AeroVironment, Inc. (NASDAQ: AVAV) today reported financial

results for its second quarter ended October 31, 2015.

“Strong performance in our core UAS business delivered a 23

percent increase in AeroVironment’s quarterly revenue

year-over-year and a 76 percent increase in quarterly gross margin,

including 19 percentage points from a government contract reserve

reduction. Solid bookings of more than $66 million in UAS contracts

and contract extensions further illustrate our team’s effectiveness

during the quarter,” said Tim Conver, AeroVironment chairman and

chief executive officer. "We also produced meaningful progress from

of our investments in commercial UAS information services and

Tactical Missile Systems that have positioned AeroVironment

favorably for emerging opportunities in both sectors. In our EES

segment, we have more narrowly focused our EV charging business on

consumer and business solutions to drive more profitable long-term

growth, and Hyundai became the seventh global automaker to select

AeroVironment for electric vehicle charging systems.”

FISCAL 2016 SECOND QUARTER RESULTS

Revenue for the second quarter of fiscal 2016 was

$64.7 million, up 23% from second quarter fiscal 2015 revenue

of $52.7 million. The increase in revenue resulted from an

increase in sales in our Unmanned Aircraft Systems (UAS) segment of

$13.5 million, offset by a decrease in sales in our Efficient

Energy Systems (EES) segment of $1.5 million.

Gross margin for the second quarter of fiscal 2016 was

$31.5 million, up 76% from second quarter fiscal 2015 gross

margin of $17.9 million. The increase in gross margin was due

to an increase in product margin of $9.6 million and an

increase in service margin of $4.1 million, both of which were

impacted by a reserve reversal of $3.5 million for the settlement

of prior year government incurred cost audits. As a percentage of

revenue, gross margin increased to 49% from 34%.

Income from operations for the second quarter of fiscal 2016 was

$6.9 million compared to loss from operations for the second

quarter of fiscal 2015 of $4.1 million. The increase in income from

operations was a result of an increase in gross margin of $13.7

million, offset by an increase in research and development

(R&D) of $1.4 million and in selling, general &

administrative (SG&A) expense of $1.3 million.

Other income, net, for the second quarter of fiscal 2016 was

$0.1 million compared to other expense, net, for the second quarter

of fiscal 2015 of $0.4 million.

Net income for the second quarter of fiscal 2016 was

$4.4 million compared to net loss for the second quarter of

fiscal 2015 of $2.9 million.

Earnings per diluted share for the second quarter of fiscal 2016

were $0.19 compared to loss per share for the second quarter of

fiscal 2015 of $0.13. Loss per share for the second quarter of

fiscal 2015 increased by $0.01 due to the decrease in fair value of

the conversion option of our convertible bond investment and

related sales of stock. There was no impact to earnings per share

for the second quarter of fiscal 2016 for the convertible bond

investment or sales of stock.

FISCAL 2016 YEAR-TO-DATE RESULTS

Revenue for the first six months of fiscal 2016 was

$111.8 million, up 7% from first six months fiscal 2015

revenue of $104.5 million. The increase in revenue resulted

from an increase in sales in our UAS segment of $12.5 million

offset by a decrease in sales in our EES segment of $5.3

million.

Gross margin for the first six months of fiscal 2016 was

$47.6 million, up 49% from first six months fiscal 2015 gross

margin of $31.9 million. The increase in gross margin was due

to an increase in service margin of $8.2 million and an

increase in product margin of $7.5 million, both of which were

impacted by a reserve reversal of $3.5 million for the settlement

of prior year government incurred cost audits. As a percentage of

revenue, gross margin increased to 43% from 31%.

Loss from operations for the first six months of fiscal 2016 was

$2.2 million compared to loss from operations for the first

six months of fiscal 2015 of $10.6 million. The decrease in loss

from operations was a result of an increase in gross margin of

$15.6 million, offset by an increase in research and development

(R&D) expense of $4.1 million and in selling, general &

administrative (SG&A) expense of $3.1 million.

Other expense, net, for the first six months of fiscal 2016 was

$2.1 million compared to other income, net for the first six months

of fiscal 2015 of $0.4 million. The increase in expense is

primarily due to the recording of an other-than-temporary

impairment loss on our CybAero equity securities.

Net loss for the first six months of fiscal 2016 was

$2.6 million compared to net loss for the first six months of

fiscal 2015 of $6.5 million.

Loss per share for the first six months of fiscal 2016 was $0.11

compared to loss per share for the first six months of fiscal 2015

of $0.29. Loss per share for the first six months of fiscal 2016

was increased by $0.06 due to both the impairment loss and loss on

sale of our CybAero equity securities. Loss per share for the first

six months of fiscal 2015 decreased by $0.01 due to the increase in

fair value of the conversion option of our convertible bond

investment and related sales of stock.

BACKLOG

As of October 31, 2015, funded backlog (unfilled firm orders for

which funding is currently appropriated to us under a customer

contract) was $97.2 million compared to $64.7 million as of

April 30, 2015.

FISCAL 2016 — OUTLOOK FOR THE FULL YEAR

For fiscal 2016, the company continues to expect revenue of

between $260 million and $280 million, and a gross profit margin of

between 36 percent and 37.5 percent, net of reserve effect. Planned

increases in strategic R&D and SG&A investments for

Commercial UAS in fiscal 2016 may largely offset operating

profit in the current fiscal year.

The foregoing estimates are forward looking and reflect

management's view of current and future market conditions,

including certain assumptions with respect to our ability to obtain

and retain government contracts, changes in the timing and/or

amount of government spending, changes in the demand for our

products and services, activities of competitors, changes in the

regulatory environment, and general economic and business

conditions in the United States and elsewhere in the world.

Investors are reminded that actual results may differ materially

from these estimates.

CONFERENCE CALL

In conjunction with this release, AeroVironment, Inc. will host

a conference call today, Tuesday, December 8, 2015, at 1:30 pm

Pacific Time that will be broadcast live over the Internet. Timothy

E. Conver, chairman and chief executive officer, Raymond D. Cook,

chief financial officer and Steven A. Gitlin, vice president of

investor relations, will host the call.

4:30 PM ET3:30 PM CT2:30 PM MT1:30 PM PT

Investors may dial into the call at (877) 561-2749 (U.S.) or

(678) 809-1029 (international) five to ten minutes prior to the

start time to allow for registration.

Investors with Internet access may listen to the live audio

webcast via the Investor Relations page of the AeroVironment, Inc.

website, http://investor.avinc.com. Please allow 15 minutes prior

to the call to download and install any necessary audio

software.

Audio Replay Options

An audio replay of the event will be archived on the Investor

Relations page of the company's website, at

http://investor.avinc.com. The audio replay will also be available

via telephone from Tuesday, December 8, 2015, at approximately 4:30

p.m. Pacific Time through Tuesday, December 15, 2015, at 9:00 p.m.

Pacific Time. Dial (855) 859-2056 and enter the passcode 89717937.

International callers should dial (404) 537-3406 and enter the same

passcode number to access the audio replay.

ABOUT AEROVIRONMENT, INC.

AeroVironment is a technology solutions provider that designs,

develops, produces, supports and operates an advanced portfolio of

Unmanned Aircraft Systems (UAS) and electric transportation

solutions. The company's electric-powered, hand-launched UASs

generate and process data to deliver powerful insight, on-demand,

to people engaged in military, public safety and commercial

activities around the world. AeroVironment's electric

transportation solutions include a comprehensive suite of electric

vehicle (EV) charging systems, installation and network services

for consumers, automakers, utilities and government agencies, power

cycling and test systems for EV developers and industrial EV

charging systems for commercial fleets. More information about

AeroVironment is available at www.avinc.com.

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” as that

term is defined in the Private Securities Litigation Reform Act of

1995. Forward-looking statements include, without limitation, any

statement that may predict, forecast, indicate or imply future

results, performance or achievements, and may contain words such as

“believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,”

“plan,” or words or phrases with similar meaning. Forward-looking

statements are based on current expectations, forecasts and

assumptions that involve risks and uncertainties, including, but

not limited to, economic, competitive, governmental and

technological factors outside of our control, that may cause our

business, strategy or actual results to differ materially from the

forward-looking statements. Factors that could cause actual results

to differ materially from the forward-looking statements include,

but are not limited to, reliance on sales to the U.S. government;

availability of U.S. government funding for defense procurement and

R&D programs; changes in the timing and/or amount of government

spending; potential need for changes in our long-term strategy in

response to future developments; unexpected technical and marketing

difficulties inherent in major research and product development

efforts; changes in the supply and/or demand and/or prices for our

products and services; the activities of competitors and increased

competition; failure of the markets in which we operate to grow;

failure to remain a market innovator and create new market

opportunities; changes in significant operating expenses, including

components and raw materials; failure to develop new products; the

extensive regulatory requirements governing our contracts with the

U.S. government; product liability, infringement and other claims;

changes in the regulatory environment; and general economic and

business conditions in the United States and elsewhere in the

world. For a further list and description of such risks and

uncertainties, see the reports we file with the Securities and

Exchange Commission. We do not intend, and undertake no obligation,

to update any forward-looking statements, whether as a result of

new information, future events or otherwise.

AeroVironment, Inc.

Consolidated Statements of Operations

(Unaudited)

(In thousands except share and per

share data)

Three Months Ended Six Months Ended October

31, November 1, October 31,

November 1, 2015 2014 2015

2014 Revenue: Product sales $ 49,492 $ 42,874

$ 76,131 $ 85,685 Contract services 15,239 9,790 35,650

18,845 64,731 52,664 111,781 104,530 Cost of sales: Product

sales 24,802 27,779 41,567 58,576 Contract services 8,396

7,014 22,658 14,029 33,198 34,793 64,225 72,605 Gross

margin: Product sales 24,690 15,095 34,564 27,109 Contract services

6,843 2,776 12,992 4,816 31,533 17,871 47,556 31,925

Selling, general and administrative 14,733 13,470 29,989 26,873

Research and development 9,897 8,531 19,728 15,655

Income (loss) from operations 6,903 (4,130 ) (2,161 ) (10,603 )

Other income (expense): Interest income 268 193 492 405 Other

(expense) income (192 ) (583 ) (2,581 ) 8 Income (loss) before

income taxes 6,979 (4,520 ) (4,250 ) (10,190 ) Provision (benefit)

for income taxes 2,560 (1,619 ) (1,688 ) (3,680 ) Net Income

(loss) $ 4,419 $ (2,901 ) $ (2,562 ) $ (6,510 ) Earnings

(loss) per share data: Basic $ 0.19 $ (0.13 ) $ (0.11 ) $ (0.29 )

Diluted $ 0.19 $ (0.13 ) $ (0.11 ) $ (0.29 ) Weighted average

shares outstanding: Basic 22,985,956 22,878,410 22,966,513

22,840,465 Diluted 23,148,456 22,878,410 22,966,513 22,840,465

AeroVironment, Inc.

Reconciliation of Earnings (Loss) per

Share (Unaudited)

Three Months Ended Six Months Ended

October 31, November 1, October 31,

November 1, 2015 2014

2015 2014 Earnings (loss) per diluted

share as adjusted $ 0.19 $ (0.12 ) $ (0.05 ) $ (0.30 )

Other-than-temporary impairment loss and loss on sale of stock — —

(0.06 ) — (Decrease) increase in fair value of convertible bond and

related sale of stock — (0.01 ) —

0.01 Earnings (loss) per diluted share as reported $

0.19 $ (0.13 ) $ (0.11 ) $ (0.29 )

AeroVironment, Inc.

Consolidated Balance Sheets

(In thousands except share

data)

October 31,2015 April

30,2015 (Unaudited) Assets Current assets:

Cash and cash equivalents $ 128,032 $ 143,410 Short-term

investments 77,967 85,381 Accounts receivable, net of allowance for

doubtful accounts of $212 at October 31, 2015 and $606 at April 30,

2015 42,746 33,607 Unbilled receivables and retentions 11,798

17,356 Inventories, net 48,336 39,414 Income tax receivable 2,836 —

Deferred income taxes 5,050 5,265 Prepaid expenses and other

current assets 4,555 4,599 Total current assets 321,320 329,032

Long-term investments 37,715 46,769 Property and equipment, net

13,579 13,499 Deferred income taxes 6,725 7,426 Other assets 690

741 Total assets $ 380,029 $ 397,467

Liabilities and

Stockholders’ Equity Current liabilities: Accounts payable $

11,590 $ 19,243 Wages and related accruals 10,503 13,395 Income

taxes payable — 692 Customer advances 3,835 4,235 Other current

liabilities 5,669 9,170 Total current liabilities 31,597 46,735

Deferred rent 1,266 1,381 Liability for uncertain tax positions 439

439 Commitments and contingencies Stockholders’ equity: Preferred

stock, $0.0001 par value: Authorized shares — 10,000,000; none

issued or outstanding — — Common stock, $0.0001 par value:

Authorized shares — 100,000,000 Issued and outstanding shares —

23,318,688 at October 31, 2015 and 23,314,640 at April 30, 2015 2 2

Additional paid-in capital 151,269 148,293 Accumulated other

comprehensive loss (201 ) (1,358 ) Retained earnings 195,657

201,975 Total stockholders’ equity 346,727 348,912 Total

liabilities and stockholders’ equity $ 380,029 $ 397,467

AeroVironment, Inc.

Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

Six Months Ended October 31,2015

November 1,2014 Operating activities Net loss

$ (2,562 ) $ (6,510 ) Adjustments to reconcile net loss to cash

(used in) provided by operating activities: Depreciation and

amortization 2,765 4,303 Impairment of available-for-sale

securities 2,186 — Loss from equity method investments 122 98

Provision for doubtful accounts (231 ) (105 ) Deferred income taxes

215 42 Loss (gain) on sale of equity securities 219 (347 )

Stock-based compensation 2,082 1,745 Foreign currency losses 63 281

Increase in fair value of conversion feature of convertible bonds —

(73 ) Tax benefit from exercise of stock options 196 11 Excess tax

benefit from stock-based compensation — (348 ) Amortization of

held-to-maturity investments 2,146 2,211 Changes in operating

assets and liabilities: Accounts receivable (8,908 ) 748 Unbilled

receivables and retentions 5,558 3,826 Inventories (8,922 ) (1,105

) Income tax receivable (2,887 ) 1,708 Other assets 119 27 Accounts

payable (7,653 ) 5,082 Other liabilities (7,417 ) 764 Net cash

(used in) provided by operating activities (22,909 ) 12,358

Investing activities Acquisitions of property and equipment

(2,804 ) (1,070 ) Equity method investments (186 ) (186 ) Purchases

of held-to-maturity investments (43,072 ) (68,524 ) Redemptions of

held-to-maturity investments 55,847 46,727 Sales of

available-for-sale investments 987 9,038 Net cash provided

by (used in) investing activities 10,772 (14,015 )

Financing

activities Purchase and retirement of common stock (3,756 ) —

Tax withholding payment related to net settlement of equity awards

(29 ) — Excess tax benefit from exercise of stock options — 348

Exercise of stock options 544 679 Net cash (used in)

provided by financing activities (3,241 ) 1,027 Net decrease in

cash and cash equivalents (15,378 ) (630 ) Cash and cash

equivalents at beginning of period 143,410 126,969 Cash and

cash equivalents at end of period $ 128,032 $ 126,339

Supplemental disclosure: Unrealized change in fair value of

investments recorded in other comprehensive income (loss), net of

deferred taxes of $18 and $(397), respectively $ 27 $ 596

Reclassification from share-based liability compensation to equity

$ 228 $ —

AeroVironment, Inc.

Reportable Segment Results are as

Follows (Unaudited):

(In thousands)

Three Months Ended Six Months Ended

October 31, November 1, October 31,

November 1, 2015 2014

2015 2014 Revenue: UAS $ 56,589 $ 43,045 $

96,756 $ 84,231 EES 8,142 9,619 15,025 20,299 Total

64,731 52,664 111,781 104,530 Cost of sales: UAS

28,314 27,575 54,780 58,590 EES 4,884 7,218 9,445

14,015 Total 33,198 34,793 64,225 72,605 Gross

margin: UAS 28,275 15,470 41,976 25,641 EES 3,258 2,401

5,580 6,284 Total 31,533 17,871 47,556 31,925

Selling, general and administrative 14,733 13,470 29,989 26,873

Research and development 9,897 8,531 19,728 15,655

Income (loss) from operations 6,903 (4,130 ) (2,161 ) (10,603 )

Other income (expense): Interest income 268 193 492 405 Other

(expense) income (192 ) (583 ) (2,581 ) 8 Income (loss) before

income taxes $ 6,979 $ (4,520 ) $ (4,250 ) $ (10,190 )

Additional AV News: http://avinc.com/resources/news/AV Media

Gallery: http://avinc.com/media_gallery/Follow us:

www.twitter.com/aerovironmentFacebook:

http://www.facebook.com/#!/pages/AeroVironment-Inc/91762492182

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151208006635/en/

AeroVironment, Inc.Steven Gitlin, +1 (626)

357-9983ir@avinc.com

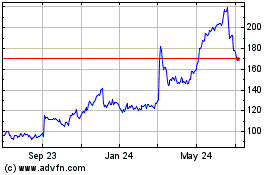

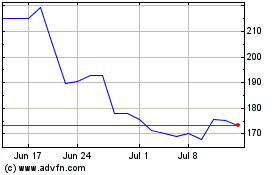

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Apr 2023 to Apr 2024