UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________

FORM 8-K

____________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 13, 2015

____________________________________________________________________

Applied Materials, Inc.

(Exact name of registrant as specified in its charter)

____________________________________________________________________

|

| | | | |

| | | | |

Delaware | | 000-06920 | | 94-1655526 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

3050 Bowers Avenue | | |

P.O. Box 58039 Santa Clara, CA | | 95052-8039 |

(Address of principal executive | | (Zip Code) |

offices) | | |

Registrant’s telephone number, including area code: (408) 727-5555

N/A

(Former name or former address, if changed since last report.)

____________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On August 13, 2015, Applied Materials, Inc. (“Applied Materials”) announced its financial results for its third quarter ended July 26, 2015. A copy of Applied Materials’ press release is attached hereto as Exhibit 99.1.

The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing of Applied Materials, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing. The information in this report, including the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

| | |

| | |

Exhibit No. | | Description |

99.1 | | Press Release issued by Applied Materials, Inc. dated August 13, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| |

Applied Materials, Inc. (Registrant) |

Date: | August 13, 2015 | By: | /s/ Thomas F. Larkins |

| | | Thomas F. Larkins |

| | | Senior Vice President, General Counsel and Corporate Secretary |

EXHIBIT INDEX

|

| | |

| | |

Exhibit No. | | Description |

99.1 | | Press Release issued by Applied Materials, Inc. dated August 13, 2015. |

Exhibit 99.1

APPLIED MATERIALS ANNOUNCES THIRD QUARTER RESULTS

| |

• | Q3 orders of $2.89 billion up 17% year over year, with record Silicon Systems orders |

| |

• | Q3 net sales of $2.49 billion up 10% year over year led by growth in Silicon Systems and Services |

| |

• | Q3 non-GAAP adjusted EPS of $0.33 up 18% year over year; GAAP EPS of $0.27 up 13% year over year |

SANTA CLARA, Calif., Aug. 13, 2015 - Applied Materials, Inc. (NASDAQ:AMAT), the global leader in materials engineering solutions for the semiconductor, display and solar industries, today reported results for its third quarter ended July 26, 2015.

Third quarter orders were $2.89 billion, up 15 percent sequentially and up 17 percent year over year. Net sales were $2.49 billion, up 2 percent sequentially and up 10 percent year over year.

On a non-GAAP adjusted basis, the company reported gross margin of 43.9 percent, operating margin of 20.8 percent, and net income of $410 million or $0.33 per diluted share. The company recorded GAAP gross margin of 40.9 percent, operating margin of 15.9 percent, and net income of $329 million or $0.27 per diluted share. The GAAP results included the effect of cost reduction actions in the solar business consisting of $34 million of inventory charges and $17 million of restructuring and asset impairment charges.

The company generated $334 million in cash from operations, paid dividends of $123 million and used $625 million to repurchase 32 million shares of common stock.

“Applied is focused on profitable growth and the results show in our third-quarter performance when we delivered our highest ever 300mm semiconductor equipment orders and record revenue in services,” said Gary Dickerson, president and CEO. “Our highly differentiated materials engineering products help customers accelerate major technology inflections including 3D NAND, and this quarter we generated the highest flash memory orders in our history.”

Quarterly Results Summary

|

| | | | | | | | | | |

| | | | | | | | Change |

| | Q3 FY2015 | | Q2 FY2015 | | Q3 FY2014 | | Q3 FY2015 vs. Q2 FY2015 | | Q3 FY2015

vs. Q3 FY2014 |

| | (In millions, except per share amounts and percentages) |

New orders | | $2,892 | | $2,515 | | $2,479 | | 15% | | 17% |

Net sales | | $2,490 | | $2,442 | | $2,265 | | 2% | | 10% |

Gross margin | | 40.9% | | 41.6% | | 43.8% | | (0.7) points | | (2.9) points |

Operating margin | | 15.9% | | 17.0% | | 17.3% | | (1.1) points | | (1.4) points |

Net income | | $329 | | $364 | | $301 | | (10)% | | 9% |

Diluted earnings per share (EPS) | | $0.27 | | $0.29 | | $0.24 | | (7)% | | 13% |

Applied Materials, Inc.

Page 2 of 12

|

| | | | | | | | | | |

| | | | | | | | Change |

Non-GAAP Adjusted Results | | Q3 FY2015 | | Q2 FY2015 | | Q3 FY2014 | | Q3 FY2015

vs.

Q2 FY2015 | | Q3 FY2015

vs.

Q3 FY2014 |

| | (In millions, except per share amounts and percentages) |

Non-GAAP adjusted gross margin | | 43.9% | | 43.2% | | 45.5% | | 0.7 points | | (1.6) points |

Non-GAAP adjusted operating margin | | 20.8% | | 19.5% | | 21.1% | | 1.3 points | | (0.3) points |

Non-GAAP adjusted net income | | $410 | | $362 | | $349 | | 13% | | 17% |

Non-GAAP adjusted diluted EPS | | $0.33 | | $0.29 | | $0.28 | | 14% | | 18% |

Applied's non-GAAP adjusted results exclude the impact of the following, where applicable: certain items related to mergers and acquisitions; restructuring charges and any associated adjustments; impairments of assets, or investments; gain or loss on sale of strategic investments; and certain discrete adjustments and tax items. A reconciliation of the GAAP and non-GAAP adjusted results is provided in the financial tables included in this release. See also “Use of Non-GAAP Adjusted Financial Measures” section.

Business Outlook

For the fourth quarter of fiscal 2015, Applied expects net sales to be in the range of flat to down 7 percent from the previous quarter, and non-GAAP adjusted diluted EPS is expected to be in the range of $0.27 to $0.31.

This outlook excludes known charges related to completed acquisitions of $0.04 per share and does not exclude other non-GAAP adjustments that may arise subsequent to this release.

Third Quarter Reportable Segment Information

|

| | | | | | | | | | | |

Silicon Systems Group | Q3 FY2015 | | Q2 FY2015 | | Q3 FY2014 |

| | | | | |

| (In millions, except percentages) |

New orders | $ | 2,007 |

| | $ | 1,704 |

| | $ | 1,565 |

|

Foundry | 32 | % | | 36 | % | | 50 | % |

DRAM | 18 | % | | 31 | % | | 14 | % |

Flash | 39 | % | | 21 | % | | 22 | % |

Logic and other | 11 | % | | 12 | % | | 14 | % |

Net sales | 1,635 |

| | 1,560 |

| | 1,476 |

|

Operating income | 411 |

| | 374 |

| | 381 |

|

Operating margin | 25.1 | % | | 24.0 | % | | 25.8 | % |

Non-GAAP Adjusted Results | | | | |

Non-GAAP adjusted operating income | $ | 455 |

| | $ | 418 |

| | $ | 423 |

|

Non-GAAP adjusted operating margin | 27.8 | % | | 26.8 | % | | 28.7 | % |

Applied Materials, Inc.

Page 3 of 12

|

| | | | | | | | | | | |

Applied Global Services

| Q3 FY2015 | | Q2 FY2015 | | Q3 FY2014 |

| | | | | |

| (In millions, except percentages) |

New orders | $ | 561 |

| | $ | 641 |

| | $ | 552 |

|

Net sales | 665 |

| | 646 |

| | 567 |

|

Operating income | 170 |

| | 170 |

| | 154 |

|

Operating margin | 25.6 | % | | 26.3 | % | | 27.2 | % |

Non-GAAP Adjusted Results | | | | |

Non-GAAP adjusted operating income | $ | 173 |

| | $ | 170 |

| | $ | 154 |

|

Non-GAAP adjusted operating margin | 26.0 | % | | 26.3 | % | | 27.2 | % |

|

| | | | | | | | | | | |

Display | Q3 FY2015 | | Q2 FY2015 | | Q3 FY2014 |

| | | | | |

| (In millions, except percentages) |

New orders | $ | 295 |

| | $ | 120 |

| | $ | 296 |

|

Net sales | 151 |

| | 163 |

| | 119 |

|

Operating income | 25 |

| | 40 |

| | 25 |

|

Operating margin | 16.6 | % | | 24.5 | % | | 21.0 | % |

Non-GAAP Adjusted Results | | | | |

Non-GAAP adjusted operating income | $ | 26 |

| | $ | 40 |

| | $ | 26 |

|

Non-GAAP adjusted operating margin | 17.2 | % | | 24.5 | % | | 21.8 | % |

|

| | | | | | | | | | | |

Energy and Environmental Solutions | Q3 FY2015 | | Q2 FY2015 | | Q3 FY2014 |

| | | | | |

| (In millions, except percentages) |

New orders | $ | 29 |

| | $ | 50 |

| | $ | 66 |

|

Net sales | 39 |

| | 73 |

| | 103 |

|

Operating income (loss) | (52 | ) | | (5 | ) | | 24 |

|

Operating margin | (133.3 | )% | | (6.8 | )% | | 23.3 | % |

Non-GAAP Adjusted Results | | | | |

Non-GAAP adjusted operating income (loss) | $ | (2 | ) | | $ | (4 | ) | | $ | 25 |

|

Non-GAAP adjusted operating margin | (5.1 | )% | | (5.5 | )% | | 24.3 | % |

Backlog Information

Applied's backlog grew 11 percent sequentially to $3.10 billion and included negative adjustments of $84 million, primarily consisting of order cancellations from a foundry customer. Backlog composition by reportable segment was as follows:

|

| | |

Silicon Systems Group | 57 | % |

Applied Global Services | 22 | % |

Display | 17 | % |

Energy and Environmental Solutions | 4 | % |

Applied Materials, Inc.

Page 4 of 12

Use of Non-GAAP Adjusted Financial Measures

Management uses non-GAAP adjusted results to evaluate the company’s operating and financial performance in light of business objectives and for planning purposes. These measures are not in accordance with GAAP and may differ from non-GAAP methods of accounting and reporting used by other companies. Applied believes these measures enhance investors’ ability to review the company’s business from the same perspective as the company’s management and facilitate comparisons of this period’s results with prior periods. The presentation of this additional information should not be considered a substitute for results prepared in accordance with GAAP.

Webcast Information

Applied Materials will discuss these results during an earnings call that begins at 1:30 p.m. Pacific Time today. A live webcast will be available at www.appliedmaterials.com. A replay will be available on the website beginning at 5:00 p.m. Pacific Time today.

Forward-Looking Statements

This press release contains forward-looking statements, including those regarding anticipated growth and trends in our businesses and markets, industry outlooks, technology transitions, our financial performance and market share positions, our business outlook for the fourth quarter of fiscal 2015, and other statements that are not historical facts. These statements and their underlying assumptions are subject to risks and uncertainties and are not guarantees of future performance. Factors that could cause actual results to differ materially from those expressed or implied by such statements include, without limitation: the level of demand for our products; global economic and industry conditions; consumer demand for electronic products; the demand for semiconductors; customers’ technology and capacity requirements; the introduction of new and innovative technologies, and the timing of technology transitions; our ability to develop, deliver and support new products and technologies; the concentrated nature of our customer base; our ability to expand our current markets, increase market share and develop new markets; market acceptance of existing and newly developed products; our ability to obtain and protect intellectual property rights in key technologies; our ability to achieve the objectives of operational and strategic initiatives, align our resources and cost structure with business conditions, and attract, motivate and retain key employees; the variability of operating expenses and results among products and segments, and our ability to accurately forecast future results, market conditions, customer requirements and business needs; and other risks and uncertainties described in our SEC filings, including our most recent Forms 10-Q and 8-K. All forward-looking statements are based on management’s current estimates, projections and assumptions, and we assume no obligation to update them.

About Applied Materials

Applied Materials, Inc. (Nasdaq:AMAT) is the global leader in materials engineering solutions for the semiconductor, flat panel display and solar photovoltaic industries. Our technologies help make innovations like smartphones, flat screen TVs and solar panels more affordable and accessible to consumers and businesses around the world. Learn more at www.appliedmaterials.com.

Contact:

Kevin Winston (editorial/media) 408.235.4498

Michael Sullivan (financial community) 408.986.7977

Applied Materials, Inc.

Page 5 of 12

APPLIED MATERIALS, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

(In millions, except per share amounts) | | July 26,

2015 | | April 26,

2015 | | July 27,

2014 | | July 26,

2015 | | July 27,

2014 |

Net sales | | $ | 2,490 |

| | $ | 2,442 |

| | $ | 2,265 |

| | $ | 7,291 |

| | $ | 6,808 |

|

Cost of products sold | | 1,472 |

| | 1,426 |

| | 1,273 |

| | 4,298 |

| | 3,924 |

|

Gross profit | | 1,018 |

| | 1,016 |

| | 992 |

| | 2,993 |

| | 2,884 |

|

Operating expenses: | | | | | | | | | | |

Research, development and engineering | | 372 |

| | 365 |

| | 357 |

| | 1,088 |

| | 1,068 |

|

Marketing and selling | | 112 |

| | 109 |

| | 108 |

| | 332 |

| | 324 |

|

General and administrative | | 135 |

| | 140 |

| | 126 |

| | 392 |

| | 375 |

|

Loss (gain) on derivatives associated with terminated business combination | | 3 |

| | (14 | ) | | 10 |

| | (89 | ) | | 9 |

|

Total operating expenses | | 622 |

| | 600 |

| | 601 |

| | 1,723 |

| | 1,776 |

|

Income from operations | | 396 |

| | 416 |

| | 391 |

| | 1,270 |

| | 1,108 |

|

Interest expense | | 24 |

| | 24 |

| | 24 |

| | 71 |

| | 72 |

|

Interest income and other income (loss), net | | 3 |

| | (3 | ) | | 3 |

| | 2 |

| | 14 |

|

Income before income taxes | | 375 |

| | 389 |

| | 370 |

| | 1,201 |

| | 1,050 |

|

Provision for income taxes | | 46 |

| | 25 |

| | 69 |

| | 160 |

| | 234 |

|

Net income | | $ | 329 |

| | $ | 364 |

| | $ | 301 |

| | $ | 1,041 |

| | $ | 816 |

|

Earnings per share: | | | | | | | | | | |

Basic | | $ | 0.27 |

| | $ | 0.30 |

| | $ | 0.25 |

| | $ | 0.85 |

| | $ | 0.67 |

|

Diluted | | $ | 0.27 |

| | $ | 0.29 |

| | $ | 0.24 |

| | $ | 0.84 |

| | $ | 0.66 |

|

Weighted average number of shares: | | | | | | | | | | |

Basic | | 1,221 |

| | 1,230 |

| | 1,218 |

| | 1,225 |

| | 1,213 |

|

Diluted | | 1,231 |

| | 1,241 |

| | 1,233 |

| | 1,238 |

| | 1,230 |

|

Applied Materials, Inc.

Page 6 of 12

APPLIED MATERIALS, INC.

UNAUDITED CONSOLIDATED CONDENSED BALANCE SHEETS

|

| | | | | | | | | | | | |

(In millions) | | July 26,

2015 | | April 26,

2015 | | October 26,

2014 |

ASSETS | | | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 2,574 |

| | $ | 3,067 |

| | $ | 3,002 |

|

Short-term investments | | 169 |

| | 163 |

| | 160 |

|

Accounts receivable, net | | 1,991 |

| | 1,798 |

| | 1,670 |

|

Inventories | | 1,739 |

| | 1,713 |

| | 1,567 |

|

Other current assets | | 570 |

| | 706 |

| | 568 |

|

Total current assets | | 7,043 |

| | 7,447 |

| | 6,967 |

|

Long-term investments | | 958 |

| | 936 |

| | 935 |

|

Property, plant and equipment, net | | 882 |

| | 887 |

| | 861 |

|

Goodwill | | 3,304 |

| | 3,304 |

| | 3,304 |

|

Purchased technology and other intangible assets, net | | 811 |

| | 860 |

| | 951 |

|

Deferred income taxes and other assets | | 155 |

| | 153 |

| | 156 |

|

Total assets | | $ | 13,153 |

| | $ | 13,587 |

| | $ | 13,174 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | |

Current liabilities: | | | | | | |

Accounts payable, notes payable and accrued expenses | | $ | 2,162 |

| | $ | 1,822 |

| | $ | 1,883 |

|

Customer deposits and deferred revenue | | 858 |

| | 874 |

| | 940 |

|

Total current liabilities | | 3,020 |

| | 2,696 |

| | 2,823 |

|

Long-term debt | | 1,547 |

| | 1,947 |

| | 1,947 |

|

Other liabilities | | 609 |

| | 593 |

| | 536 |

|

Total liabilities | | 5,176 |

| | 5,236 |

| | 5,306 |

|

Total stockholders’ equity | | 7,977 |

| | 8,351 |

| | 7,868 |

|

Total liabilities and stockholders’ equity | | $ | 13,153 |

| | $ | 13,587 |

| | $ | 13,174 |

|

Applied Materials, Inc.

Page 7 of 12

APPLIED MATERIALS, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

|

| | | | | | | | | | | | | | | | | | | |

(In millions) | Three Months Ended | | Nine Months Ended |

July 26,

2015 | | April 26,

2015 | | July 27,

2014 | July 26,

2015 | | July 27,

2014 |

Cash flows from operating activities: | | | | | | | | | |

Net income | $ | 329 |

| | $ | 364 |

| | $ | 301 |

| | $ | 1,041 |

| | $ | 816 |

|

Adjustments required to reconcile net income to cash provided by operating activities: | | | | | | | | | |

Depreciation and amortization | 93 |

| | 90 |

| | 93 |

| | 275 |

| | 281 |

|

Share-based compensation | 46 |

| | 47 |

| | 44 |

| | 141 |

| | 132 |

|

Excess tax benefits from share-based compensation | (3 | ) | | (12 | ) | | (1 | ) | | (54 | ) | | (26 | ) |

Other | 61 |

| | (8 | ) | | 49 |

| | 89 |

| | 70 |

|

Net change in operating assets and liabilities | (192 | ) | | (183 | ) | | 98 |

| | (800 | ) | | 120 |

|

Cash provided by operating activities | 334 |

| | 298 |

| | 584 |

| | 692 |

| | 1,393 |

|

Cash flows from investing activities: | | | | | | | | | |

Capital expenditures | (51 | ) | | (64 | ) | | (65 | ) | | (164 | ) | | (178 | ) |

Proceeds from sales and maturities of investments | 583 |

| | 177 |

| | 181 |

| | 900 |

| | 702 |

|

Purchases of investments | (616 | ) | | (203 | ) | | (308 | ) | | (960 | ) | | (632 | ) |

Cash used in investing activities | (84 | ) | | (90 | ) | | (192 | ) | | (224 | ) | | (108 | ) |

Cash flows from financing activities: | | | | | | | | | |

Proceeds from common stock issuances and others, net | 1 |

| | 42 |

| | 1 |

| | 43 |

| | 67 |

|

Common stock repurchases | (625 | ) | | — |

| | — |

| | (625 | ) | | — |

|

Excess tax benefits from share-based compensation | 3 |

| | 12 |

| | 1 |

| | 54 |

| | 26 |

|

Payments of dividends to stockholders | (123 | ) | | (123 | ) | | (121 | ) | | (368 | ) | | (363 | ) |

Cash used in financing activities | (744 | ) | | (69 | ) | | (119 | ) | | (896 | ) | | (270 | ) |

Effect of exchange rate changes on cash and cash equivalents | 1 |

| | (1 | ) | | — |

| | — |

| | — |

|

Increase (decrease) in cash and cash equivalents | (493 | ) | | 138 |

| | 273 |

| | (428 | ) | | 1,015 |

|

Cash and cash equivalents — beginning of period | 3,067 |

| | 2,929 |

| | 2,453 |

| | 3,002 |

| | 1,711 |

|

Cash and cash equivalents — end of period | $ | 2,574 |

| | $ | 3,067 |

| | $ | 2,726 |

| | $ | 2,574 |

| | $ | 2,726 |

|

Supplemental cash flow information: | | | | | | | | | |

Cash payments for income taxes | $ | 51 |

| | $ | 118 |

| | $ | 49 |

| | $ | 258 |

| | $ | 108 |

|

Cash refunds from income taxes | $ | 5 |

| | $ | 2 |

| | $ | 21 |

| | $ | 10 |

| | $ | 33 |

|

Cash payments for interest | $ | 39 |

| | $ | 7 |

| | $ | 39 |

| | $ | 85 |

| | $ | 85 |

|

Applied Materials, Inc.

Page 8 of 12

APPLIED MATERIALS, INC.

UNAUDITED SUPPLEMENTAL INFORMATION

Corporate Unallocated Expenses

|

| | | | | | | | | | | | |

(In millions) | | Q3 FY2015 | | Q2 FY2015 | | Q3 FY2014 |

Share-based compensation | | $ | 46 |

| | $ | 47 |

| | $ | 44 |

|

Certain items associated with terminated business combination | | 1 |

| | 29 |

| | 23 |

|

Loss (gain) on derivative associated with terminated business combination, net | | 3 |

| | (14 | ) | | 10 |

|

Other unallocated expenses | | 108 |

| | 101 |

| | 116 |

|

Total corporate | | $ | 158 |

| | $ | 163 |

| | $ | 193 |

|

Additional Information

|

| | | | | | | | | | | | | | | | | | |

| | Q3 FY2015 | | Q2 FY2015 | | Q3 FY2014 |

New Orders and Net Sales by Geography | | | | | | | | | | | | |

(In $ millions) | | New Orders | | Net Sales | | New Orders | | Net Sales | | New Orders | | Net Sales |

United States | | 262 |

| | 650 |

| | 368 |

| | 632 |

| | 680 |

| | 683 |

|

% of Total | | 9 | % | | 26 | % | | 15 | % | | 26 | % | | 27 | % | | 30 | % |

Europe | | 142 |

| | 134 |

| | 131 |

| | 150 |

| | 146 |

| | 160 |

|

% of Total | | 5 | % | | 6 | % | | 5 | % | | 6 | % | | 6 | % | | 7 | % |

Japan | | 727 |

| | 271 |

| | 365 |

| | 257 |

| | 378 |

| | 229 |

|

% of Total | | 25 | % | | 11 | % | | 15 | % | | 10 | % | | 15 | % | | 10 | % |

Korea | | 349 |

| | 308 |

| | 607 |

| | 449 |

| | 217 |

| | 226 |

|

% of Total | | 12 | % | | 12 | % | | 24 | % | | 18 | % | | 9 | % | | 10 | % |

Taiwan | | 828 |

| | 751 |

| | 589 |

| | 455 |

| | 497 |

| | 598 |

|

% of Total | | 29 | % | | 30 | % | | 23 | % | | 19 | % | | 20 | % | | 26 | % |

Southeast Asia | | 142 |

| | 94 |

| | 103 |

| | 87 |

| | 177 |

| | 81 |

|

% of Total | | 5 | % | | 4 | % | | 4 | % | | 4 | % | | 7 | % | | 4 | % |

China | | 442 |

| | 282 |

| | 352 |

| | 412 |

| | 384 |

| | 288 |

|

% of Total | | 15 | % | | 11 | % | | 14 | % | | 17 | % | | 16 | % | | 13 | % |

| | | | | | | | | | | | |

Employees (In thousands) | | | | | | | | | | | | |

Regular Full Time | | 14.5 | | | 14.3 | | | 13.8 | |

Applied Materials, Inc.

Page 9 of 12

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED RESULTS

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

(In millions, except percentages) | | July 26,

2015 | | April 26,

2015 | | July 27,

2014 | | July 26,

2015 | | July 27,

2014 |

Non-GAAP Adjusted Gross Profit | | | | | | | | | | |

Reported gross profit - GAAP basis | | $ | 1,018 |

| | $ | 1,016 |

| | $ | 992 |

| | $ | 2,993 |

| | $ | 2,884 |

|

Certain items associated with acquisitions1 | | 41 |

| | 39 |

| | 38 |

| | 120 |

| | 116 |

|

Inventory charges related to restructuring3 | | 34 |

| | — |

| | — |

| | 34 |

| | — |

|

Acquisition integration costs | | — |

| | — |

| | — |

| | — |

| | 1 |

|

Non-GAAP adjusted gross profit | | $ | 1,093 |

| | $ | 1,055 |

| | $ | 1,030 |

| | $ | 3,147 |

| | $ | 3,001 |

|

Non-GAAP adjusted gross margin | | 43.9 | % | | 43.2 | % | | 45.5 | % | | 43.2 | % | | 44.1 | % |

Non-GAAP Adjusted Operating Income | | | | | | | | | | |

Reported operating income - GAAP basis | | $ | 396 |

| | $ | 416 |

| | $ | 391 |

| | $ | 1,270 |

| | $ | 1,108 |

|

Certain items associated with acquisitions1 | | 47 |

| | 45 |

| | 44 |

| | 138 |

| | 135 |

|

Acquisition integration costs | | 1 |

| | — |

| | 9 |

| | 2 |

| | 30 |

|

Loss (gain) on derivatives associated with terminated business combination, net | | 3 |

| | (14 | ) | | 10 |

| | (89 | ) | | 9 |

|

Certain items associated with terminated business combination2 | | 1 |

| | 29 |

| | 23 |

| | 50 |

| | 50 |

|

Restructuring, inventory charges and asset impairments3, 4 | | 50 |

| | — |

| | — |

| | 50 |

| | 7 |

|

Foreign exchange loss due to functional currency change5 | | 19 |

| | — |

| | — |

| | 19 |

| | — |

|

Non-GAAP adjusted operating income | | $ | 517 |

| | $ | 476 |

| | $ | 477 |

| | $ | 1,440 |

| | $ | 1,339 |

|

Non-GAAP adjusted operating margin | | 20.8 | % | | 19.5 | % | | 21.1 | % | | 19.8 | % | | 19.7 | % |

Non-GAAP Adjusted Net Income | | | | | | | | | | |

Reported net income - GAAP basis6 | | $ | 329 |

| | $ | 364 |

| | $ | 301 |

| | $ | 1,041 |

| | $ | 816 |

|

Certain items associated with acquisitions1 | | 47 |

| | 45 |

| | 44 |

| | 138 |

| | 135 |

|

Acquisition integration costs | | 1 |

| | — |

| | 9 |

| | 2 |

| | 30 |

|

Loss (gain) on derivatives associated with terminated business combination, net | | 3 |

| | (14 | ) | | 10 |

| | (89 | ) | | 9 |

|

Certain items associated with terminated business combination2 | | 1 |

| | 29 |

| | 23 |

| | 50 |

| | 50 |

|

Restructuring, inventory charges and asset impairments3, 4 | | 50 |

| | — |

| | — |

| | 50 |

| | 7 |

|

Impairment (gain on sale) of strategic investments, net | | (1 | ) | | 6 |

| | (1 | ) | | 6 |

| | (4 | ) |

Foreign exchange loss due to functional currency change5 | | 19 |

| | — |

| | — |

| | 19 |

| | — |

|

Reinstatement of federal R&D tax credit, resolution of prior years’ income tax filings and other tax items6 | | (21 | ) | | (54 | ) | | (19 | ) | | (92 | ) | | (22 | ) |

Income tax effect of non-GAAP adjustments | | (18 | ) | | (14 | ) | | (18 | ) | | (15 | ) | | (45 | ) |

Non-GAAP adjusted net income | | $ | 410 |

| | $ | 362 |

| | $ | 349 |

| | $ | 1,110 |

| | $ | 976 |

|

|

| |

1 | These items are incremental charges attributable to completed acquisitions, consisting of amortization of purchased intangible assets. |

| |

2 | These items are incremental charges related to the terminated business combination agreement with Tokyo Electron Limited, consisting of acquisition-related and integration planning costs. |

| |

3 | Results for the three and nine months ended July 26, 2015 primarily included $34 million of inventory charges and $17 million of restructuring charges and asset impairments related to cost reductions in the solar business. |

| |

4 | Results for the nine months ended July 27, 2014 included a $7 million of employee-related costs related to the restructuring program announced on October 3, 2012. |

| |

5 | Results for the three and nine months ended July 26, 2015 included a $19 million foreign exchange loss due to an immaterial correction of an error related to functional currency change. |

| |

6 | Amounts for the three months ended April 26, 2015 and nine months ended July 26, 2015 included an adjustment to decrease the provision for income taxes by $39 million and $35 million, respectively, with a corresponding increase in net income, resulting in an increase in diluted earnings per share of $0.03. The adjustment was excluded in Applied's non-GAAP adjusted results and was made primarily to correct an error in the recognition of cost of sales in the U.S. related to intercompany sales, which resulted in overstating profitability in the U.S. and the provision for income taxes in immaterial amounts in each year since fiscal 2010. |

Applied Materials, Inc.

Page 10 of 12

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED RESULTS

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

(In millions except per share amounts) | | July 26,

2015 | | April 26,

2015 | | July 27,

2014 | | July 26,

2015 | | July 27,

2014 |

Non-GAAP Adjusted Earnings Per Diluted Share | | | | | | | | | | |

Reported earnings per diluted share - GAAP basis1 | | $ | 0.27 |

| | $ | 0.29 |

| | $ | 0.24 |

| | $ | 0.84 |

| | $ | 0.66 |

|

Certain items associated with acquisitions | | 0.03 |

| | 0.03 |

| | 0.03 |

| | 0.10 |

| | 0.09 |

|

Acquisition integration costs | | — |

| | — |

| | 0.01 |

| | — |

| | 0.02 |

|

Certain items associated with terminated business combination | | — |

| | 0.02 |

| | 0.02 |

| | 0.03 |

| | 0.04 |

|

Gain on derivative associated with terminated business combination, net | | — |

| | (0.01 | ) | | — |

| | (0.05 | ) | | — |

|

Restructuring, inventory charges and asset impairments | | 0.03 |

| | — |

| | — |

| | 0.03 |

| | — |

|

Reinstatement of federal R&D tax credit, resolution of prior years’ income tax filings and other tax items1 | | (0.02 | ) | | (0.04 | ) | | (0.02 | ) | | (0.07 | ) | | (0.02 | ) |

Foreign exchange loss due to functional currency change | | 0.02 |

| | — |

| | — |

| | 0.02 |

| | — |

|

Non-GAAP adjusted earnings per diluted share | | $ | 0.33 |

| | $ | 0.29 |

| | $ | 0.28 |

| | $ | 0.90 |

| | $ | 0.79 |

|

Weighted average number of diluted shares | | 1,231 |

| | 1,241 |

| | 1,233 |

| | 1,238 |

| | 1,230 |

|

|

| |

1 | Amounts for the three months ended April 26, 2015 and nine months ended July 26, 2015 included an adjustment to decrease the provision for income taxes by $39 million and $35 million, respectively, with a corresponding increase in net income, resulting in an increase in diluted earnings per share of $0.03. The adjustment was excluded in Applied's non-GAAP adjusted results and was made primarily to correct an error in the recognition of cost of sales in the U.S. related to intercompany sales, which resulted in overstating profitability in the U.S. and the provision for income taxes in immaterial amounts in each year since fiscal 2010. |

| |

Applied Materials, Inc.

Page 11 of 12

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED RESULTS

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

(In millions, except percentages) | | July 26,

2015 | | April 26,

2015 | | July 27,

2014 | | July 26,

2015 | | July 27,

2014 |

SSG Non-GAAP Adjusted Operating Income | | | | | | | | | | |

Reported operating income - GAAP basis | | $ | 411 |

| | $ | 374 |

| | $ | 381 |

| | $ | 1,092 |

| | $ | 1,086 |

|

Certain items associated with acquisitions1 | | 44 |

| | 44 |

| | 42 |

| | 131 |

| | 126 |

|

Acquisition integration costs | | — |

| | — |

| | — |

| | — |

| | 1 |

|

Non-GAAP adjusted operating income | | $ | 455 |

| | $ | 418 |

| | $ | 423 |

| | $ | 1,223 |

| | $ | 1,213 |

|

Non-GAAP adjusted operating margin | | 27.8 | % | | 26.8 | % | | 28.7 | % | | 26.4 | % | | 26.7 | % |

AGS Non-GAAP Adjusted Operating Income | | | | | | | | | | |

Reported operating income - GAAP basis | | $ | 170 |

| | $ | 170 |

| | $ | 154 |

| | $ | 493 |

| | $ | 427 |

|

Certain items associated with acquisitions1 | | — |

| | — |

| | — |

| | 1 |

| | 3 |

|

Inventory charges related to restructuring2 | | 3 |

| | — |

| | — |

| | 3 |

| | — |

|

Non-GAAP adjusted operating income | | $ | 173 |

| | $ | 170 |

| | $ | 154 |

| | $ | 497 |

| | $ | 430 |

|

Non-GAAP adjusted operating margin | | 26.0 | % | | 26.3 | % | | 27.2 | % | | 26.2 | % | | 26.7 | % |

Display Non-GAAP Adjusted Operating Income | | | | | | | | | | |

Reported operating income - GAAP basis | | $ | 25 |

| | $ | 40 |

| | $ | 25 |

| | $ | 137 |

| | $ | 77 |

|

Certain items associated with acquisitions1 | | 1 |

| | — |

| | 1 |

| | 2 |

| | 2 |

|

Non-GAAP adjusted operating income | | $ | 26 |

| | $ | 40 |

| | $ | 26 |

| | $ | 139 |

| | $ | 79 |

|

Non-GAAP adjusted operating margin | | 17.2 | % | | 24.5 | % | | 21.8 | % | | 23.6 | % | | 18.6 | % |

EES Non-GAAP Adjusted Operating Income (Loss) | | | | | | | | | | |

Reported operating income (loss) - GAAP basis | | $ | (52 | ) | | $ | (5 | ) | | $ | 24 |

| | $ | (61 | ) | | $ | 18 |

|

Certain items associated with acquisitions1 | | 2 |

| | 1 |

| | 1 |

| | 4 |

| | 4 |

|

Restructuring, inventory charges and asset impairments2 | | 48 |

| | — |

| | — |

| | 48 |

| | — |

|

Non-GAAP adjusted operating income (loss) | | $ | (2 | ) | | $ | (4 | ) | | $ | 25 |

| | $ | (9 | ) | | $ | 22 |

|

Non-GAAP adjusted operating margin | | (5.1 | )% | | (5.5 | )% | | 24.3 | % | | (5.4 | )% | | 9.5 | % |

|

| |

1 | These items are incremental charges attributable to completed acquisitions, consisting of amortization of purchased intangible assets. |

| |

2 | Results for the three and nine months ended July 26, 2015 included a $34 million of inventory charges and $17 million of restructuring charges and asset impairments related to cost reductions in the solar business. |

Applied Materials, Inc.

Page 12 of 12

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED OPERATING EXPENSES

|

| | | | | | | |

| Three Months Ended |

(In millions) | July 26, 2015 | | April 26, 2015 |

| | | |

Operating expenses - GAAP basis | $ | 622 |

| | $ | 600 |

|

Gain (loss) on derivative associated with terminated business combination, net | (3 | ) | | 14 |

|

Restructuring charges and asset impairments | (16 | ) | | — |

|

Certain items associated with acquisitions | (6 | ) | | (6 | ) |

Acquisition integration costs | (1 | ) | | — |

|

Certain items associated with terminated business combination

| (1 | ) | | (29 | ) |

Foreign exchange loss due to functional currency change | (19 | ) | | — |

|

Non-GAAP adjusted operating expenses | $ | 576 |

| | $ | 579 |

|

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED EFFECTIVE INCOME TAX RATE

|

| | | |

| Three Months Ended |

(In millions, except percentages) | July 26, 2015 |

| |

Provision for income taxes - GAAP basis (a) | $ | 46 |

|

Reinstatement of federal R&D tax credit, resolutions of prior years’ income tax filings and other tax items | 21 |

|

Income tax effect of non-GAAP adjustments | 18 |

|

Non-GAAP adjusted provision for income taxes (b) | $ | 85 |

|

| |

Income before income taxes - GAAP basis (c) | $ | 375 |

|

Certain items associated with acquisitions | 47 |

|

Restructuring, inventory charges and asset impairments | 50 |

|

Acquisition integration costs | 1 |

|

Loss on derivative associated with terminated business combination | 3 |

|

Certain items associated with terminated business combination | 1 |

|

Gain on strategic investments, net | (1 | ) |

Foreign exchange loss due to functional currency change | 19 |

|

Non-GAAP adjusted income before income taxes (d) | $ | 495 |

|

| |

Effective income tax rate - GAAP basis (a/c) | 12.3 | % |

| |

Non-GAAP adjusted effective income tax rate (b/d) | 17.2 | % |

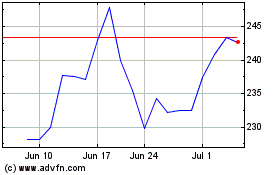

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

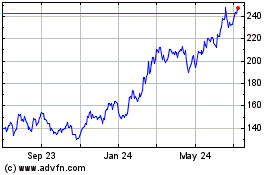

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024