BioScrip Prices Underwritten Offering of Common Stock

June 16 2016 - 10:20PM

BioScrip, Inc. (NASDAQ:BIOS) (the “Company” or “BioScrip”) today

announced the pricing of an underwritten offering of 40,000,000

shares of its common stock (the “Offering”) at a price to the

public of $2.00 per share (the “Offering Price”). Jefferies LLC is

acting as the lead joint book-running manager and SunTrust Robinson

Humphrey, Inc. is acting as a passive book-running manager.

Craig-Hallum Capital Group LLC is acting as a co-manager. The

Company has granted the underwriters an option for a period of 30

days to purchase up to an additional 5,200,000 shares of the

Company’s common stock at the Offering Price. The Company

expects to receive approximately $73.38 million in net proceeds

from the offering after deducting underwriting discounts and

commissions and other offering expenses payable by the Company,

assuming no exercise by the underwriters of their option to

purchase additional shares, or approximately $83.15 million if the

underwriters exercise their option to purchase additional shares in

full.

The Offering is being made pursuant to a

registration statement previously filed and declared effective by

the Securities and Exchange Commission (the “SEC”). A

preliminary prospectus supplement and accompanying prospectus

relating to the offering have been filed with the SEC and are

available on the SEC's website at http://www.sec.gov. Copies of the

final prospectus supplement and accompanying prospectus relating to

this offering, when available, may be obtained from: Jefferies LLC,

Attention: Equity Syndicate Prospectus Department, 520 Madison

Avenue, 12th Floor, New York, New York, 10022, Telephone:

877-547-6340, Email: Prospectus_Department@Jefferies.com.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy the securities

described herein, nor shall there be any sale of these securities

in any state or jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state or jurisdiction.

About BioScrip, Inc.

BioScrip, Inc. is a leading national provider of

infusion and home care management solutions. BioScrip partners with

physicians, hospital systems, skilled nursing facilities,

healthcare payors, and pharmaceutical manufacturers to provide

patients access to post-acute care services. BioScrip

operates with a commitment to bring customer-focused pharmacy and

related healthcare infusion therapy services into the home or

alternate-site setting. By collaborating with the full

spectrum of healthcare professionals and the patient, BioScrip

provides cost-effective care that is driven by clinical excellence,

customer service, and values that promote positive outcomes and an

enhanced quality of life for those it serves.

Forward-Looking Statements – Safe Harbor

This press release includes statements that may

constitute “forward-looking statements," that involve substantial

risks and uncertainties. These statements are made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. You can identify these statements by the fact

that they do not relate strictly to historical or current facts.

In some cases, forward-looking statements can be identified

by words such as "may," "should," "could," "anticipate,"

"estimate," "expect," "project," "intend," "plan," "believe,"

"predict," "potential," "continue" or comparable terms.

These forward-looking statements include, among others,

statements about the Company’s expectations with respect to the

proposed offering, including its intention to offer and sell shares

and its intended use of proceeds from the Offering. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors, which may cause actual results to

be materially different from any results expressed or implied by

such forward-looking statements. For example, there are risks

associated with market conditions, the underwriters fulfilling its

obligations to purchase the shares in the Offering and the

Company’s ability to satisfy certain conditions precedent to the

closing of the Offering; as well as the risks described in the

prospectus supplement and the Company's periodic filings with the

Securities and Exchange Commission, including, but not limited to,

the Company’s annual report on Form 10-K for the year ended

December 31, 2015. The Company does not undertake any

duty to update these forward-looking statements after the date

hereof, even though the Company’s situation may change in the

future. All of the forward-looking statements herein are

qualified by these cautionary statements.

For Further Information:

Investor Contact

Jeffrey M. Kreger

BioScrip Chief Financial Officer

(720) 697-5200

jeffrey.kreger@bioscrip.com

Media Contact

Susan J. Lewis

(303) 766-4343 or (303) 518-7100

slewis@pairelations.com

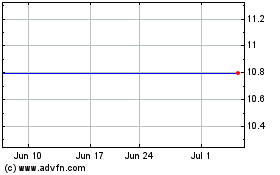

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

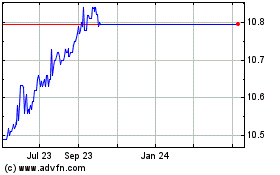

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024