Amgen to Buy Dezima, Signs Pact With Xencor -- Update

September 16 2015 - 10:12AM

Dow Jones News

By Lisa Beilfuss

Amgen Inc. said Wednesday that it has agreed to buy

Netherlands-based Dezima Pharma BV and struck a research and

license agreement with Xencor Inc., as the biotech company aims to

expand both its cardiovascular and immuno-oncology portfolio.

Amgen will pay $300 million in cash upfront and up to $1.25

billion in milestone payments for cholesterol-drug maker Dezima.

The deal, which could be valued at more than $1.5 billion, is

expected to close in the fourth quarter.

Dezima is currently developing TA-8995, an oral drug that

reduced low-density lipoprotein cholesterol by up to 48% in a

mid-stage trial.

In August, the Food and Drug Administration approved Amgen's

cholesterol-lowering Repatha, teeing up a rivalry with a similar

treatment that was approved just weeks earlier.

The agreement with Xencor covers six programs for which Amgen

will be fully responsible for preclinical and clinical development

and commercialization.

The collaboration, which includes molecular engineering by

Xencor and preclinical development of bispecific molecules for five

programs proposed by Amgen, brings together Amgen's capabilities in

target discovery and protein therapeutics with Xencor's XmAb

antibody engineering technology platform, the companies said.

Amgen, which has faced pressure from activist shareholders, like

other big drug companies needs to bring new treatments to market as

older ones face the threat of low-price competition.

An appeals court recently denied California-based Amgen's

request to block Swiss rival Novartis AG from selling a biosimilar

version of Amgen's cancer-care medicine Neupogen. Last year, the

drug brought in $5.76 billion and represented a quarter of Amgen's

top line. Novartis said it would start selling the first biosimilar

drug in the U.S. at a 15% discount to the original.

Xencor, also based in California, specializes in developing

monoclonal antibody therapeutics for the treatment of cancer,

autoimmune disorders and asthma, among other conditions.

Under the terms, Xencor will receive a $45 million upfront

payment and is eligible for up to $1.7 billion in milestone

payments. Xencor may also receive royalties, the companies

said.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 16, 2015 09:57 ET (13:57 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

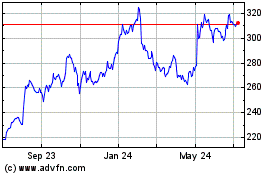

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

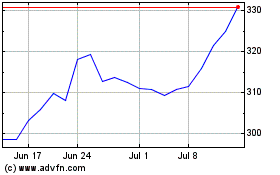

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024