China's Meituan-Dianping Raises $3.3 Billion

January 19 2016 - 9:40AM

Dow Jones News

China's top online seller of movie tickets and restaurant

bookings raised $3.3 billion in the largest private fundraising

round ever for a venture capital-backed startup.

Valued at over $18 billion by the fundraising, Meituan-Dianping,

formed by the merger of two rival startups last year, said Tuesday

it raised the fresh capital from investors ranging from Chinese

Internet giant Tencent Holdings Ltd. to venture capital investor

DST Global and Singapore state investment firm Temasek Holdings

Pte. Ltd.

China's growing importance to venture capitalists and startup

investors is underscored by the massive fundraising. The Meituan

fundraising, which started last year before the merger, tops a $3

billion round raised by Chinese homegrown ride-hailing startup Didi

Kuaidi Joint Co. to become the largest single funding round on

record for a privately-held startup with venture capital

investors.

Meituan's fundraising was complicated by growing competition in

online-to-offline services market where Chinese search leader Baidu

Inc. and Chinese e-commerce giant Alibaba Group Holding Ltd. are

spending billions on their own offerings. After sounding out

investors on a fundraising last year at valuations as high as $20

billion, investors pushed Meituan to lower its asking price and

encouraged the merger with rival Dianping to cut spending on

subsidies.

The merger with Dianping opened the door for Meituan and its

founder, serial entrepreneur Wang Xing, to form a new alliance with

Chinese social-and-gaming company Tencent at the expense of

Alibaba. The merger with Dianping diluted the ownership stake of

Alibaba, which was an early investor in Meituan. When the merger

was agreed upon, Tencent offered to put in around $1 billion as

part of the $3.3 billion fundraising to boost its ownership in

Meituan-Dianping.

Many investors viewed the merger agreement as favorable to

Dianping's existing shareholders, according to people familiar with

the situation. As a result of the Meituan-Dianping merger, Alibaba

decided to sell its roughly $1 billion stake in the startup.

Alibaba had already signaled its desire to refocus on its own

online-to-offline operations, called Koubei. Alibaba was offering

the stake ownership, which represented around 7% of the company, at

a discount to the current fundraising round. The discount was due

to its shares having less downside protection rights than the new

shares sold in this round.

Meituan-Dianping's offerings are in some ways similar to the

group-buying and restaurant-booking services sold by Groupon Inc.

and Yelp Inc. of the U.S. The company said Tuesday that its total

transaction volume had reached 170 billion yuan ($25.8 billion)

last year.

The sales of such services have grown bigger in China than the

U.S. given the country's urban megacities and the widespread

adoption of smartphone technologies. Steep discounts, particularly

on movie tickets, have been a major driver of Meituan's growth.

China's Internet giants have sought to expand their shares of

the fiercely competitive market for smartphone applications

connecting users with brick-and-mortar services such as taxi rides,

food deliveries, restaurant bookings and movie ticketing.

Many startups have burned out in the battle to attract users

with heavy discounts and subsidies, but the likes of Alibaba and

Tencent say they have deep pockets and supporting services such as

maps, data and payments platforms to give them an edge over other

competitors.

Alibaba's executives have said the company's dominance in

e-commerce can translate to success in the offline, local-services

niche, pointing to the heavy traffic of hundreds of millions of

users of its shopping app, Taobao, and affiliated payments

business, Alipay. The company also has a mapping arm and other

assets that can support such a business, they have said.

Rather than run its own operations, Tencent's strategy has been

to take minority stakes in other technology companies and use the

alliances to offer a wider range of services on the company's

messaging and social-networking applications, which also have

hundreds of millions of users.

Search company Baidu Inc., sometimes called China's Google, has

also been spending heavily to win share in the market because it

views the services as blending in with its lucrative search and map

business to increase revenue through commissions from

merchants.

Gillian Wong contributed to this article

Write to Rick Carew at rick.carew@wsj.com

(END) Dow Jones Newswires

January 19, 2016 09:25 ET (14:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

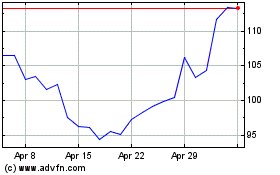

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

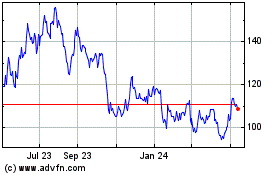

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024