CVS Drops Coverage of 2 Branded Biotech Drugs in Favor of Copies

August 02 2016 - 7:30PM

Dow Jones News

CVS Health Corp. is embracing new, cheaper copies of biotech

medicines in an attempt to combat rising prescription drug

costs.

CVS, whose Caremark unit administers drug-benefit plans for

employers and insurers, said Tuesday it would drop coverage of two

higher-priced medicines used in diabetes and cancer treatments. It

will instead cover their replica versions, sometimes called

biosimilars, for many of its drug-plan members.

The changes, which go into effect Jan. 1, are a blow to Sanofi

SA's Lantus, a popular brand-name insulin treatment for diabetes,

and Amgen Inc.'s Neupogen, which helps to prevent infections

related to cancer treatment. A vial of Lantus retails for about

$260 while a single dose of Neupogen costs about $350, according to

GoodRx.

Cheaper copies of biotech drugs have only recently begun to

enter the U.S. market and haven't yet made much of a dent in the

nation's drug spending, in part because they have been priced at

relatively small discounts to their branded rivals.

But the move by CVS is the latest indication that U.S. health

insurers and pharmacy benefit managers are eager to reap savings

from the new drugs. CVS Chief Medical Officer Troyen A. Brennan

said biosimilars are typically priced 10% to 15% cheaper but that

CVS has negotiated additional discounts.

"We want to signal that this biosimilar movement is real," Dr.

Brennan said in an interview. "We have big hopes for [biosimilars]

to reduce drug costs over all."

An Amgen spokeswoman said Neupogen "is competitively priced,"

and that patients and doctors should be able to choose which

product they want to use. A Sanofi spokesman said CVS's decision to

exclude Lantus and another of the company's insulins would make "it

difficult for patients to benefit from the gold standard of basal

insulin treatment."

CVS, best known as a retail pharmacy chain, is also a major

player in the pharmacy benefit management industry, overseeing drug

spending for U.S. employers, health insurers and labor unions. CVS

and other PBMs pool their customers' purchasing power to negotiate

better prices from drugmakers. In exchange, PBMs often steer their

clients to products for which they receive the best prices. Last

year, CVS dropped coverage for Pfizer Inc.'s anti-impotence pill

Viagra in favor of Eli Lilly & Co.'s Cialis.

However, the exclusions aren't ironclad. Some PBM clients

customize their own covered-drug lists, and many prefer to give

beneficiaries as many options as possible. The changes that CVS

announced on Tuesday, for instance, will apply mainly to its

commercial employer and labor union clients who subscribe to its

standard formulary, or list of covered drugs.

CVS said it would exclude an additional 35 products in 2017,

including Novartis AG's cancer drugs Gleevec and Tasigna. A generic

version of Gleevec was launched earlier this year. CVS's Dr.

Brennan said the company intends to have all patients currently

taking Gleevec switched to the generic version.

A Novartis spokesman said the company was disappointed that CVS

would limit access to Tasigna, but that CVS had indicated the

coverage decision wouldn't "affect any patients who are currently

taking Tasigna."

Write to Joseph Walker at joseph.walker@wsj.com and Paul Ziobro

at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

August 02, 2016 19:15 ET (23:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

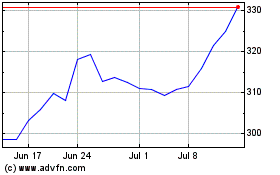

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

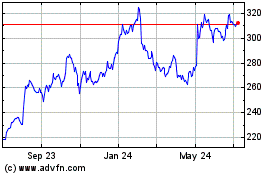

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024