Uber Spends Big on International Expansion

March 02 2016 - 7:30PM

Dow Jones News

Uber Technologies Inc. has spent big to expand its ride-hailing

service around the globe, a European regulatory filing showed,

providing a rare look at the company's finances.

Uber said its international business lost $237 million in 2014,

wider than its $32 million loss the previous year, according to a

filing it made last month with the Dutch Chamber of Commerce, which

handles corporate registrations in the Netherlands. That was the

most recent period for which the closely held company was required

to report financial data to authorities in Amsterdam, the site of

its international headquarters.

The filing applies to only one Uber subsidiary, Uber

International C.V., and the extent to which it represents the

company's overall international business is unclear. Still, the

numbers reveal a large jump in spending from 2013 to 2014, a period

in which Uber accelerated its international expansion. The company

now operates in about 400 cities, up from fewer than 100 at the

start of 2014.

Uber's international losses have likely grown even higher. Chief

Executive Travis Kalanick, in an interview last month with Canadian

publication Betakit, said his company is losing $1 billion a year

just in China, where it launched in 2013 and is spending heavily to

compete with homegrown rival Didi Kuaidi Joint Co. Uber said in

October that about 30% of its total global trips were in China.

Mr. Kalanick said in that interview that Uber is profitable in

the U.S. A spokeswoman for the company declined to say whether the

statement factored in costs such as running its San Francisco

headquarters.

"We're a rapidly growing company that is investing heavily to

bring our service to more people in more cities," the Uber

spokeswoman said in an email.

The Dutch filing is dated Feb. 3 but hadn't previously gained

wide attention. It was reported on earlier Wednesday by Reuters,

which cited Dutch broadcaster RT.

Revenue for Uber's international unit was $68 million in 2014,

according to the filing. The company didn't disclose revenue for

any previous year, nor provide the total amount of gross bookings,

or fares paid by customers, which likely was much higher.

Both private and public companies in many countries must file

paperwork with their national corporate registries, though only

some classes of companies need to include publicly accessible

profit-loss statements.

Uber has raised more than $10 billion in debt and equity as it

races to expand around the world. The ride-hailing company and its

competitors sink cash into subsidizing the cost of lower-priced

rides to attract new passengers and giving out lucrative bonuses to

attract new drivers.

LetterOne, an investment company founded by Russian billionaire

Mikhail Fridman said last month that it has invested $200 million

in Uber. Other overseas investors include Chinese search giant

Baidu Inc., Indian publishing group Bennett Coleman & Co. and

Qatar's sovereign-wealth fund.

Uber is raising customer fees in other parts of its business. On

Wednesday, the company told San Francisco customers of its UberEats

food-delivery service that it would add a new $1.50 delivery fee to

each order. An Uber spokeswoman said the company has charged

different delivery fees in each of the 10 U.S. cities where

UberEats is available, as it experiments with pricing that works

best in each market.

Sam Schechner contributed to this article.

Write to Douglas MacMillan at douglas.macmillan@wsj.com

(END) Dow Jones Newswires

March 02, 2016 19:15 ET (00:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

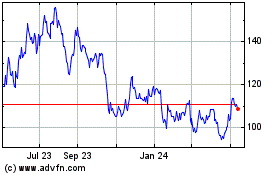

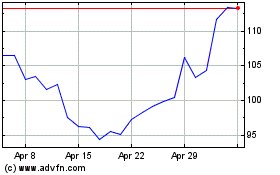

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024