UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 19, 2016

BIOSCRIP, INC.

(Exact name of Registrant as specified in

its charter)

| Delaware |

|

000-28740 |

|

05-0489664 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 100 Clearbrook Road, Elmsford, New York |

|

10523 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (914) 460-1600

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 2 – Financial Information

Item 2.02. Results of Operations and Financial Condition.

On January 19, 2016, BioScrip, Inc. (the

“Company”) issued a press release providing an update on the Company’s previously announced financial improvement

plan and, in connection with the update, announcing certain unaudited preliminary 2015 fourth quarter financial results (the “Press

Release”). A copy of the Press Release is furnished with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated

herein by reference.

Section 7 - Regulation FD

Item 7.01. Regulation FD Disclosure.

On January 19, 2016, the Company issued

the Press Release as disclosed above under Item 2.02 of this Current Report. A copy of the Press Release is attached to this Current

Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

As provided in General Instruction B.2 to

Form 8-K, the information furnished in Item 2.02, Item 7.01 and Exhibit 99.1 hereto shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities under that Section and shall not be deemed incorporated by reference into any filing of the Company with the

Securities and Exchange Commission under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

provided by specific reference in such filing.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

| (d) |

Exhibits. |

| |

See the Exhibit Index which is hereby incorporated by reference. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BIOSCRIP, INC. |

| |

|

| Date: January 19, 2016 |

/s/ Kathryn M. Stalmack |

| |

By: |

Kathryn M. Stalmack |

| |

|

Senior Vice President, General Counsel and |

| |

|

Secretary |

Exhibit

Index

| Exhibit Number |

Description |

|

| |

|

|

| 99.1 |

Press Release issued by the Company, dated January 19, 2016. |

|

EXHIBIT 99.1

PRESS RELEASE

Contact:

Lisa Wilson

In-Site Communications, Inc.

T: 212-452-2793

E: lwilson@insitecony.com

BIOSCRIP PROVIDES BUSINESS

UPDATE ON IMPLEMENTATION OF FINANCIAL

IMPROVEMENT PLAN AND PROGRESS TO ENHANCE SHAREHOLDER VALUE

Review of Strategic Alternatives Continues

Patient Census Growth Continues, Cost

Savings Initiatives on Track and Increased Cash Collections

ELMSFORD, NY –January 19, 2016 – BioScrip,

Inc. (NASDAQ: BIOS) (“BioScrip” or the “Company”) today provided an update on the Company’s progress

implementing its Financial Improvement Plan to enhance shareholder value, improve financial flexibility and position BioScrip for

success in 2016. As previously announced, the Company expects the Financial Improvement Plan to realize $35 million – $40

million in annualized net cost savings.

As the Company stated in its third quarter 2015 financial results

in November 2015, its Financial Improvement Plan is focused on reducing costs, improving margins and aligning the Company’s

operations around a more focused core infusion business. Since the end of the third quarter 2015 the Company:

| · | Substantially completed the previously announced targeted workforce reduction and remains on track to deliver the expected

$19 million in annual cost savings in 2016; |

| · | Achieved the anticipated additional supply chain program initiatives that are expected to add $3 million in annual savings

in 2016; |

| · | Effected the

initiatives expected to reduce corporate costs by $5 million in 2016; and |

| · | Implemented cost reduction programs that are expected to reduce infusion field costs by $5 million in 2016. These cost reductions

are in specific targeted areas that include improved nursing utilization and productivity, travel expense, office expense, and

other variable cost categories. |

Carter Pate, Chair of the Financial Improvement Plan Committee

of the Board of Directors, said, “We made significant progress towards implementing our cost savings and financial improvement

initiatives during the fourth quarter. We continue to believe in the strength of the Company’s infusion services platform

and the direction in which the business is heading.”

Rick Smith, President and Chief Executive Officer of BioScrip,

said, “Our preliminary results for the fourth quarter 2015 reflect increased patients serviced in the fourth quarter compared

to the fourth quarter of 2014, continued progress in the successful execution of our cost reduction initiatives and enhanced focus

on our operations. Our team is encouraged by our progress as we enter 2016. We are committed to realizing the benefits of the Financial

Improvement Plan and creating value for our shareholders.”

With the continued implementation of the Company’s financial

improvement programs, FTI Consulting’s engagement has concluded and Scott Davido is no longer acting as chief implementation

officer.

Preliminary Fourth Quarter 2015 Expectations

The Company also announced today certain unaudited preliminary

fourth quarter 2015 financial results. The Company anticipates total patient census growth of approximately 4% in the fourth quarter

of 2015 compared to the same period in 2014. The Company anticipates Core Therapy patient census growth of approximately 9% in

the fourth quarter of 2015 compared to the same period in 2014.

Liquidity and Capital Resources

During the fourth quarter BioScrip generated increased cash

collections sequentially compared to the third quarter. In the fourth quarter, the Company generated its highest quarterly infusion

division cash collection total for 2015. In addition, during the fourth quarter the Company collected approximately $6.8 million

on an account receivable balance from a former PBM vendor. The Company had retained this receivable, which was excluded from the

sale of the PBM business.

As of December 31, 2015, the Company had reduced the amount

of borrowings outstanding on its Revolving Line of Credit to $15 million compared to $30 million of borrowings outstanding as of

September 30, 2015. The Company improved its cash flow in 2015 and expects to be operating cash flow positive in 2016. In addition,

the Company expects to pay down more than $12 million of bank term debt in 2016 from operating cash flow.

Exploration of Strategic Alternatives

As previously announced, BioScrip is executing on its Financial

Improvement Plan and, with the assistance of its financial advisor, is reviewing a range of strategic alternatives, which could

include, among other options, a potential sale or merger of the Company. As noted previously, the exploration of strategic alternatives

will not necessarily result in any changes to the Company's current business plan and Financial Improvement Plan or any transactions

or agreements. The Company does not intend to disclose developments regarding the exploration of strategic alternatives unless

and until a final decision is made.

BioScrip Fourth Quarter 2015 Results Call

The Company expects to announce the release date of its fourth

quarter 2015 financial results within the next four weeks.

About BioScrip, Inc.

BioScrip, Inc. is a leading national provider of infusion and

home healthcare management solutions. BioScrip partners with healthcare providers, including physicians, hospital systems, skilled

nursing facilities, and with healthcare payors to provide patients better access to high quality, efficient post-acute care services.

BioScrip operates with a commitment to bring infusion therapy services into the home or alternate-site settings. By collaborating

with the full spectrum of healthcare professionals and the patient, BioScrip provides cost-effective care that is driven by clinical

excellence, customer service, and values that promote positive outcomes and an enhanced quality of life for those it serves.

Forward-Looking Statements – Safe Harbor

This press release includes statements that may constitute "forward-looking

statements," including projections of certain measures of the Company's results of operations, liquidity, projections of future

levels of certain charges and expenses, and other statements regarding the Company's financial improvement plan and strategy. These

statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify

these statements by the fact that they do not relate strictly to historical or current facts. In some cases, forward-looking statements

can be identified by words such as "may," "should," "could," "anticipate," "estimate,"

"expect," "project," "outlook," "aim," "intend," "plan," "believe,"

"predict," "potential," "continue" or comparable terms. Because such statements inherently involve

risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and

uncertainties, and that actual results may differ materially from those in the forward-looking statements as a result of various

factors. Important factors that could cause or contribute to such differences include but are not limited to risks associated with:

the Company's ability to continue to execute and achieve results under its financial improvement plan to reduce operating costs

and focus its business on its Infusion Services segment; reductions in federal, state and commercial reimbursement for the Company's

products and services; increased government regulation related to the health care and insurance industries; as well as the risks

described in the Company's periodic filings with the Securities and Exchange Commission. The Company does not undertake any duty

to update these forward-looking statements after the date hereof, even though the Company's situation may change in the future.

All of the forward-looking statements herein are qualified by these cautionary statements.

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

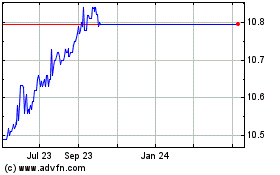

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024