BioScrip Completes Public Offering of Common Stock

June 22 2016 - 10:13AM

BioScrip, Inc. (NASDAQ:BIOS) (the “Company” or “BioScrip”)

announced today that it has completed its previously announced

underwritten public offering (the “Offering”) of 45,200,000 shares

of its common stock, including 5,200,000 shares of common stock

issued upon full exercise of the underwriters’ over-allotment

option, at a public offering price of $2.00 per share. The

Offering resulted in net proceeds of approximately $83.15 million,

after deducting underwriting discounts and commissions and offering

expenses. Jefferies LLC acted as the lead joint book-running

manager, SunTrust Robinson Humphrey, Inc. acted as a passive

book-running manager and Craig-Hallum Capital Group LLC acted as a

co-manager.

The Company intends to use the net proceeds from

the Offering in the following order of priority: (i) to fund the

cash portion of the previously announced proposed acquisition of

substantially all the assets of HS Infusion Holdings, Inc. (the

“Transaction”) and pay fees and expenses in connection with the

Transaction, (ii) to repay a portion of our outstanding borrowings

under its revolving credit facility and (iii) for general corporate

purposes. If the Transaction is not completed, we intend to

use any net proceeds from the Offering (i) to repay a portion of

our outstanding borrowings under our revolving credit facility and

(ii) for general corporate purposes.

The Offering is being made pursuant to a

registration statement previously filed and declared effective by

the Securities and Exchange Commission (the “SEC”). A

preliminary and final prospectus supplement and accompanying

prospectus relating to the offering have been filed with the SEC

and are available on the SEC's website at http://www.sec.gov.

Copies of the final prospectus supplement and accompanying

prospectus relating to the Offering may also be obtained from:

Jefferies LLC, Attention: Equity Syndicate Prospectus Department,

520 Madison Avenue, 12th Floor, New York, New York, 10022,

Telephone: 877-547-6340, Email:

Prospectus_Department@Jefferies.com.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy the securities

described herein, nor shall there be any sale of these securities

in any state or jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state or jurisdiction.

About BioScrip, Inc.

BioScrip, Inc. is a leading national provider of

infusion and home care management solutions. BioScrip partners with

physicians, hospital systems, skilled nursing facilities,

healthcare payors, and pharmaceutical manufacturers to provide

patients access to post-acute care services. BioScrip

operates with a commitment to bring customer-focused pharmacy and

related healthcare infusion therapy services into the home or

alternate-site setting. By collaborating with the full

spectrum of healthcare professionals and the patient, BioScrip

provides cost-effective care that is driven by clinical excellence,

customer service, and values that promote positive outcomes and an

enhanced quality of life for those it serves.

Forward-Looking Statements – Safe Harbor

This press release includes statements that may

constitute “forward-looking statements," that involve substantial

risks and uncertainties. These statements are made pursuant

to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. You can identify these statements by the

fact that they do not relate strictly to historical or current

facts. In some cases, forward-looking statements can be

identified by words such as "may," "should," "could," "anticipate,"

"estimate," "expect," "project," "intend," "plan," "believe,"

"predict," "potential," "continue" or comparable terms.

These forward-looking statements include, among others,

statements about the Company’s expectations with respect to the

intended use of proceeds from the Offering. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors, which may cause actual results to

be materially different from any results expressed or implied by

such forward-looking statements. For example, there are risks

associated with the Transaction, market conditions, as well as the

risks described in the prospectus supplement and the Company's

periodic filings with the Securities and Exchange Commission,

including, but not limited to, the Company’s annual report on Form

10-K for the year ended December 31, 2015. The Company

does not undertake any duty to update these forward-looking

statements after the date hereof, even though the Company’s

situation may change in the future. All of the

forward-looking statements herein are qualified by these cautionary

statements.

For Further Information:

Investor Contact

Jeffrey M. Kreger

BioScrip Chief Financial Officer

(720) 697-5200

jeffrey.kreger@bioscrip.com

Media Contact

Susan J. Lewis

(303) 766-4343 or (303) 518-7100

slewis@pairelations.com

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

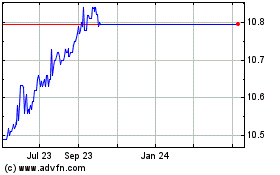

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024