Massey Director Defends Board's Oversight Of Coal Company

April 29 2010 - 5:24PM

Dow Jones News

Massey Energy Co.'s (MEE) lead independent director defended the

board's oversight of the coal company, fending off criticism that

the board failed to police management's handling of safety issues

in the period before a deadly explosion this month.

Retired Adm. Bobby R. Inman wrote in an April 28 letter to a

group of public pension funds that the accusations are "patently

false." He said that the board works to ensure a "strong process"

for identifying "critical risks," and reaffirmed his support for

Massey's chief executive.

The letter came as a union-backed investment group stepped up a

campaign against three directors who are up for re-election. The

CtW Investment Group, an arm of labor federation Change to Win, on

Thursday said it has begun making presentations to big

institutional investors, urging them to withhold support for the

directors at Massey's May 18 shareholder meeting.

"Massey's alarming record of regulatory noncompliance and

corporate-governance failures make a clear immediate case for

shareholder action to remove these directors," said William

Patterson, Executive Director of the CtW Investment Group, in a

statement. The group works with union funds that hold less than 1%

of Massey shares.

Massey shares have declined more than 20% since reaching a high

of $53.05 on April 5, the day an explosion at the Upper Big Branch

mine killed 29 workers in the deadliest coal-mining accident in 40

years. Inman wrote that Massey's value has grown from $758 million

since the company went public in 2000 to about $4.2 billion as of

last Friday, and that Chief Executive Don Blankenship "has been

responsible for much of that growth."

A separate group of public pension funds, which include the

California Public Employees' Retirement System and the California

State Teachers' Retirement System, have also argued that the board

failed in its oversight and have said that Massey Chief Executive

Don Blankenship's dual position as chairman and top executive have

"severely compromised" that oversight.

In the letter to the pension funds, Inman countered that as lead

independent director "I play a very active role" and "have

consistently represented an outside perspective consistent with the

concerns and priorities of our shareholders." He also wrote that "I

stand by the independence of our board and the expertise of its

members."

The jousting came amid news of another deadly coal mining

accident, this time at an underground mine in Kentucky. A roof

collapse at the Dotiki Mine in Kentucky, owned by Alliance

Resources Partners LP (ARLP), left one worker dead and another

unaccounted for, the Mine Safety and Health Administration said on

Thursday. Rescue personnel are still trying to locate the second

miner, the agency said.

-By Siobhan Hughes, Dow Jones Newswires; 202-862-6654;

siobhan.hughes@dowjones.com

(Joann S. Lublin of the Wall Street Journal contributed to this

report.)

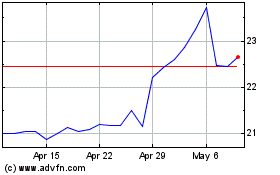

Alliance Resource Partners (NASDAQ:ARLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

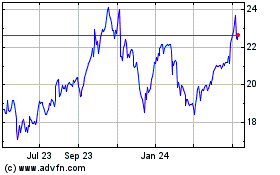

Alliance Resource Partners (NASDAQ:ARLP)

Historical Stock Chart

From Apr 2023 to Apr 2024