Aeterna Zentaris Announces Pricing of US$16.65 Million Public Offering of Common Shares and Warrants

December 09 2015 - 8:25AM

Business Wire

Aeterna Zentaris Inc. (NASDAQ:AEZS) (TSX:AEZ)

(the “Company”) today announced the pricing of its previously

announced underwritten public offering (the “Offering”) of common

shares and warrants with a public offering price of US$5.55 for one

common share together with a warrant to purchase 0.7 of a common

share for gross proceeds of US$16.65 million. A total of 3.0

million common shares and warrants to acquire 2.1 million common

shares are expected to be issued on closing of the Offering. In

addition, the Company has granted the underwriter a 45-day option

to purchase up to an additional 330,000 common shares and/or

warrants to purchase up to an additional 231,000 common shares, to

cover over-allotments, if any.

The warrants will be exercisable immediately and expire five

years following issuance at an exercise price of US$7.10 per share.

The warrants do not contain any price or other adjustment

provision, except for customary adjustment provisions that apply in

the event of certain corporate events or transactions that affect

all outstanding common shares. The warrants may at any time be

exercised on a “net” or “cashless” basis in accordance with a

customary formula but do not contain an alternate cashless exercise

feature contained in our previously issued Series B common shares

purchase warrants. The warrants will not be listed on any stock

exchange.

The Offering is expected to close on or about December 14, 2015,

subject to customary closing conditions including, but not limited

to, the receipt of all necessary regulatory approvals, including

the approvals of the NASDAQ Capital Market (“NASDAQ”) and the

Toronto Stock Exchange (“TSX”).

Net proceeds from the Offering are expected to be approximately

US$15.0 million, after deducting underwriting commissions and

discounts and other expenses related to the Offering. The Company

intends to use the net proceeds from the Offering to continue to

fund its ongoing drug development activities, for the potential

addition of commercialized products to the Company’s portfolio, and

for general corporate purposes, for working capital and to fund

negative cash flow.

Maxim Group LLC is acting as sole book-running manager for the

Offering. H.C. Wainwright & Co., LLC is acting as financial

advisor to the Company in connection with the Offering.

The Offering is being conducted pursuant to the Company’s

effective shelf registration statement on Form F-10 filed with the

U.S. Securities and Exchange Commission (the “SEC”), its

corresponding Canadian base shelf prospectus and an exemption from

the Autorité des marches financiers permitting the Company to offer

common shares, warrants and such other securities specified therein

in the United States. The proposed Offering will be made only by

means of a preliminary prospectus supplement, a final prospectus

supplement and the accompanying short form base shelf prospectus.

When available, copies of the preliminary prospectus supplement,

the final prospectus supplement and the accompanying short form

base shelf prospectus may be obtained upon request by contacting

Maxim Group LLC, 405 Lexington Avenue, 2nd Floor, New York, NY

10174, (212) 895-3745. Electronic copies of the preliminary

prospectus supplement, the final prospectus supplement and the

accompanying short form base shelf prospectus will also be

available free of charge at www.sedar.com and www.sec.gov,

respectively.

This press release does not and shall not constitute an offer

to sell or the solicitation of an offer to buy any of the Company’s

securities, nor shall there be any sale of the Company’s securities

in any state or jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state or jurisdiction.

About Aeterna Zentaris Inc.

Aeterna Zentaris is a specialty biopharmaceutical company

engaged in developing and commercializing novel treatments in

oncology, endocrinology and women’s health. We are engaged in drug

development activities and in the promotion of products for others.

The focus of our business development efforts is the acquisition of

licenses to products that are relevant to our therapeutic areas of

focus. We also intend to license out certain commercial rights of

internally developed products to licensees in territories where

such out-licensing would enable us to ensure development,

registration and launch of our product candidates. Our goal is to

become a growth-oriented specialty biopharmaceutical company by

pursuing successful development and commercialization of our

product portfolio, achieving successful commercial presence and

growth, while consistently delivering value to our shareholders,

employees and the medical providers and patients who will benefit

from our products. For more information, visit www.aezsinc.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151209005691/en/

Aeterna Zentaris Inc.Philip Theodore, 843-900-3223Senior Vice

Presidentptheodore@aezsinc.com

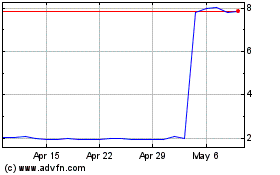

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

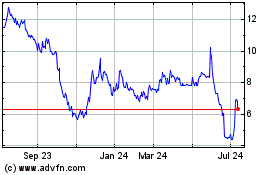

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024