By Paul Ziobro

WEST CHESTER, Pa. -- QVC Inc., after years of shrugging off

competition from traditional and online retailers, is seeing cracks

emerge in a business model that has long relied on impulsive

purchases by TV viewers.

The home-shopping channel's U.S. sales fell 6% in its third

quarter, the first drop in seven years on its home turf. In

November, executives warned the declines had extended into the

crucial holiday quarter. The weak results have weighed on shares of

QVC Group, which lost a quarter of their value last year.

The slip raises questions about the resilience of QVC, which

John Malone's Liberty Interactive Corp. has owned since 2003. While

it doesn't face the same pressure to stock and run hundreds of

stores like traditional brick-and-mortar retailers, QVC still faces

competition for consumer dollars from all corners of e-commerce,

including Amazon.com Inc.

"Anything and everything is already available online and there

are all kinds of niche sites out there to help people discover new

items," said Sucharita Mulpuru, chief retail strategist for

conference producer Shoptalk. "That's something available in spades

anywhere you turn online."

Cord-cutting, or the canceling of home cable packages, also

poses a risk to QVC which is mainly broadcast on cable-television

channels. But QVC says consumers who are opting out of pay-TV

packages -- generally younger and lower-income shoppers -- aren't

its core customers. The company also says the benefits of offering

its channels free in apps, on streaming devices and even through

Facebook Live broadcasts add other ways to reach customers.

At a time when fewer people are subscribing to cable, QVC says

viewership is still rising.

QVC's business model counts on getting just enough viewers who

may be tuning in throughout the day or unwinding at night to make

impulsive purchases. The company say 87% of its U.S. customers are

women, 88% are homeowners, and the average age ranges between 35

and 64 years.

It is a formula that Chief Executive Mike George argues can help

QVC hold on to its retailing niche in an age of immediacy, where

shoppers can find and buy most anything they want with a few taps

on a phone.

"We're going to try to find 120 to 140 items every day where we

think we can tell compelling stories and inspire you to consider

it," Mr. George said in an interview at the company's headquarters

and broadcast studio here. Once shoppers start buying from QVC,

their habits are remarkably steady; on average, its customers have

bought 24 items a year in each of the last five years.

Mr. George says the latest sales drop was caused by unusual

issues. Department stores offered more promotions last summer.

Round-the-clock election coverage and even the Summer Olympics

competed for attention from viewers who otherwise may have been

watching QVC. There were also problems with specific brands. Its

haircare business was hurt after a major brand, Wen, came under a

probe. While QVC didn't stock the specific products named in the

investigation, all of the brand's products took a hit.

Meanwhile, big sellers, such as Keurig coffee machines and

Vitamix blenders, had few new products to launch.

And competitors have encroached into QVC's turf. Since March,

Amazon has broadcast a live webcast on weeknights where hosts

highlight beauty products and fashion apparel sold on its site.

Mr. George rebuts the effect of that move, adding that if Amazon

was behind QVC's recent sales decline, the slump wouldn't have

materialized so suddenly. He sees Amazon's foray into live shows as

an attempt to establish itself as a stronger fashion authority with

younger consumers rather than the product curation that QVC does.

"I never discount Amazon on anything, but I don't think they're

trying to do what we do," Mr. George said.

QVC was founded in 1986 by Joseph Segel, an entrepreneur also

behind the mail-order collectible company the Franklin Mint. The

channel was launched in the footsteps of Home Shopping Network. QVC

is now more than 2.5-times larger than HSN, based on sales, and

owns a nearly 40% stake in the rival broadcaster.

Unlike other retailers who were slow to react, QVC has long

viewed Amazon as a true competitor. QVC launched its online

shopping portal in 1996, a year after Amazon sold its first books

online. In 2015, QVC paid around $2.4 billion to buy Zulily Inc., a

company which specializes in flash sales online.

With the addition of Zulily, QVC is now positioned as the 10th

largest e-commerce retailer in the U.S., according to Internet

Retailer, a trade magazine.

Two-thirds of QVC shoppers regularly shop on Amazon, higher than

any other retailer, the company says. But they shop at both outlets

for different reasons. Amazon can save a trip to the store, while

QVC and other home-shopping channels show off products that viewers

didn't know they wanted.

Colleen Hunt, a 55-year-old graphic designer from Livonia,

Mich., estimates she buys half a dozen items each year from QVC,

which often runs in the background while she is doing

housework.

Shopping on Amazon, she says, is much more targeted. "When I go

to Amazon, I'm looking for something specific. I'll search it, get

it, done, " Ms. Hunt said. QVC, however, "they're bringing it to

me."

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

January 12, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

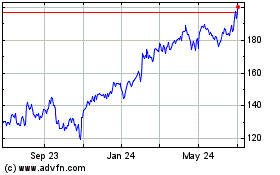

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024