Among the companies with shares expected to trade actively in

Friday's session are Hilton Worldwide Holdings Inc. (HLT), Foot

Locker Inc. (FL) and Ford Motor Co. (F).

Hilton Worldwide Holdings Inc. confirmed plans to spinoff most

of its hotels into a real-estate investment trust, a popular move

among companies looking to slim down, and said it would split off

its timeshare business into a separate company. Shares rose 5.2% to

$21.25 in premarket trading.

Foot Locker Inc. said sales at existing stores in its latest

quarter jumped again, boosting profit and revenue, as the athletic

retailer continues to attract customers with its widening selection

of merchandise. Shares rose 1.67% to $68.15 premarket.

Ford Motor Co. is investing $145 million in its Cleveland engine

plant to ramp up production of its second-generation EcoBoost

engine family for the 2017 F-150 lineup, as the auto maker makes

good on a promise to upgrade plants amid soaring demand for its

pickup trucks. Shares rose 0.56% to $12.46 premarket.

Media-solutions firm RR Media (RRM) said Friday it had agreed to

be taken private by Luxembourg-based satellite operator SES S.A. in

an all-cash deal worth $242 million. RR Media shares rose 48.97% to

$12.96 premarket.

The chief executive of cosmetics giant Revlon Inc. (REV) is

stepping down a month after its controlling shareholder and

Chairman Ronald O. Perelman disclosed he was exploring strategic

alternatives for the company.

Liberty Media Corp. (LMCA) on Friday reported its profit fell

5.9% in the final quarter of the year, though revenue climbed more

than expected on strong performance from SiriusXM.

Sotheby's (BID) on Friday swung to a loss in the final quarter

of the year as the company booked a hefty income tax charge on the

repatriation of foreign earnings.

Autodesk Inc. (ADSK) swung to a loss in the January quarter on

restructuring charges, but the design software company's profit

excluding items came in above its guidance.

Baidu Inc.'s (BIDU) fourth-quarter adjusted profit and revenue

beat expectations, even as the company continues to spend heavily

to expand market share.

BioMarin Pharmaceutical Inc. (BMRN) on Thursday posted a wider

fourth-quarter loss excluding items, reflecting higher spending on

research and development costs and selling, general and

administrative expenses.

EOG Resources Inc. (EOG) on Thursday reported the first annual

loss since it was spun off from Enron Corp. more than a decade ago

and said it would slash spending on capital projects this year to

counter low energy prices.

Gap Inc. (GPS) on Thursday said profit would fall this business

year and that it would cut capital spending and buy back fewer

shares as it moves to pay down debt.

Herbalife Ltd. (HLF) on Thursday cut its profit projections for

the current year citing the impact of the stronger U.S. dollar that

drove down revenue in the December quarter even as sales volume

rose, driven by China.

Intuit Inc.(INTU), the maker of TurboTax software, on Thursday

reported better-than-expected results for its second quarter,

driven in part by more online subscribers of its QuickBooks

product.

Kraft Heinz Co. (KHC) on Thursday reported profit and revenue

that beat Wall Street expectations in its fourth quarter, the

packaged-foods giant's second financial report since the merger of

Kraft and Heinz in July.

Live Nation Entertainment Inc. (LYV) on Thursday reported a

10.5% increase in fourth-quarter revenue, boosted in part by growth

at its artist management company.

Flooring company Mohawk Industries Inc.'s (MHK) fourth-quarter

profit rose 30.5%, reflecting strong margins, acquisition

contributions and an improving economy.

Monster Beverage Corp. (MNST) on Thursday reported

weaker-than-expected results for its fiscal fourth quarter as

distribution hiccups and currency exchange rates limited its sales

growth.

Noodles & Co. on Thursday (NDLS) issued downbeat guidance

for the current fiscal year, even as it reported a 7.9% jump in

revenue for its latest quarter driven by the number of new location

openings.

Palo Alto Networks Inc.'s (PANW) loss widened in the latest

quarter on higher expenses, though the cybersecurity company posted

continued growth in bookings and revenue. The company said a

"manual error" caused the results to be posted on its website

before the market closed.

Re/Max Holdings Inc. (RMAX) on Thursday reported fourth-quarter

results above Wall Street views but said revenue would decline this

year as it sold its last company-owned brokerage offices.

Republic Airways Holdings Inc.(RJET), one of the biggest U.S.

regional carriers, filed for bankruptcy protection on Thursday,

succumbing to the pressures of a pilot shortage and a shift by

large network airlines to using larger planes.

Scripps Networks Interactive Inc. (SNI) said it acquired the

remaining 35% interest in Travel Channel Media that it didn't

already own from Cox Communications Inc. for $99 million.

Southwestern Energy Co. (SWN) on Thursday posted a $2.1 billion

fourth-quarter loss, reflecting an impairment charge, as it

continued to suffer from low prices for oil, gas and natural-gas

liquids.

Big-data software company Splunk Inc. (SPLK) said revenue for

the January quarter rose 49% and increased its revenue guidance for

the year ending in January 2017.

Hospital company Universal Health Services Inc. (UHS) on

Thursday reported weaker-than-expected earnings for its fiscal

fourth quarter, in part because of climbing labor costs.

Weight Watchers International Inc. (WTW) on Thursday reported

revenue fell 21% in the quarter ended Jan. 2 as its membership

rolls shrank for the 12th straight quarter. The New York company

reported a net loss of $11.3 million, including an $8.3 million

charge related to Oprah Winfrey's investment. Meanwhile,

Nutrisystem Inc. (NTRI), whose eating plan focuses on selling

meals, reported a 28% drop in profit despite higher sales.

Zoe's Kitchen Inc. (ZOES) swung to a profit in the December

quarter as the company booked a $3.4 million tax benefit.

Write to Chris Wack at chris.wack@wsj.com or Maria Armental at

maria.armental@wsj.com

(END) Dow Jones Newswires

February 26, 2016 09:33 ET (14:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

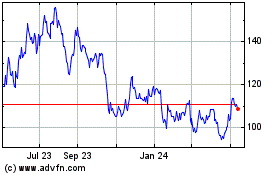

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

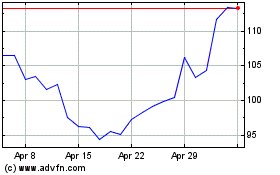

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024