Amgen Profit Rises 13%, 2016 Outlook Raised

July 27 2016 - 5:00PM

Dow Jones News

By Tess Stynes

Amgen Inc. said its second-quarter earnings rose 13% on

better-than-expected revenue growth, which was again driven by

sales of key drugs such as Enbrel.

The Thousand Oaks, Calif., biotechnology company's per-share

earnings, excluding certain items, also beat expectations.

Amgen again raised its 2016 outlook and now expects per-share

earnings of $11.10 to $11.40 on revenue of $22.5 billion to $22.8

billion. The company previously had projected per-share profit of

$10.85 to $11.20 and revenue of $22.2 billion to $22.6 billion.

Like many other drugmakers, Amgen has been counting on

introductions of new medicines as some of the company's older

biotech drugs face competition from lower-priced treatments.

Chief Executive Robert A. Bradway said in prepared remarks that

Amgen is on track to meet or exceed its long-term targets.

"We are in the early stages of a new product launch cycle and

have several additional pipeline opportunities rapidly nearing

regulatory milestones," Mr. Bradway stated.

These include the company's recently submitted filing with the

Food and Drug Administration seeking approval for osteoporosis drug

romosozumab. An FDA panel also recently voted in favor of

recommending approval for Amgen's biosimilar version of AbbVie's

blockbuster rheumatoid arthritis drug Humira.

Investors will be listening on the conference call for updates

on Amgen's drug pipeline and its strategy for biosimilars -- less

expensive copycat versions of biotech drugs.

Amgen also reported progress for anti-cholesterol drug Repatha,

which received FDA approval in August. In the latest quarter,

Repatha contributed sales of $27 million, compared with $16 million

in the first quarter. Analysts had expected Repatha sales of $26

million, according to FactSet. The rollout of Repatha has been slow

amid resistance from some health insurers, pharmacy-benefit

managers and other payers.

Amgen also is facing competition from biosimilar versions of

some of its own drugs, including Novartis AG's Zarxio, the Swiss

drugmaker's version of Neupogen. In the latest quarter, Neupogen

sales slumped 23% to $196 million.

Meanwhile, sales of rheumatoid arthritis and psoriasis drug

Enbrel rose 10% to $1.48 billion in the quarter, driven by higher

prices. An FDA panel also has urged approval of Novartis's

biosimilar drug etanercept -- a copycat version of Enbrel.

Over all, Amgen reported a profit of $1.87 billion, or $2.47 a

share, up from $1.65 billion, or $2.15 a share, a year earlier.

Excluding acquisition-related expenses and other items, adjusted

per-share earnings rose to $2.84 from $2.57. Revenue increased 5.9%

to $5.69 billion.

Analysts polled by Thomson Reuters expected per-share profit of

$2.74 and revenue of $5.58 billion.

Demand for Amgen's bone drugs continued to grow, with Xgeva

sales rising 15% to $381 million and Prolia sales climbing 30% to

$441 million.

Sales of multiple myeloma drug Kyprolis jumped 45% to $172

million, also driven by higher demand. Amgen gained Kyprolis with

its $10.4 billion acquisition of Onyx Pharmaceuticals Inc. in

2013.

Neulasta sales fell 1% to $1.15 billion, amid lower demand that

was partly offset by higher pricing in the U.S.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

July 27, 2016 16:45 ET (20:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

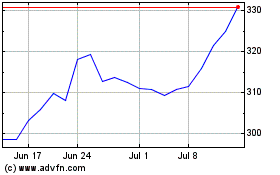

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

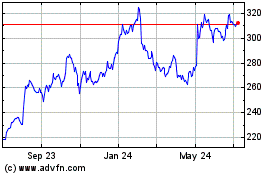

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024