Chinese Startups Near Merger in Deal Worth Over $15 Billion

October 07 2015 - 12:10AM

Dow Jones News

HONG KONG—Two of China's biggest tech startups are nearing a

merger worth more than $15 billion, creating the country's biggest

online-to-offline provider of services ranging from movie tickets

to restaurant bookings, according to people familiar with the

situation.

Rivals Meituan.com, China's version of Groupon.com, and

restaurant-review app Dianping Holdings Ltd. are nearing a deal to

merge that would create a company with a combined value of more

than $15 billion, according to the people. The deal by the two

startups, already worth billions of dollars through several rounds

of funding, could be announced in the coming days, according to one

of the people.

The deal brings together two rivals backed separately by Chinese

Internet giants Alibaba Group Holding Ltd. and Tencent Holdings

Ltd. and follows a template set out by the $6 billion combination

of the two rival taxi-hailing services separately backed by the

Chinese Internet giants in February. After the two rival taxi apps

combined to form Didi Kuaidi Joint Co., the new company was able to

raise $3 billion from investors at a $16 billion valuation.

Investors in Meituan and Dianping are hoping for a similar

result as the two companies specializing in deals for restaurants,

movie tickets, and other offline services turn from competing

against each other to taking on Chinese online search giant Baidu

Inc.'s group-buying platform Nuomi. Baidu said in June it planned

to invest $3.2 billion in Nuomi over the next three years as the

online search engine pivots its business model toward connecting

online users with offline services.

The combined Meituan.com and Dianping will present a more

formidable competitor to Baidu. The competing platforms have spent

aggressively to attract merchants and consumers, burning cash in

the process. Meituan and Baidu executives have said that commission

rates, also known as "take rates," range between 2% and 5%. The

executives have said they need to raise those rates to between 5%

and 7% in the longer-term to be able to make money.

Putting the two companies together would be the biggest deal in

a series of Chinese Internet consolidations this year. Many Chinese

tech entrepreneurs have expanded their startups by aggressively

providing subsidies to users and merchants to gain scale, wiping

out competitors that don't have access to capital. That model has

whittled down the field of competitors in many segments of the

Chinese Internet to a handful of well-funded competitors.

Write to Rick Carew at rick.carew@wsj.com and Juro Osawa at

juro.osawa@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 06, 2015 23:55 ET (03:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

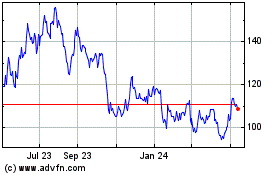

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024