Lam Research, KLA-Tenor Call Off Merger on Antitrust Concerns -- Update

October 05 2016 - 8:42PM

Dow Jones News

By Don Clark and Ezequiel Minaya

Lam Research Corp. and KLA-Tencor Corp. called off a planned

$10.6 billion merger announced nearly a year ago, citing opposition

by the Justice Department on antitrust grounds.

The department said late Wednesday it had serious concerns that

the deal would harm competition in the market for machines used to

manufacture computer chips.

Lam, which Gartner Inc. ranks as the second-largest maker of

such machines behind Applied Materials Inc., had agreed to buy

KLA-Tencor, the No. 5 supplier. The companies said they had decided

mutually to call off the deal, a move that calls for no termination

fee to be paid by either party.

The decision by the two Silicon Valley companies comes as little

surprise, following a joint announcement in August that they might

not be able to receive necessary government approvals by Oct. 20,

when they hoped to close the deal.

Lam and KLA-Tencor lead different portions of a market Gartner

put at $33.6 billion in 2015. Lam is the largest maker of machines

that deposit or etch away materials on the silicon wafers used to

make computer chips. KLA-Tencor's machines, by contrast, are used

to measure and inspect circuitry on chips during the manufacturing

process, for purposes that include spotting defects.

Dan Hutcheson, an analyst at VLSI Research, said acquiring

KLA-Tencor could have given Lam access to information about

customers' technology and future directions that would work hurt

competitors, including Applied Materials and Tokyo Electron Corp.

Lam, in theory, would have an edge in knowing what features to add

to its products, he said.

"The proposed transaction presented concerns about the ability

of the merged firm to foreclose competitors' development of leading

edge fabrication tools and process technology on a timely basis,"

said Renata Hesse, acting assistant attorney general of the Justice

Department's antitrust division, in a statement issued late

Wednesday.

KLA-Tencor said Wednesday that the companies decided to

terminate the merger after the Justice Department told the

companies it wouldn't "continue with a consent decree that the

parties had been negotiating." It didn't elaborate. Companies

sometimes negotiate consent decrees with government agencies in

connection with mergers, which in some cases include agreements to

spin off business units.

KLA-Tencor expressed disappointment with calling off the deal,

as did LAM. "We believe that this proposed combination would have

resulted in compelling benefits for our customers, employees and

stockholders, as well as accelerate innovation in the broader

semiconductor industry," said Martin Anstice, Lam's president and

chief executive officer, in prepared remarks.

Mr. Anstice said Lam would explore other collaboration

opportunities with KLA. The companies scheduled separate conference

calls Thursday to discuss their announcement.

Lam slid 0.8% on the news after hours to $95.40, while KLA sank

3.4% to $68.80.

The Lam-KLA deal is the second big deal among makers of chip

production tools to fall victim to U.S. government opposition.

Applied Materials last year dropped its plan to buy Tokyo Electron,

after the Justice Department raised antitrust objections. That

deal, announced in September 2013,(CQ) was expected to create a

company with a market value of $29 billion.

--Brent Kendall contributed to this article.

Write to Don Clark at don.clark@wsj.com and Ezequiel Minaya at

ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

October 05, 2016 20:27 ET (00:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

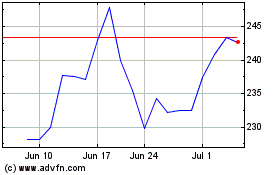

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

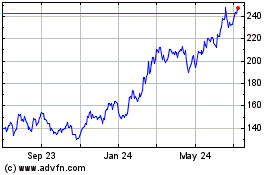

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024