Amended Statement of Beneficial Ownership (sc 13d/a)

March 12 2015 - 6:04AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on March 11, 2015

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

Amendment No. 3*

BioScrip,

Inc.

(Name of Issuer)

Common Stock

(Title of

Class of Securities)

09069N108

(CUSIP Number)

Michael

L. Zuppone, Esq.

Paul Hastings LLP

75 East 55th Street

New

York, New York 10022

(212) 318-6906

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 10, 2015

(Date of

Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ¨.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

|

|

|

| CUSIP No. 09069N108 |

|

Page 2 of 8 Pages |

SCHEDULE 13D

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Delaware Street Capital Master Fund, L.P.

66-0613158 |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) x |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman Islands |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

1,842,241 |

|

8 |

|

SHARED VOTING POWER

0 |

|

9 |

|

SOLE DISPOSITIVE POWER

1,842,241 |

|

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,842,241 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 2.7% |

| 14 |

|

TYPE OF REPORTING PERSON

IV |

|

|

|

| CUSIP No. 09069N108 |

|

Page 3 of 8 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

DSC Advisors, L.P.

38-3662495 |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) x |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

1,842,241 |

|

8 |

|

SHARED VOTING POWER

0 |

|

9 |

|

SOLE DISPOSITIVE POWER

1,842,241 |

|

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,842,241 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 2.7% |

| 14 |

|

TYPE OF REPORTING PERSON

IA |

|

|

|

| CUSIP No. 09069N108 |

|

Page 4 of 8 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

DSC Managers, L.L.C.

36-4425033 |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) x |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

1,842,241 |

|

8 |

|

SHARED VOTING POWER

0 |

|

9 |

|

SOLE DISPOSITIVE POWER

1,842,241 |

|

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,842,241 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 2.7% |

| 14 |

|

TYPE OF REPORTING PERSON

OO |

|

|

|

| CUSIP No. 09069N108 |

|

Page 5 of 8 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

DSC Advisors, L.L.C.

36-4425033 |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) x |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

1,842,241 |

|

8 |

|

SHARED VOTING POWER

0 |

|

9 |

|

SOLE DISPOSITIVE POWER

1,842,241 |

|

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,842,241 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 2.7% |

| 14 |

|

TYPE OF REPORTING PERSON

OO |

|

|

|

| CUSIP No. 09069N108 |

|

Page 6 of 8 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Andrew G. Bluhm |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) x |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

1,842,241 |

|

8 |

|

SHARED VOTING POWER

0 |

|

9 |

|

SOLE DISPOSITIVE POWER

1,842,241 |

|

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,842,241 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 2.7% |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

|

|

|

| CUSIP No. 09069N108 |

|

Page 7 of 8 Pages |

| Item 1. |

Security and Issuer. |

This Amendment No. 3 (“Amendment No. 3”) to the Initial

Statement on Schedule 13D filed with the Securities and Exchange Commission on December 29, 2014, as amended by Amendment No. 1 to the Initial Statement filed on January 22, 2015 and Amendment No. 2 to the Initial Statement filed

on February 10, 2015 (the “Initial Statement” and, together with this Amendment No.3, the “Schedule 13D”), relates to common stock, par value $0.0001 per share (“Common Stock”), of BioScrip, Inc., a Delaware

corporation (the “Issuer”), whose principal executive offices are located at 100 Clearbrook Road, Elmsford, NY 10523.

Capitalized terms used

but not defined herein shall have the meanings ascribed to them in the Initial Statement. The Initial Statement is amended as follows.

| Item 4. |

Purpose of Transaction. |

Item 4 is hereby amended by restating in its entirety the last

paragraph thereof as follows:

As a result of their association with each other and the circumstances relating to their respective investment in the

Issuer under which they have coordinated their purchases of shares of Common Stock and developed their investment strategy with respect to such investment, the Reporting Persons and Cloud Gate Capital Master Fund LP and certain persons affiliated or

associated with it (the “Associated Persons”) may be deemed to constitute a group within the meaning of section 13(d)(3) of the Act. The Associated Persons have concurrently filed a Schedule 13D amendment reporting aggregate beneficial

ownership of 1,214,225 shares of Common Stock, representing 1.8% of the outstanding shares of Common Stock. The Reporting Persons and the Associated Persons as a group beneficially own 3,056,466 shares of Common Stock, which represent approximately

4.5% of the outstanding shares of Common Stock (calculated in accordance with Rule 13d-3). Neither the filing of this Schedule 13D nor any of its contents shall be deemed to constitute an admission that any of the Reporting Persons is, for any other

purpose, the beneficial owner of any of the shares of Common Stock and each of the Reporting Persons disclaims beneficial ownership as to the shares of Common Stock reported herein or held by any other person for purposes of Section 13(d) of

the Act, except to the extent of his or its pecuniary interests therein.

| Item 5. |

Interest in Securities of the Issuer. |

Item 5 is hereby amended by restating paragraphs (a),

(b) and (c) in their entirety with the following:

(a) and (b) The aggregate percentage of Common Stock reported beneficially owned by the

Reporting Persons as of the date of filing of this Schedule 13D is based upon 68,636,965 shares of Common Stock issued and outstanding as February 25, 2015, as reported in the Issuer’s Annual Report for the fiscal year ended

December 31, 2014 on Form 10-K, as filed with the Securities and Exchange Commission on March 2, 2015.

|

|

|

| CUSIP No. 09069N108 |

|

Page 8 of 8 Pages |

DSC MF, as the entity that legally owns the securities, is deemed the direct beneficial owner of 1,842,241 shares of Common

Stock. DSCM, as the general partner of DSC MF, is deemed the indirect beneficial owner of 1,842,241 shares of Common Stock. DSCA LP, as the investment manager of DSC MF, is deemed the indirect beneficial owner of 1,842,241 shares of Common Stock.

DSCA LLC, as the general partner of the investment manager, is deemed the indirect beneficial owner of 1,842,241 shares of Common Stock. Andrew Bluhm, as the managing member of DSCA LLC, is deemed the indirect beneficial owner of 1,842,241 shares of

Common Stock.

(c) During the sixty (60) days through the date of this report, DSC MF traded the following shares of Common Stock in the open market

not previously reported in this Schedule 13D:

|

|

|

|

|

|

|

| Trade

Type |

|

Trade

Date |

|

# of

Shares |

|

Net USD

Price/Shr. |

| Sale |

|

3/10/2015 |

|

1,503,757 |

|

3.77 |

Item 5 is hereby further amended by adding paragraph (e) as follows:

(e) As of March 10, 2015, the Reporting Persons and the Associated Persons together ceased to beneficially own more than 5% of the outstanding shares of

Common Stock.

SIGNATURE

After reasonable inquiry and to the best of its knowledge and belief, each of the undersigned certifies that the information set forth in this

statement is true, complete and correct.

Dated: March 11, 2015

|

|

|

|

|

|

|

| DELAWARE STREET MASTER FUND, L.P. |

|

| By: DSC MANAGERS, L.L.C. its general partner |

|

|

|

|

|

By: |

|

/s/ David Nietfeldt |

|

|

|

|

Name: |

|

David Nietfeldt |

|

|

|

|

Title: |

|

Chief Financial Officer and Chief Compliance officer |

|

| DSC MANAGERS, L.L.C. |

|

|

|

|

|

By: |

|

/s/ David Nietfeldt |

|

|

|

|

Name: |

|

David Nietfeldt |

|

|

|

|

Title: |

|

Chief Financial Officer and Chief Compliance officer |

|

| DSC ADVISORS., L.P. |

|

| By: DSC ADVISORS, L.L.C., its general partner |

|

|

|

|

|

By: |

|

ANDREW G. BLUHM, its managing member |

|

|

|

|

/s/ Andrew G. Bluhm |

|

| DSC ADVISORS, L.L.C |

|

|

| By: |

|

ANDREW G. BLUHM, its managing member |

|

|

|

|

/s/ Andrew G. Bluhm |

|

| ANDREW G. BLUHM |

|

| /s/ Andrew G. Bluhm |

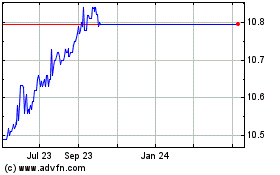

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024