Elan Sells EDT Unit To Alkermes To Generate Cash, Cut Debt

May 09 2011 - 4:46AM

Dow Jones News

Elan Corp. PLC (ELN) Monday sealed a transformational deal to

sell its drug technology unit EDT to U.S.-based Alkermes Inc.

(ALKS) in a deal valued at $960 million that allows the Irish drug

maker to pay down debt and fund pipeline development.

EDT and Alkermes will be combined under a new holding company

incorporated in Ireland. The combined group, in which Elan will

have a 25% stake, will focus on products dealing with the brain and

is expected to have annual revenue of around $450 million from 25

products, including treatments for schizophrenia and pain.

Elan said the spinoff of EDT--a long-standing aim--will allow it

to become a pure neurology-based biotech business with adequate

funding.

"This allows us to reduce debt and have a lot of cash for

investment in the research and development part of the business,

which is key for Elan, and it allows us to take financial risk off

the table and invest in our science and our assets in the

intermediate term, which has been a long-term goal of the company,"

Elan's Chief Executive Kelly Martin told Dow Jones Newswires.

Martin said the restructured company will be able to focus more

on its flagship multiple sclerosis treatment Tysabri which it

manufactures and sells along with its U.S. joint venture partner

Biogen Idec Inc.'s (BIIB).

Multiple sclerosis is a chronic, inflammatory condition that

occurs when the body essentially attacks its own central nervous

system and can be disabling in advanced stages.

"Tysabri's growth is very significant and continues to

accelerate," Martin said, adding that the medicine's growth

potential outside the U.S. looks especially promising.

The new entity will be called Alkermes PLC. Richard Pops,

currently chairman, president and CEO of Alkermes, will serve as

Alkermes PLC's chairman and chief executive.

Elan's Chief Financial Officer Shane Cooke, who is also

currently head of EDT, will join the new holding company as

president. Nigel Clerkin will be Elan's CFO on an interim

basis.

In 2009, U.S.-based Johnson & Johnson paid $885 million for

an 18.4% stake in Elan and acquired rights to advanced research

into drugs for Alzheimer's disease, representing most of the value

credited to the Elan Alzheimer's pipeline at the time.

Martin said the sale of its EDT business "will allow us to focus

even more on the area of neuro degenerative diseases with

significant strategic and financial flexibility. It's a very

shareholder-friendly transaction."

The market seemed to agree, and at 0805 GMT Elan shares were up

11%, or 53 cents higher, at EUR553. The share is up 7.5% on

year.

-By Sten Stovall, Dow Jones Newswires; +44 207 842 9292;

sten.stovall@dowjones.com

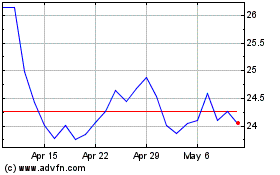

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

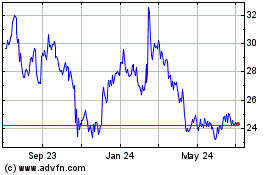

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Apr 2023 to Apr 2024