Issuer Free Writing Prospectus dated June

16, 2016

(Related to Preliminary Prospectus Supplement dated June 13, 2016)

Filed Pursuant to Rule 433

Registration No. 333-210530

![[GRAPHIC MISSING]](http://content.edgar-online.com/edgar_conv_img/2016/06/16/0001144204-16-108442_IMAGE_001.JPG)

Update to Preliminary Prospectus Supplement

Dated June 13, 2016

This Free Writing Prospectus relates to the public offering

of the shares of common stock of BioScrip, Inc. and should be read together with the preliminary prospectus supplement dated June

13, 2016 (the “Preliminary Prospectus Supplement”) to the prospectus dated May 2, 2016 that is part of the Registration

Statement on Form S-3 (File No. 333-210530) filed with the Securities and Exchange Commission (“SEC”) before making

a decision in connection with an investment in this common stock. A copy of the Preliminary Prospectus Supplement can be accessed

through the following link:

https://www.sec.gov/Archives/edgar/data/1014739/000114420416107942/v442120_424b5.htm

This Free Writing Prospectus, unless specifically described

otherwise, supplements, updates and replaces the information set forth under the following captions of the Preliminary Prospectus

Supplement:

|

|

·

|

Prospectus Supplement Summary—Recent Developments—

Pending Acquisition of Home Solutions, Inc.

;

|

|

|

·

|

Prospectus Supplement Summary—The Offering;

|

References to “BioScrip,” “Company,”

“we,” “us” and “our” are used in this Free Writing Prospectus in the same manner as in the

Preliminary Prospectus Supplement.

Pending Acquisition of Home Solutions, Inc.

On June 11, 2016, we entered into an Asset Purchase Agreement

(as amended by the First Amendment (as defined below), the “Asset Purchase Agreement”), by and among HS Infusion Holdings,

Inc., a Delaware corporation (“Home Solutions”), certain subsidiaries of Home Solutions, BioScrip and HomeChoice Partners,

Inc., a Delaware corporation. Home Solutions is a privately held company that is a leading provider of home infusion and home nursing

products and services to patients suffering from chronic and acute medical conditions. Pursuant to the Asset Purchase Agreement,

BioScrip will acquire substantially all of the assets and assume certain liabilities of Home Solutions and its subsidiaries (the

“Transaction”) for the Transaction Consideration (as defined below). In accordance with the terms of the Transaction,

BioScrip will not purchase, among other things, (a) any accounts receivable associated with governmental payors, (b) cash assets,

(c) certain non-transferrable assets (e.g., state licenses and Medicare and Medicaid certifications and personnel and employment

records), (d) the equity of Home Solutions and its subsidiaries; (e) certain tax assets, (f) causes of actions related to any of

the items specified as excluded assets or excluded liabilities in the Asset Purchase Agreement, (g) any privileged materials, documents

or records of Home Solutions related to such excluded assets or excluded liabilities, or (h) intercompany receivables.

On June 16, 2016, the Company, HomeChoice Partners, Inc. and

Home Solutions entered into an amendment to the Asset Purchase Agreement (the “First Amendment”) which modified the

terms of the consideration payable by BioScrip to Home Solutions thereunder. The terms of the Asset Purchase Agreement as modified

by the First Amendment are set forth below. Subject to certain net working capital adjustments, the consideration for the Transaction

(the “Transaction Consideration”) is comprised of: (i) $67.50 million in cash (the “Cash Consideration”);

(ii) $7.50 million of shares of BioScrip common stock calculated using the public offering price set forth on the cover page of

this prospectus supplement (the “Transaction Closing Equity Consideration”); and (iii) contingent equity securities

of the Company, in the form of restricted shares of our common stock (“RSUs”), issued in two tranches, Tranche A and

Tranche B, with different vesting conditions (collectively, the “Contingent Shares”). Upon issuance the RSUs will have

no value, but will be reported in our consolidated financial statements at their estimated fair value at the date of issuance.

BioScrip will issue the shares of its common stock issuable to Home Solutions pursuant to the RSUs in Tranche A promptly, and in

any event within five business days, following the earlier of (a) the closing price of BioScrip common stock, as reported by NASDAQ,

averaging $4.00 per share or above over 20 consecutive trading days during the period beginning on the closing date of the Transaction

and ending December 31, 2019, or (b) a change of control that occurs on or prior to December 31, 2017 or a change of control thereafter

but on or prior to December 31, 2019, pursuant to which the consideration payable per share equals or exceeds $4.00 per share.

BioScrip will issue the shares of its common stock issuable to Home Solutions pursuant to the RSUs in Tranche B promptly, and in

any event within five business days, following the earlier of (a) the closing price of BioScrip’s common stock, as reported

by NASDAQ, averaging $5.00 per share or above over 20 consecutive trading days during the period beginning on the closing date

of the Transaction and ending December 31, 2019, or (b) a change of control that occurs on or prior to December 31, 2017, or a

change of control thereafter but on or prior to December 31, 2019, pursuant to which the consideration payable per share equals

or exceeds $5.00 per share. The aggregate number of RSUs in Tranche A will be approximately 3.1 million and the aggregate number

of RSUs in Tranche B will be 4.0 million. The maximum amount of common stock issuable in connection with the Transaction represents

approximately 15.3% of BioScrip’s outstanding common stock, based on the number of outstanding shares as of March 31, 2016,

assuming all the RSUs vest and calculating the Transaction Closing Equity Consideration based on the last reported closing price

of our common stock on June 15, 2016, which was $2.19.

The Cash Consideration and the Transaction Closing Equity Consideration

will be paid at closing, subject to customary closing adjustments.

We plan to fund the cash portion of the Transaction Consideration

through the net proceeds from this offering. This offering is not conditioned on the closing of the Transaction, and we cannot

assure you that the Transaction will be completed. See “Risk Factors — Risks Relating to the Transaction”

and “Use of Proceeds.”

The consummation of the Transaction is subject to customary

closing conditions, including, but not limited to, stockholder approval to increase the number of shares of common stock that we

are authorized to issue pursuant to our certificate of incorporation, the absence of legal orders prohibiting the consummation

of the Transaction, the absence of conditions or circumstances constituting a business material adverse effect with respect to

Home Solutions, the completion of this offering, receipt of approval, or termination of the waiting period, under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976, as amended, the accuracy of the representations and warranties of the parties, the parties’

performance and compliance in all material respects with the agreements and covenants contained in the Asset Purchase Agreement

and the parties’ attainment of certain third-party consents. Although no assurance can be given that these conditions will

be timely satisfied or waived, we believe that the Transaction will be consummated in the third quarter of 2016. Under the terms

of the Asset Purchase Agreement, Home Solutions has the right to terminate the Asset Purchase Agreement if this offering is not

completed with gross proceeds of at least $70 million within the 17 days following the June 11, 2016 date of the Asset Purchase

Agreement. The Company’s obligation to consummate the transaction is conditioned upon the completion of this offering with

gross proceeds of at least $70 million.

In addition, pursuant to the Asset Purchase Agreement, upon

consummation of the Transaction, BioScrip has agreed that (1) for so long as Daniel Greenleaf remains the Chief Executive Officer

of BioScrip, Mr. Greenleaf will be a member of our board of directors and (2) Home Solutions will be entitled to designate one

member to our board of directors for a period of three years; provided that this designation right will terminate if Home Solutions

owns less than 50% of the equity interests of BioScrip (including the Contingent Shares) issued to Home Solutions pursuant to the

Asset Purchase Agreement. The Asset Purchase Agreement also provides Home Solutions with certain customary registration rights

that require us to register the resale of the Transaction Closing Equity Consideration and the Contingent Shares pursuant to the

Securities Act.

A copy of (1) the Asset Purchase Agreement and (2) the First

Amendment are included as exhibits to our Current Reports on Form 8-K filed with the SEC on June 13, 2016 and June 16, 2016, respectively,

and are incorporated by reference into this prospectus supplement. The Asset Purchase Agreement has been incorporated by reference

herein solely to provide investors and security holders with information relating to its terms. It is not intended to be a source

of financial, business or operational information about BioScrip, Home Solutions, or their respective subsidiaries or affiliates.

The representations, warranties and covenants contained in the Asset Purchase Agreement (1) are made only for the purposes of the

Asset Purchase Agreement and are made as of specific dates and are solely for the benefit of the parties to the Asset Purchase

Agreement, (2) may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential

disclosures exchanged between the parties in connection with the execution of the Asset Purchase Agreement (such disclosures include

information that has been included in public disclosures, as well as additional non-public information) and (3) may have been made

for the purposes of allocating contractual risk between the parties to the Asset Purchase Agreement instead of establishing these

matters as facts. As to factual matters concerning BioScrip and Home Solutions, you should not rely upon the representations and

warranties in the Asset Purchase Agreement.

THE OFFERING

The following is a brief summary of certain terms of this offering.

For a more complete description of our shares of our common stock, see “Description of Capital Stock” in the accompanying

prospectus.

|

Issuer

|

|

BioScrip, Inc.

|

|

|

|

|

|

Common stock offered

|

|

40,000,000 shares, or 45,200,000 shares if the underwriters exercise in full their option to purchase additional shares of common stock.

|

|

|

|

|

|

Common stock to be outstanding upon completion of this offering

|

|

108,780,241 shares, or 113,980,241 shares if the underwriters exercise in full their option to purchase additional shares of common stock.

|

|

|

|

|

|

Listing

|

|

Our shares of our common stock are listed on The NASDAQ Global Market under the symbol “BIOS.”

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering in the

following order of priority (i) to fund the cash portion of the Transaction Consideration, (ii) to pay fees and expenses in

connection with the Transaction, (iii) to repay a portion of our outstanding borrowings under our revolving credit facility

and (iv) for general corporate purposes. This offering is not conditioned on the closing of the Transaction, and we cannot

assure you that the Transaction will be completed on the terms described herein or at all. If the Transaction is completed

but the net proceeds of this offering are not sufficient to fund the Cash Consideration or the fees and expenses in

connection with the Transaction, the Company intends to fund any shortfall in such payment of the Cash Consideration or the

fees and expenses with its cash on hand and borrowing under its revolving credit facility. If the Transaction

is not completed, we intend to use any net proceeds from this offering

(i) to repay a portion of our outstanding borrowings under our revolving

credit facility and (ii) for general corporate purposes.

|

|

|

|

|

|

Dividend policy

|

|

We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future.

|

|

|

|

|

|

Risk factors

|

|

Investing in our common stock involves risks. See “Risk Factors” on page

S-

18

and “Risk Factors” in our Annual Report on Form 10-K, incorporated

by reference into this prospectus supplement, for other information you should consider before buying our shares of our

common stock.

|

The number of shares of our common stock outstanding immediately

after the closing of this offering is based on 68,780,241 shares outstanding as of March 31, 2016, and excludes:

|

|

■

|

4,058,421 shares issuable upon exercise of stock options outstanding as of March 31, 2016 at a weighted average exercise price of $7.37 per share;

|

|

|

■

|

an aggregate of 1,679,061 shares reserved for future grants under our equity incentive plans;

|

|

|

■

|

473,494 shares issuable upon conversion of our convertible securities; and

|

|

|

■

|

3,424,658 shares to be issued as Transaction Closing Equity Consideration, calculated based on the last reported closing price of our common stock on June 15, 2016, which was $2.19.

|

Unless otherwise noted, this prospectus supplement assumes no

exercise by the underwriters of their option to purchase an additional 5,200,000 shares of common stock.

USE OF PROCEEDS

We estimate that we will receive approximately

$80.52 million (or approximately $91.22 million if the underwriters’ option to purchase additional shares is exercised

in full) in net proceeds from this offering, after deducting underwriting discounts and commissions and estimated

offering expenses and assuming a public offering price of $2.19 per share based on our common stock’s closing price on

June 15, 2016. We intend to use the net proceeds from this offering in the following order of priority (i) to fund the Cash

Consideration, (ii) to pay fees and expenses in connection with the Transaction, (iii) to repay a portion of our outstanding

borrowings under our revolving credit facility and (iv) for general corporate purposes. This offering is not conditioned on

the closing of the Transaction, and we cannot assure you that the Transaction will be completed on the terms described herein

or at all. If the Transaction is completed but the net proceeds of this offering are not sufficient to fund the Cash

Consideration or the fees and expenses in connection with the Transaction, the Company intends to fund any shortfall in such

payment of the Cash Consideration or the fees and expenses with its cash on hand and borrowing under its revolving credit

facility. If the Transaction is not completed, we intend to use any net proceeds from this offering (i) to repay a portion of

our outstanding borrowings under our revolving credit facility and (ii) for general corporate purposes. For a description of

our revolving credit facility, see “Liquidity and Capital Resources” in our Annual Report on Form 10-K.

DILUTION

The net tangible book value of our common stock on March 31,

2016 was approximately $(339.5) million, or approximately $(4.94) per share. Net tangible book value per share is equal to the

amount of our total tangible assets, less total liabilities, divided by the aggregate number of shares of common stock outstanding.

Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of shares

of common stock in this offering and the net tangible book value per share of our common stock immediately after this offering.

After giving effect to the sale of shares of common stock in this offering at a public offering price of $ per

share, our net tangible book value at March 31, 2016 would have been approximately $ million, or approximately

$ per share. This represents an immediate dilution of $ per share to new investors

purchasing shares of common stock in this offering. The following table illustrates this dilution:

|

Public offering price per share

|

|

|

|

|

|

$

|

|

|

|

Net tangible book value per share at March 31, 2016

|

|

$

|

(4.94

|

)

|

|

|

|

|

|

Increase per share attributable to new investors for this offering

|

|

$

|

|

|

|

|

|

|

|

Net tangible book value per share after giving effect to this offering

|

|

|

|

|

|

$

|

|

|

|

Dilution per share to new investors

|

|

|

|

|

|

$

|

|

|

If the underwriters exercise their option to purchase additional

shares of our common stock in full, the as-adjusted net tangible book value would increase to approximately $

million, or $ per share, representing dilution to purchasers in this offering of $

per share.

The number of shares of our common stock outstanding immediately

after the closing of this offering is based on 68,780,241 shares outstanding as of March 31, 2016 and excludes:

|

|

■

|

4,058,421 shares issuable upon exercise of stock options outstanding as of March 31, 2016 at a weighted average exercise price of $7.37 per share;

|

|

|

■

|

an aggregate of 1,679,061 shares reserved for future grants under our equity incentive plans;

|

|

|

■

|

473,494 shares reserved for issuance upon conversion of our convertible securities; and

|

|

|

|

|

|

|

■

|

3,424,658 shares to be issued as Transaction Closing Equity Consideration calculated assuming that the price to the public in this offering is the same as on the last reported closing price of our common stock on June 15, 2016, which was $2.19.

|

CAPITALIZATION

The following table sets forth our cash and cash equivalents

and capitalization as of March 31, 2016;

|

|

■

|

on an adjusted basis to give effect to the sale of 40,000,000 shares of our common stock in this offering (using an assumed public offering price of $2.19 per share based on our common stock’s closing price on June 15, 2016 and assuming no exercise of the underwriters’ option to purchase additional shares), resulting in net proceeds to us, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, of $80.52 million, and the expected application of the net proceeds of this offering as described under “Use of Proceeds” in this prospectus supplement assuming the Transaction was not completed, as if this offering had occurred on March 31, 2016; and

|

|

|

■

|

on a pro forma as adjusted basis to give effect to (i) the sale of 40,000,000 shares of our common stock in this offering (using an assumed public offering price of $2.19 per share based on our common stock’s closing price on June 15, 2016 and assuming no exercise of the underwriters’ option to purchase additional shares), resulting in net proceeds to us, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, of $80.52 million, and (ii) the expected application of the net proceeds of this offering as described under “Use of Proceeds” in this prospectus supplement, assuming the consummation of the Transaction, as if each of these transactions had occurred on March 31, 2016.

|

You should read this table in conjunction with “Use of

Proceeds” and “Prospectus Supplement Summary — Summary Historical Consolidated Financial Data”

in this prospectus supplement and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and our consolidated financial statements and the related notes thereto included in our Annual Report on Form 10-K and quarterly

report on Form 10-Q incorporated by reference into this prospectus supplement.

|

|

|

As of March 31, 2016

|

|

|

|

|

Actual

|

|

|

As

Adjusted

For this

Offering

|

|

|

Pro

Forma as

Adjusted for this

Offering and the

Transaction

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

8,051

|

|

|

$

|

88,570

|

|

|

$

|

8,051

|

|

|

Debt:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revolving Credit Facility

|

|

$

|

23,000

|

|

|

$

|

23,000

|

|

|

$

|

16,831

|

|

|

Term Loan Facility

|

|

|

219.620

|

|

|

|

219,620

|

|

|

|

219,620

|

|

|

2012 Notes net of unamortized discount

|

|

|

196.191

|

|

|

|

196,191

|

|

|

|

196,191

|

|

|

Capital Leases

|

|

|

137

|

|

|

|

137

|

|

|

|

137

|

|

|

Less: Deferred financing costs

|

|

|

(15,018

|

)

|

|

|

(15,018

|

)

|

|

|

(15,018

|

)

|

|

Total debt

|

|

$

|

423,930

|

|

|

$

|

423,930

|

|

|

|

417,761

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liability classified equity instruments

|

|

|

—

|

|

|

|

—

|

|

|

|

3,433

|

|

|

Series A convertible preferred stock, $.0001 par value; 825,000 shares authorized; 635,822 shares issued and outstanding as of March 31, 2016; and, $71,701 liquidation preference as of March 31, 2016

|

|

|

65,088

|

|

|

|

65,088

|

|

|

|

65,088

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ (Deficit) Equity)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock, $.0001 par value; 4,175,000 shares authorized; no shares issued and outstanding as of March 31, 2016

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Common stock $0.0001 par value; 125,000,000 shares authorized; 71,441,664 shares issued; shares outstanding as of March 31, 2016 (actual): 68,780,241 shares outstanding as of March 31, 2016 (as adjusted for this offering): 108,780,241; shares outstanding as of March 31, 2016 (pro forma as adjusted for this offering and the Transaction): 112,204,899

|

|

|

8

|

|

|

|

11

|

|

|

|

11

|

|

Treasury stock, 2,661,423 shares, at cost, as of

March 31, 2016; no shares (as adjusted for this offering)

|

|

|

(10,754

|

)

|

|

|

—

|

|

|

|

—

|

|

|

Additional paid in capital

|

|

|

530,671

|

|

|

|

600,433

|

|

|

|

604,500

|

|

|

Accumulated deficit

|

|

|

(611,449

|

)

|

|

|

(611,449

|

)

|

|

|

(618,299

|

)

|

|

Total stockholders’ (deficit) equity

|

|

|

(91,524

|

)

|

|

|

(11,005

|

)

|

|

|

(13,788

|

)

|

|

Total capitalization

|

|

$

|

397,494

|

|

|

$

|

478,013

|

|

|

$

|

472,494

|

|

If the offering price to the public is $0.25 lower or

higher than the assumed public offering price per share of $2.19, (1) the “As Adjusted for this Offering” amount

of Total Capitalization would be $468,613 or $487,413, respectively, and (2) the “Pro Forma as Adjusted for this

Offering and the Transaction” amount of Total Capitalization would be $472,494 or $472,494, respectively.

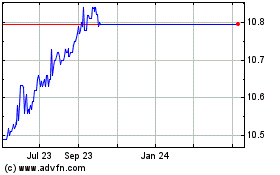

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024