

|

$ |

(31.3 |

) |

|

$(30.0) to $(50.0) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following reconciliation of the GAAP reported to non-GAAP

information provides the details of the effects of the non-GAAP

adjustments on certain components of the Company’s operating

results for each of the periods presented.

| Reconciliation Of Certain GAAP Reported

Information To non-GAAP Information |

| Three and Six Months Ended June 30, 2016 and

2015 |

| (In millions of U.S. dollars) |

| (Unaudited) |

| |

|

|

| |

Three Months Ended June 30, |

|

| |

2016 |

|

|

2015 |

|

| |

|

|

|

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

| |

GAAPReported |

|

|

Interest, Taxes, Depreciation and Amortization |

|

|

Stock-Based Compensation, Contingent Consideration and

Other Adjustments |

|

|

non-GAAP |

|

|

GAAPReported |

|

|

Interest, Taxes, Depreciation and Amortization |

|

|

Stock-Based Compensation, Contingent Consideration and

OtherAdjustments |

|

|

non-GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

$ |

51.6 |

|

|

$ |

- |

|

|

$ |

(2.3 |

) |

|

$ |

49.3 |

|

|

$ |

38.1 |

|

|

$ |

- |

|

|

$ |

(1.8 |

) |

|

$ |

36.3 |

|

| Research and

development |

|

167.0 |

|

|

|

(6.0 |

) |

|

|

(14.8 |

) |

|

|

146.2 |

|

|

|

157.9 |

|

|

|

(3.9 |

) |

|

|

(12.5 |

) |

|

|

141.5 |

|

| Selling, general and

administrative (2) |

|

109.6 |

|

|

|

(5.9 |

) |

|

|

(16.8 |

) |

|

|

86.9 |

|

|

|

101.5 |

|

|

|

(4.6 |

) |

|

|

(15.3 |

) |

|

|

81.6 |

|

| Intangible asset

amortization and contingent consideration (1) |

|

(54.4 |

) |

|

|

(7.6 |

) |

|

|

62.0 |

|

|

|

— |

|

|

|

16.9 |

|

|

|

(2.6 |

) |

|

|

(14.3 |

) |

|

|

— |

|

| Impairment of intangible

assets (3) |

|

599.1 |

|

|

|

— |

|

|

|

(599.1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Interest expense, net |

|

(8.6 |

) |

|

|

8.6 |

|

|

|

— |

|

|

|

— |

|

|

|

(9.0 |

) |

|

|

9.0 |

|

|

|

— |

|

|

|

— |

|

| Other income

(expense) |

|

(1.5 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1.5 |

) |

|

|

(9.3 |

) |

|

|

— |

|

|

|

12.8 |

|

|

|

3.5 |

|

| Benefit from income

taxes |

|

(159.4 |

) |

|

|

159.4 |

|

|

|

— |

|

|

|

— |

|

|

|

(0.6 |

) |

|

|

0.6 |

|

|

|

— |

|

|

|

— |

|

| Net Income (Loss)/non-GAAP

Income (Loss) |

|

(423.6 |

) |

|

|

(131.3 |

) |

|

|

571.0 |

|

|

|

16.1 |

|

|

|

(82.0 |

) |

|

|

19.5 |

|

|

|

56.7 |

|

|

|

(5.8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Six Months Ended June 30, |

|

| |

2016 |

|

|

2015 |

|

| |

|

|

|

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

| |

GAAPReported |

|

|

Interest, Taxes, Depreciation and Amortization |

|

|

Stock-Based Compensation, Contingent Consideration and

Other Adjustments |

|

|

non-GAAP |

|

|

GAAPReported |

|

|

Interest, Taxes, Depreciationand Amortization |

|

|

Stock-Based Compensation, Contingent Consideration and

Other Adjustments |

|

|

non-GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

$ |

94.7 |

|

|

$ |

- |

|

|

$ |

(3.9 |

) |

|

$ |

90.8 |

|

|

$ |

69.1 |

|

|

$ |

- |

|

|

$ |

(3.1 |

) |

|

$ |

66.0 |

|

| Research and

development |

|

325.8 |

|

|

|

(13.4 |

) |

|

|

(28.5 |

) |

|

|

283.9 |

|

|

|

300.0 |

|

|

|

(7.5 |

) |

|

|

(22.4 |

) |

|

|

270.1 |

|

| Selling, general and

administrative (2) |

|

214.9 |

|

|

|

(11.6 |

) |

|

|

(31.7 |

) |

|

|

171.6 |

|

|

|

194.3 |

|

|

|

(8.9 |

) |

|

|

(33.7 |

) |

|

|

151.7 |

|

| Intangible asset

amortization and contingent consideration (1) |

|

(44.0 |

) |

|

|

(15.1 |

) |

|

|

59.1 |

|

|

|

— |

|

|

|

19.8 |

|

|

|

(5.2 |

) |

|

|

(14.6 |

) |

|

|

— |

|

| Impairment of intangible

assets (3) |

|

599.1 |

|

|

|

— |

|

|

|

(599.1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Interest expense, net |

|

(16.9 |

) |

|

|

16.9 |

|

|

|

— |

|

|

|

— |

|

|

|

(17.8 |

) |

|

|

17.8 |

|

|

|

— |

|

|

|

— |

|

| Other income

(expense) |

|

(1.6 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1.6 |

) |

|

|

(9.4 |

) |

|

|

— |

|

|

|

12.8 |

|

|

|

3.4 |

|

| Benefit from income

taxes |

|

(163.4 |

) |

|

|

163.4 |

|

|

|

— |

|

|

|

— |

|

|

|

(7.8 |

) |

|

|

7.8 |

|

|

|

— |

|

|

|

— |

|

| Net Income (Loss)/non-GAAP

Income (Loss) |

|

(508.7 |

) |

|

|

(106.4 |

) |

|

|

604.1 |

|

|

|

(11.0 |

) |

|

|

(149.5 |

) |

|

|

31.6 |

|

|

|

86.6 |

|

|

|

(31.3 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

Includes the expense associated with the change in the fair value

of contingent acquisition consideration payable for the period,

resulting from changes in estimated probabilities and timing of

achieving certain developmental milestones. Amounts for the three

months ended June 30, 2016 include $43.8 million and $21.1 million

related to the change in probability of achieving the Kyndrisa and

Reveglucosidase alfa development milestones, respectively. |

| (2)

Includes $7.0 million of acquisition costs for the six months ended

June 30, 2015 related to the acquisition of Prosensa Holdings

N.V. |

| (3)

Includes $574.1 million and $25.0 million for the impairment of

intangible assets associated with the discontinuance of the

Kyndrisa and Reveglucosidase alfa development programs,

respectively, during the three months ended June 30, 2016. |

| (4)

Represents estimated restructuring charges for expected headcount

reductions to be incurred in the second half of 2016, following an

approved plan of restructuring resulting from the Kyndrisa program

termination. |

| |

Contact:

Investors:

Traci McCarty

BioMarin Pharmaceutical Inc.

(415) 455-7558

Media:

Debra Charlesworth

BioMarin Pharmaceutical Inc.

(415) 455-7451

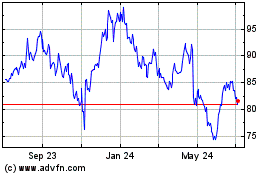

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

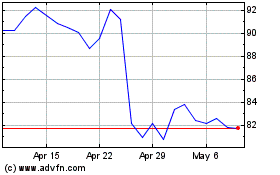

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024