— Third Quarter Revenues of $152.7 Million and

Non-GAAP Diluted Loss Per Share of $0.18 —

— Commercial Launch of ARISTADA™ Underway

Following FDA Approval for the Treatment of Schizophrenia on Oct.

5, 2015 —

— ALKS 3831 for Schizophrenia and ALKS 8700 for

Multiple Sclerosis to Commence Registration Studies Before Year-End

—

Alkermes plc (NASDAQ: ALKS) today reported financial results for

the third quarter of 2015.

“Earlier this month, the FDA approved ARISTADA™ as the first

long-acting atypical antipsychotic for the treatment of

schizophrenia with both once-monthly and six-week dosing. Our

nationwide commercial launch is underway and we are delighted to

bring this important new treatment option to patients and the

treatment community,” said Richard Pops, Chief Executive Officer of

Alkermes. “Alkermes has a number of important milestones ahead that

will drive the growth of the company. Based on our recent

discussions with the FDA, we have determined the design of the

pivotal programs for both ALKS 3831 in schizophrenia and ALKS 8700

in multiple sclerosis and expect to initiate both before year-end.

The pivotal program for ALKS 5461 in major depressive disorder is

advancing rapidly, and we expect data from the first core efficacy

study in the first quarter of 2016.”

“We are pleased by our solid financial performance during the

third quarter and are on track with our financial expectations for

the remainder of 2015. The approval of ARISTADA further strengthens

our commercial portfolio and represents a major financial

opportunity for Alkermes,” commented James Frates, Chief Financial

Officer of Alkermes. “Heading into 2016, we are well-positioned to

invest in our development plans for our late-stage pipeline, the

launch of ARISTADA and drive the growth of VIVITROL®.”

Quarter Ended Sept. 30, 2015

Highlights

- Total revenues for the quarter were

$152.7 million compared to $160.0 million for the same period in

the prior year, or $143.2 million excluding $16.8 million of

revenues from the products associated with the Gainesville

manufacturing facility that was divested in April 2015.

- Net loss according to generally

accepted accounting principles in the U.S. (GAAP) was $81.0

million, or a basic and diluted GAAP loss per share of $0.54, for

the quarter. This compared to GAAP net loss of $40.0 million, or a

basic and diluted GAAP loss per share of $0.27, for the same period

in the prior year, or $34.5 million, or a basic and diluted loss

per share of $0.24, excluding $5.5 million of GAAP net income

related to the Gainesville facility and associated products.

- Non-GAAP net loss was $26.2 million, or

a non-GAAP diluted loss per share of $0.18 for the quarter. This

compared to non-GAAP net income of $3.9 million, or a non-GAAP

diluted earnings per share of $0.03, for the same period in the

prior year, or a non-GAAP net loss of $3.5 million, or a non-GAAP

basic and diluted loss per share of $0.02, excluding $7.4 million

of non-GAAP net income related to the Gainesville facility and

associated products.

Quarter Ended Sept. 30, 2015 Financial

Results

Revenues

- Manufacturing and royalty revenues from

RISPERDAL CONSTA® and INVEGA SUSTENNA®/XEPLION® were $67.6 million,

compared to $68.5 million for the same period in the prior

year.

- Net sales of VIVITROL were $37.9

million, compared to $25.8 million for the same period in the prior

year, representing an increase of approximately 47%.

- Manufacturing and royalty revenues from

AMPYRA®/FAMPYRA®1 were $22.1 million, compared to $16.5 million for

the same period in the prior year.

- Royalty revenue from BYDUREON® was

$13.0 million, compared to $10.3 million for the same period in the

prior year.

Costs and Expenses

- Operating expenses were $230.1 million,

reflecting increased investment in the company’s rapidly advancing

development pipeline and pre-launch activities for ARISTADA, and

included $13.9 million of share-based compensation expense related

to the partial vesting of a performance-based equity grant related

to the approval of ARISTADA. This compared to $192.7 million for

the same period in the prior year, or $180.0 million excluding

$12.7 million of operating expenses related to the Gainesville

facility and associated products.

- Income tax provision was $3.0 million,

compared to $3.5 million for the same period in the prior

year.

Balance Sheet

At Sept. 30, 2015, Alkermes had cash and total investments of

$815.5 million, compared to $801.6 million at Dec. 31, 2014. At

Sept. 30, 2015, the company’s total debt outstanding was $353.2

million.

Conference Call

Alkermes will host a conference call at 8:30 a.m. EDT (12:30

p.m. GMT) on Thursday, Oct. 29, 2015, to discuss these financial

results and provide an update on the company. The conference call

may be accessed by dialing +1 888 424 8151 for U.S. callers and +1

847 585 4422 for international callers. The conference call ID

number is 6037988. In addition, a replay of the conference call

will be available from 11:00 a.m. EDT (3:00 p.m. GMT) on Thursday,

Oct. 29, 2015, through 5:00 p.m. EST (10:00 p.m. GMT) on Thursday,

Nov. 5, 2015, and may be accessed by visiting Alkermes’ website or

by dialing +1 888 843 7419 for U.S. callers and +1 630 652 3042 for

international callers. The replay access code is 6037988.

About Alkermes

Alkermes plc is a fully integrated, global

biopharmaceutical company developing innovative medicines for the

treatment of central nervous system (CNS) diseases. The company has

a diversified commercial product portfolio and a substantial

clinical pipeline of product candidates for chronic diseases that

include schizophrenia, depression, addiction and multiple

sclerosis. Headquartered in Dublin, Ireland, Alkermes plc has an

R&D center in Waltham, Massachusetts; a research and

manufacturing facility in Athlone, Ireland; and a manufacturing

facility in Wilmington, Ohio. For more information, please visit

Alkermes’ website at www.alkermes.com.

Non-GAAP Financial

Measures

This press release includes information about certain financial

measures that are not prepared in accordance with generally

accepted accounting principles in the U.S. (GAAP), including

non-GAAP net income or loss, non-GAAP diluted earnings or loss per

share and free cash flow. These non-GAAP measures are not based on

any standardized methodology prescribed by GAAP and are not

necessarily comparable to similar measures presented by other

companies.

Management defines its non-GAAP financial measures as

follows:

- Non-GAAP net income or loss adjusts for

one-time and non-cash charges by excluding from GAAP results:

share-based compensation expense; amortization; depreciation;

non-cash net interest expense; non-cash tax expense; deferred

revenue; and certain other one-time or non-cash items.

- Free cash flow represents non-GAAP net

income or loss less capital expenditures.

The company’s management believes that these non-GAAP financial

measures, when viewed with the company’s results under GAAP and the

accompanying reconciliations, better indicate underlying trends in

ongoing operations and cash flows. However, non-GAAP net income or

loss, non-GAAP diluted earnings or loss per share and free cash

flow are not measures of financial performance under GAAP and,

accordingly, should not be considered as alternatives to GAAP

measures as indicators of operating performance.

A reconciliation of GAAP to non-GAAP financial measures has been

provided in the tables included in this press release.

Note Regarding Forward-Looking

Statements

Certain statements set forth above may constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, as amended, including,

but not limited to: statements concerning future financial and

operating performance, business plans or prospects; the likelihood

of continued revenue growth from the company’s commercial products;

the therapeutic and commercial value of the company’s products; and

expectations concerning the timing and results of development

activities, including the timing of the commencement of the pivotal

programs for ALKS 3831 and ALKS 8700 and the receipt of data from

the first core efficacy study of ALKS 5461. The company cautions

that forward-looking statements are inherently uncertain. Although

the company believes that such statements are based on reasonable

assumptions within the bounds of its knowledge of its business and

operations, the forward-looking statements are neither promises nor

guarantees and they are necessarily subject to a high degree of

uncertainty and risk. Actual performance and results may differ

materially from those expressed or implied in the forward-looking

statements due to various risks and uncertainties. These risks and

uncertainties include, among others: the impact of litigation,

including litigation against regulatory authorities, in respect of

our products; clinical development activities may not be completed

on time or at all and the results of such activities may not be

predictive of real-world results or of results in subsequent

clinical trials; regulatory submissions may not occur or be

submitted in a timely manner; the company, and its partners, may

not be able to continue to successfully commercialize its products;

there may be a reduction in payment rate or reimbursement for the

company’s products or an increase in the company’s financial

obligations to governmental payers; the U.S. Food and Drug

Administration or regulatory authorities outside the U.S. may make

adverse decisions regarding the company’s products; the company’s

products may prove difficult to manufacture, be precluded from

commercialization by the proprietary rights of third parties, or

have unintended side effects, adverse reactions or incidents of

misuse; and those risks and uncertainties described under the

heading “Item 1A. Risk Factors” in the company’s Annual Report on

Form 10-K for the fiscal year ended Dec. 31, 2014 and under

the heading “Item 1A. Risk Factors” in the company’s Quarterly

Report on Form 10-Q for the fiscal quarter ended Sept. 30,

2015, and in any other subsequent filings made by the company with

the Securities and Exchange Commission (“SEC”), which are available

on the SEC’s website at www.sec.gov. Existing and prospective

investors are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date they

are made. The information contained in this press release is

provided by the company as of the date hereof and, except as

required by law, the company disclaims any intention or

responsibility for updating or revising any forward-looking

information contained in this press release.

ARISTADA™ is a trademark of Alkermes Pharma Ireland Limited;

VIVITROL® is a registered trademark of Alkermes, Inc. RISPERDAL

CONSTA®, INVEGA SUSTENNA® and XEPLION® are registered trademarks of

Johnson & Johnson; AMPYRA® and FAMPYRA® are registered

trademarks of Acorda Therapeutics, Inc.; BYDUREON® is a registered

trademark of Amylin Pharmaceuticals, LLC.

1AMPYRA® (dalfampridine) Extended Release Tablets, 10 mg is

developed and marketed in the U.S. by Acorda Therapeutics, Inc. and

outside the U.S. by Biogen International GmbH, under a licensing

agreement with Acorda Therapeutics, Inc., as FAMPYRA®

(prolonged-release fampridine tablets).

(tables follow)

Alkermes plc and

SubsidiariesSelected Financial Information (Unaudited)

Three Months Three Months Ended Ended

Condensed

Consolidated Statements of Operations - GAAP September 30,

September 30,

(In thousands, except per share data)

2015 2014 Revenues: Manufacturing and royalty

revenues $ 114,072 $ 132,028 Product sales, net 37,903 25,802

Research and development revenues 678 2,162

Total Revenues 152,653 159,992

Expenses: Cost of goods manufactured and sold 33,806 47,335

Research and development 92,558 78,263 Selling, general and

administrative 89,497 51,888 Amortization of acquired intangible

assets 14,207 15,244 Total Expenses

230,068 192,730 Operating Loss

(77,415 ) (32,738 ) Other Expense, net: Interest income 865

546 Interest expense (3,325 ) (3,356 ) Gain on the Gainesville

Transaction 26 - Increase in the fair value of contingent

consideration 1,200 - Gain on sale of property, plant and equipment

- 36 Other income (expense), net 629 (921 )

Total Other Expense, net (605 ) (3,695 ) Loss Before

Income Taxes (78,020 ) (36,433 ) Income Tax Provision

2,995 3,523

Net Loss — GAAP $

(81,015 ) $ (39,956 )

(Loss) Earnings Per Share: GAAP

loss per share — basic and diluted $ (0.54 ) $ (0.27 ) Non-GAAP

(loss) earnings per share — basic and diluted $ (0.18 ) $ 0.03

Weighted Average Number of Ordinary Shares

Outstanding: Basic and diluted — GAAP 149,512

145,896 Basic — Non-GAAP 149,512

145,896 Diluted — Non-GAAP 149,512

154,399 An itemized reconciliation between net loss

on a GAAP basis and non-GAAP net (loss) income is as follows:

Net Loss — GAAP $ (81,015 ) $ (39,956 ) Adjustments:

Share-based compensation expense 35,267 13,481 Amortization expense

14,207 15,244 Depreciation expense 6,486 9,989 Non-cash taxes 677

3,640 Non-cash net interest expense 234 238 Deferred revenue (725 )

696 Net (gain) loss on transactions with equity method investee

(397 ) 603 Gain on the Gainesville Transaction (26 ) - Increase in

the fair value of contingent consideration (1,200 ) - Change in the

fair value of common stock warrants 318 - Gain on sale of property,

plant and equipment - (36 )

Non-GAAP Net

(Loss) Income $ (26,174 ) $ 3,899 Capital expenditures

11,974 8,888

Free Cash Outflow $

(38,148 ) $ (4,989 ) Nine Months Nine Months

Ended Ended

Condensed Consolidated Statements of Operations -

GAAP September 30, September 30,

(In thousands, except per

share data) 2015 2014 Revenues:

Manufacturing and royalty revenues $ 355,978 $ 373,674 Product

sales, net 106,212 64,476 Research and development revenues

3,047 5,478 Total Revenues 465,237

443,628 Expenses: Cost of goods manufactured

and sold 104,198 129,464 Research and development 250,718 197,610

Selling, general and administrative 224,086 145,101 Amortization of

acquired intangible assets 43,479 42,909

Total Expenses 622,481 515,084

Operating Loss (157,244 ) (71,456 )

Other Income, net: Interest income 2,320 1,380 Interest expense

(9,928 ) (10,097 ) Gain on the Gainesville Transaction 9,937 -

Increase in the fair value of contingent consideration 2,700 - Gain

on sale of investment in Acceleron Pharma Inc. - 15,296 Gain on

sale of property, plant and equipment - 12,321 Other income

(expense), net 1,003 (2,253 ) Total Other

Income, net 6,032 16,647 Loss Before

Income Taxes (151,212 ) (54,809 ) Income Tax

Provision 6,569 5,766

Net Loss —

GAAP $ (157,781 ) $ (60,575 )

(Loss) Earnings Per

Share: GAAP loss per share — basic and diluted $ (1.06 ) $

(0.42 ) Non-GAAP (loss) earnings per share — basic $ (0.21 ) $ 0.26

Non-GAAP (loss) earnings per share — diluted $ (0.21 ) $

0.25

Weighted Average Number of Ordinary Shares

Outstanding: Basic and diluted — GAAP 148,828

144,732 Basic — Non-GAAP 148,828

144,732 Diluted — Non-GAAP 148,828

154,017 An itemized reconciliation between net loss

on a GAAP basis and non-GAAP net (loss) income is as follows:

Net Loss — GAAP $ (157,781 ) $ (60,575 ) Adjustments:

Share-based compensation expense 74,473 46,238 Amortization expense

43,479 42,909 Depreciation expense 20,336 29,810 Non-cash taxes

4,199 5,055 Non-cash net interest expense 705 717 Deferred revenue

(1,627 ) (607 ) Net (gain) loss on transactions with equity method

investee (1,191 ) 1,842 Gain on the Gainesville Transaction (9,937

) - Increase in the fair value of contingent consideration (2,700 )

- Change in the fair value of common stock warrants (558 ) - Gain

on sale of investment in Acceleron Pharma Inc. - (15,296 ) Gain on

sale of property, plant and equipment -

(12,321 )

Non-GAAP Net (Loss) Income $ (30,602 ) $ 37,772

Capital expenditures 36,730 20,326

Free Cash (Outflow) Inflow $ (67,332 ) $ 17,446

Condensed Consolidated Balance Sheets

September 30, December 31,

(In thousands) 2015 2014 Cash,

cash equivalents and total investments $ 815,499 $ 801,646

Receivables 140,987 151,551 Inventory 36,783 51,357 Prepaid

expenses and other current assets 50,893 42,719 Property, plant and

equipment, net 242,675 265,740 Intangible assets, net and goodwill

486,266 573,624 Contingent consideration 60,300 - Other assets

47,552 34,635

Total Assets $

1,880,955 $ 1,921,272 Long-term debt — current

portion $ 66,712 $ 6,750 Other current liabilities 133,690 123,832

Long-term debt 286,512 351,220 Deferred revenue — long-term 7,477

11,801 Other long-term liabilities 19,759 30,832 Total

shareholders' equity 1,366,805 1,396,837

Total Liabilities and Shareholders' Equity $

1,880,955 $ 1,921,272 Ordinary shares

outstanding (in thousands) 149,854 147,539

This selected financial information should be read in

conjunction with the consolidated financial statements and notes

thereto included in Alkermes plc's Quarterly Report on Form 10-Q

for the three and nine months ended September 30, 2015, which the

company intends to file in October 2015.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151029005359/en/

AlkermesFor Investors:Sandy Coombs,

+1-781-609-6377orFor Media:Jennifer Snyder, +1-781-609-6166

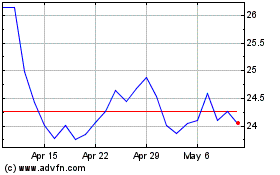

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

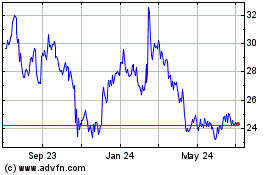

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Apr 2023 to Apr 2024