By Paul Ziobro

As thousands of shoppers wait outside Target Corp. stores on

Thanksgiving Day to buy toys, electronics and kitchen gadgets,

workers inside are getting ready to send some of those very items

out the door.

The Minneapolis-based retailer is enlisting small teams of

workers in about one-quarter of its 1,800 U.S. stores to pack up

some of the orders placed through Target.com earlier in the day.

The employees work in shifts, in a few cases starting up to 10

hours before the official 6 p.m. store opening, navigating dimly

lighted aisles and picking items to mail to customers who pounced

on Web deals hours before shoppers could in a store.

The strategy is a new twist on the Black Friday weekend. What

for decades had been a purely in-store shopping frenzy has ceded

much ground to the Internet. A Deloitte LLP survey found shoppers

expect to spend 59% of their money online for the four days

starting Thursday, compared with 36% in stores. The remaining 5% is

spent on catalogs.

Heather Douglass of Denver is one of those shoppers online. The

41-year-old pastry chef planned to log onto her computer around

midnight and hit Target.com for discounted clothes, books and boots

for her two teenage daughters, plus anything else she stumbles

upon. "Once I start browsing, I find more things that I don't need

but wind up buying anyway, " she says.

Ms. Douglass says she has a better chance of getting what she

wants online. Still, she planned to visit actual stores later on

Thanksgiving, a couple hours after the first wave of shoppers

enter. The first stop: Target. "We'll go look at stuff we couldn't

find online."

The growth in online spending is affecting how one of the

nation's largest retailers operates on one of the busiest and most

important shopping days of the year. The change is born out of a

need to cut down on delivery time and shipping costs to keep pace

with Amazon.com Inc., and to put inventory sitting on store shelves

to better use by using it to fulfill orders coming from the

Internet.

"It's a sign of the times," says Rodney Sides, a vice chairman

at the consultancy Deloitte. "With the shift online, you've got to

take advantage of the inventory where it is and when you can."

Physical retailers have long grappled with managing the

logistics of online sales. The problem stems from a legacy that

includes hundreds of stores that must be filled with millions of

pieces of inventory and manned by thousands of employees. Layered

on top of that is a network of online fulfillment centers.

Amazon and other pure-play online retailers don't have that

complexity. They can spread out inventory at a smaller number of

locations--Amazon says it has more than 50 distribution

centers--and focus on shipping packages. The online giant is

compressing shipping times further, with same-day delivery

available in 16 metro areas free for members of its Prime service,

and offering to deliver orders in as little as an hour in some

markets.

Retailers call their answer omnichannel, a strategy that views

all inventory the same and uses algorithms to calculate whether it

makes more sense to ship online orders from a distribution center

or a store. In some cases, customers want the order ready at a

store to pick up.

Shipping from stores is a big part of the plan. The National

Retail Federation says nearly one-third of retailers are working on

shipping products from stores. However, many take a pause during

the busiest times of the year, and none is taking it as far as

Target this year. Best Buy Co., Macy's Inc. and Wal-Mart Stores

Inc. all are open Thanksgiving, but will suspend efforts to ship

items from stores.

"It's just a very busy time," says Dan Toporek, a spokesman for

Wal-Mart, which plans to ship nearly all online orders from

distribution centers in the 48 hours around Black Friday. "We want

to make sure we're delivering the best experience in stores for

customers."

While the logistics of shipping from stores before the rush of

Thanksgiving shoppers can make sense--stores will be empty, orders

will be easy to find before the crowds mess up things--the

financials can be a challenge. The biggest cost of shipping from

store is labor, analysts say, and holiday-pay rates mean it costs

at least 1.5-times more than normal. "Ship from store can turn the

model upside down if you're not careful," Mr. Sides says.

Retailers face additional margin pressures from shoppers, who

don't want to pay shipping fees. Best Buy and Target have

eliminated shipping charges on all orders for the holidays.

Wal-Mart, meanwhile, has a $50 threshold to eliminate the

charge.

There is also the incongruity of whittling your inventory on one

of the few appointment shopping days of the year. "All of your

efforts have been toward driving traffic to stores," says Nikki

Baird, managing partner at Retail Systems Research, a research

firm. "Why would you then ship from stores to meet demand that's

coming from online?"

Target isn't shipping out of stores some of the most heavily

advertised items. The prime deals--$249 55-inch televisions and

$395 drones with high-definition cameras--are reserved for shoppers

in stores, says Eddie Baeb, a spokesman. Anyone buying those items

on Target.com on Thursday, where the same deals are available, will

get them from distribution centers. For the nonrestricted items,

once store inventory gets down to a certain level, that location

will stop shipping it.

Target has 462 stores around the country shipping items from

stores. Most will have workers arrive two to four hours before

Thursday's opening. Forty-four stores meanwhile have souped up

shipping operations with expanded backrooms for packing up to 1,500

orders a day. There, workers will start at least four hours before

shoppers arrive.

Robert DeMarino arrived at the Jersey City, N.J., Target store

he manages around 7:30 in the morning Thursday to oversee a team of

10 workers on the ship-from-store team. Plenty of the orders were

concentrated in the toy and electronics sections, he says. By

mid-morning, the store was well on its way toward hitting its goal

of shipping 900 orders, up from 500 on normal days, and getting

most of it done before shoppers start to stream in.

"This is nice for one day to just not have any distractions," he

says. "We want to make sure that come 6 o'clock, we're ahead of the

game and helping our guests with anything they need in the

store."

The strategy is also part necessity. Target has nine online

fulfillment centers and some of them will churn out eight-times the

number of orders on Friday versus a normal day. But that isn't

enough, and they need the stores to help with the sheer volume.

Target expects stores to process one million online orders in

store--whether shipping them out or holding for pickup--between

Thursday and Sunday.

The torrid pace will continue throughout the holidays. For the

quarter, Target expects 40% of orders to be shipping from stores,

up from 25% normally.

Drew FitzGerald, Suzanne Kapner and Sarah Nassauer contributed

to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 26, 2015 11:46 ET (16:46 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

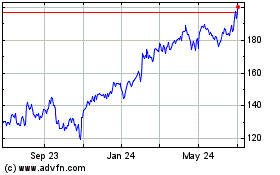

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024