UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 9, 2015

BIOSCRIP, INC.

(Exact name of Registrant as specified in

its charter)

| Delaware |

|

000-28740 |

|

05-0489664 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 100 Clearbrook Road, Elmsford, New York |

|

10523 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (914) 460-1600

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Explanatory Note

BioScrip,

Inc. (the “Company”) is filing this amendment No. 1 on Form 8-K/A to update its Current Report on Form 8-K filed on

March 10, 2015 (“Original Form 8-K”), which reported the Company’s completion of a transaction with Coliseum

Capital Partners, L.P., Coliseum Capital Partners II, L.P., and Blackwell Partners, LLC, Series A (collectively, the “Investors”)

for the purchase and sale of (a) the Company’s Series A Convertible Preferred Stock,

(b) 1,800,000 Class A warrants to purchase the Company’s common stock at a price of $5.295 per share (the

“Class A Warrants”), and (c) 1,800,000 Class B warrants to purchase the Company’s common stock at a price of

$6.595 per share (the “Class B Warrants” and, together with the Class A Warrants, the “Warrants”), for

gross proceeds of $62.5 million (the “Transaction”). This Form 8-K/A amends Item 1.01 of the Original Form 8-K to include

the entry by the Company and the Investors into an addendum (the “Addendum”) to the Warrant Agreement.

Item

1.01– Entry Into a Material Definitive Agreement

Addendum to the Warrants

As part of the Transaction, the Company

and the Investors entered into a Warrant Agreement on March 9, 2015 to memorialize the terms and conditions of the Warrants.

On March 23, 2015, the Company entered into an Addendum to the Warrant Agreement with the Investors.

Pursuant to the Addendum, the Investors

made an aggregate payment to the Company of $483,559 (the “Payment”) in exchange for a reduction in the exercise price

of the Warrants in a corresponding per share amount to give effect to the Payment. As a result, the exercise price of the

Class A Warrants was reduced to $5.17, and the exercise price of the Class B Warrants was reduced to $6.45. The Company

and the Investors agreed to enter into the Addendum to ensure that the Transaction complied with NASDAQ Marketplace Rule 5635(d).

All other terms of the Transaction remained the same. The Payment will be used by the Company for general corporate purposes.

Item

7.01– Regulation FD Disclosure

Rights Offering

The Company previously announced its intention

to conduct a registered rights offering to grant Company stockholders the right to purchase their pro rata share of a $20 million

offering of the same securities that were offered to the Investors in the Transaction. If the Company decides to effect this

rights offering, the warrants offered to the stockholders in that offering will contain the same exercise prices as set forth in

the Addendum.

On March 10, 2015 the Company filed an

initial registration statement for that potential rights offering with the Securities and Exchange Commission. The rights and securities

offered for subscription thereunder may not be sold, nor may offers to buy be accepted, prior to the time such registration statement

becomes effective.

This Current Report on Form 8-K/A shall

not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these rights offering securities

in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such state or jurisdiction.

Item 9.01 Financial Statements and Exhibits.

The Exhibit Index attached to this Form

8-K/A is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

| |

|

BIOSCRIP, INC. |

| |

|

|

| Date: March 24, 2015 |

|

|

|

/s/ Kimberlee C. Seah |

| |

|

By: |

|

Kimberlee C. Seah |

| |

|

|

|

Senior Vice President and General Counsel |

Exhibit

Index

| Exhibit No. |

Description |

| 10.3* |

Addendum to the Warrant Agreement dated March 23, 2015, by and among Bioscrip, Inc., Coliseum Capital Partners, L.P., Coliseum Capital Partners II, L.P., and Blackwell Partners, LLC, Series A. |

* Filed herewith.

Exhibit 10.3

ADDENDUM

TO THE

WARRANT AGREEMENT

This Addendum, which

is attached to and forms part of the Agreement (defined below) (the “Addendum”), is dated as of March 23, 2015, and

is by and among BioScrip, Inc., a Delaware corporation (together with its successors and assigns, the “Company”), Coliseum

Capital Partners, L.P., a Delaware limited partnership, Coliseum Capital Partners II, L.P., a Delaware limited partnership, and

Blackwell Partners, LLC, Series A, a Delaware limited liability company (collectively and together with each of their respective

successors and assigns, the “Purchasers”). Capitalized terms shall have the meaning set forth in the Agreement. To

the extent that any of the terms or conditions contained in this Addendum may contradict or conflict with any of the terms or conditions

of the Agreement, it is expressly understood and agreed that the terms of the Addendum shall take precedence and supersede the

Agreement.

WHEREAS, the

Company and the Purchasers executed that certain Warrant Agreement dated March 9, 2015 (the “Agreement”);

WHEREAS, pursuant

to the Agreement and the Warrant Certificates, the Purchasers received warrants that represent the right to purchase, in the aggregate,

3,600,000 shares of Common Stock, subject to adjustment as set forth in the Agreement;

WHEREAS, in

connection with the Agreement, each Purchaser was issued two Warrant Certificates, each representing one half of the total warrants

to be issued to the Purchaser, and each having the same terms and conditions except for the Initial Exercise Price, with one Warrant

Certificate being exercisable at $5.295 per share of Common Stock on the Issue Date (the “Warrant No. 1 Initial Exercise

Price”) and the second Warrant Certificate being exercisable at $6.595 per share of Common Stock on the Issue Date (the “Warrant

No. 2 Initial Exercise Price”);

WHEREAS, pursuant

to this Addendum, the Purchasers desire to make an immediate payment of $483,559 (the “Pre-Payment”) in aggregate,

for the purpose of reducing the Exercise Price of the Warrants;

WHEREAS, the

Company desires to receive the Pre-Payment for the purpose of reducing the Exercise Price of the Warrants and agrees to issue two

revised Warrant Certificates to each of the Purchasers reflecting the reduction in Warrant No.1 Initial Exercise Price and Warrant

No. 2 Initial Exercise Price;

WHEREAS, pursuant

to Section 6.2 of the Agreement, the Warrant No. 1 Initial Exercise Price and the Warrant No. 2 Initial Exercise Price may only

be amended with the prior written consent of all holders of Warrants then outstanding, and the Purchasers collectively hold all

of the Warrants that are outstanding as of the date hereof;

NOW, THEREFORE,

in consideration of the premises and the mutual agreements set forth herein, the parties enter into this Addendum pursuant to Section

6.2 of the Agreement as follows:

1. The terms and

conditions set forth in this Addendum shall be effective and in full force as of the date of the Agreement.

2. Concurrently

with the execution and delivery of this Addendum, the Purchaser shall pay the Pre-Payment to an account designated by the Company.

3. By executing

this Addendum, the Company acknowledges receipt of the Pre-Payment from the Purchasers.

4. For each Purchaser,

the Warrant No. 1 Initial Exercise Price is hereby reduced to $5.17 and the Warrant No. 2 Initial Exercise Price is hereby reduced

to $6.45, and the Agreement is hereby amended accordingly.

5. Section 1.4 of

the Agreement is hereby appended to include a new Section 1.4(e) as follows:

(e) Warrant

Certificates to reflect any addendum to, or amendment of, the Agreement pursuant to Section 6.2.

6. The Company shall

issue new Warrant Certificates to each of the Purchasers reflecting the Warrant No. 1 Initial Exercise Price and Warrant No. 2

Initial Exercise Price as amended by Section 4 hereof. Such new Warrant Certificates shall replace and supersede in their entirety

any Warrant Certificates previously issued to the Purchasers in connection with the Agreement.

7. Except as modified

by this Addendum, the Agreement remains in full force and effect according to its terms.

IN WITNESS WHEREOF,

the parties have caused the Addendum to be duly executed as of the date first written above.

| |

BIOSCRIP, INC. |

| |

|

|

| |

|

|

| |

By: |

|

| |

Name: Richard M. Smith |

| |

Title: President and Chief Executive Officer |

| |

|

| |

|

| |

COLISEUM CAPITAL PARTNERS, L.P. |

| |

|

| |

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

|

|

| |

COLISEUM CAPITAL PARTNERS II, L.P. |

| |

|

| |

|

| |

By: |

|

| |

Name: |

| |

Title: |

| |

|

|

| |

|

|

| |

BLACKWELL PARTNERS, LLC, SERIES A |

| |

By: Coliseum Capital Management, LLC, Attorney-in-fact |

| |

|

| |

|

|

| |

By: |

|

| |

|

Name: |

| |

|

Title: |

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

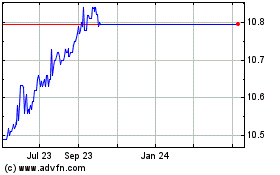

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024