By Sarah E. Needleman

Activision Blizzard Inc. on Thursday turned in a lackluster

report for the holiday quarter, which included a rare miss on

analyst profit forecasts.

Investors punished the company's stock in return. Shares of

Activision, which had rallied from around $28 a share in price to

near $40 in the final months of last year, tumbled by as much as

18% in after-hours trading on Thursday. In recent trade, the stock

price was down 13.5%.

Activision reported that adjusted profit fell in the fourth

quarter to 83 cents a share from 94 cents a year ago. Analysts had

forecast 86 cents, while the company expected 82 cents.

The company hasn't missed on analyst per-share profit

expectations in about five years, according to Colin Sebastian, an

analyst at R.W. Baird & Co. "This market is unforgiving right

now," he said. "There's an exaggerated reaction to misses because

there's a lot of uncertainty."

Along with the profit miss, Activision announced a delay to the

sequel of a key game, while results slumped at King Digital

Entertainment PLC, the mobile game maker Activision is

acquiring.

The company had expected adjusted revenue in the fourth quarter,

which is the important holiday period, to be flat at $2.15 billion,

since it released a similar holiday slate of games a year earlier,

including a fresh "Call of Duty" installment. Instead, adjusted

revenue fell roughly 4% to $2.12 billion.

Videogame companies, as well as Wall Street, focus on adjusted

results because under U.S. accounting rules, revenue for

online-enabled games is deferred as long as new content is being

added.

Meanwhile, the impact of a strong U.S. dollar trimmed $125

million from revenue and 11 cents a share in profit, Activision

added.

Activision also partly blamed a soft showing from casual games,

such as "Skylanders SuperChargers," for its subpar fourth quarter.

Stores were filled this past Christmas with toys-to-life

competitors, such as an "Infinity" game from Walt Disney Co.

featuring "Star Wars" characters and a new entrant from Lego A/S

called "Dimensions" that included Batman.

Casual players are also shifting to mobile devices, hurting

console games such as "Guitar Hero Live," the company said.

Activision has taken steps to expand beyond its core business of

console gaming, including the $5.9 billion acquisition of King,

which has one of the world's most successful mobile franchises in

"Candy Crush." The deal, which is expected to be completed later

this month, gives Activision a stronger foothold in the

fast-growing mobile-games business. Once completed, Activision said

it would have 500 million monthly active users, up from 80

million.

But Activision faces challenges in growing King beyond its

"Candy Crush" fame. For the fourth quarter, King on Thursday

reported revenue, profit and a user base that were lower than a

year earlier. Spending by players in newer games was increasing,

but not enough to offset a drop in spending on older games,

particularly "Candy Crush Saga," King said.

King, which will continue to operate as an independent unit

under CEO Riccardo Zacconi after the acquisition is final, posted

$478 million in adjusted revenue and per-share profit of 38 cents

for the holiday quarter. That was down from $559 million and 57

cents a share a year ago. Adjusted bookings tumbled 13% to $509

million. Monthly unique payers fell 21% to 6.58 million.

Still, Activision expects a brighter 2016, with adjusted revenue

of $6.25 billion and per-share profit of $1.75, well above the

$4.62 billion in adjusted revenue and $1.32 in per-share profit

earned in 2015.

On a conference call with analysts, Chief Executive Bobby Kotick

reiterated that Activision views itself as a broad entertainment

company. He described its customer base as comparable to that of

major social and entertainment giants such as Facebook Inc., ESPN

and the National Football League.

To illustrate that point, he highlighted the King acquisition

and that of "e-sports" producer and broadcaster Major League Gaming

Inc. He said they were key to growing monthly active users as well

as the number of hours people spend watching the company's

content.

Other company executives on the call also talked up the release

of "Overwatch," a new franchise coming in 2016 that is integral to

the company's e-sports expansion. At the same time, though,

Activision said it was pushing back a sequel to the smash hit

"Destiny" to 2017.

Rising demand for content delivered over the Internet helped

boost digital sales to a high for the holiday period, Activision

said. For example, the company sold nearly double as many digital

downloads of "Call of Duty: Black Ops III" as it did with the

series' prior installment, "Advanced Warfare," released a year

earlier.

Adjusted digital revenue reached a record $780 million,

accounting for a record 37% of total adjusted revenue. Rivals

Electronic Arts Inc. and Take-Two Interactive Software Inc. in

recent days also reported strong digital revenue, a boon for profit

margins.

Under generally accepted accounting principles, Activision

reported fourth-quarter revenue of $1.35 billion and a profit of 21

cents a share, down from $1.58 billion and 49 cents a share a year

earlier.

Write to Sarah E. Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

February 11, 2016 19:36 ET (00:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

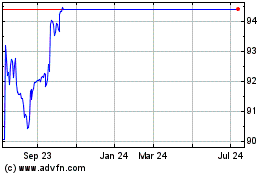

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

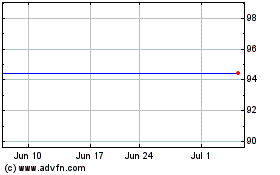

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Apr 2023 to Apr 2024