Chinese Province Aims to Lead Big Data Charge

May 24 2016 - 12:48PM

Dow Jones News

By Eva Dou and Yang Jie

GUIYANG, China -- The chief executives of major high-tech

companies met China's premier on Tuesday against an unusual

backdrop: one of China's poorest provinces.

The high-tech convocation in Guizhou, a province better known

for producing fertilizer and liquor, is a measure of the Chinese

government's desire to bring technology investment to its

less-developed interior. While China boasts globally competitive

high-tech clusters on its economically developed east coast, inland

provinces largely lag behind in manufacturing and other traditional

industries, let alone more cutting-edge fields.

On Tuesday, China's Premier Li Keqiang and senior ministers

gathered foreign and Chinese high-tech executives in the capital of

Guizhou to stump for the goal of building a big data industry. Big

data is a hot computing field that involves crunching the massive

amounts of data collected by Internet companies to discover trends.

Guizhou wants to attract everything from the server farms that

store the data to the engineers that design programs to sift

through the information.

"The western region is not very developed, but there is

intelligence growing here," said Mr. Li, according to a video

reviewed by The Wall Street Journal. "I encourage all of you,

including foreign colleagues, to work together to foster new

development of the big data sector."

Beijing's plans and backing count for much in China's heavily

government-directed economy, so the prospect of a meeting with the

Chinese premier drew the chief executives of multinationals

including Dell Inc. and Foxconn Technology Group, which makes

iPhones and other products in China. The heads of top Chinese tech

companies also attended, including messaging and gaming giant

Tencent Holdings Ltd., search provider Baidu Inc., chip maker

Tsinghua Unigroup and ride-hailing service provider Didi Chuxing

Technology Inc.

Guizhou's big data conference, which opens Wednesday, is its

second annual event. The province has been trying to sell itself as

an ideal location, given its plentiful amounts of water and coal

for energy, a mild climate and lower land and labor costs than many

other parts of China.

Luring a big-data industry would mark a big step up for Guizhou,

a region of mountains and isolated hollows. The province's top

three exports are fertilizer, tires and liquor -- the famous

Chinese Maotai liquor comes from Guizhou. It routinely ranks near

the bottom of all China's provinces and regions for literacy and

income. Provincial economic output per capita last year stood at

29,847 yuan ($4,553), less than two-thirds of the national average

of 52,000 yuan.

Big data is a relatively new field for China. According to a

Bain & Co. report, spending on one part of it -- cloud

computing -- is growing by as much as 45% annually and is projected

to be a $20 billion business by 2020. In competing for investment

Guizhou is going up against eastern metropolises like Beijing and

Shenzhen, which have fostered high-tech industries for two or more

decades.

Guizhou is offering tax breaks, grants and housing allowances to

attract tech firms. Heeding the call so far is Tsinghua Unigroup, a

subsidiary of which has invested in a cloud-computing platform, and

U.S. network tech firm Qualcomm Inc., which set up a $280 million

joint venture to develop chips for servers in January.

The province reported this year that its big data "industrial

value" was 200 billion yuan, with a target of a 25% increase this

year, although it isn't clear how the figure was calculated.

Guizhou also requires a company only to be registered in the

province, not to set up physical facilities, so it is unclear how

much the value is produced there.

Tuesday's gathering appeared designed to show Guizhou's interest

in international partnerships. In an unusual setup for a Chinese

official meeting, Dell founder Michael Dell served as moderator and

sat beside Mr. Li onstage, according to a video of the event.

Foxconn Chairman Terry Gou and Tencent's chairman, Pony Ma, were

among the six executives each invited to give a six-minute speech,

according to a copy of the schedule.

Write to Eva Dou at eva.dou@wsj.com

(END) Dow Jones Newswires

May 24, 2016 12:33 ET (16:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

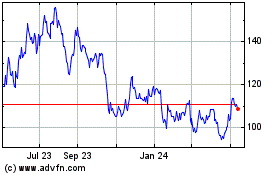

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

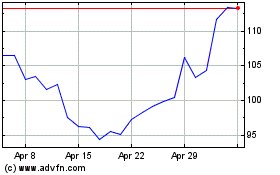

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024