Current Report Filing (8-k)

June 08 2016 - 4:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

June 8, 2016

ALKERMES PUBLIC LIMITED COMPANY

(Exact Name of Registrant as Specified in its Charter)

|

Ireland

|

|

001—35299

|

|

98-1007018

|

|

(State or Other Jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

Incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

Connaught House

|

|

|

|

1 Burlington Road

|

|

|

|

Dublin 4, Ireland

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

+353-1-772-8000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01

Other Events.

On June 3, 2016, the U.S. Patent and Trademark Office (the “U.S. PTO”) accepted two separate petitions for inter partes review (“IPR”) filed by Luye Pharma Group Ltd., Luye Pharma (USA) Ltd., Shandong Luye Pharmaceutical Co., Ltd., and Nanjing Luye Pharmaceutical Co., Ltd. (collectively, “Luye”) challenging U.S. Patent Number 6,667,061 (the “‘061 Patent”), which is an Orange Book-listed patent for each of

Bydureon®, Risperdal Consta® and Vivitrol®. Alkermes plc, together with its affiliates (the “Company”), has a three-month period to respond, following which the U.S. PTO has a further three-month period to decide whether or not to institute a review of the challenged claims of the ‘061 Patent. If such review is instituted, a decision on the matter would be expected, pursuant to the statutory time frame, within one year of the U.S. PTO’s decision to institute such review.

The Company will oppose Luye’s requests to institute the challenge of the

‘061 Patent

, and, if the U.S. PTO institutes such challenge, the Company will oppose the full proceedings and vigorously defend the ‘061 Patent.

Note Regarding Forward-Looking Statements

Certain statements set forth in Item 8.01 above constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including if the U.S. PTO

institutes the challenge of the ‘061 Patent, the timing of the U.S. PTO’s decision if such challenge is instituted, the Company’s ability to oppose the institution of the ‘061 Patent IPR and, if instituted, the Company’s ability to defend the ‘061 Patent. Although Alkermes believes that such statements are based on reasonable assumptions within the bounds of its knowledge of its business and operations, the forward-looking statements are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks and uncertainties. These risks and uncertainties include those risks described in the Alkermes plc Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2015 and in any other subsequent filings made by the Company with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. The information contained in Item 8.01 above is provided by the Company as of the date hereof, and, except as required by law, the Company disclaims any intention or responsibility for updating or revising any forward-looking information contained therein.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

ALKERMES PLC

|

|

|

|

|

|

|

|

|

|

Date: June 8, 2016

|

By:

|

/s/ James M. Frates

|

|

|

|

James M. Frates

|

|

|

|

Senior Vice President, Chief Financial Officer and Treasurer

|

3

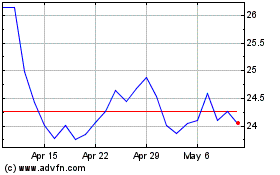

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

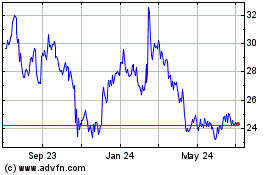

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Apr 2023 to Apr 2024