Uber's China Unit Raises Funding at $7 Billion Valuation

January 11 2016 - 2:20PM

Dow Jones News

Uber Technologies Inc. said Monday it has raised fresh funds

that value its expanding China unit at $7 billion, bringing in

local partners to aid its battle with a homegrown Chinese

rival.

The global ride-hailing leader, which is locked in a fierce

battle with Chinese startup Didi Kuaidi Joint Co. for market share,

said it now counts Chinese airline operator HNA Group, car maker

Guangzhou Automobile Co. Group, and China's biggest life insurer

China Life Insurance as investors in its China unit, UberChina.

China is the rare global market where the U.S. tech company lags

behind a local rival. Uber Chief Executive Travis Kalanick has made

China a focal point for his company's rapid global expansion,

earmarking $1 billion last year for that country alone and setting

up an independent Chinese entity, UberChina, with local

search-and-mapping company Baidu Inc.

Uber said the $7 billion valuation for its Chinese unit is

before the additional funds raised from UberChina's second round,

which follows a first round of fundraising last year that netted

$1.2 billion to fund its expansion plans. Mr. Kalanick disclosed

the Chinese investors in a speech he gave in Beijing.

Local ride-hailing rival Didi Kuaidi, which was formed by the

merger of two competing taxi apps early last year, has proven

itself to be a formidable challenger to Uber in both raising money

and operationally. Didi Kuaidi closed a $3 billion round of funding

last year at a $16 billion valuation in the biggest ever single

placement raised by a venture capital-backed startup. It counts

China's top two Internet companies, e-commerce giant Alibaba Group

Holding Ltd. and messaging-and-gaming leader Tencent Holdings Ltd.,

as major shareholders.

The two sides in the Chinese ride-sharing war have sought to

bring big local partners to its side to give them a leg up in

funding and expanding operations. Uber garnered support from two

Chinese deep-pocketed insurers, China Life and China Taiping

Insurance, while Didi Kuaidi has found support from $740 billion

sovereign-wealth fund China Investment Corp. and Chinese financial

conglomerate Ping An Insurance (Group) Co.

Both companies have spent much of the funding raised on

subsidies to attract Chinese drivers and riders to their competing

services. Uber has found some success with its private car

offerings and Didi Kuaidi dominates the local taxi-hailing

business.

Didi Kuaidi has also attacked Uber on its home turf by investing

$100 million Uber's primary U.S. rival Lyft Inc. The Chinese

company, along with other Asian ride-hailing companies, have formed

an alliance, known in tech circles as the "anti-Uber alliance," to

allow users of each app to hail rides from using their home

country's app while traveling abroad. That is expected to help

counter Uber's appeal to jet-set travels, giving them a more

familiar local interface and payment options when they go

overseas.

In December, The Wall Street Journal reported that Uber is in

the midst of raising as much as $2.1 billion in a round that could

value the company at up to $64.6 billion, which would be the

highest for a private venture-backed company on record.

(END) Dow Jones Newswires

January 11, 2016 14:05 ET (19:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

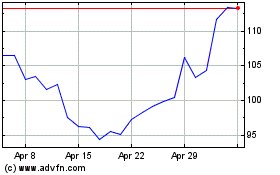

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

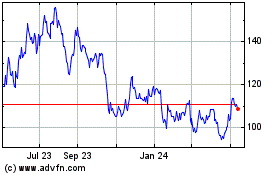

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024