HONG KONG—One of the last companies to float in the U.S. this

year could set a trend for 2016.

Chinese online peer-to-peer lender Yirendai Ltd. on Thursday

raised $75 million in an initial public offering on the New York

Stock Exchange, according to people with knowledge of the matter,

becoming the first Chinese company of its kind to be publicly

traded overseas.

Despite its small size, Yirendai's IPO has opened the door to a

possible wave of listings from Chinese financial technology, or

so-called "fintech" companies. Such companies provide financial

services including lending, insurance and payment with Internet or

mobile-based software.

The online lender will join the ranks of U.S. counterparts such

as LendingClub Corp, the world's largest online credit marketplace

according to its website, and On Deck Capital Inc., which lends to

small businesses. Both saw their shares rise sharply after their

IPOs in December last year, but are down more than 50% this

year.

Still, the popularity of Yirendai's IPO suggests there is strong

investor demand for such companies. Its books were covered seven to

eight times with 80% of investors from the U.S., according to one

person with knowledge of the matter. It sold 7.5 million shares at

$10 each, the midpoint of the indicative range, the people with

knowledge of the matter said.

Many Chinese fintech companies have so far obtained funding from

private investors. Chinese Internet giant Baidu Inc. invested $10

million in Yirendai in the same week as its IPO, via a private

placement deal, one of the people said. Baidu declined to comment

on its investment in Yirendai.

Private investment in China's fintech sector has reached $3.5

billion this year, up from 2014's $927 million, data from the

Centre for Asia Private Equity Research show.

"Eventually these people [private investors] would like to exit

and IPO is clearly an option," said Maggie Lee, partner with KPMG

China.

The largest potential IPO in the pipeline is Lufax's up to $5

billion Hong Kong listing, which could materialize in the second

half of next year, according to people with knowledge of the

matter. The company, backed by Chinese insurer Ping An Insurance

(Group) Co. of China Ltd., is currently aiming to raise more than

$900 million from private investors, giving it a valuation of $18.4

billion, according to a term sheet seen by The Wall Street

Journal.

Another online peer-to-peer lender, China Rapid Finance, which

is valued at $1 billion according to data company CB Insights, is

planning a roughly $200 million IPO in the U.S. as early as the

first half of next year.

Ant Financial Services Group, an Alibaba Group Holding Ltd.

affiliate, is also expected to go public in the next two years,

according to people with knowledge of the matter. The company,

which operates Alibaba's payments platform Alipay, raised more than

12 billion yuan ($1.9 billion) this year from investors including

China's national social security fund and private-equity firm

Primavera Capital Group.

The fintech sector is emerging as an investment opportunity just

as China's traditional financial services, especially its banking

sector, are falling out of favor, thanks mainly to rising credit

risks in China's slowing economy.

Several recent IPOs of Chinese commercial banks in Hong Kong

were all priced at or near the bottom end of their price range.

However, new doesn't necessarily mean safe. Problems have

already emerged in the peer-to-peer lending space, which remains

relatively unregulated compared with traditional lenders.

More than 30% of the 3,769 online lending platforms in China had

experienced credit issues by the end of November, according to a

report jointly published by Chinese peer-to-peer portal

Wangdaizhijia and consulting firm Yingcan.

The nascent fintech sector also generally lacks a track record

of profitability. Lufax is estimated to break even only next year,

although its projected profit for 2017 could reach 10 billion yuan,

according to its latest fundraising term sheet.

Yirendai is growing fast. Its revenue grew tenfold to $32

million in 2014, and has already surged to $138 million in just the

first nine months of 2015, with a net profit over that period of

$31 million.

Yirendai was founded in 2012 by Beijing-based financial-services

firm CreditEase, whose investors include Morgan Stanley Private

Equity Asia, Kleiner Perkins Caufield & Byers and IDG Capital

Partners.

Yirendai and CreditEase couldn't be reached for comment.

Morgan Stanley, Credit Suisse and China Renaissance Securities

(Hong Kong) Ltd. are the lead underwriters of Yirendai's IPO.

Telis Demos and Rick Carew contributed to this article.

(END) Dow Jones Newswires

December 18, 2015 06:25 ET (11:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

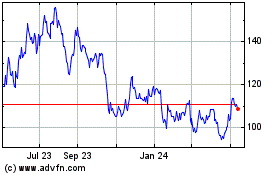

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

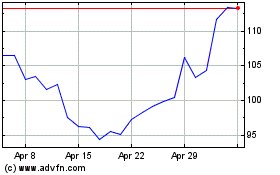

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024