Current Report Filing (8-k)

June 10 2015 - 1:16PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

current

report

Pursuant to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): June 10, 2015

BioScrip, Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

000-28740 |

05-0489664 |

| (State or other jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

100 Clearbrook Road

Elmsford, New York 10523

(Address of principal

executive offices) (Zip Code)

(914) 460-1600

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

On June 10, 2015, BioScrip, Inc. issued a press release announcing

the extension of its previously announced exchange offer for $200.0 million of its 8.875% Senior Notes due 2021 to 5:00 p.m. Eastern

Time on June 16, 2015, unless further extended. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated

herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit Number |

Description |

| |

|

| 99.1 |

Press Release, dated June 10, 2015. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned,

thereunto duly authorized.

| |

BIOSCRIP, INC. |

| |

|

|

| Date: June 10, 2015 |

By: |

/s/ Kimberlee C. Seah |

| |

|

Kimberlee C. Seah |

| |

|

Senior Vice President and General Counsel |

EXHIBIT INDEX

| Exhibit Number |

Description |

| |

|

| 99.1 |

Press Release, dated June 10, 2015. |

Exhibit 99.1

| NEWS RELEASE |

|

|

| |

|

|

Contact:

Lisa Wilson

In-Site Communications, Inc.

T: 212-452-2793

E: lwilson@insitecony.com

FOR IMMEDIATE RELEASE

BioScrip

announces EXTENSION OF EXPIRATION DATE OF EXCHANGE OFFER FOR ITS 8.875% SENIOR NOTES DUE 2021

Elmsford, NY – June 10, 2015 – BioScrip®,

Inc. (NASDAQ: BIOS) (“BioScrip”), today announced the extension of the expiration date of its offer (the “Exchange

Offer”) to exchange up to $200,000,000 in aggregate principal amount of 8.875% Senior Notes due 2021 (the “Exchange

Notes”), which have been registered under the Securities Act of 1933, as amended (the “Securities Act”), for

an equal aggregate principal amount of its outstanding 8.875% Senior Notes due 2021 (the “Old Notes”) that were originally

issued on February 11, 2014, in a transaction exempt from registration under the Securities Act. The terms and conditions

of the Exchange Offer are set forth in the Prospectus dated May 7, 2015 (the “Prospectus”) and the related Letter of

Transmittal (the “Letter of Transmittal”).

The Exchange Offer, previously set to expire at 5:00 p.m., New

York City time, on June 9, 2015, will now expire at 5:00 p.m., New York City time, on June 16, 2015, unless further extended or

earlier terminated.

Except for the extension described above, all other terms and

conditions of the Exchange Offer remain unchanged. The extension of the Exchange Offer has been made to allow all qualifying holders

of outstanding Old Notes who have not yet tendered their Old Notes for exchange to do so. As of 5:00 p.m., New York City time,

on June 9, 2015, approximately $199,725,000 in aggregate principal amount, or approximately 99.8625%, of the Old Notes had been

validly tendered for exchange and not withdrawn.

This press release is neither an offer

to purchase, nor a solicitation for acceptance of an offer to sell, any securities. The Company is making the Exchange Offer

only by, and pursuant to the terms of, the Prospectus and the related Letter of Transmittal. The complete terms and conditions

of the Exchange Offer are set forth in the Prospectus and the Letter of Transmittal. Holders are urged to read these documents

carefully.

About BioScrip, Inc.

BioScrip, Inc. is a leading national

provider of infusion and home care management solutions. BioScrip partners with physicians, hospital systems, skilled

nursing facilities, healthcare payors, and pharmaceutical manufacturers to provide patients access to post-acute care services. BioScrip operates

with a commitment to bring customer-focused pharmacy and related healthcare infusion therapy services into the home or alternate-site

setting. By collaborating with the full spectrum of healthcare professionals and the patient, BioScrip provides cost-effective

care that is driven by clinical excellence, customer service, and values that promote positive outcomes and an enhanced quality

of life for those it serves. BioScrip provides its infusion services from over 70 locations across 28 states.

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

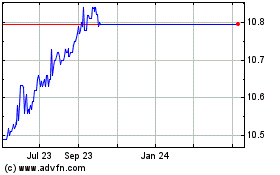

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024