UberChina Take Aim at Didi in Ride Sharing for Private Cars

June 03 2016 - 2:20AM

Dow Jones News

Uber Technologies Inc.'s Chinese unit wants to overtake local

market leader Didi Chuxing Technology Co. in China's private-car

ride-sharing sector next year, a senior executive said Friday.

In China's hypercompetitive car-hailing market, UberChina has

been locked in a fierce battle with Didi to attract drivers and

passengers. While Didi remains the market leader, UberChina has

been gaining ground rapidly, said Liu Zhen, the company's senior

vice president of strategy, at the Converge technology conference

hosted by The Wall Street Journal and f.ounders in Hong Kong.

"Last year we were only operating in eight cities with only a 1%

market share [in China]," Ms. Liu said. But since then, Uber's

ride-sharing market share has surged to nearly a third, she said.

Ms. Liu said that China is "absolutely" the most important market

in the world for Uber now.

Still, Uber faces an uphill battle in China against Didi, which

dominates China's taxi-hailing market and has a larger share than

UberChina in the private-car-hailing segment. The two companies

have disagreed on the exact market share figures.

In China, the world's biggest mobile internet market by users,

UberChina and Didi are intensifying their battle as they raise more

funds from powerful investors. UberChina is backed by Chinese

search provider Baidu Inc., while Didi's major investors include

Alibaba Group Holding Ltd. and social network giant Tencent

Holdings Ltd.

Last month, Apple Inc. poured $1 billion into Didi. Uber

Technologies, meanwhile, recently raised $3.5 billion from the

investment arm of Saudi Arabia. Ms. Liu said that part of the $3.5

billion fund will flow into Uber's China operations.

Ms. Liu said UberChina's alliance with Baidu is an advantage

because passengers can hail an Uber ride using Baidu's mobile map

app, which has hundreds of millions of users. Didi, meanwhile, has

been working closely with Tencent, which operates the popular

WeChat messaging application, which has more than 700 million

monthly active users. WeChat comes with a ride-hailing button that

directs users to Didi Kuaidi's service.

Intense competition in China's ride-hailing market has forced

major players to continue subsidizing the cost of rides for both

passengers and drivers. Some investors and analysts have said the

companies will need to gradually shift toward more sustainable

business models.

Ms. Liu said that UberChina could build a profitable business

"soon" as it has been cutting costs and spending less on incentives

for drivers. The company is now spending 80% less per trip than it

did a year ago, she said.

"We are on the right track" to turn operations profitable, she

said.

Discount wars in China's mobile on-demand services sector have

already resulted in some high-profile mergers. Didi, for example,

was created last year due to the merger between two rival

ride-hailing startups.

Asked whether UberChina would ever consider a merger with Didi,

Ms. Liu didn't provide an answer but instead talked about

UberChina's growth and improvements in the efficiency of its

operations.

UberChina and Didi "have a lot in common to talk about," she

said.

Write to Juro Osawa at juro.osawa@wsj.com

(END) Dow Jones Newswires

June 03, 2016 02:05 ET (06:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

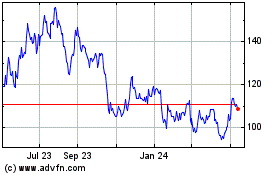

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

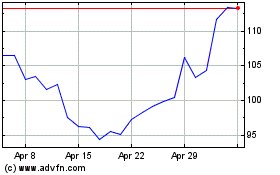

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024