UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 28, 2015

ATLANTIC TELE-NETWORK, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-12593 |

|

47-0728886 |

|

(State or other |

|

(Commission File Number) |

|

(IRS Employer |

|

jurisdiction of incorporation) |

|

|

|

Identification No.) |

600 Cummings Center

Beverly, MA 01915

(Address of principal executive offices and zip code)

(978) 619-1300

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On October 28, 2015, Atlantic Tele-Network, Inc. (the “Company”) issued a press release announcing financial results for the three and nine months ended September 30, 2015. A copy of the press release is furnished herewith as Exhibit 99.1.

Exhibit 99.1 is furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

|

Item 9.01 |

|

Financial Statements and Exhibits. |

|

|

|

|

|

(d) |

|

Exhibits |

|

|

|

|

|

99.1 |

|

Press Release of the Company, dated October 28, 2015. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ATLANTIC TELE-NETWORK, INC. |

|

|

|

|

|

|

By: |

/s/ Justin D. Benincasa |

|

|

|

Justin D. Benincasa |

|

|

|

Chief Financial Officer |

|

|

|

|

|

Dated: October 28, 2015 |

|

|

3

EXHIBIT INDEX

|

Exhibit

Number |

|

Description of Exhibit |

|

|

|

|

|

99.1 |

|

Press Release of the Company, dated October 28, 2015. |

4

Exhibit 99.1

NEWS RELEASE

|

FOR IMMEDIATE RELEASE |

|

CONTACT: |

|

Michael T. Prior |

|

Wednesday October 28, 2015 |

|

|

|

Chief Executive Officer |

|

|

|

|

|

978-619-1300 |

|

|

|

|

|

|

|

|

|

|

|

Justin D. Benincasa |

|

|

|

|

|

Chief Financial Officer |

|

|

|

|

|

978-619-1300 |

ATN Reports

Third Quarter and Nine Month 2015 Results

—Two Recently-Announced Acquisition Agreements Illustrate ATN’s Opportunity to Consolidate and Strengthen Its Position in Existing Markets—

Third Quarter 2015 Highlights:

· Revenues of $96.8 million

· Adjusted EBITDA(1) of $39.7 million

· Operating income of $22.5 million included $2.5 million of transaction-related costs

· Net income attributable to ATN’s stockholders was $6.6 million, or $0.41 per diluted share

· Cash flow from operating activities for the first nine months of 2015 was $113.1 million

Beverly, MA (October 28, 2015) — ATN (NASDAQ: ATNI), today reported results for the third quarter ended September 30, 2015. Unless otherwise indicated, the discussion of the Company’s results is focused on its continuing operations, and comparisons are to the same period in the prior year.

Third Quarter 2015 Results

“Third quarter results were in line with our overall expectations, reflecting a mix of factors affecting revenues and operating profitability that are consistent with the execution of our strategy,” said Michael Prior, Chief Executive Officer.

Third quarter 2015 revenues were $96.8 million, 8% above the $89.4 million reported for the third quarter of 2014. U.S. wireless business revenues benefited from positive year-on-year comparisons in retail operations and from a significant increase in data traffic across the expanded wholesale network. While lower contracted wholesale rates offset most of the positive revenue impact of volume gains, the Company views this as a value-enhancing strategy to generate steady long-term cash flows and provide an attractive

outsourced network model for its carrier customers. Additionally, year-over-year comparisons benefited from the addition of the solar operations acquired in late 2014.

Adjusted EBITDA(1) for the third quarter was $39.7 million, a 3% decrease over the $41.0 million reported for the 2014 third quarter. Third quarter Adjusted EBITDA(1) results in the U.S. Wireless business reflected increased operating expenses related to expanded network coverage and the multiple technologies utilized to support the growth in traffic volume. The Company also incurred higher operating expenses this quarter in its Guyana operations, where approximately one-half of the increase is related to re-branding, legal and consulting expenses.

Operating income was $22.5 million, down 20% compared to last year’s $28.2 million due to $2.5 million of one-time transaction-related charges, the increased expenses in Guyana and the impact of the U.S. wholesale increased traffic volume and reduced rates in the third quarter of 2015. Net income from continuing operations attributable to ATN’s stockholders was $6.6 million or $0.41 per diluted share, a decrease from the $16.2 million or $1.01 per diluted share reported in last year’s third quarter due in large part to reduced operating income and an increase in the effective tax rate in the third quarter of 2015.

Nine Month 2015 Financial Results

Nine month revenues were $272.5 million, 10% above the $247.8 million reported for the same period in 2014. Adjusted EBITDA(1) was $114.3 million, up 10% from $104.1 million in the prior year period. Operating income was $70.4 million, up 7% compared to last year’s $66.0 million. Net income attributable to ATN’s stockholders was $12.8 million or $0.79 per diluted share compared with $35.5 million or $2.22 per diluted share in the prior year’s period. Net income for the nine months ended September 30, 2015 included a $19.9 million loss related to the deconsolidation of the non-controlling interest from the sale of our holdings in Turks and Caicos. Excluding this one-time loss on deconsolidation, net income attributable to ATN’s stockholders(2) was $32.7 million, or $2.03 per diluted share.

Acquisition Updates

“In October, we announced two strategically important transactions that are aligned with our approach of building out our service offerings in geographies where we see the potential to create long term value.” said Michael Prior, Chief Executive Officer. “With the Innovative acquisition, which we expect to complete in mid-2016 pending regulatory approval, we will significantly increase our footprint in the U.S. Virgin Islands, adding wireline video, broadband and local voice services to our existing mobile services there. Our acquisition of a controlling interest in KeyTech Bermuda pairs our 43% ownership of CellOne with their 42% ownership and adds wireline voice, broadband and video services to our existing mobile services. KeyTech recently received shareholder approval for the transaction and we are now awaiting regulatory approval.

“Once completed, we expect these acquisitions to add approximately $180 - $200 million in annualized revenues and we are targeting normalized Adjusted EBITDA(1) margins of 25% - 30% on a combined basis, inclusive of our existing businesses in those markets.

“In both cases, we are investing in markets and geographies we know well, and where we will have the ability to provide customers with a single connectivity solution for mobile and fixed telecom and media services. After accounting for the cash outlays associated with these agreements, ATN still will have significant cash resources and debt capacity to invest in organic growth projects and to deploy in additional acquisitions, and we are actively reviewing opportunities in both categories,” Mr. Prior noted. “In particular, we are seeing a pickup in opportunities in the renewable energy segment and would like to put additional capital to work there.”

(1) See Table 4 for reconciliation of Net Income to Adjusted EBITDA.

(2) See Table 5 for reconciliation of Net Income Attributable to ATN Stockholders to Net Income Attributable to ATN Stockholders Excluding Loss on Deconsolidation.

Third Quarter 2015 Operating Highlights

U.S. Wireless

U.S. wireless revenues primarily consist of voice and data revenues from the Company’s wholesale roaming operations and the Company’s smaller retail operations. Total revenues from the U.S. wireless business were $47.0 million in the third quarter of 2015, an increase of 6% from the $44.3 million reported in the third quarter of 2014. This increase was mainly driven by an increase in U.S. retail revenues. U.S. wholesale revenues were slightly above prior year levels in the third quarter of 2015 as a result of expanded network and traffic volume offsetting lower wholesale rates, but in this year’s fourth quarter revenues are expected to be significantly below prior year results as the full impact of recent rate reductions is felt. The projected decline in the fourth quarter is partly due to traffic volumes exceeding certain annual pricing tiers which should mean that the associated revenues rebound in the first quarter of 2016. Data revenues accounted for 66% of U.S. wireless revenues in the 2015 third quarter and 68% in the 2014 third quarter. The Company ended the third quarter of 2015 with 799 domestic base stations in service compared to 716 at the end of last year’s third quarter.

International Wireless

International wireless revenues include retail and wholesale voice and data wireless revenues from operations in Bermuda and the Caribbean. International wireless revenues were $20.4 million, a decrease of 5% from the $21.6 million reported in the third quarter of 2014, as a result of the sale of our Turks and Caicos operations in the first quarter of 2015, and lower wholesale roaming revenues in many of our Island properties due to anticipated rate declines. We expect retail revenues to continue to grow but wholesale revenues to decline in our international markets over time.

Wireline

Wireline revenues are generated by the Company’s wireline operations in Guyana, integrated voice and data and wholesale transport operations in New England and New York State, and domestic and international wholesale and retail long-distance voice services. Wireline revenues were $21.8 million, up 1% from $21.5 million in the third quarter of 2014 resulting mainly from increases in broadband revenues in Guyana.

Renewable Energy

Renewable energy revenues are generated principally by the sale of energy and solar renewable energy credits from our 28 commercial solar projects. For the third quarter of 2015, revenues from our renewable energy business were $5.1 million, consistent with past quarters.

Reportable Operating Segments

The Company has five reportable segments: (i) U.S. Wireless; (ii) International Integrated Telephony, which operates in Guyana; (iii) Island Wireless, which generates its revenues and has its assets located in Bermuda and the Caribbean (iv) U.S. Wireline; and (v) Renewable Energy, which provides distributed generation solar power to corporate, utility and municipal customers in the United States. Financial data on our reportable operating segments for the three months ended September 30, 2015 and 2014 are as follows (in thousands):

For the three months ended September 30, 2015:

|

|

|

U.S. Wireless |

|

International

Integrated

Telephony |

|

Island Wireless |

|

U.S. Wireline |

|

Renewable

Energy |

|

Reconciling

Items (3) |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue |

|

$ |

47,679 |

|

$ |

22,537 |

|

$ |

15,368 |

|

$ |

6,146 |

|

$ |

5,052 |

|

$ |

— |

|

$ |

96,782 |

|

|

Adjusted EBITDA |

|

29,730 |

|

5,783 |

|

5,545 |

|

203 |

|

3,934 |

|

(5,545 |

) |

39,650 |

|

|

Operating Income (Loss) |

|

25,208 |

|

1,313 |

|

3,615 |

|

(990 |

) |

2,694 |

|

(9,316 |

) |

22,524 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, 2014:

|

|

|

U.S. Wireless |

|

International

Integrated

Telephony |

|

Island Wireless |

|

U.S. Wireline |

|

Renewable

Energy |

|

Reconciling

Items (3) |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue |

|

$ |

44,736 |

|

$ |

21,831 |

|

$ |

16,627 |

|

$ |

6,199 |

|

n/a |

|

$ |

— |

|

$ |

89,393 |

|

|

Adjusted EBITDA |

|

31,242 |

|

9,462 |

|

4,827 |

|

722 |

|

n/a |

|

(5,280 |

) |

40,973 |

|

|

Operating Income (Loss) |

|

27,585 |

|

5,065 |

|

2,231 |

|

(471 |

) |

n/a |

|

(6,252 |

) |

28,158 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet and Cash Flow Highlights

Cash and cash equivalents at September 30, 2015 were $397.8 million. In addition, the Company holds $5.8 million of restricted cash related to our renewable energy business. Net cash provided by operating activities of continuing operations was $113.1 million for the first nine months of 2015, compared with net cash provided by operating activities of continuing operations of $51.0 million in the first nine months of 2014. The increase in the current year is due to increased net income attributable to ATN’s stockholders(2) excluding the loss on deconsolidation, current year changes in working capital and prior year tax payments. Capital expenditures were $46.0 million for the first nine months of 2015, and the Company expects full year 2015 telecom capital expenditures in the range of $60.0 million to $70.0 million. Capital expenditures in the Renewable Energy segment are more difficult to project, however the Company continues to actively pursue investments in this segment.

Conference Call Information

ATN will host a conference call on Thursday, October 29, 2015 at 9:30 a.m. Eastern Time (ET) to discuss its 2015 third quarter results. The call will be hosted by Michael Prior, President and Chief Executive Officer, and Justin Benincasa, Chief Financial Officer. The dial-in numbers are US/Canada: (877) 734-4582 and International: (678) 905-9376, conference ID 60797803. A replay of the call will be available at ir.atni.com beginning at 1:00 p.m. (ET) on Thursday, October 29, 2015.

About ATN

ATN (Nasdaq:ATNI), headquartered in Beverly, Massachusetts, provides telecommunications services to rural, niche and other under-served markets and geographies in the United States, Bermuda and the Caribbean and owns and operates solar power systems in select locations in the United States. Through our operating subsidiaries, we (i) provide both wireless and wireline connectivity to residential and business customers, including a range of mobile wireless solutions, local exchange services and broadband internet services, (ii) provide distributed solar electric power to corporate, utility and municipal customers and (iii) are the owner and operator of terrestrial and submarine fiber optic transport systems. For more information, please visit www.atni.com.

Cautionary Language Concerning Forward Looking Statements

This press release contains forward-looking statements relating to, among other matters, our future financial performance and results of operations; the competitive environment in our key markets, demand for our services and industry trends; the outcome of regulatory matters; the pace of our network expansion and improvement, including our level of estimated future capital expenditures and our realization of the benefits of these investments; and management’s plans and strategy for the future. These forward-looking statements are based on estimates, projections, beliefs, and assumptions and are not guarantees of future events or results. Actual future events and results could differ materially from the events and results indicated in these statements as a result of many factors, including, among others, (1) the general performance of our operations, including operating margins, revenues, and the future growth and retention of our subscriber base and consumer demand for solar power; (2) government regulation of our businesses, which may impact our FCC and other telecommunications licenses or our renewables business; (3) economic, political and other risks facing our operations; (4) our ability to maintain favorable roaming arrangements; (5) our ability to efficiently and cost-effectively upgrade our networks and IT platforms to address rapid and significant technological changes in the telecommunications industry; (6) the loss of or an inability to recruit skilled personnel in our various jurisdictions, including key members of management; (7) our ability to find investment or acquisition or disposition opportunities that fit our strategic goals for the Company; (8) increased competition; (9) our ability to operate in the renewable energy industry; (10) our reliance on a limited number of key suppliers and vendors for timely supply of equipment and services relating to our network infrastructure; (11) the adequacy and expansion capabilities of our network capacity and customer service system to support our customer growth; (12) the occurrence of weather events and natural catastrophes; (13) our continued access to capital and credit markets; (14) our ability to realize the value that we believe exists in our businesses; and (15) our ability to receive requisite regulatory consents and approvals and satisfy other conditions needed to complete our proposed acquisitions. These and other additional factors that may cause actual future events and results to differ materially from the events and results indicated in the forward-looking statements above are set forth more fully under Item 1A “Risk Factors” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on March 16, 2015 and the other reports we file from time to time with the SEC. The Company undertakes no obligation and has no intention to update these forward-looking statements to reflect actual results, changes in assumptions or changes in other factors that may affect such forward-looking statements.

Use of Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with generally accepted accounting principles (GAAP), this news release also contains non-GAAP financial measures. Specifically, ATN has presented an Adjusted EBITDA measure and a net income measure exclusive of the results of loss on the deconsolidation of subsidiaries. Adjusted EBITDA is defined as net income attributable to ATN stockholders before income from discontinued operations, gain on disposal of discontinued operations, interest, taxes, depreciation and amortization, transaction-related charges, other income or expense, and net income attributable to non-controlling interests. Net income attributable to ATN stockholders excluding loss on deconsolidation of subsidiary and the related earnings per diluted share is defined as net income

attributable to ATN stockholders less the loss and tax impact of the deconsolidation of the subsidiary. The Company believes that the inclusion of these non-GAAP financial measures helps investors gain a meaningful understanding of the Company’s core operating results and enhances comparing such performance with prior periods. ATN’s management uses these non-GAAP measures, in addition to GAAP financial measures, as the basis for measuring our core operating performance and comparing such performance to that of prior periods. The non-GAAP financial measures included in this news release are not meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP. Reconciliations of these non-GAAP financial measures used in this news release to the most directly comparable GAAP financial measure is set forth in the text of, and the accompanying tables to, this press release.

Table 1

ATLANTIC TELE-NETWORK, INC.

Unaudited Condensed Consolidated Balance Sheets

(in Thousands)

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

397,797 |

|

$ |

326,216 |

|

|

Restricted cash |

|

797 |

|

39,703 |

|

|

Assets of discontinued operations |

|

44 |

|

175 |

|

|

Other current assets |

|

79,958 |

|

85,280 |

|

|

|

|

|

|

|

|

|

Total current assets |

|

478,596 |

|

451,374 |

|

|

|

|

|

|

|

|

|

Long-term restricted cash |

|

5,013 |

|

5,475 |

|

|

Property, plant and equipment, net |

|

366,015 |

|

369,582 |

|

|

Goodwill and other intangible assets, net |

|

90,277 |

|

91,080 |

|

|

Other assets |

|

6,557 |

|

7,519 |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

946,458 |

|

$ |

925,030 |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity: |

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

6,254 |

|

$ |

6,083 |

|

|

Liabilities of discontinued operations |

|

1,293 |

|

1,247 |

|

|

Other current liabilities |

|

81,040 |

|

96,739 |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

88,587 |

|

104,069 |

|

|

|

|

|

|

|

|

|

Long-term debt, net of current portion |

|

$ |

28,141 |

|

$ |

32,794 |

|

|

Deferred income taxes |

|

37,694 |

|

30,366 |

|

|

Other long-term liabilities |

|

28,738 |

|

19,619 |

|

|

|

|

|

|

|

|

|

Total long-term liabilities |

|

94,573 |

|

82,779 |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

183,160 |

|

186,848 |

|

|

|

|

|

|

|

|

|

Total Atlantic Tele-Network, Inc.’s stockholders’ equity |

|

679,516 |

|

677,222 |

|

|

Non-controlling interests |

|

83,782 |

|

60,960 |

|

|

|

|

|

|

|

|

|

Total equity |

|

763,298 |

|

738,182 |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

946,458 |

|

$ |

925,030 |

|

Table 2

ATLANTIC TELE-NETWORK, INC.

Unaudited Condensed Consolidated Statements of Operations

(in Thousands, Except per Share Data)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

U.S. wireless |

|

$ |

47,047 |

|

$ |

44,306 |

|

$ |

122,993 |

|

$ |

110,153 |

|

|

International wireless |

|

20,392 |

|

21,557 |

|

61,787 |

|

67,127 |

|

|

Wireline |

|

21,815 |

|

21,531 |

|

64,497 |

|

64,344 |

|

|

Renewable energy |

|

5,052 |

|

— |

|

15,631 |

|

— |

|

|

Equipment and other |

|

2,476 |

|

1,999 |

|

7,545 |

|

6,212 |

|

|

Total revenue |

|

96,782 |

|

89,393 |

|

272,453 |

|

247,836 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Termination and access fees |

|

21,343 |

|

19,321 |

|

60,827 |

|

58,188 |

|

|

Engineering and operations |

|

10,631 |

|

7,525 |

|

26,218 |

|

21,508 |

|

|

Sales, marketing and customer service |

|

5,797 |

|

5,827 |

|

16,315 |

|

16,499 |

|

|

Equipment expense |

|

3,431 |

|

2,924 |

|

10,093 |

|

8,938 |

|

|

General and administrative |

|

15,930 |

|

12,823 |

|

44,743 |

|

38,596 |

|

|

Transaction-related charges |

|

2,536 |

|

(27 |

) |

2,852 |

|

341 |

|

|

Depreciation and amortization |

|

14,590 |

|

12,842 |

|

43,813 |

|

37,752 |

|

|

Gain on disposition of long-lived assets |

|

— |

|

— |

|

(2,823 |

) |

— |

|

|

Total operating expenses |

|

74,258 |

|

61,235 |

|

202,038 |

|

181,822 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

22,524 |

|

28,158 |

|

70,415 |

|

66,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(795 |

) |

(13 |

) |

(2,153 |

) |

(220 |

) |

|

Loss on deconsolidation of subsidiary |

|

— |

|

— |

|

(19,937 |

) |

— |

|

|

Other income (expense) |

|

53 |

|

338 |

|

114 |

|

302 |

|

|

Other income (expense), net |

|

(742 |

) |

325 |

|

(21,976 |

) |

82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations before income taxes |

|

21,782 |

|

28,483 |

|

48,439 |

|

66,096 |

|

|

Income tax expense |

|

10,134 |

|

9,569 |

|

22,655 |

|

22,460 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations |

|

11,648 |

|

18,914 |

|

25,784 |

|

43,636 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from discontinued operations, net of tax |

|

— |

|

— |

|

390 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

11,648 |

|

18,914 |

|

26,174 |

|

43,636 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to non-controlling interests, net of tax: |

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

(5,072 |

) |

(2,747 |

) |

(13,417 |

) |

(8,116 |

) |

|

Discontinued operations |

|

— |

|

— |

|

— |

|

— |

|

|

Net income attributable to non-controlling interests, net |

|

(5,072 |

) |

(2,747 |

) |

(13,417 |

) |

(8,116 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders |

|

$ |

6,576 |

|

$ |

16,167 |

|

$ |

12,757 |

|

$ |

35,520 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per weighted average share attributable to Atlantic Tele-Network, Inc. stockholders: |

|

|

|

|

|

|

|

|

|

|

Income from continuing operations |

|

$ |

0.41 |

|

$ |

1.02 |

|

$ |

0.77 |

|

$ |

2.24 |

|

|

Income from discontinued operations |

|

— |

|

— |

|

0.02 |

|

— |

|

|

Net income |

|

$ |

0.41 |

|

$ |

1.02 |

|

$ |

0.79 |

|

$ |

2.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net income per weighted average share attributable to Atlantic Tele-Network, Inc. stockholders: |

|

|

|

|

|

|

|

|

|

|

Income from continuing operations |

|

$ |

0.41 |

|

$ |

1.01 |

|

$ |

0.77 |

|

$ |

2.22 |

|

|

Income from discontinued operations |

|

— |

|

— |

|

0.02 |

|

— |

|

|

Net income |

|

$ |

0.41 |

|

$ |

1.01 |

|

$ |

0.79 |

|

$ |

2.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

16,049 |

|

15,923 |

|

16,009 |

|

15,890 |

|

|

Diluted |

|

16,165 |

|

16,030 |

|

16,128 |

|

16,001 |

|

Table 3

ATLANTIC TELE-NETWORK, INC.

Unaudited Condensed Consolidated Cash Flow Statement

(in Thousands)

|

|

|

Nine Months Ended September 30, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

26,174 |

|

$ |

43,636 |

|

|

Income from discontinued operations |

|

(390 |

) |

— |

|

|

Depreciation and amortization |

|

43,813 |

|

37,752 |

|

|

Loss on deconsolidation of subsidiary |

|

19,937 |

|

— |

|

|

Gain on disposition of long-lived assets |

|

(2,823 |

) |

— |

|

|

Change in prepaid and accrued taxes |

|

27,684 |

|

(18,401 |

) |

|

Change in other operating assets and liabilities |

|

(6,817 |

) |

(12,092 |

) |

|

Other non-cash activity |

|

4,967 |

|

4,766 |

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities of continuing operations |

|

112,545 |

|

55,661 |

|

|

Net cash provided by (used in) operating activities of discontinued operations |

|

566 |

|

(4,612 |

) |

|

Net cash provided by operating activities |

|

113,111 |

|

51,049 |

|

|

|

|

|

|

|

|

|

Capital expenditures, net |

|

(46,031 |

) |

(41,699 |

) |

|

Acquisition of business |

|

(11,968 |

) |

— |

|

|

Net proceeds from sale of assets |

|

5,873 |

|

1,371 |

|

|

Change in restricted cash |

|

39,368 |

|

38,707 |

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

(12,758 |

) |

(1,621 |

) |

|

|

|

|

|

|

|

|

Dividends paid on common stock |

|

(13,920 |

) |

(12,873 |

) |

|

Distributions to non-controlling interests |

|

(11,363 |

) |

(7,931 |

) |

|

Other |

|

(3,489 |

) |

(805 |

) |

|

|

|

|

|

|

|

|

Net cash used in financing activities |

|

(28,772 |

) |

(21,609 |

) |

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

71,581 |

|

27,819 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, beginning of period |

|

326,216 |

|

356,607 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, end of period |

|

$ |

397,797 |

|

$ |

384,426 |

|

Table 4

ATLANTIC TELE-NETWORK, INC.

Reconciliation of Non-GAAP Measures

(In Thousands)

Reconciliation of Net Income to Adjusted EBITDA for the Three Months Ended September 30, 2014 and 2015

Three Months Ended September 30, 2014

|

|

|

U.S Wireless |

|

International

Integrated

Telephony |

|

Island

Wireless |

|

U.S. Wireline |

|

Renewable

Energy |

|

Reconciling

Items |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

16,167 |

|

|

Net income attributable to non-controlling interests, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

2,747 |

|

|

Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

9,569 |

|

|

Other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

(338 |

) |

|

Interest expense, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

Operating income (loss) |

|

$ |

27,585 |

|

$ |

5,065 |

|

$ |

2,231 |

|

$ |

(471 |

) |

$ |

— |

|

$ |

(6,252 |

) |

$ |

28,158 |

|

|

Depreciation and amortization |

|

3,657 |

|

4,397 |

|

2,596 |

|

1,193 |

|

— |

|

999 |

|

12,842 |

|

|

Transaction-related charges |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(27 |

) |

(27 |

) |

|

Adjusted EBITDA |

|

$ |

31,242 |

|

$ |

9,462 |

|

$ |

4,827 |

|

$ |

722 |

|

$ |

— |

|

$ |

(5,280 |

) |

$ |

40,973 |

|

Three Months Ended September 30, 2015

|

|

|

U.S Wireless |

|

International

Integrated

Telephony |

|

Island

Wireless |

|

U.S. Wireline |

|

Renewable

Energy |

|

Reconciling

Items |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

6,576 |

|

|

Net income attributable to non-controlling interests, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

5,072 |

|

|

Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

10,134 |

|

|

Other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

(53 |

) |

|

Interest expense, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

795 |

|

|

Operating income (loss) |

|

$ |

25,208 |

|

$ |

1,313 |

|

$ |

3,615 |

|

$ |

(990 |

) |

$ |

2,694 |

|

$ |

(9,316 |

) |

$ |

22,524 |

|

|

Depreciation and amortization |

|

4,522 |

|

4,470 |

|

1,930 |

|

1,193 |

|

1,205 |

|

1,270 |

|

14,590 |

|

|

Transaction-related charges |

|

— |

|

— |

|

— |

|

— |

|

35 |

|

2,501 |

|

2,536 |

|

|

Adjusted EBITDA |

|

$ |

29,730 |

|

$ |

5,783 |

|

$ |

5,545 |

|

$ |

203 |

|

$ |

3,934 |

|

$ |

(5,545 |

) |

$ |

39,650 |

|

Reconciliation of Net Income to Adjusted EBITDA for the Nine Months Ended September 30, 2014 and 2015

Nine Months Ended September 30, 2014

|

|

|

U.S Wireless |

|

International

Integrated

Telephony |

|

Island

Wireless |

|

U.S. Wireline |

|

Renewable

Energy |

|

Reconciling

Items |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

35,520 |

|

|

Net income attributable to non-controlling interests, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

8,116 |

|

|

Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

22,460 |

|

|

Other expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

(302 |

) |

|

Interest expense, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

220 |

|

|

Operating income (loss) |

|

$ |

63,826 |

|

$ |

15,293 |

|

$ |

8,210 |

|

$ |

(2,511 |

) |

$ |

— |

|

$ |

(18,804 |

) |

$ |

66,014 |

|

|

Depreciation and amortization |

|

10,413 |

|

13,111 |

|

7,810 |

|

3,519 |

|

— |

|

2,899 |

|

37,752 |

|

|

Transaction-related charges |

|

— |

|

— |

|

— |

|

— |

|

— |

|

341 |

|

341 |

|

|

Adjusted EBITDA |

|

$ |

74,239 |

|

$ |

28,404 |

|

$ |

16,020 |

|

$ |

1,008 |

|

$ |

— |

|

$ |

(15,564 |

) |

$ |

104,107 |

|

Nine Months Ended September 30, 2015

|

|

|

U.S Wireless |

|

International

Integrated

Telephony |

|

Island

Wireless |

|

U.S. Wireline |

|

Renewable

Energy |

|

Reconciling

Items |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

12,757 |

|

|

Net income attributable to non-controlling interests, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

13,417 |

|

|

Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

22,655 |

|

|

Other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

(114 |

) |

|

Income from discontinued operations net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

(390 |

) |

|

Loss on deconsolidation of subsidiary |

|

|

|

|

|

|

|

|

|

|

|

|

|

19,937 |

|

|

Interest expense, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

2,153 |

|

|

Operating income (loss) |

|

$ |

67,160 |

|

$ |

11,545 |

|

$ |

9,902 |

|

$ |

(3,046 |

) |

$ |

8,037 |

|

$ |

(23,183 |

) |

$ |

70,415 |

|

|

Depreciation and amortization |

|

13,175 |

|

13,249 |

|

6,461 |

|

3,699 |

|

3,613 |

|

3,616 |

|

43,813 |

|

|

Gain on disposition of long lived asset |

|

(2,823 |

) |

— |

|

— |

|

— |

|

— |

|

— |

|

(2,823 |

) |

|

Transaction-related charges |

|

— |

|

— |

|

— |

|

— |

|

97 |

|

2,755 |

|

2,852 |

|

|

Adjusted EBITDA |

|

$ |

77,512 |

|

$ |

24,794 |

|

$ |

16,363 |

|

$ |

653 |

|

$ |

11,747 |

|

$ |

(16,812 |

) |

$ |

114,257 |

|

Table 5

ATLANTIC TELE-NETWORK, INC.

Reconciliation of Non-GAAP Measures

(In Thousands)

Reconciliation of Net Income Attributable to Atlantic Tele-Network, Inc Stockholders and Earnings Per Share to Net Income Attributable to Atlantic Tele-Network, Inc Stockholders Excluding Loss on Deconsolidation of Subsidiary and Diluted Earnings Per Share for the Three Months Ended September 30, 2014 and 2015

Three Months Ended September 30, 2014

|

|

|

Total |

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders |

|

$ |

16,167 |

|

|

|

|

|

|

|

Adjustments: None |

|

— |

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders excluding loss on deconsolidation of subsidiary |

|

$ |

16,167 |

|

|

|

|

|

|

|

Diluted net income per weighted average share attributable to Atlantic Tele-Network, Inc. stockholder |

|

$ |

1.01 |

|

|

|

|

|

|

|

Adjustments: None |

|

— |

|

|

|

|

|

|

|

Diluted net income per weighted average share attributable to Atlantic Tele-Network, Inc. stockholder excluding loss on deconsolidation of subsidiary |

|

$ |

1.01 |

|

Three Months Ended September 30, 2015

|

|

|

Total |

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders |

|

$ |

6,576 |

|

|

|

|

|

|

|

Adjustments: None |

|

— |

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders excluding loss on deconsolidation of subsidiary, net of tax |

|

$ |

6,576 |

|

|

|

|

|

|

|

Diluted net income per weighted average share attributable to Atlantic Tele-Network, Inc. stockholder |

|

$ |

0.41 |

|

|

|

|

|

|

|

Adjustments: None |

|

— |

|

|

|

|

|

|

|

Diluted net income per weighted average share attributable to Atlantic Tele-Network, Inc. stockholder excluding loss on deconsolidation of subsidiary |

|

$ |

0.41 |

|

ATLANTIC TELE-NETWORK, INC.

Reconciliation of Non-GAAP Measures

(In Thousands)

Reconciliation of Net Income Attributable to Atlantic Tele-Network, Inc Stockholders and Earnings Per Share to Net Income Attributable to Atlantic Tele-Network, Inc Stockholders Excluding Loss on Deconsolidation of Subsidiary and Diluted Earnings Per Share for the Nine Months Ended September 30, 2014 and 2015

Nine Months Ended September 30, 2014

|

|

|

Total |

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders |

|

$ |

35,520 |

|

|

|

|

|

|

|

Adjustments: None |

|

— |

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders excluding loss on deconsolidation of subsidiary |

|

$ |

35,520 |

|

|

|

|

|

|

|

Diluted net income per weighted average share attributable to Atlantic Tele-Network, Inc. stockholder |

|

$ |

2.22 |

|

|

|

|

|

|

|

Adjustments: None |

|

— |

|

|

|

|

|

|

|

Diluted net income per weighted average share attributable to Atlantic Tele-Network, Inc. stockholder excluding loss on deconsolidation of subsidiary |

|

$ |

2.22 |

|

Nine Months Ended September 30, 2015

|

|

|

Total |

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders |

|

$ |

12,757 |

|

|

|

|

|

|

|

Loss on deconsolidation of subsidiary |

|

19,937 |

|

|

Income tax expense adjustment |

|

— |

|

|

|

|

|

|

|

Net income attributable to Atlantic Tele-Network, Inc. stockholders excluding loss on deconsolidation of subsidiary, net of tax |

|

$ |

32,694 |

|

|

|

|

|

|

|

Diluted net income per weighted average share attributable to Atlantic Tele-Network, Inc. stockholder |

|

$ |

0.79 |

|

|

|

|

|

|

|

Adjustment for loss on deconsolidation |

|

1.24 |

|

|

|

|

|

|

|

Diluted net income per weighted average share attributable to Atlantic Tele-Network, Inc. stockholder excluding loss on deconsolidation of subsidiary |

|

$ |

2.03 |

|

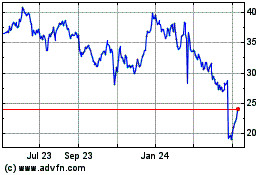

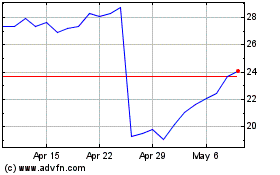

ATN (NASDAQ:ATNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

ATN (NASDAQ:ATNI)

Historical Stock Chart

From Apr 2023 to Apr 2024