UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 6, 2015

ALLIANCE RESOURCE PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation or organization) |

|

Commission

File No.: 0-26823 |

|

73-1564280

(IRS Employer

Identification No.) |

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119

(Address of principal executive offices and zip code)

(918) 295-7600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01 REGULATION FD DISCLOSURE.

Alliance Resource Partners, L.P. (ARLP) announced that in response to continued uncertainty in the coal markets, it has taken several actions to reduce production at its higher-cost mines in order to focus on maximizing production at its lower-cost mines.

· Beginning last Friday, October 30, 2015, ARLP’s subsidiary, Hopkins County Coal, LLC, reduced production from three units to two units at its Elk Creek mine, which remains slated to cease production in the first quarter of 2016. This action did not result in any job loss as a result of employment opportunities at other ARLP operations.

· On November 6, 2015, ARLP’s subsidiary, Gibson County Coal, LLC, issued Worker Adjustment and Retraining Notification (WARN) Act notices to approximately 120 of its employees in anticipation of eliminating a total of one and a half production units at its Gibson North and Gibson South mines.

· On November 6, 2015, ARLP’s subsidiary, Sebree Mining, LLC, issued WARN Act notices to all employees at the Onton mine, and stopped coal production at the mine. As a result of employment opportunities at other ARLP operations, this reduction in force is expected to affect approximately 140 employees.

The Onton # 9 Mine has generated 2015 year-to-date coal sales and production volumes of approximately 1,861,000 tons and 1,869,000 tons, respectively. Gibson North has generated 2015 year-to-date coal sales and production volumes of approximately 1,939,000 tons and 1,983,000 tons, respectively. The Elk Creek Mine has generated 2015 year-to-date coal sales and production volumes of approximately 2,537,000 tons and 2,648,000 tons, respectively.

A copy of the Partnership’s press release is attached hereto as Exhibit 99.1.

The information furnished in this Item 7.01 including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent specifically referenced in any such filings.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

|

99.1 |

Alliance Resource Partners, L.P. press release dated as of November 6, 2015. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

Alliance Resource Partners, L.P. |

|

|

|

|

|

|

By: |

Alliance Resource Management GP, LLC, |

|

|

|

its managing general partner |

|

|

|

|

|

|

By: |

/s/ Joseph W. Craft III |

|

|

|

Joseph W. Craft III |

|

|

|

President and Chief Executive Officer |

|

Date: November 6, 2015

3

Exhibit 99.1

PRESS RELEASE

|

|

|

CONTACT: |

|

|

Brian L. Cantrell |

|

|

Alliance Resource Partners, L.P. |

|

|

1717 South Boulder Avenue, Suite 400 |

|

|

Tulsa, Oklahoma 74119 |

|

|

(918) 295-7673 |

|

FOR IMMEDIATE RELEASE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLIANCE RESOURCE PARTNERS, L.P.

Announces Production Adjustments; Issuance of WARN Act Notices at Its Sebree and Gibson Complexes

TULSA, OKLAHOMA, November 6, 2015 — Alliance Resource Partners, L.P. (NASDAQ: ARLP) announced today that in response to continued uncertainty in the coal markets, it has taken several actions to reduce production at its higher-cost mines in order to focus on maximizing production at its lower-cost mines.

· Beginning last Friday, October 30, 2015, ARLP’s subsidiary, Hopkins County Coal, LLC, reduced production from three units to two units at its Elk Creek mine, which remains slated to cease production in the first quarter of 2016. This action did not result in any job loss as a result of employment opportunities at other ARLP operations.

· On November 6, 2015, ARLP’s subsidiary, Gibson County Coal, LLC, issued Worker Adjustment and Retraining Notification (WARN) Act notices to approximately 120 of its employees in anticipation of eliminating a total of one and a half production units at its Gibson North and Gibson South mines. By December 31, 2015, ARLP currently expects production at the Gibson South mine to be increased to four production units with the Gibson North mine idled.

· On November 6, 2015, ARLP’s subsidiary, Sebree Mining, LLC, issued WARN Act notices to all employees at the Onton mine, and stopped coal production at the mine. As a result of employment opportunities at other ARLP operations, this reduction in force is expected to affect approximately 140 employees.

“Unfortunately, prolonged weak market conditions made this production response necessary,” said Joseph W. Craft III, President and Chief Executive Officer. “We deeply regret the impact of these decisions on our employees, their families and their communities. While we were hopeful that conditions would improve, an oversupplied market combined with weak pricing forced us to take these actions and shift production to our lowest-cost mines. These steps are consistent with our current projected production and sales volumes for 2015 and beyond.”

The Onton #9 Mine has generated 2015 year-to-date coal sales and production volumes of approximately 1,861,000 tons and 1,869,000 tons, respectively. Gibson North has generated 2015 year-to-date coal sales and production volumes of approximately 1,939,000 tons and 1,983,000 tons, respectively. The Elk Creek Mine has generated 2015 year-to-date coal sales and production volumes of approximately 2,537,000 tons and 2,648,000 tons, respectively.

Some of the coal production from the reductions at Onton, Gibson North, and Elk Creek will be replaced by increased production at ARLP’s lower-cost mines. ARLP confirms its previously announced earnings guidance provided in its October 27, 2015 Press Release and Conference Call, including 2015 full-year ranges for coal production of 41.1 to 41.7 million tons and coal sales volumes of 40.9 to 41.5 million tons and 2016 full-year ranges for coal production and sales volumes of 40.0 to 45.0 million tons.

-MORE-

About Alliance Resource Partners, L.P.

ARLP is a diversified producer and marketer of coal to major United States utilities and industrial users. ARLP, the nation’s first publicly traded master limited partnership involved in the production and marketing of coal, is currently the third largest coal producer in the eastern United States with mining operations in the Illinois Basin and Appalachian coal producing regions.

ARLP currently operates eleven mining complexes in Illinois, Indiana, Kentucky, Maryland and West Virginia. ARLP also operates a coal loading terminal on the Ohio River at Mount Vernon, Indiana.

News, unit prices and additional information about ARLP, including filings with the Securities and Exchange Commission, are available at http://www.arlp.com. For more information, contact the investor relations department of Alliance Resource Partners, L.P. at (918) 295-7674 or via e-mail at investorrelations@arlp.com.

***

The statements and projections used throughout this release are based on current expectations. These statements and projections are forward-looking, and actual results may differ materially. At the end of this release, we have included more information regarding business risks that could affect our results.

FORWARD-LOOKING STATEMENTS: With the exception of historical matters, any matters discussed in this press release are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. These risks, uncertainties and contingencies include, but are not limited to, the following: changes in competition in coal markets and our ability to respond to such changes; changes in coal prices, which could affect our operating results and cash flows; risks associated with the expansion of our operations and properties; legislation, regulations, and court decisions and interpretations thereof, including those relating to the environment, mining, miner health and safety and health care; deregulation of the electric utility industry or the effects of any adverse change in the coal industry, electric utility industry, or general economic conditions; dependence on significant customer contracts, including renewing customer contracts upon expiration of existing contracts; changing global economic conditions or in industries in which our customers operate; liquidity constraints, including those resulting from any future unavailability of financing; customer bankruptcies, cancellations or breaches to existing contracts, or other failures to perform; customer delays, failure to take coal under contracts or defaults in making payments; adjustments made in price, volume or terms to existing coal supply agreements; fluctuations in coal demand, prices and availability; our productivity levels and margins earned on our coal sales; changes in raw material costs; changes in the availability of skilled labor; our ability to maintain satisfactory relations with our employees; increases in labor costs, adverse changes in work rules, or cash payments or projections associated with post-mine reclamation and workers’ compensation claims; increases in transportation costs and risk of transportation delays or interruptions; operational interruptions due to geologic, permitting, labor, weather-related or other factors; risks associated with major mine-related accidents, such as mine fires, or interruptions; results of litigation, including claims not yet asserted; difficulty maintaining our surety bonds for mine reclamation as well as workers’ compensation and black lung benefits; difficulty in making accurate assumptions and projections regarding pension, black lung benefits and other post-retirement benefit liabilities; the coal industry’s share of electricity generation, including as a result of environmental concerns related to coal mining and combustion and the cost and perceived benefits of other sources of electricity, such as natural gas, nuclear energy and renewable fuels; uncertainties in estimating and replacing our coal reserves; a loss or reduction of benefits from certain tax deductions and credits; difficulty obtaining commercial property insurance, and risks associated with our participation (excluding any applicable deductible) in the commercial insurance property program; and difficulty in making accurate assumptions and projections regarding future revenues and costs associated with equity investments in companies we do not control.

Additional information concerning these and other factors can be found in ARLP’s public periodic filings with the Securities and Exchange Commission (“SEC”), including ARLP’s Annual Report on Form 10-K for the year ended December 31, 2014, filed on February 27, 2015 and ARLP’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015, filed on May 8, 2015 and August 6, 2015, respectively, with the SEC. Except as required by applicable securities laws, ARLP does not intend to update its forward-looking statements.

-END-

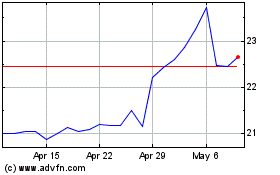

Alliance Resource Partners (NASDAQ:ARLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

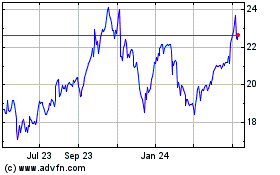

Alliance Resource Partners (NASDAQ:ARLP)

Historical Stock Chart

From Apr 2023 to Apr 2024