ATN to Acquire Controlling Interest in KeyTech Bermuda

October 06 2015 - 7:54AM

ATN (NASDAQ:ATNI) announced today that it has entered into an

agreement with KeyTech Limited (BSX:KEY.BH) to acquire a

controlling interest in KeyTech as part of a proposed business

combination of KeyTech with Bermuda Digital Communications Limited.

The proposed transaction will combine Bermuda Digital

Communications, a leading mobile provider in Bermuda doing business

under the “CellOne” name, with KeyTech, a Bermuda company that

provides voice, broadband, and cable television services under the

“Logic” name in Bermuda and the Cayman Islands. ATN and KeyTech

together currently own approximately 85% of CellOne. As part of the

proposed transaction, ATN will contribute its current ownership

interest of approximately 43% in CellOne and approximately $42

million in cash in exchange for a 51% stake in KeyTech. Following

the contribution, CellOne will be merged with and into a company

within the KeyTech group and the approximate 15% interest in

CellOne held, in the aggregate, by the minority shareholders will

be converted into the right to receive, in the aggregate,

approximately 8.9% of the common shares in KeyTech. A portion of

the cash proceeds that KeyTech will receive upon closing will be

used to fund a one-time special dividend to KeyTech’s existing

shareholders and to retire KeyTech’s subordinated debt. ATN expects

the proposed transaction to be accretive to its net income

beginning in the first full quarter following closing.

The combined business will offer a compelling

suite of telecom and video services that will provide a superior

customer experience to residential and commercial subscribers.

Additionally, the proposed transaction will serve as an entry point

for ATN to the growing Cayman Islands market, where it will be

offering a similar array of services.

“This transaction is consistent with our

strategy of building out our services in key geographies where we

see the opportunity to create long term value,” said Michael Prior,

ATN’s Chief Executive Officer. “We were the primary investors

behind the local Bermudian launch of independent wireless

operations in Bermuda in 1998 and merged them with KeyTech’s

wireless business in 2011, creating a very successful, locally-run

company known for its commitment to customer satisfaction and

technology leadership. The combined business will have the

resources to continue to support investments to extend and upgrade

the communications infrastructure of Bermuda and the Cayman

Islands. Efficiencies gained through our four year partnership with

KeyTech in Bermuda have enabled us to offer best in class mobile

services and competitive pricing. In bringing together these two

businesses, we expect to gain additional efficiencies by leveraging

our performance in the wireless market with KeyTech’s local

wireline expertise.”

ATN currently consolidates the operations of

CellOne and, upon closing of the proposed transaction, will

consolidate the results of the combined business in its financial

statements. The KeyTech operations are currently expected to

contribute incremental annual revenue of between $80-90 million.

Following the transaction, KeyTech is expected to have

approximately $37 million of remaining debt that will be

consolidated on ATN’s balance sheet.

As recent KeyTech financial results include

consolidation and restructuring initiatives undertaken over the

last year, ATN does not believe such results are representative of

future financial performance. ATN expects to provide additional

information with respect to the accretive impact of the proposed

transaction on ATN’s operating margins and future consolidated

operating results at the time that it reports its third quarter

2015 results.

“This marks the second transaction that we have

announced this month, illustrating the potential to consolidate and

strengthen our position in existing markets and to provide

customers with a single connectivity solution for mobile and fixed

telecom and media services,” said Michael Prior.

The proposed transaction is subject to customary closing terms

and conditions, including, among others, the affirmative vote by

KeyTech’s shareholders, the receipt of approval from the Bermuda

Regulatory Authority, the Federal Communications Commission, and

the Information and Communications Technology Authority of the

Cayman Islands and the consent of the Bermuda Stock Exchange to

certain transaction matters. ATN currently expects to complete the

proposed transaction in the first quarter of 2016.

BofA Merrill Lynch served as financial advisor to ATN, and

Wakefield Quin Limited and Cleary Gottlieb Steen & Hamilton LLP

are acting as legal counsel.

About ATN

Atlantic Tele-Network, Inc. (Nasdaq:ATNI),

headquartered in Beverly, Massachusetts, provides

telecommunications services to rural, niche and other under-served

markets and geographies in the United

States, Bermuda and the Caribbean and owns and

operates solar power systems in select locations

in the United States. Through our operating subsidiaries,

we (i) provide both wireless and wireline connectivity to

residential and business customers, including a range of mobile

wireless solutions, local exchange services and broadband internet

services, (ii) provide distributed solar electric power to

corporate, utility and municipal customers and (iii) are the owner

and operator of terrestrial and submarine fiber optic transport

systems. For more information, please visit www.atni.com.

Cautionary Language Concerning Forward Looking

Statements

This press release contains forward-looking

statements relating to, among other matters, our future financial

performance and results of operations; the competitive environment

in our key markets, demand for our services and industry trends;

the outcome of regulatory matters; the pace of our network

expansion and improvement, including our level of estimated future

capital expenditures and our realization of the benefits of these

investments; and management's plans and strategy for the future.

These forward-looking statements are based on estimates,

projections, beliefs, and assumptions and are not guarantees of

future events or results. Actual future events and results

could differ materially from the events and results indicated in

these statements as a result of many factors, including, among

others, (i) our ability to receive the requisite regulatory

consents and approvals to consummate the transaction; (ii) the

satisfaction of the other conditions to completion of the

transaction; (iii) the performance of the acquired business;

(iv) our ability to operate in a new industry; (v) our ability to

integrate the new business into our current operations; (vi)

increased competition; (vii) changes in laws and government

regulations affecting the acquired business; and the risk factors

set forth in our Annual Report on Form 10-K for the year

ended December 31, 2014, filed with the SEC on March

16, 2015 and the other reports we file from time to time with

the SEC. The information set forth in this news release speaks

only as of the date hereof, and ATN disclaims any intention or

obligation to update any forward-looking statements as a result of

developments occurring after the date of this news release.

CONTACT:

Michael T. Prior

Chief Executive Officer

978-619-1300

Justin D. Benincasa

Chief Financial Officer

978-619-1300

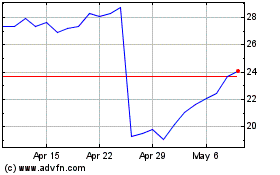

ATN (NASDAQ:ATNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

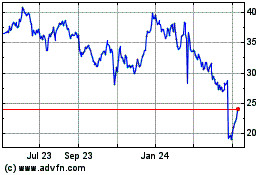

ATN (NASDAQ:ATNI)

Historical Stock Chart

From Apr 2023 to Apr 2024