China Life Insurance To Invest More Than $500 Million in Ride-Hailing Firm Didi Chuxing -- Update

June 12 2016 - 7:04PM

Dow Jones News

By Rick Carew, Douglas MacMillan and Juro Osawa

China's top life insurer is making a big investment in the

country's $25 billion homegrown competitor to Uber Technologies

Inc., despite already investing in Uber's China operation,

according to people familiar with the situation.

China Life Insurance Co. is plowing more than $500 million into

Didi Chuxing Technology Co., after Apple Inc. made a $1 billion

investment in the firm, China's biggest ride-sharing company,

according to one of the people.

Didi has been raising money from investors for a monster

financing round that would top $3.5 billion, including the China

Life and Apple money, and would value the company at more than $25

billion.

As the two biggest ride-hailing companies scour the globe for

capital, a few of the same investors are putting money into both

companies.

China Life, which is a state-owned insurer, previously has

invested in UberChina, the independent entity set up by San

Francisco-based Uber last year.

China-based investment firm Hillhouse Capital Group was an early

investor in Didi but also led a convertible bond deal to invest in

Uber's global operations. Similarly, Tiger Global Management LLC

has backed Didi in China and cut a deal in December for an

investment in Uber's global operations.

Competing startups dislike overlapping shareholder bases because

they often share confidential strategy and financial results with

investors. It is unclear what arrangements Didi and Uber have made

for those investors.

The battle for global investment allies has only intensified in

recent months. Uber raised $3.5 billion from the investment arm of

Saudi Arabia earlier this month as part of a $5 billion financing

round, the largest to date raised by a private, venture-backed

company.

Two of Didi's largest existing investors, online shopping

company Alibaba Group Holding Ltd. and social network company

Tencent Holdings Ltd., are boosting their investment in this latest

round, the people said.

Didi's $25 billion-plus valuation is more than three times as

large as that of UberChina, which has been valued at over $8

billion by investors. But Didi is still dwarfed by San

Francisco-based Uber, which recently was valued at nearly $68

billion.

While Uber continues its global expansion, Didi has forged

alliances with other ride-sharing companies around the world that

compete against Uber. Didi has, for example, invested in U.S.

ride-hailing firm Lyft Inc. and Singapore-based GrabTaxi Holdings

Pte.

China is a crucial market for Uber, as it pours billions of

dollars into expanding there. It has also run into the greatest

competition in that country from Didi, which was formed last year

by the merger of two rival Chinese taxi-hailing apps. Today, Didi

not only has a larger share of China's private car-sharing market

than Uber, but also dominates the taxi-hailing segment. The two

companies disagreed on their market-share figures.

Liu Zhen, senior vice president of strategy at Uber's Chinese

unit, said earlier this month that part of Uber's new funds raised

from Saudi Arabia's investment arm will flow into its China

operations.

Meanwhile, Uber and Didi both have strategic investors in China

that can help broaden their reach.

Internet company Baidu Inc., for example, is an investor in

UberChina, which lets hundreds of millions of users of Baidu's

popular mobile-map app to hail an Uber ride. Didi, on the other

hand, has been working closely with Tencent, operator of the

popular WeChat messaging application whose 762 million monthly

active users are predominantly in China. WeChat comes with a

ride-hailing button that directs its users to Didi's services.

Write to Rick Carew at rick.carew@wsj.com, Douglas MacMillan at

douglas.macmillan@wsj.com and Juro Osawa at juro.osawa@wsj.com

(END) Dow Jones Newswires

June 12, 2016 18:49 ET (22:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

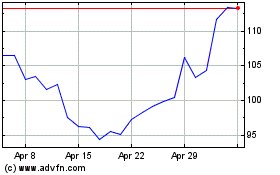

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

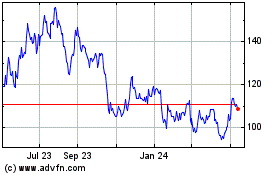

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024