Why Europe's Clothing Retailers Won't Be Torn Apart by Amazon -- Heard on the Street

July 19 2016 - 12:36PM

Dow Jones News

By Stephen Wilmot

In a fast-growing sector, worrying about competition misses the

point. The ambitions of Amazon.com Inc. in clothing retail pose a

bigger threat to high-street fashion chains than they do to online

rivals Zalando and ASOS.

This is one lesson of an expectation-smashing second-quarter

update from Zalando. Since its 2008 foundation by Rocket Internet

as a European copy of Amazon's Zappos.com website, this

Berlin-based company has become Europe's largest online fashion

retailer after Amazon. But its shares have fallen this year as

investors have fretted about weak first-quarter margins and

Amazon's renewed push into fashion.

Those worries now look overblown. The company said Tuesday that

its second-quarter adjusted operating margin would be between 7.5%

and 9.5%. The consensus of analysts had expected 5%, so earnings

upgrades are inevitable. The shares jumped 17% in morning

trading.

Until the company releases full figures and holds a conference

call next month, the reasons for the profit beat will remain

somewhat mysterious. The company noted "operating leverage"--the

mathematical drop-through of strong sales growth to the bottom

line--but second-quarter sales growth in the 24-26% range was in

line with analyst forecasts. At the same time, management insisted

it was keeping its foot on the gas pedal with investments.

This muddy picture will do nothing to clear Zalando's reputation

for unpredictable financial performance, and the shares will

doubtless remain volatile. But even after Tuesday's jump, they look

cheap on 1.7 times prospective sales, relative to those of smaller

U.K. peer ASOS on over 2 times.

The two companies have slightly different focuses. ASOS targets

the market for 20-something fashionistas globally, whereas Zalando

pitches itself at a wider demographic, but only in Europe. ASOS

places more emphasis on fashion and curated content, Zalando on

cutting-edge logistics and web technology. Yet these differences

can be exaggerated: both are growing sales at about 25% a year as

they take market share from bricks-and-mortar retail, and both

should now make full-year margins of roughly 5%.

The key reason why ASOS might warrant a higher valuation is that

its focus on fast fashion and the millennial niche better protects

it from direct competition with Amazon. But focusing on the Amazon

threat is misleading. The U.S. giant already has a higher market

share in European fashion than its local peers, according to

research group Euromonitor, so the competition is nothing new.

There's a reason why most clothes are sold by specialist

retailers; the online world may be no different. As long as Zalando

and ASOS keep up with Amazon's logistics operation, and keep their

current edge in website design and function, they should be able to

grow at least as fast as more and more clothes shoppers move

online.

It is time to consign those Zalando shorts to the back of the

wardrobe. This is a market with growth for all.

Write to Stephen Wilmot at stephen.wilmot@wsj.com

(END) Dow Jones Newswires

July 19, 2016 12:21 ET (16:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

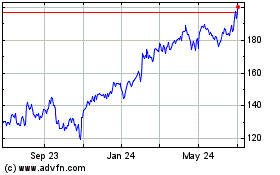

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024