Amgen Profit Rises 17%, Guidance Raised--Update

April 28 2016 - 6:16PM

Dow Jones News

By Tess Stynes

Amgen Inc. said its first-quarter earnings rose 17% on

better-than-expected revenue, again boosted by sales of key drugs

such as Enbrel, and bone drugs Xgeva and Prolia.

The Thousand Oaks, Calif., biotechnology company again raised

its 2016 outlook. Amgen now expects per-share earnings of $10.85 to

$11.20 and revenue of $22.2 billion to $22.6 billion. Amgen

previously had projected per-share earnings of $10.60 to $11 and

revenue of $22 billion to $22.5 billion.

Like other big drugmakers, Amgen has been counting on

introductions of new therapies and its drug-development pipeline to

help offset competition facing some of its older biotech drugs.

Amgen said its anti-cholesterol drug Repatha, which was approved

by the U.S. Food and Drug Administration in August, contributed

sales of $16 million in the latest quarter. Analysts had expected

Repatha sales of $27 million, according to FactSet.

This marked the first earnings report in which Amgen has broken

out sales for Repatha, which belongs to a powerful new drug class

that promises help for patients who have struggled to control their

cholesterol using older statin medicines. Repatha is competing with

Praluent, from Sanofi SA and Regeneron Pharmaceuticals Inc.

Big sales were predicted for the drugs, but both have gotten off

to slow starts.

Amgen previously has said criteria set by health insurers and

drug-benefit managers have limited the number of prescriptions that

get filled.

Over all, Amgen reported a profit of $1.9 billion, or $2.50 a

share, up from $1.62 billion, or $2.11 a share, a year earlier.

Excluding certain items, adjusted per-share earnings rose to $2.90

from $2.48. Revenue increased 9.8% to $5.53 billion.

Analysts polled by Thomson Reuters expected per-share profit of

$2.60 and revenue of $5.32 billion.

Operating margin rose to 43.5% from 40.2%. Excluding certain

items, adjusted operating margin improved to 54.6% from 50.2%.

In the latest quarter, sales of rheumatoid arthritis and

psoriasis drug Enbrel rose 24% to $1.4 billion, with a boost from

higher prices.

Demand for Amgen's bone drugs continued to grow, with Xgeva

sales rising 11% to $378 million and Prolia sales increasing by 29%

to $352 million.

Sales of multiple myeloma drug Kyprolis surged 43% to $154

million. Amgen gained Kyprolis with its $10.4 billion acquisition

of Onyx Pharmaceuticals Inc. in 2013.

The company also said sales of Blincyto climbed 80% to $27

million. Blincyto received FDA approval in December 2014 as a

therapy for a rare and hard-to-treat cancer of the blood and blood

marrow.

Sales of long-acting dialysis drug Aranesp sales rose 11% to

$532 million amid a shift by some U.S. customers that had been

using Amgen's older, shorter-acting dialysis treatment, Epogen.

Sales of Epogen fell 44% amid the impact of losing market

exclusivity in the U.S., and to a lesser extent, the customer

shifts to Aranesp.

Neulasta sales rose 4% to $1.18 billion, amid increased demand

and higher pricing in the U.S. However, sales of Neupogen sales

declined 13% to $213 million amid increased competition in the U.S.

since the entry of Novartis's biosimilar Zarxio last year.

Shares edged up 44 cents to $161 in recent after-hours

trading.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

April 28, 2016 18:01 ET (22:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

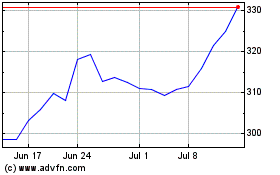

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

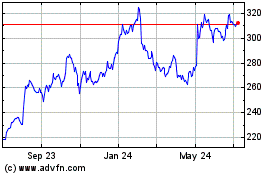

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024