AeroVironment, Inc. (NASDAQ: AVAV) today reported financial

results for its fourth quarter ended April 30, 2016.

“Fiscal 2016 fully diluted earnings per share increased 200

percent from the prior year to $0.39, we delivered revenue within

our guidance range and exceeded gross profit margin guidance,

including a favorable one-time government contract reserve

reduction,” said Wahid Nawabi, AeroVironment president and chief

executive officer. “International small UAS revenue grew

significantly in fiscal 2016 and we expect it to remain a major

contributor to fiscal 2017 revenue. We also made significant

progress in developing the right solution for what we believe

is a very large emerging market opportunity for commercial UAS

applications, where early adopter customers are evaluating new

hardware prototypes and pre-release software.”

“Our team maintained leading market positions in small UAS and

Tactical Missile Systems for defense applications, and in electric

vehicle charging and test solutions for commercial and consumer

applications throughout 2016. We believe we are well positioned for

long-term growth potential in our core and growth markets by

staying focused on helping our customers proceed with certainty,”

Mr. Nawabi added.

FISCAL 2016 FOURTH QUARTER RESULTS

Revenue for the fourth quarter of fiscal 2016 was

$84.8 million, a decrease of 2% from fourth quarter fiscal

2015 revenue of $86.5 million. The decrease in revenue

resulted from a decrease in sales in our Unmanned Aircraft Systems

(UAS) segment of $2.8 million, partially offset by an increase in

sales in our Efficient Energy Systems (EES) segment of

$1.1 million.

Gross margin for the fourth quarter of fiscal 2016 was

$37.9 million, a decrease of 16% from fourth quarter fiscal

2015 gross margin of $45.4 million. The decrease in gross

margin was due to a decrease in product margin of

$8.1 million, partially offset by an increase in service

margin of $0.7 million. As a percentage of revenue, gross

margin decreased to 45% from 52%.

Income from operations for the fourth quarter of fiscal 2016 was

$6.8 million compared to income from operations for the fourth

quarter of fiscal 2015 of $7.5 million. The decrease in income from

operations was a result of a decrease in gross margin of $7.4

million and an increase in selling, general & administrative

(SG&A) expense of $1.2 million, partially offset by a decrease

in research and development (R&D) of $7.9 million.

Other income, net, for the fourth quarter of fiscal 2016 was

$0.5 million compared to other expense, net, for the fourth quarter

of fiscal 2015 of $0.5 million. The increase in other income, net

was primarily due to losses on our CybAero equity securities

recorded during the fourth quarter of fiscal 2015. The CybAero

equity securities were sold during the second quarter of fiscal

2016.

Net income for the fourth quarter of fiscal 2016 was

$5.4 million compared to net income for the fourth quarter of

fiscal 2015 of $7.1 million.

Earnings per diluted share for the fourth quarter of fiscal 2016

were $0.23 compared to earnings per diluted share for the fourth

quarter of fiscal 2015 of $0.31. Earnings per diluted share for the

fourth quarter of fiscal 2015 included a loss of $0.01 per share

due to losses on our equity investment.

FISCAL 2016 FULL-YEAR RESULTS

Revenue for fiscal 2016 was $264.1 million, up 2% from

fiscal 2015 revenue of $259.4 million. The increase in revenue

resulted from an increase in sales in our UAS segment of

$12.8 million, partially offset by a decrease in sales in our

EES segment of $8.1 million.

Gross margin for fiscal 2016 was $112.1 million, up 8% from

fiscal 2015 gross margin of $104.3 million. The increase in

gross margin was due to an increase in service margin of

$10.5 million, partially offset by a decrease in product

margin of $2.7 million, both of which were impacted by a

reserve reversal of $3.6 million for the settlement and resolution

of prior year government incurred cost audits during 2016. As a

percentage of revenue, gross margin increased to 42% from 40%.

Income from operations for fiscal 2016 was $9.7 million

compared to income from operations for fiscal 2015 of $2.0 million.

The increase in income from operations was a result of an increase

in gross margin of $7.8 million and a decrease in R&D of $4.2

million, partially offset by an increase in SG&A of $4.3

million.

Other expense, net, for fiscal 2016 was $1.7 million compared to

other expense, net, for fiscal 2015 of $0.1 million. The increase

in other expense, net was primarily due to the recording of an

other-than-temporary impairment loss on our CybAero equity

securities during the first quarter of fiscal 2016.

Net income for fiscal 2016 was $9.0 million compared to net

income for fiscal 2015 of $2.9 million.

Earnings per diluted share for fiscal 2016 were $0.39 compared

to earnings per diluted share for fiscal 2015 of $0.13. Net income

per diluted share for fiscal 2016 increased by $0.10 due to the

reserve reversal for the settlement and resolution of prior year

government incurred cost audits, increased by $0.05 due to R&D

tax credits related to prior fiscal years, primarily as a result of

the reenactment of the federal R&D tax credit, and decreased by

$0.06 due to both the impairment loss and loss on sale of our

CybAero equity securities during the first quarter.

BACKLOG

As of April 30, 2016, funded backlog (unfilled firm orders for

which funding is currently appropriated to us under a customer

contract) was $65.8 million compared to $64.7 million as of

April 30, 2015.

FISCAL 2017 — OUTLOOK FOR THE FULL YEAR

For fiscal 2017, the company expects to generate revenue of

between $260 million and $280 million, and earnings per fully

diluted share of between $0.20 and $0.35.

The foregoing estimates are forward looking and reflect

management's view of current and future market conditions,

including certain assumptions with respect to our ability to obtain

and retain government contracts, changes in the timing and/or

amount of government spending, changes in the demand for our

products and services, activities of competitors, changes in the

regulatory environment, and general economic and business

conditions in the United States and elsewhere in the world.

Investors are reminded that actual results may differ materially

from these estimates.

CONFERENCE CALL

In conjunction with this release, AeroVironment, Inc. will host

a conference call today, Tuesday, June 28, 2016, at 1:30 pm Pacific

Time that will be broadcast live over the Internet. Wahid Nawabi,

president and chief executive officer, Raymond D. Cook, chief

financial officer and Steven A. Gitlin, vice president of investor

relations, will host the call.

4:30 PM ET3:30 PM CT2:30 PM MT1:30 PM PT

Investors may dial into the call at (877) 561-2749 (U.S.) or

(678) 809-1029 (international) five to ten minutes prior to the

start time to allow for registration.

Investors with Internet access may listen to the live audio

webcast via the Investor Relations page of the AeroVironment, Inc.

website, http://investor.avinc.com. Please allow 15 minutes prior

to the call to download and install any necessary audio

software.

Audio Replay Options

An audio replay of the event will be archived on the Investor

Relations page of the company's website, at

http://investor.avinc.com. The audio replay will also be available

via telephone from Tuesday, June 28, 2016, at approximately 4:30

p.m. Pacific Time through Tuesday, July 5, 2016, at 9:00 p.m.

Pacific Time. Dial (855) 859-2056 and enter the passcode 22090043.

International callers should dial (404) 537-3406 and enter the same

passcode number to access the audio replay.

ABOUT AEROVIRONMENT, INC.

AeroVironment (NASDAQ: AVAV) provides customers with more

actionable intelligence so they can proceed with certainty. Based

in California, AeroVironment is a global leader in unmanned

aircraft systems, tactical missile systems and electric vehicle

charging and test systems, and serves militaries, government

agencies, businesses and consumers. For more information visit

www.avinc.com.

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” as that

term is defined in the Private Securities Litigation Reform Act of

1995. Forward-looking statements include, without limitation, any

statement that may predict, forecast, indicate or imply future

results, performance or achievements, and may contain words such as

“believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,”

“plan,” or words or phrases with similar meaning. Forward-looking

statements are based on current expectations, forecasts and

assumptions that involve risks and uncertainties, including, but

not limited to, economic, competitive, governmental and

technological factors outside of our control, that may cause our

business, strategy or actual results to differ materially from the

forward-looking statements. Factors that could cause actual results

to differ materially from the forward-looking statements include,

but are not limited to, reliance on sales to the U.S. government;

availability of U.S. government funding for defense procurement and

R&D programs; changes in the timing and/or amount of government

spending; potential need for changes in our long-term strategy in

response to future developments; unexpected technical and marketing

difficulties inherent in major research and product development

efforts; changes in the supply and/or demand and/or prices for our

products and services; the activities of competitors and increased

competition; failure of the markets in which we operate to grow;

failure to remain a market innovator and create new market

opportunities; changes in significant operating expenses, including

components and raw materials; failure to develop new products; the

extensive regulatory requirements governing our contracts with the

U.S. government; product liability, infringement and other claims;

changes in the regulatory environment; and general economic and

business conditions in the United States and elsewhere in the

world. For a further list and description of such risks and

uncertainties, see the reports we file with the Securities and

Exchange Commission. We do not intend, and undertake no obligation,

to update any forward-looking statements, whether as a result of

new information, future events or otherwise.

AeroVironment, Inc. Consolidated Statements

of Income (In thousands except share and per share data)

Three Months Ended Twelve Months Ended

April 30, April 30, April 30,

April 30, 2016 2015 2016

2015 (Unaudited) Revenue: Product sales $

60,040 $ 63,034 $ 189,476 $ 205,027 Contract services 24,717 23,437

74,622 54,371 84,757 86,471 264,098 259,398

Cost of sales: Product sales 32,510 27,357 105,987 118,834 Contract

services 14,325 13,764 46,008 36,296 46,835

41,121 151,995 155,130 Gross margin: Product

gross margin 27,530 35,677 83,489 86,193 Contract gross margin

10,392 9,673 28,614 18,074 37,922 45,350

112,103 104,268 Selling, general and administrative 16,775 15,622

60,077 55,763 Research and development 14,316 22,259 42,291

46,491 Income from operations 6,831 7,469 9,735 2,014

Other income (expense): Interest income, net 359 253 1,032 882

Other income (expense), net 97 (727 ) (2,699 ) (1,003 ) Income

before income taxes 7,287 6,995 8,068 1,893 Provision (benefit) for

income taxes 1,923 (85 ) (898 ) (1,002 ) Net income $ 5,364 $ 7,080

$ 8,966 $ 2,895 Earnings per share data: Basic

$ 0.23 $ 0.31 $ 0.39 $ 0.13 Diluted $ 0.23 $ 0.31 $ 0.39 $ 0.13

Weighted average shares outstanding: Basic 22,921,480 22,905,235

22,936,413 22,868,733 Diluted 23,143,504 23,148,256 23,153,493

23,145,997

AeroVironment, Inc.

Reconciliation of Earnings per Share (Unaudited)

Three Months Ended Twelve Months Ended

April 30, April 30, April 30,

April 30, 2016 2015 2016

2015 Earnings per diluted share as adjusted $ 0.23 $

0.32 $ 0.30 $ 0.13 Other-than-temporary impairment loss and loss on

sale of stock — — (0.06 ) —

Reserve reversal for the settlement and resolution of prior year

government incurred cost audits — —

0.10 — R&D tax credits related to prior fiscal

years, related to the reenactment of the federal R&D tax credit

— — 0.05 — Decrease in

fair value of convertible bond and related sale of stock —

(0.01 ) — — Earnings per diluted share

as reported $ 0.23 $ 0.31 $ 0.39 $ 0.13

AeroVironment, Inc. Consolidated Balance Sheets

(In thousands except share data) April 30,

2016 2015

Assets Current assets: Cash and cash equivalents $ 124,287 $

143,410 Short-term investments 103,404 85,381 Accounts receivable,

net of allowance for doubtful accounts of $262 at April 30, 2016

and $606 at April 30, 2015 56,045 33,607 Unbilled receivables and

retentions 18,899 17,356 Inventories, net 37,486 39,414 Deferred

income taxes 5,432 5,265 Prepaid expenses and other current assets

4,150 4,599 Total current assets

349,703 329,032 Long-term investments 33,859 46,769 Property and

equipment, net 16,762 13,499 Deferred income taxes 9,319 7,426

Other assets 750 741 Total assets $

410,393 $ 397,467

Liabilities and stockholders’

equity Current liabilities: Accounts payable $ 17,712 $ 19,243

Wages and related accruals 13,973 13,395 Income taxes payable 943

692 Customer advances 2,544 4,235 Other current liabilities

11,173 9,170 Total current liabilities 46,345

46,735 Deferred rent 1,714 1,381 Capital lease obligations – net of

current portion 449 — Other non-current liabilities 184 — Liability

for uncertain tax positions 441 439 Commitments and contingencies

Stockholders’ equity: Preferred stock, $0.0001 par value:

Authorized shares—10,000,000; none issued or outstanding — — Common

stock, $0.0001 par value: Authorized shares—100,000,000 Issued and

outstanding shares—23,359,925 shares at April 30, 2016 and

23,314,640 at April 30, 2015 2 2 Additional paid-in capital 154,274

148,293 Accumulated other comprehensive loss (201 ) (1,358 )

Retained earnings 207,185 201,975 Total

stockholders’ equity 361,260 348,912

Total liabilities and stockholders’ equity $ 410,393 $

397,467

AEROVIRONMENT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands)

Year ended April 30, 2016

2015 2014 Operating activities Net

income $ 8,966 $ 2,895 $ 13,718 Adjustments to reconcile net income

to cash provided by operating activities: Depreciation and

amortization 6,074 8,366 9,155 Loss from equity method investments

138 240 30 Impairment of available-for-sale securities 2,186 - -

Impairment of long-lived assets - 438 3,317 Provision for doubtful

accounts (178 ) (106 ) (6 ) Losses on foreign currency transactions

63 580 21 Loss (gain) on sale of equity securities 219 209 (4 )

Deferred income taxes (2,912 ) (3,382 ) (3,110 ) Change in fair

value of conversion feature of convertible bonds - (73 ) (1,773 )

Stock-based compensation 4,562 3,768 3,622 Tax benefit from

exercise of stock options 161 52 2,305 Excess tax benefit from

stock-based compensation (39 ) (162 ) (648 ) (Gain) loss on

disposition of property and equipment (22 ) 3,661 — Amortization of

held-to-maturity investments 3,875 4,532 5,037 Changes in operating

assets and liabilities: Accounts receivable (22,260 ) (1,762 )

(11,963 ) Unbilled receivables and retentions (1,543 ) (6,427 ) 375

Inventories 1,928 11,285 11,862 Income tax receivable — 6,584 5,193

Prepaid expenses and other assets 517 (339 ) 157 Accounts payable

(2,705 ) 5,337 (2,238 ) Other liabilities 1,521 3,717 (1,045 )

Net cash provided by

operating activities 551 39,413 34,005

Investing activities

Acquisition of property and equipment (6,829 ) (5,279 ) (7,143 )

Equity method investment (295 ) (395 ) (105 ) Redemptions of

held-to-maturity investments 84,433 69,387 75,022 Purchases of

held-to-maturity investments (94,954 ) (97,464 ) (56,946 )

Acquisition of intangible assets - (150 ) (750 ) Proceeds from the

sale of property and equipment 80 - - Sales of available-for-sale

investments 987 10,081 360

Net cash (used in) provided by investing activities (16,578

) (23,820 ) 10,438

Financing activities Excess tax benefit

from stock-based compensation 39 162 648 Principal payments of

capital lease obligations (472 ) - - Purchase and retirement of

common stock (3,756 ) - - Tax withholding payment related to net

settlement of equity awards (29 ) (36 ) (163 ) Exercise of stock

options 1,122 722 6,709

Net cash (used in) provided by financing activities (3,096 ) 848

7,194 Net (decrease)

increase in cash and cash equivalents (19,123 ) 16,441 51,637 Cash

and cash equivalents at beginning of year 143,410 126,969 75,332

Cash and cash equivalents

at end of year $ 124,287 $ 143,410 $ 126,969

Supplemental disclosures of cash flow information

Cash paid during the year for: Income taxes $ 1,576 $ 700 $ 2,556

Non-cash activities Unrealized change in fair value of

long-term investments recorded in accumulated other comprehensive

income (loss), net of tax expense (benefit) of $18, $(730) and $295

for the fiscal years ended April 30, 2016, April 30, 2015 and April

30, 2014, respectively $ 27 $ (1,095) $ 442 Reclassification from

share-based liability compensation to equity $ 228 $ — $ —

Forfeiture of vested stock-based compensation $ 86 $ 23 $ —

Acquisitions of property and equipment financed with capital lease

obligations $ 932 $ — $ — Acquisitions of property and equipment

included in accounts payable $ 1,174 $ — $ — Accrued acquisition of

intangible assets $ — $ 250 $ —

Reportable Segment

Results are as Follows: (In thousands)

Three Months Ended Twelve Months Ended April

30, April 30, April 30, April

30, 2016 2015 2016

2015 (Unaudited) Revenue: UAS $ 75,896 $

78,693 $ 233,738 $ 220,950 EES 8,861 7,778 30,360

38,448 Total 84,757 86,471 264,098 259,398

Cost of sales: UAS 40,941 36,384 132,209 128,233 EES 5,894

4,737 19,786 26,897 Total 46,835 41,121

151,995 155,130 Gross margin: UAS 34,955 42,309

101,529 92,717 EES 2,967 3,041 10,574 11,551

Total 37,922 45,350 112,103 104,268 Selling,

general and administrative 16,775 15,622 60,077 55,763 Research and

development 14,316 22,259 42,291 46,491 Income

from operations 6,831 7,469 9,735 2,014 Other income (expense):

Interest income, net 359 253 1,032 882 Other income (expense), net

97 (727 ) (2,699 ) (1,003 ) Income before income taxes $ 7,287 $

6,995 $ 8,068 $ 1,893

Additional AV News: http://avinc.com/resources/news/AV Media

Gallery: http://avinc.com/media_gallery/Follow us:

www.twitter.com/aerovironmentFacebook:

http://www.facebook.com/#!/pages/AeroVironment-Inc/91762492182

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160628006564/en/

AeroVironment, Inc.Steven Gitlin+1 (626)

357-9983ir@avinc.com

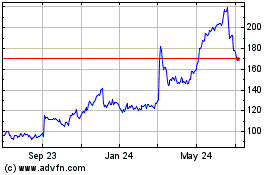

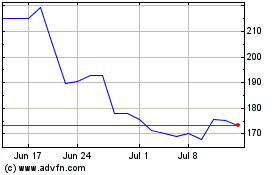

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Apr 2023 to Apr 2024