UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 11, 2015

BIOSCRIP, INC.

(Exact name of Registrant as specified in its

charter)

| Delaware |

|

000-28740 |

|

05-0489664 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 100 Clearbrook Road, Elmsford, New York |

|

10523 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (914) 460-1600

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 5 – Corporate Governance and Management

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) Director Resignations

On May 11, 2015, Stuart A. Samuels, Charlotte

W. Collins and Yon Y. Jorden (each, a “Resigning Director” and collectively, the “Resigning Directors”),

each notified BioScrip, Inc. (the “Company”) of their decision to resign as a member of the Company’s board of

directors (the “Board”), effective immediately. Each Resigning Director resigned subsequent to re-election to the Board

by the Company’s stockholders at the Company’s 2015 Annual Meeting of Stockholders (the “Annual Meeting”),

held on May 11, 2015. Each Resigning Director indicated that the decision to resign was not a result of any disagreement with the

Company. At the time of the resignations, each Resigning Director was an independent director of the Board, Ms. Jorden was Chair

of the Audit Committee, Mr. Samuels was Chair of the Management Development and Compensation Committee and Ms. Collins was Chair

of the Governance, Compliance and Nominating Committee. Upon accepting the resignations of the Resigning Directors, the Board reduced

the number of directors from ten to seven.

In connection with the resignations, the Board

appointed, effective immediately, (i) newly elected Board member R. Carter Pate to serve as Chair of the Audit Committee, (ii)

newly elected Board member David W. Golding to serve as Chair of the Management Development and Compensation Committee, and (iii)

newly elected Board member Michael Goldstein to serve as Chair of the Governance, Compliance and Nominating Committee. Messrs.

Pate, Golding and Goldstein are all independent.

(d) Election of a Director

On May 11, 2015, Christopher S. Shackelton, a

Managing Director of Coliseum Capital Management, LLC (“Coliseum”), was re-elected as the Series A Director (as defined

below) to the Board pursuant to a unanimous written consent of the PIPE Investors (as defined below), holders of all of the Company’s

issued and outstanding shares of Series A Convertible Preferred Stock (the “Preferred Stock”). The Board appointed,

effective immediately, Mr. Shackelton to serve as Chair of the Company’s Corporate Strategy Committee, and Mr. Shackelton

was also appointed to the Company’s Governance, Compliance and Nominating Committee and Audit Committee. Mr. Shackelton’s

term as director will run until the Company’s 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”).

As previously announced, the Company entered

into a securities purchase agreement on March 9, 2015, with Coliseum Capital Partners, L.P., Coliseum Capital Partners II, L.P.,

and Blackwell Partners, LLC, Series A, (collectively, the “PIPE Investors”), affiliates of Coliseum, pursuant to which

the Company issued and sold to the PIPE Investors in a private placement (the “PIPE Transaction”) an aggregate of (a)

625,000 shares of Preferred Stock, (b) 1,800,000 Class A warrants to purchase Company common stock (“Common Stock”)

(the “Class A Warrants”), and (c) 1,800,000 Class B warrants to purchase Common Stock (the “Class B Warrants”

and, together with the Class A Warrants, the “Warrants”). In accordance with the Certificate of Designations of the

Preferred Stock, so long as shares of the Preferred Stock represent at least 5% of the outstanding voting stock of the Company

(on an as-converted into Common Stock basis), the holders of a majority of the shares of Preferred Stock are entitled to designate

one member of the Board (the “Series A Director”).

As

a Managing Director of Coliseum and an affiliate of the PIPE Investors, Mr. Shackelton

has an indirect interest in the shares of Preferred Stock and the Warrants acquired by the

PIPE Investors. Coliseum is a stockholder in LHC Group, Inc. (“LHC”). LHC purchased the Company’s home health

segment in February 2014. Otherwise Mr. Shackelton does not have a direct or indirect material interest in any transaction

with the Company required to be disclosed pursuant to Item 404(a) of Regulation S-K. Mr. Shackelton will be entitled to receive

any standard fees and other equity awards that the Company pays, or awards its independent directors.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On May 11, 2015, at the Annual Meeting, the stockholders

of the Company (i) elected nine directors to serve for one-year terms, (ii) approved the removal of certain caps on the conversion

of the Preferred Stock into Common Stock and on the exercise of the Warrants to purchase Common Stock (the “Conversion Caps”)

and a cap on voting power (the “Voting Cap” and, together with the Conversion Caps, the “Caps”) that prevent

the issuance of Common Stock if a single holder would own or vote more than 19.99% of the Common Stock or have more than 19.99%

of the voting power, (iii) ratified the appointment of KPMG LLP as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2015, and (iv) approved by an advisory non-binding vote the compensation paid to the

Company’s named executive officers. The proposals are described in detail in the Company’s 2015 definitive proxy materials

filed with the Securities and Exchange Commission (“SEC”) (collectively, the “Proxy Materials”).

On March 27, 2015, the record date for the Annual

Meeting, 68,636,965 shares of Common Stock and 625,000 shares of Preferred Stock (representing 12,088,974 shares of Common Stock

on an as-converted into Common Stock basis, with each share of Preferred Stock convertible into 19.342 shares of Common Stock)

were issued and outstanding, of which 70,248,338 were present at the Annual Meeting for purposes of establishing a quorum. The

final results for the votes regarding each proposal are set forth below.

1. Election

of nine directors, as set forth in the Proxy Materials, to each serve a one-year term expiring at the conclusion of the 2016 Annual

Meeting or until their respective successors are duly elected and qualified:

| Name | |

Votes

FOR | | |

Votes

Withheld | |

| | |

| | |

| |

| Richard M. Smith | |

| 51,287,640 | | |

| 1,651,012 | |

| | |

| | | |

| | |

| Charlotte W. Collins | |

| 19,218,106 | | |

| 33,720,546 | |

| | |

| | | |

| | |

| David W. Golding | |

| 50,827,544 | | |

| 2,111,108 | |

| | |

| | | |

| | |

| Michael Goldstein | |

| 50,374,583 | | |

| 2,564,069 | |

| | |

| | | |

| | |

| Myron Z. Holubiak | |

| 41,076,021 | | |

| 11,862,631 | |

| | |

| | | |

| | |

| Yon Y. Jorden | |

| 18,947,516 | | |

| 33,991,136 | |

| | |

| | | |

| | |

| Tricia H. Nguyen | |

| 30,049,247 | | |

| 22,889,405 | |

| | |

| | | |

| | |

| R. Carter Pate | |

| 50,824,875 | | |

| 2,113,777 | |

| | |

| | | |

| | |

| Stuart A. Samuels | |

| 29,117,360 | | |

| 23,821,292 | |

In addition, there were 17,309,686 broker non-votes for the election

of directors.

2. Approval

of (a) the issuance of shares of the Company’s Common Stock that would cause a holder to beneficially own 20% or more of

the outstanding shares of Common Stock upon the conversion of the Company’s current and future outstanding shares of Preferred

Stock, (b) the ability to vote with 20% or more of the aggregate voting power of the Common Stock and Preferred Stock (on an as-converted

into Common Stock basis) and (c) the ability to exercise the Company’s current and future outstanding Warrants if a holder

would beneficially own 20% or more of the Company’s outstanding shares of Common Stock upon exercise (the “Stockholder

Approval”):

Votes

FOR | | |

Votes

AGAINST | | |

Abstentions | | |

Broker

Non-Votes | |

| | 38,272,332 | | |

| 2,496,083 | | |

| 81,263 | | |

| 17,309,686 | |

3. Ratification

of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending

December 31, 2015:

Votes

FOR | | |

Votes

AGAINST | | |

Abstentions | |

| | 69,501,344 | | |

| 560,306 | | |

| 186,688 | |

4. Approval,

by advisory vote on a non-binding basis, of the compensation paid to the Company’s named executive officers:

Votes

FOR | | |

Votes

AGAINST | | |

Abstentions | | |

Broker

Non-Votes | |

| | 43,295,813 | | |

| 8,499,864 | | |

| 1,142,975 | | |

| 17,309,686 | |

Section 8 – Other Events

Item 8.01. Other Events.

As previously announced, on April 30, 2015,

the Company entered into a memorandum of understanding (the “Memorandum of Understanding”) to settle two separate putative

class action lawsuits filed on April 9, 2015 in connection with the PIPE Transaction. Pursuant to the terms of the Memorandum of

Understanding, the parties entered into a stipulation of settlement on May 11, 2015 (the “Stipulation of Settlement”).

The two separate putative class action lawsuits were filed in the Delaware Court of Chancery (the “Court”) by purported

stockholders against the Company, the individual directors of the Company and the PIPE Investors. The two separate class action

lawsuits were consolidated by order of the Court as In re BioScrip, Inc. Stockholder Litigation , Consol. C.A. 10893-VCG

(the “Delaware Action”).

In consideration for the full settlement and

release of the Delaware Action (the “Settlement”), the Stipulation of Settlement provides, among other things, that

in the event Stockholder Approval is obtained at the Annual Meeting, causing the Caps to be removed and certain dividend rate increases

on the Preferred Stock to never go into effect, the Delaware Action will be dismissed with prejudice, subject to Court approval

of the Settlement. Such Stockholder Approval was obtained at the Annual Meeting and, therefore, the Delaware Action will be dismissed

with prejudice by the Court, subject to Court approval of the Settlement.

A complete description of the Memorandum of Understanding

is included in the Company’s Current Report on Form 8-K filed with the SEC on May 1, 2015.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

BIOSCRIP, INC. |

| |

|

|

| Date: May 13, 2015 |

|

|

|

/s/ Kimberlee C. Seah |

| |

|

By: |

|

Kimberlee C. Seah |

| |

|

|

|

Senior Vice President and General Counsel |

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

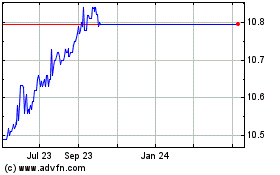

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024