UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2015

Commission file number 0-30752

AETERNA

ZENTARIS INC.

c/o Norton Rose Fulbright Canada LLP

1 Place Ville Marie

Suite 2500

Montreal, QC

H3B 1R1

(Address

of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b): 82- .

DOCUMENTS INDEX

|

|

|

| Documents |

|

Description |

|

|

| 99.1 |

|

Press release dated December 8, 2015 |

|

|

| 99.2 |

|

Form of Common Share Purchase Warrant to be issued by the registrant in connection with an offering |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AETERNA ZENTARIS INC. |

|

|

|

|

| Date: December 8, 2015 |

|

|

|

By: |

|

/s/ Philip A. Theodore |

|

|

|

|

|

|

Philip A. Theodore |

|

|

|

|

|

|

Senior Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary |

Exhibit 99.1

Aeterna Zentaris Inc. 1405 du Parc-Technologique Blvd.

Québec (Québec) Canada G1P 4P5 T 418 652-8525 F 418 652-0881

www.aezsinc.com

Press Release

For immediate release

Aeterna Zentaris

Announces Proposed Public Offering of Common Shares and Warrants

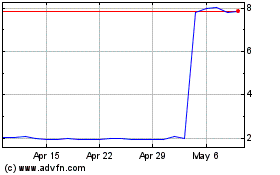

Quebec City, Canada, December 8, 2015 – Aeterna Zentaris Inc. (NASDAQ:

AEZS; TSX: AEZ) (the “Company”) today announced that it has commenced an underwritten public offering (the “Offering”) of common shares and warrants to purchase common shares. Investors whose purchase of common shares

in the Offering would result in them beneficially owning more than the initial beneficial ownership limitation to be included in the warrants following the consummation of the Offering will have the opportunity to acquire pre-funded warrants

substituted for any common shares they would have otherwise acquired over the initial beneficial ownership limitation, paying the same price per share. The pricing and number of shares and warrants as well as the exercise price and duration of the

warrants will be determined in the course of marketing.

Maxim Group LLC is acting as sole book-running manager for the proposed Offering.

The proposed Offering is subject to customary conditions, including the approval of The NASDAQ Stock Market (“NASDAQ”) and the Toronto Stock Exchange (“TSX”), and there can be no assurance as to whether or when the proposed

Offering may be completed, or as to the actual size or terms of the Offering. The Company has no intention of listing the warrants on the NASDAQ or TSX.

The Offering is being conducted pursuant to the Company’s effective shelf registration statement on Form F-10 filed with the U.S. Securities and Exchange

Commission (the “SEC”), its corresponding Canadian base shelf prospectus and an exemption from the Autorité des marches financiers permitting the Company to offer common shares, warrants and such other securities specified

therein in the United States. The proposed Offering will be made only by means of a preliminary prospectus supplement, a final prospectus supplement and the accompanying short form base shelf prospectus. When available, copies of the preliminary

prospectus supplement, the final prospectus supplement and the accompanying short form base shelf prospectus may be obtained upon request by contacting Maxim Group LLC, 405 Lexington Avenue, 2nd Floor, New York, NY 10174, (212) 895-3745.

Electronic copies of the preliminary prospectus supplement, the final prospectus supplement and the accompanying short form base shelf prospectus will also be available free of charge at www.sedar.com and www.sec.gov, respectively.

This press release does not and shall not constitute an offer to sell or the solicitation of an offer to buy any of the Company’s securities, nor

shall there be any sale of the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or

jurisdiction.

About Aeterna Zentaris Inc.

Aeterna Zentaris is a specialty biopharmaceutical company engaged in developing and commercializing novel treatments in oncology, endocrinology and

women’s health. We are engaged in drug development activities and in the promotion of products for others. The focus of our business development efforts is the acquisition of licenses to products that are relevant to our therapeutic areas of

focus. We also intend to license out certain commercial rights of internally developed products to licensees in territories where such out-licensing would enable us to ensure development, registration and launch of our product candidates.

Our goal is to become a growth-oriented specialty biopharmaceutical company by pursuing successful development and

commercialization of our product portfolio, achieving successful commercial presence and growth, while consistently delivering value to our shareholders, employees and the medical providers and patients who will benefit from our products. For

more information, visit www.aezsinc.com.

Contact:

Philip Theodore

Senior Vice President

ptheodore@aezsinc.com

-30-

Exhibit 99.2

FORM OF COMMON SHARE PURCHASE WARRANT

AETERNA ZENTARIS INC.

|

|

|

| Warrant Shares: |

|

Issue Date: December , 2015 |

|

|

| Warrant Number: W- |

|

Initial Exercise Date: December , 2015 |

THIS COMMON SHARE PURCHASE WARRANT (this “Warrant”) certifies that, for value received, (or

its assigns) (the “Holder”) is entitled, upon the terms and subject to the limitations on exercise and the conditions hereinafter set forth, at any time on or after December , 2015 (the “Initial Exercise Date”) and

on or prior to the close of business on the Termination Date (as defined below) but not thereafter, to subscribe for and purchase from Aeterna Zentaris Inc., a Canadian corporation (the “Corporation”), up to Common Shares (as

defined below) (the “Warrant Shares”) of the capital of the Corporation. The purchase price of one Common Share under this Warrant shall be equal to the Exercise Price, as defined in Section 1(b) hereof. This Warrant is one of

the Warrants (collectively, the “Warrants”) issued by the Corporation in connection with an offering of Common Shares and warrants to purchase Common Shares pursuant to that certain Underwriting Agreement, dated December , 2015 (the

“Subscription Date”), by and between the Corporation and the underwriter(s) named therein. Except as otherwise defined herein, capitalized terms in this Warrant shall have the meanings set forth in Section 5.

Section 1. Exercise.

(a) Exercise of Warrant. Exercise of the purchase rights represented by this Warrant may be made, in whole or in part,

at any time or times on or after the Initial Exercise Date and on or before the Termination Date by delivery to the Corporation (or such other office or agency of the Corporation as it may designate by notice in writing to the registered Holder at

the address of the Holder appearing on the books of the Corporation) of a duly executed copy by facsimile or e-mail of the Notice of Exercise Form annexed hereto. No ink original Notice of Exercise shall be required, nor shall any medallion

guarantee (or other type of guarantee or notarization) of any Notice of Exercise form be required. On or before the first Trading Day following the date on which the Corporation has received the Notice of Exercise Form (the date upon which the

Corporation has received the Notice of Exercise Form, the “Exercise Date”), the Corporation shall transmit by facsimile or e-mail transmission an acknowledgment of receipt of the Notice of Exercise Form to the Holder and the

Corporation’s transfer agent for the Common Shares (the “Transfer Agent”). The Corporation shall deliver any objection to the Notice of Exercise Form on or before the end of the first Trading Day following the date on which the

Corporation has received the Notice of Exercise Form. Notwithstanding anything herein to the contrary, the Holder shall not be required to physically surrender this Warrant to the Corporation until the Holder has purchased all of the Warrant Shares

available hereunder and this Warrant has been exercised in full, in which case, the Holder shall surrender this Warrant to the Corporation for cancellation within three (3) Trading Days of the date the final Notice of Exercise Form is delivered

to the Corporation. Partial exercises of this Warrant resulting in purchases of a portion of the total number of Warrant Shares available hereunder shall have the effect of reducing the outstanding number of Warrant Shares purchasable hereunder in

an amount equal to the applicable number of Warrant Shares purchased. The Holder and the Corporation shall maintain records showing the number of Warrant Shares purchased and the date of such purchases. The Holder and any assignee, by acceptance

of this Warrant, acknowledge and agree that, by reason of the provisions of this paragraph, following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time will be

less than the amount stated on the face hereof.

(b) Exercise Price. The exercise price per Common Share under this Warrant

shall be US$ , subject to adjustment hereunder (the “Exercise Price”).

(c) Cashless Exercise.

(i) Notwithstanding anything contained herein to the contrary (other than Section 1(f) below), the Holder may, in its

sole discretion, exercise this Warrant in whole or in part and, in lieu of making the cash payment of the Exercise Price otherwise contemplated to be made to the Corporation upon such exercise, elect instead to receive upon such exercise the

“Net Number” of Common Shares determined according to the following formula (a “Cashless Exercise”):

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Number = |

|

(A- B) x (C) |

|

|

|

|

|

|

|

|

|

|

|

|

(A) |

|

|

|

|

|

|

|

|

|

|

For purposes of the foregoing formula:

A= the last VWAP for a full Trading Day immediately preceding the time that the Holder elects to exercise this Warrant by means of a

“cashless exercise,” as set forth in the applicable Notice of Exercise.

B = the Exercise Price of this Warrant, as adjusted in

accordance with the provisions of this Warrant.

C = the number of Warrant Shares that would be issuable upon exercise of this Warrant in

accordance with the terms of this Warrant if such exercise were by means of a cash exercise rather than a cashless exercise.

(ii) If Warrant Shares are issued in a Cashless Exercise, the parties acknowledge and agree that in accordance with

Section 3(a)(9) of the 1933 Act, the Warrant Shares shall take on the registered characteristics of the Warrants being exercised. The Corporation agrees not to take any position contrary to this Section 1(c)(ii).

(d) Disputes. In the case of a dispute as to the determination of the Exercise Price or the arithmetic calculation of

the number of Warrant Shares to be issued pursuant to the terms hereof, the Corporation shall promptly issue to the Holder the number of Warrant Shares that are not disputed and resolve such dispute in accordance with Section 4(f).

- 2 -

(e) Mechanics of Exercise.

(i) Share Delivery. On or before the end of the first Trading Day following the date on which the Corporation has

received the Notice of Exercise Form and, provided, that, the Holder has paid in full the aggregate Exercise Price for the Warrants being exercised by wire transfer or cashier’s check drawn on a United States bank or pursuant to the Cashless

Exercise procedure specified in Section 1(c) above (the “Share Delivery Date”), the Corporation shall, (X) provided that the Transfer Agent is participating in The Depository Trust Corporation (“DTC”) Fast

Automated Securities Transfer Program (the “FAST Program”) and so long as the certificates therefor are not required to bear a legend regarding restriction on transferability (which includes, without limitation, any exercise of this

Warrant pursuant to a Cashless Exercise), upon the request of the Holder, credit such aggregate number of Common Shares to which the Holder is entitled pursuant to such exercise to the Holder’s or its designee’s balance account with DTC

through its Deposit/Withdrawal at Custodian system, or (Y), if the Transfer Agent is not participating in the FAST Program or if the certificates are required to bear a legend regarding restriction on transferability, issue and dispatch by overnight

courier to the address as specified in the Notice of Exercise Form, a certificate, registered in the Corporation’s share register in the name of the Holder or its designee, representing the number of Common Shares to which the Holder is

entitled pursuant to such exercise. The Corporation shall pay any and all taxes and other expenses of the Corporation (including overnight delivery charges) that may be payable with respect to the issuance and delivery of Warrant Shares upon

exercise of this Warrant; provided, however, that the Corporation shall not be required to pay any tax which may be payable in respect of any transfer involved in the registration of any certificates for Warrant Shares or Warrants in a name other

than that of the Holder or an Affiliate thereof. The Company agrees to maintain a transfer agent that is a participant in the FAST program so long as this Warrant remains outstanding and exercisable. Solely for purposes of Regulation SHO under the

Securities Act, the Warrant Shares shall be deemed to have been issued, and the Holder shall be deemed to have become a holder of record of such shares as of the time of delivery of the Notice of Exercise, so long as payment to the Company of the

aggregate Exercise Price (or by “cashless exercise” pursuant to Section 1(c)) is made on or prior the second Trading Day following the delivery of such Notice of Exercise.

(ii) Delivery of New Warrants Upon Exercise. If this Warrant shall have been exercised in part, the Corporation shall,

at the request of a Holder and upon surrender of this Warrant certificate, at the time of delivery of the Warrant Shares, deliver to the Holder a new Warrant evidencing the rights of the Holder to purchase the balance of the unpurchased Warrant

Shares called for by this Warrant, which new Warrant shall in all other respects be identical with this Warrant.

(iii)

Rescission Rights. If the Corporation fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares pursuant to Section 1(e)(i) hereof by the Share Delivery Date, then the Holder will have the right to rescind such

exercise.

- 3 -

(iv) Compensation for Buy-In on Failure to Timely Deliver Warrant Shares Upon

Exercise. In addition to any other rights available to the Holder, if the Corporation fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares pursuant to an exercise on or before the Share Delivery Date, and if after such

date the Holder is required by its broker to purchase (in an open market transaction or otherwise) or the Holder’s brokerage firm otherwise purchases, Common Shares to deliver in satisfaction of a sale by the Holder of the Warrant Shares which

the Holder anticipated receiving upon such exercise (a “Buy-In”), then the Corporation shall (A) pay in cash to the Holder the amount, if any, by which (x) the Holder’s total purchase price (including brokerage

commissions, if any) for the Common Shares so purchased exceeds (y) the amount obtained by multiplying (1) the number of Warrant Shares that the Corporation was required to deliver to the Holder in connection with the exercise at issue

times (2) the price at which the sell order giving rise to such purchase obligation was executed, and (B) at the option of the Holder, either reinstate the portion of this Warrant and equivalent number of Warrant Shares for which such

exercise was not honored (in which case such exercise shall be deemed rescinded) or deliver to the Holder the number of Common Shares that would have been issued had the Corporation timely complied with its exercise and delivery obligations

hereunder. For example, if the Holder purchases Common Shares having a total purchase price of US$11,000 to cover a Buy-In with respect to an attempted exercise of shares of Common Shares with an aggregate sale price giving rise to such purchase

obligation of US$10,000, under clause (A) of the immediately preceding sentence the Corporation shall be required to pay the Holder US$1,000. Notwithstanding the foregoing, the Corporation shall not be required to make the payments set forth

herein in the case of uncertificated Warrant Shares if the Holder fails to timely file a request with the DTC to receive such uncertificated Warrant Shares. The Holder shall provide the Corporation written notice indicating the amounts payable to

the Holder in respect of the Buy-In and, upon request of the Corporation, evidence of the amount of such loss. Nothing herein shall limit a Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including,

without limitation, a decree of specific performance and/or injunctive relief with respect to the Corporation’s failure to timely deliver the Warrant Shares as required pursuant to the terms hereof.

(v) No Fractional Shares or Scrip. No fractional shares or scrip representing fractional shares shall be issued upon

the exercise of this Warrant. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such exercise, the Corporation shall, at its election, either pay a cash adjustment in respect of such final fraction in an

amount equal to such fraction multiplied by the Exercise Price or round up to the next whole share.

(vi) Charges,

Taxes and Expenses. Issuance of Warrant Shares shall be made without charge to the Holder for any issue or transfer tax or other incidental expense in respect of the issuance of such Warrant Shares, all of which taxes and expenses shall be paid

by the Corporation, and such Warrant Shares shall be issued in the name of the Holder or in such name or names as may be directed by the Holder; provided, however, that in the event Warrant Shares are to be issued in a name other than

the name of the Holder, this Warrant when surrendered for exercise shall be accompanied by the Assignment Form attached hereto duly executed by the Holder and the Corporation may require, as a condition thereto, the payment of a sum sufficient to

reimburse it for any transfer tax incidental thereto.

- 4 -

(vii) Closing of Books. The Corporation will not close its shareholder

books or records in any manner which prevents the timely exercise of this Warrant, pursuant to the terms hereof.

(f)

Holder’s Exercise Limitations. The Corporation shall not effect any exercise of this Warrant, and a Holder shall not have the right to exercise any portion of this Warrant, pursuant to Section 1 hereof or otherwise, to the extent

that after giving effect to such issuance after exercise as set forth on the applicable Notice of Exercise, the Holder (together with the Holder’s Affiliates, and any other Person acting as a group together with the Holder or any of the

Holder’s Affiliates (such Persons, “Attribution Parties”)), would beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For purposes of the foregoing sentence, the number of Common Shares

beneficially owned by the Holder and its Affiliates and Attribution Parties shall include the number of Common Shares issuable upon exercise of this Warrant with respect to which such determination is being made, but shall exclude the number of

Common Shares which would be issuable upon (i) exercise of the remaining, non-exercised portion of this Warrant beneficially owned by the Holder or any of its Affiliates or any Attribution Parties and (ii) exercise or conversion of the

unexercised or non-converted portion of any other securities of the Corporation (including, without limitation, any other Common Shares Equivalents) subject to a limitation on conversion or exercise analogous to the limitation contained herein

beneficially owned by the Holder or any of its Affiliates or Attribution Parties. Except as set forth in the preceding sentence, for purposes of this Section 1(f), beneficial ownership shall be calculated in accordance with Section 13(d)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder, it being acknowledged by the Holder that the Corporation is not representing to the Holder that such

calculation is in compliance with Section 13(d) of the Exchange Act and the Holder is solely responsible for any schedules required to be filed in accordance therewith. To the extent that the limitation contained in this Section 1(f)

applies, the determination of whether this Warrant is exercisable (in relation to other securities owned by the Holder together with any Affiliates and Attribution Parties) and of which portion of this Warrant is exercisable shall be in the sole

discretion of the Holder, and the submission of a Notice of Exercise shall be deemed to be the Holder’s determination of whether this Warrant is exercisable (in relation to other securities owned by the Holder together with any Affiliates and

Attribution Parties) and of which portion of this Warrant is exercisable, in each case subject to the Beneficial Ownership Limitation, and the Corporation shall have no obligation to verify or confirm the accuracy of such determination and shall

have no liability for exercises of this Warrant that are in non-compliance with the Beneficial Ownership Limitation. In addition, a determination as to any group status as contemplated above shall be determined in accordance with Section 13(d)

of the Exchange Act and the rules and regulations promulgated thereunder. For purposes of this Section 1(f), in determining the number of outstanding Common Shares, a Holder may rely on the number of outstanding Common Shares as reflected in

(A) the Corporation’s most recent audited annual or unaudited interim consolidated financial statements and/or accompanying management’s discussion and analysis filed with or furnished to the U.S. Securities and Exchange Commission

(the “Commission”), as the case may be, (B) a more recent public

- 5 -

announcement by the Corporation or (C) a more recent written notice by the Corporation or the Transfer Agent setting forth the number of Common Shares outstanding. Upon the written or oral

request of a Holder, the Corporation shall within one Trading Day confirm orally and in writing to the Holder the number of Common Shares then outstanding as established by (A), (B) or (C) above, as applicable. In any case, the number of

outstanding Common Shares shall be determined after giving effect to the conversion or exercise of securities of the Corporation, including this Warrant, by the Holder or its Affiliates or Attribution Parties since the date as of which such number

of outstanding shares of Common Shares was reported. The “Beneficial Ownership Limitation” shall initially be 4.99% of the number of Common Shares outstanding immediately after giving effect to the issuance of Common Shares issuable

upon exercise of this Warrant (or such lower percentage as otherwise requested by the Holder in writing on or prior to the Subscription Date). At any time the Holder may increase or decrease the Beneficial Ownership Limitation to any other

percentage not in excess of 9.99% as specified in a written notice by the Holder to the Corporation; provided that (i) any such increase will not be effective until the 61st day after such notice is delivered to the Corporation, and

(ii) any such increase or decrease will apply only to the Holder sending such notice and not to any other holder of Warrants. The provisions of this paragraph shall be construed and implemented in a manner otherwise than in strict conformity

with the terms of this Section 1(f) to correct this paragraph (or any portion hereof) which may be defective or inconsistent with the intended Beneficial Ownership Limitation herein contained or to make changes or supplements necessary or

desirable to properly give effect to such limitation. The limitations contained in this paragraph shall apply to a successor holder of this Warrant. If any Common Shares are delivered to a Holder (or its designee) in violation of this

Section 1(f) as a result of an error or omission made or committed by or the inadvertence of the Holder (including in connection with any breach or inaccuracy of the Holder’s representation provided in Item 3 of the Notice of

Exercise), the Corporation shall, to the extent permitted by the Canada Business Corporations Act and only if no issuer bid or issuer tender offer rules would in any way apply thereto, use its commercially reasonable efforts to have the

Corporation’s registrar and transfer agent unwind such issuance and cancel such Common Shares, with the Holder having the right thereafter to cancel, in whole or in part, such Exercise Notice, as applicable, with respect to the issuance of such

amount in excess of the Beneficial Ownership Limitation at such time (after which such amount shall be eligible to be exercised hereunder).

Section 2. Certain Adjustments.

(a) Stock Dividends and Splits. Without limiting any provision of Section 2, if the Corporation, at any time on or

after the Subscription Date, (i) pays a share dividend on one or more classes of its then outstanding Common Shares or otherwise makes a distribution on any class of share capital that is payable in Common Shares, (ii) subdivides (by any

share split, share dividend, recapitalization or otherwise) one or more classes of its then outstanding Common Shares into a larger number of shares or (iii) combines (by combination, reverse share split or otherwise) one or more classes of its

then outstanding Common Shares into a smaller number of shares, then in each such case the Exercise Price shall be multiplied by a fraction of which the numerator shall be the number of Common Shares outstanding immediately before such event and of

which the denominator shall be the number of Common Shares outstanding immediately after such event. Any adjustment made

- 6 -

pursuant to clause (i) of this paragraph shall become effective immediately after the record date for the determination of shareholders entitled to receive such dividend or distribution, and

any adjustment pursuant to clause (ii) or (iii) of this paragraph shall become effective immediately after the effective date of such subdivision or combination. If any event requiring an adjustment under this paragraph occurs during the

period that an Exercise Price is calculated hereunder, then the calculation of such Exercise Price shall be adjusted appropriately to reflect such event. Any adjustment made pursuant to this Section 2(a) shall become effective immediately after

the record date for the determination of shareholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination, consolidation or re-classification.

(b) Subsequent Rights Offerings. In addition to any adjustments pursuant to Section 2(a) above, if at any

time after the Subscription Date and on or prior to the Termination Date the Corporation grants, issues or sells any Options, Convertible Securities or rights to purchase shares, warrants, securities or other property pro rata to the record

holders of any class of Common Shares (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the

Holder had held the number of Common Shares acquirable upon complete exercise of this Warrant (without regard to any limitations on exercise hereof, including without limitation, the Beneficial Ownership Limitation) immediately before the date on

which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of Common Shares are to be determined for the grant, issuance or sale of such Purchase Rights

(provided, however, to the extent that the Holder’s right to participate in any such Purchase Right would result in the Holder exceeding the Beneficial Ownership Limitation, then the Holder shall not be entitled to participate in such Purchase

Right to such extent (or beneficial ownership of such Common Shares as a result of such Purchase Right to such extent) and such Purchase Right to such extent shall be held in abeyance for the Holder until such time, if ever, as its right thereto

would not result in the Holder exceeding the Beneficial Ownership Limitation).

(c) Pro Rata Distributions.

At any time after the Subscription Date and on or prior to the Termination Date, if the Corporation shall declare or make any dividend or other distribution of its assets (or rights to acquire its assets) to holders of Common Shares, by way of

return of capital or otherwise (including, without limitation, any distribution of cash, shares or other securities, property or options by way of a dividend, spin off, reclassification, corporate rearrangement, scheme of arrangement or other

similar transaction), other than the dividends or other distributions described in Section 2(a) above (a “Distribution”), at any time after the Subscription Date, then, in each such case, the Holder shall be entitled to

participate in such Distribution to the same extent that the Holder would have participated therein if the Holder had held the number of Common Shares acquirable upon complete exercise of this Warrant (without regard to any limitations on exercise

hereof, including without limitation, the Beneficial Ownership Limitation) immediately before the date on which a record is taken for such Distribution, or, if no such record is taken, the date as of which the record holders of Common Shares are to

be determined for the participation in such Distribution (provided, however, to the extent that the Holder’s right to participate in any such Distribution would result in the Holder exceeding the Beneficial Ownership Limitation,

then the Holder shall not be entitled to participate in such Distribution to such extent (or in the beneficial ownership of any such Common Shares as a result of such Distribution to such extent) and the portion of such Distribution shall be held in

abeyance for the benefit of the Holder until such time, if ever, as its right thereto would not result in the Holder exceeding the Beneficial Ownership Limitation).

- 7 -

(d) Number of Warrant Shares. Simultaneously with any adjustment to the

Exercise Price pursuant to paragraph(a) of this Section 2, the number of Warrant Shares that may be purchased upon exercise of this Warrant shall be increased or decreased proportionately, so that after such adjustment the aggregate Exercise

Price payable hereunder for the adjusted number of Warrant Shares shall be the same as the aggregate Exercise Price in effect immediately prior to such adjustment (without regard to any limitations on exercise contained herein).

(e) Voluntary Adjustment By Corporation. The Corporation may at any time during the term of this Warrant, with the

prior written consent of the Holder and with the approval of the TSX, provided the Corporation shall at such time be an issuer listed on the TSX and to the extent such approval is required under TSX rules and policies at such time, reduce the then

current Exercise Price to any amount and for any period of time deemed appropriate by the Board of Directors of the Corporation.

(f) Fundamental Transaction. The Corporation shall not enter into or be party to a Fundamental Transaction unless

(i) the Successor Entity assumes in writing all of the obligations of the Corporation under this Warrant in accordance with the provisions of this Section 2(f) pursuant to written agreements in form and substance satisfactory to the Holder

and approved by the Holder prior to such Fundamental Transaction, including agreements to deliver to the Holder in exchange for this Warrant a security of the Successor Entity evidenced by a written instrument substantially similar in form and

substance to this Warrant, including, without limitation, which is exercisable for a corresponding number of shares of share capital equivalent to the Common Shares acquirable and receivable upon exercise of this Warrant (without regard to any

limitations on the exercise of this Warrant) prior to such Fundamental Transaction, and with an exercise price which applies the exercise price hereunder to such shares of share capital (but taking into account the relative value of the Common

Shares pursuant to such Fundamental Transaction and the value of such shares of share capital, such adjustments to the number of shares of share capital and such exercise price being for the purpose of protecting the economic value of this Warrant

immediately prior to the consummation of such Fundamental Transaction) and (ii) the Successor Entity (including its Parent Entity) is a publicly traded corporation whose Common Shares are quoted on or listed for trading on an Eligible Market.

Upon the consummation of each Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of the applicable Fundamental Transaction, the provisions of this Warrant referring to the

“Corporation” shall refer instead to the Successor Entity), and may exercise every right and power of the Corporation and shall assume all of the obligations of the Corporation under this Warrant with the same effect as if such Successor

Entity had been named as the Corporation herein. Upon consummation of each Fundamental Transaction, the Successor Entity shall deliver to the Holder confirmation that there shall be issued upon exercise of this Warrant at any time after the

consummation of the applicable Fundamental Transaction, in lieu of the Common Shares (or other securities, cash, assets or other property (except such items still issuable under Section 2(b) and (c) above, which shall continue to be

- 8 -

receivable thereafter)) issuable upon the exercise of this Warrant prior to the applicable Fundamental Transaction, such shares of publicly traded common stock (or its equivalent) of the

Successor Entity (including its Parent Entity) which the Holder would have been entitled to receive upon the happening of the applicable Fundamental Transaction had this Warrant been exercised immediately prior to the applicable Fundamental

Transaction (without regard to any limitations on the exercise of this Warrant), as adjusted in accordance with the provisions of this Warrant. Notwithstanding the foregoing, and without limiting Section 1(f) hereof, the Holder may elect, at

its sole option, by delivery of written notice to the Corporation to waive this Section 2(f) to permit the Fundamental Transaction without the assumption of this Warrant. In addition to and not in substitution for any other rights hereunder,

prior to the consummation of each Fundamental Transaction pursuant to which holders of Common Shares are entitled to receive securities or other assets with respect to or in exchange for Common Shares (a “Corporate Event”), the

Corporation shall make appropriate provision to insure that the Holder will thereafter have the right to receive upon an exercise of this Warrant at any time after the consummation of the applicable Fundamental Transaction but prior to the

Termination Date, in lieu of the Common Shares (or other securities, cash, assets or other property (except such items still issuable under Section 2(b) and (c) above, which shall continue to be receivable thereafter)) issuable upon the

exercise of this Warrant prior to such Fundamental Transaction, such shares, securities, cash, assets or any other property whatsoever (including warrants or other purchase or subscription rights) which the Holder would have been entitled to receive

upon the happening of the applicable Fundamental Transaction had this Warrant been exercised immediately prior to the applicable Fundamental Transaction (without regard to any limitations on the exercise of this Warrant). Provision made pursuant to

the preceding sentence shall be in a form and substance reasonably satisfactory to the Holder.

(g) Black Scholes

Valuation. Notwithstanding the foregoing and the provisions of Section 2(f) above, at the request of the Holder delivered at any time commencing on the date of the public disclosure of any Fundamental Transaction through the date that is

ninety (90) days after the public disclosure of the consummation of such Fundamental Transaction, the Corporation or the Successor Entity (as the case may be) shall purchase this Warrant from the Holder within five (5) Business Days of

such request by paying to the Holder cash in an amount equal to the Black Scholes Value.

(h) Calculations. All

calculations under this Section 2 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be.

For purposes of this Section 2, the number of Common Shares deemed to be issued and outstanding as of a given date shall

be the sum of the number of Common Shares issued and outstanding.

(i) Notice to Holder.

(i) Adjustment to Exercise Price. Whenever the Exercise Price is adjusted pursuant to any provision of this

Section 2, the Corporation shall promptly deliver via e-mail or facsimile to the Holder a notice setting forth the Exercise Price after such adjustment and setting forth a brief statement of the facts requiring such adjustment. The Corporation

may, at its option and in lieu of delivering via e-mail or facsimile to the Holder the notice and brief statement described in the preceding sentence, post on its corporate website a notice and statement setting forth all of the relevant details of

the adjustment with a clear indication of which set or series of outstanding warrants such adjustment(s) apply to in a manner such that the Holder will be able to clearly identify what adjustment(s) apply(ies) to its Warrant(s).

- 9 -

(ii) Notice to Allow Exercise by Holder. If during the term in which this

Warrant may be exercised by the Holder (A) the Corporation shall declare a dividend (or any other distribution in whatever form payable pro rata to all of the Corporation’s shareholders) on the Common Shares, (B) the

Corporation shall declare a special non-recurring cash dividend on or a redemption of the Common Shares, (C) the Corporation shall authorize the granting to all holders of the Common Shares rights or warrants to subscribe for or purchase any

shares of capital stock of any class or of any rights (excluding any granting or issuance of rights to all of the Corporation’s shareholders pursuant to a shareholder rights plan), (D) the approval of any shareholders of the Corporation

shall be required in connection with any reclassification of the Common Shares, any consolidation or merger to which the Corporation is a party, any sale or transfer of all or substantially all of the assets of the Corporation, or any compulsory

share exchange whereby the Common Shares are converted into other securities, cash or property, or (E) the Corporation shall authorize the voluntary or involuntary dissolution, liquidation or winding-up of the affairs of the Corporation, then,

in each case, the Corporation shall cause to be delivered via e-mail or facsimile to the Holder at its last address as it shall appear upon the Warrant Register of the Corporation, at least twenty (20) calendar days prior to the applicable

record or effective date hereinafter specified, a notice stating (x) the date on which a record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants, or if a record is not to be taken, the date as of

which the holders of the Common Shares of record to be entitled to such dividend, distributions, redemption, rights or warrants are to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer or share

exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Shares of record shall be entitled to exchange their Common Shares for securities, cash or other property deliverable upon such

reclassification, consolidation, merger, sale, transfer or share exchange; provided that the failure to deliver such notice or any defect therein or in the delivering thereof shall not affect the validity of the corporate action required to be

specified in such notice. Without limiting the generality of the foregoing, the Corporation will give written notice to the Holder (i) promptly following each adjustment of the Exercise Price and the number of Warrant Shares, setting forth in

reasonable detail, and certifying, the calculation of such adjustment(s), (ii) at least twenty (20) days prior to the date on which the Corporation closes its books or takes a record (A) with respect to any grants, issuances or sales

of any Options, Convertible Securities or rights to purchase shares, warrants, securities or other property to holders of Common Shares (excluding any granting or issuance of rights to all of the Corporation’s shareholders pursuant to a

shareholder rights plan) or (B) for determining rights to vote with respect to any Fundamental Transaction, dissolution or liquidation, provided in each case that such information shall be made known to the public prior to or in conjunction

with such notice being provided to the Holder,

- 10 -

and (iii) at least ten (10) Trading Days prior to the consummation of any Fundamental Transaction. The Holder shall remain entitled to exercise this Warrant during the period commencing

on the date of such notice to the effective date of the event triggering such notice except as may otherwise be expressly set forth herein. To the extent that any notice provided hereunder constitutes, or contains, material, non-public information

regarding the Corporation or any of its Subsidiaries, the Corporation shall simultaneously file such notice with the Commission pursuant to a Report of Foreign Issuer on Form 6-K. It is expressly understood and agreed that the time of execution

specified by the Holder in each Notice of Exercise shall be definitive and may not be disputed or challenged by the Corporation.

Section 3. Transfer of Warrant.

(a) Transferability. Subject to compliance with applicable securities laws, this Warrant and all rights hereunder are

transferable, in whole or in part, upon surrender of this Warrant at the principal office of the Corporation or its designated agent, together with a written assignment of this Warrant substantially in the form attached hereto duly executed by the

Holder or its agent or attorney and funds sufficient to pay any transfer taxes payable upon the making of such transfer. Upon such surrender and, if required, such payment, the Corporation shall execute and deliver a new Warrant or Warrants in the

name of the assignee or assignees, as applicable, and in the denomination or denominations specified in such instrument of assignment, and shall issue to the assignor a new Warrant evidencing the portion of this Warrant not so assigned, and this

Warrant shall promptly be cancelled. This Warrant, if properly assigned in accordance herewith, may be exercised by a new holder for the purchase of Warrant Shares without having a new Warrant issued.

(b) New Warrants. This Warrant may be divided or combined with other Warrants upon presentation hereof at the aforesaid

office of the Corporation, together with a written notice specifying the names and denominations in which new Warrants are to be issued, signed by the Holder or its agent or attorney. Subject to compliance with Section 3(a), as to any transfer

which may be involved in such division or combination, the Corporation shall execute and deliver a new Warrant or Warrants in exchange for the Warrant or Warrants to be divided or combined in accordance with such notice. All Warrants issued on

transfers or exchanges shall include reference to the initial issue date set forth on the first page of this Warrant and shall be identical with this Warrant except as to the number of Warrant Shares issuable pursuant thereto and the Warrant number.

(c) Warrant Register. The Corporation shall register this Warrant, upon records to be maintained by the

Corporation for that purpose (the “Warrant Register”), in the name of the record Holder hereof from time to time. The Corporation may deem and treat the registered Holder of this Warrant as the absolute owner hereof for the purpose

of any exercise hereof or any distribution to the Holder, and for all other purposes, absent actual written notice to the contrary.

- 11 -

Section 4. Miscellaneous.

(a) No Rights as Shareholder Until Exercise. This Warrant does not entitle the Holder to any voting rights, dividends

or other rights as a shareholder of the Corporation prior to the exercise hereof except as otherwise set forth herein.

(b) Loss, Theft, Destruction or Mutilation of Warrant. The Corporation covenants that upon receipt by the Corporation

of evidence reasonably satisfactory to it of the loss, theft, destruction or mutilation of this Warrant or any share certificate relating to the Warrant Shares, and in case of loss, theft or destruction, of indemnity or security reasonably

satisfactory to it, and upon surrender and cancellation of such Warrant or share certificate, if mutilated, the Corporation will make and deliver a new Warrant or share certificate of like tenor and dated as of such cancellation, in lieu of such

Warrant or share certificate. Applicants for a replacement Warrant under such circumstances shall also comply with such other reasonable regulations and procedures and pay such other reasonable charges as the Corporation may prescribe.

(c) Saturdays, Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of

any right required or granted herein shall not be a Business Day, then, such action may be taken or such right may be exercised on the next succeeding Business Day.

(d) Authorized Shares. The Corporation hereby represents and warrants to the Holder that its articles do not provide

for any limit on the number of Common Shares that may be issued by the Corporation. The Corporation covenants that its issuance of this Warrant shall constitute full authority to its officers who are charged with the duty of executing share

certificates to execute and issue the necessary Warrant Shares upon the exercise of the purchase rights under this Warrant. The Corporation will take all such reasonable action as may be necessary to assure that such Warrant Shares may be issued as

provided herein without violation of any applicable law or regulation, or of any requirements of the Trading Market upon which the Common Shares may be listed. The Corporation covenants that all Warrant Shares which may be issued upon the exercise

of the purchase rights represented by this Warrant will, upon exercise of the purchase rights represented by this Warrant and payment for such Warrant Shares in accordance herewith, be duly authorized, validly issued, fully paid and non-assessable

and free from all taxes, liens and charges created by the Corporation in respect of the issue thereof (other than taxes in respect of any transfer occurring contemporaneously with such issue).

Except and to the extent as waived or consented to by the Holder, the Corporation shall not by any action, including, without

limitation, amending its articles of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issuance or sale of securities or any other voluntary action, avoid or seek to avoid the observance or

performance of any of the terms of this Warrant, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may be necessary or appropriate to protect the rights of the Holder as set

forth in this Warrant against impairment. Without limiting the generality of the foregoing, the Corporation will (i) take all such action as may be necessary or appropriate in order that the Corporation may validly and legally issue fully paid

and non-assessable Warrant Shares upon the exercise of this Warrant and (ii) use reasonable best efforts to obtain all such authorizations, exemptions or consents from any public regulatory body having jurisdiction thereof, as may be, necessary

to enable the Corporation to perform its obligations under this Warrant.

- 12 -

Before taking any action which would result in an adjustment in the number of

Warrant Shares for which this Warrant is exercisable or in the Exercise Price, the Corporation shall obtain all such authorizations or exemptions thereof, or consents thereto, as may be necessary from any public regulatory body or bodies having

jurisdiction thereof.

(e) Governing Law; Jurisdiction. This Warrant shall be governed by and construed and

enforced in accordance with, and all questions concerning the construction, validity, interpretation and performance of this Warrant shall be governed by, the internal laws of the State of New York, without giving effect to any choice of law or

conflict of law provision or rule (whether of the State of New York or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of New York. The Corporation and the Holder (including, for

greater certainty, any assignee of the Holder) hereby irrevocably submit to the exclusive jurisdiction of the state and federal courts sitting in The City of New York, Borough of Manhattan, for the adjudication of any dispute hereunder or in

connection herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waive, and agree not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such

court, that such suit, action or proceeding is brought in an inconvenient forum or that the venue of such suit, action or proceeding is improper. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner

permitted by law. Nothing contained herein shall be deemed or operate to preclude the Holder from bringing suit or taking other legal action against the Corporation in any other jurisdiction to collect on the Corporation’s obligations to the

Holder or to enforce a judgment or other court ruling in favor of the Holder. THE CORPORATION HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN

CONNECTION WITH OR ARISING OUT OF THIS WARRANT OR ANY TRANSACTION CONTEMPLATED HEREBY.

(f) Dispute

Resolution. In the case of a dispute as to the determination of the Exercise Price or the arithmetic calculation of the Warrant Shares, the Company shall submit the disputed determinations or arithmetic calculations via e-mail or facsimile

within two (2) Business Days of receipt of the Notice of Exercise giving rise to such dispute, as the case may be, to the Holder. If the Holder and the Company are unable to agree upon such determination or calculation of the Exercise

Price or the Warrant Shares within three (3) Business Days of such disputed determination or arithmetic calculation being submitted to the Holder, then the Company shall, within two (2) Business Days submit via e-mail or facsimile

(a) the disputed determination of the Exercise Price to an independent, reputable investment bank selected by the Company and approved by the Holder or (b) the disputed arithmetic calculation of the Warrant Shares to the

Company’s independent, outside accountant. The Company shall cause at its expense the investment bank or the accountant, as the case may be, to perform the determinations or calculations and notify the Company and the Holder of the results

no later than ten (10) Business Days from the time it receives the disputed determinations or calculations. Such investment bank’s or accountant’s determination or calculation, as the case may be, shall be binding upon all

parties absent demonstrable error.

- 13 -

(g) Restrictions. The Holder acknowledges that the Warrant Shares acquired

upon the exercise of this Warrant, if not registered, and the Holder does not utilize Cashless Exercise, will have restrictions upon resale imposed by state and federal securities laws and Canadian securities laws.

(h) Non-waiver and Expenses. No course of dealing or any delay or failure to exercise any right hereunder on the part

of the Holder shall operate as a waiver of such right or otherwise prejudice the Holder’s rights, powers or remedies.

(i) Notices. Unless otherwise provided, any notice required or permitted under this Warrant shall be given in writing

and shall be deemed effectively given as hereinafter described (i) if given by personal delivery, then such notice shall be deemed given upon such delivery, (ii) if given by e-mail or facsimile, then such notice shall be deemed given upon

receipt of confirmation of complete transmittal, (iii) if given by mail, then such notice shall be deemed given upon the earlier of (A) receipt of such notice by the recipient or (B) three Business Days after such notice is deposited

in first class mail, postage prepaid, and (iv) if given by a U.S. nationally recognized overnight air courier service, then such notice shall be deemed given one Business Day after delivery to such courier service. All notices shall be

addressed as follows: if to the Corporation, at its principal executive office and, if to the Holder, at its address specified in the Warrant Register.

(j) Limitation of Liability. No provision hereof, in the absence of any affirmative action by the Holder to exercise

this Warrant to purchase Warrant Shares, and no enumeration herein of the rights or privileges of Holder, shall give rise to any liability of Holder for the purchase price of any Common Shares or as a shareholder of the Corporation, whether such

liability is asserted by the Corporation or by creditors of the Corporation.

(k) Remedies. The remedies provided

in this Warrant shall be cumulative and in addition to all other remedies available under this Warrant, at law or in equity (including a decree of specific performance and/or other injunctive relief), and nothing herein shall limit the right of the

Holder to pursue actual and consequential damages for any failure by the Corporation to comply with the terms of this Warrant. The Corporation covenants to the Holder that there shall be no characterization concerning this instrument other than as

expressly provided herein. Amounts set forth or provided for herein with respect to payments, exercises and the like (and the computation thereof) shall be the amounts to be received by the Holder and shall not, except as expressly provided herein,

be subject to any other obligation of the Corporation (or the performance thereof). The Corporation acknowledges that a breach by it of its obligations hereunder will cause irreparable harm to the Holder and that the remedy at law for any such

breach may be inadequate. The Corporation therefore agrees that, in the event of any such breach or threatened breach, the holder of this Warrant shall be entitled, in addition to all other available remedies, to an injunction restraining any

breach, without the necessity of showing economic loss and without any bond or other security being required. The Corporation shall provide all information and documentation to the Holder that is requested by the Holder to enable the Holder to

confirm the Corporation’s compliance with the terms and conditions of this Warrant (including, without limitation, compliance with Section 2 hereof). The issuance of shares and certificates for shares as contemplated hereby upon the

exercise of this Warrant shall be made without charge to the Holder or such shares for any issuance tax or other costs in respect thereof, provided that the Corporation shall not be required to pay any tax which may be payable in respect of any

transfer involved in the issuance and delivery of any certificate in a name other than the Holder or its agent on its behalf.

- 14 -

(l) Successors and Assigns. Subject to applicable securities laws, this

Warrant and the rights and obligations evidenced hereby shall inure to the benefit of and be binding upon the successors and permitted assigns of the Corporation and the successors and permitted assigns of the Holder. The provisions of this Warrant

are intended to be for the benefit of any Holder from time to time of this Warrant and shall be enforceable by the Holder or holder of Warrant Shares.

(m) Amendment. This Warrant may be modified or amended with the written consent of the Corporation and the Holder and

with the approval of the TSX, provided the Corporation shall at such time be an issuer listed on the TSX and to the extent such approval is required under TSX rules and policies at such time. A Holder may also waive in writing a provision hereof in

its favour or for its benefit. No consideration shall be offered or paid to the Holder to amend or consent to a waiver or modification of any provision of this Warrant unless the same consideration is also offered to all of the holders of the other

Warrants.

(n) Severability. If any provision of this Warrant is prohibited by law or otherwise determined to be

invalid or unenforceable by a court of competent jurisdiction, the provision that would otherwise be prohibited, invalid or unenforceable shall be deemed amended to apply to the broadest extent that it would be valid and enforceable, and the

invalidity or unenforceability of such provision shall not affect the validity of the remaining provisions of this Warrant so long as this Warrant as so modified continues to express, without material change, the original intentions of the parties

as to the subject matter hereof and the prohibited nature, invalidity or unenforceability of the provision(s) in question does not substantially impair the respective expectations or reciprocal obligations of the parties or the practical realization

of the benefits that would otherwise be conferred upon the parties. The parties will endeavor in good faith negotiations to replace the prohibited, invalid or unenforceable provision(s) with a valid provision(s), the effect of which comes as close

as possible to that of the prohibited, invalid or unenforceable provision(s).

(o) Headings. The headings used in

this Warrant are for the convenience of reference only and shall not, for any purpose, be deemed a part of this Warrant.

(p) Payment of Collection, Enforcement and Other Costs. If (a) this Warrant is placed in the hands of an attorney

for collection or enforcement or is collected or enforced through any legal proceeding or the holder otherwise takes action to collect amounts due under this Warrant or to enforce the provisions of this Warrant or (b) there occurs any

bankruptcy, reorganization, receivership of the Corporation or other proceedings affecting the rights of the Corporation’s creditors and involving a claim under this Warrant, then the Corporation shall pay the costs incurred by the Holder for

such collection, enforcement or action or in connection with such bankruptcy, reorganization, receivership or other proceeding, including, without limitation, reasonable attorneys’ fees and disbursements.

- 15 -

Section 5. Certain Definitions. For purposes of this Warrant, the following terms

shall have the following meanings:

(a) “1933 Act” means the Securities Act of 1933, as amended, and the

rules and regulations promulgated thereunder.

(b) “Affiliate” means, with respect to any Person, any

other Person which directly or indirectly through one or more intermediaries controls, is controlled by, or is under common control with, such Person.

(c) “Bid Price” means for any security as of the particular time of determination, the bid price for such

security on NASDAQ as reported by Bloomberg as of such time of determination, or, if NASDAQ is not the principal securities exchange or trading market for such security, the bid price of such security on the principal securities exchange or trading

market where such security is listed or traded as reported by Bloomberg as of such time of determination, or if the foregoing does not apply, the bid price of such security in the over-the-counter market on the electronic bulletin board for such

security as reported by Bloomberg as of such time of determination, or, if no bid price is reported for such security by Bloomberg as of such time of determination, the average of the bid prices of any market makers for such security as reported in

the “pink sheets” by OTC Markets Group Inc. (formerly Pink Sheets LLC) as of such time of determination. If the Bid Price cannot be calculated for a security as of the particular time of determination on any of the foregoing bases, the Bid

Price of such security as of such time of determination shall be the fair market value as mutually determined by the Corporation and the Holder. If the Corporation and the Holder are unable to agree upon the fair market value of such security, then

such dispute shall be resolved in accordance with the procedures in Section 4(f). All such determinations shall be appropriately adjusted for any share dividend, share split, share combination or other similar transaction during such period.

(d) “Black Scholes Value” means the value of the unexercised portion of this Warrant remaining on the

date of the Holder’s request pursuant to Section 2(g), which value is calculated using the Black Scholes Option Pricing Model obtained from the “OV” function on Bloomberg utilizing (i) an underlying price per share equal to

the greatest of (1) the highest Closing Sale Price of the Common Shares during the period beginning on the Trading Day immediately preceding the earliest to occur of (x) the public disclosure of the applicable Fundamental Transaction,

(y) the consummation of the applicable Fundamental Transaction and (z) the date on which the Holder first became aware of the applicable Fundamental Transaction and ending on the Trading Day of the Holder’s request pursuant to

Section 2(g), (2) the sum of the price per share being offered in cash in the applicable Fundamental Transaction (if any) plus the value of the non-cash consideration being offered in the applicable Fundamental Transaction (if any) and

(3) without limiting clauses (1) and (2) above, if the applicable Fundamental Transaction results from a sale of all or substantially all of the assets of the Corporation or any of its Subsidiaries, a price per share equal to the

quotient of (A) the sum of (X) the total consideration (including, without limitation, cash and non-cash consideration, the assumption of indebtedness and other amounts, earn-outs and contingent consideration) offered in the applicable

Fundament Transaction plus (Y) the aggregate amount of cash then held by the Corporation and its Subsidiaries divided by (B)

- 16 -

the total number of Common Shares outstanding on the earlier to occur of the Trading Day of the Holder’s request pursuant to Section 2(g) and the date of consummation of the applicable

Fundamental Transaction, (ii) a strike price equal to the Exercise Price in effect on the date of the Holder’s request pursuant to Section 2(g), (iii) a risk-free interest rate corresponding to the U.S. Treasury rate for a period

equal to the greater of (1) the remaining term of this Warrant as of the date of the Holder’s request pursuant to Section 2(g) and (2) the remaining term of this Warrant as of the date of consummation of the applicable

Fundamental Transaction or as of the date of the Holder’s request pursuant to Section 2(g) if such request is prior to the date of the consummation of the applicable Fundamental Transaction, (iv) a zero cost of borrow and (v) an

expected volatility equal to the greater of 100% and the 100 day volatility obtained from the HVT function on Bloomberg (determined utilizing a 365 day annualization factor) as of the Trading Day immediately following the public disclosure of the

applicable Fundamental Transaction.

(e) “Bloomberg” means Bloomberg L.P. or, if Bloomberg L.P. no longer

reports the applicable pricing or other information, such other data service as may in the future replace Bloomberg L.P. as the primary industry source of stock market data.

(f) “Business Day” means any day other than a Saturday, Sunday or other legal holiday on which commercial

banks in The City of New York and Toronto, Canada, are open for the general transaction of business.

(g) “Closing

Sale Price” means for any security as of any date, the last closing trade price for such security on NASDAQ, as reported by Bloomberg, or, if NASDAQ begins to operate on an extended hours basis and does not designate the closing trade

price, then the last trade price of such security prior to 4:00:00 p.m., New York time, as reported by Bloomberg, or, if NASDAQ is not the principal securities exchange or trading market for such security, the last trade price of such security on

the principal securities exchange or trading market where such security is listed or traded as reported by Bloomberg, or if the foregoing does not apply, the last trade price of such security in the over-the-counter market on the electronic bulletin

board for such security as reported by Bloomberg, or, if no last trade price is reported for such security by Bloomberg, the average of the ask prices of any market makers for such security as reported in the “pink sheets” by OTC Markets

Group Inc. (formerly Pink Sheets LLC). If the Closing Sale Price cannot be calculated for a security on a particular date on any of the foregoing bases, the Closing Sale Price of such security on such date shall be the fair market value as mutually

determined by the Corporation and the Holder. If the Corporation and the Holder are unable to agree upon the fair market value of such security, then such dispute shall be resolved in accordance with the procedures in Section 4(f). All such

determinations shall be appropriately adjusted for any share dividend, share split, share combination or other similar transaction during such period.

(h) “Common Shares” means (i) the Corporation’s common shares, no par value per share, and

(ii) any share capital into which such Common Shares shall have been changed or any share capital resulting from a reclassification of such Common Shares.

(i) “Convertible Securities” means any share, note, bond, debenture or any other security (other than

Options) that is, or may become, at any time and under any circumstances, directly or indirectly, convertible into, exercisable or exchangeable for, or which otherwise entitles the holder thereof to acquire, any Common Shares.

- 17 -

(j) “Eligible Market” means The New York Stock Exchange, the

NYSE MKT, NASDAQ, the Nasdaq Global Select Market or TSX.

(k) “Fundamental Transaction” means that

(i) the Corporation shall, directly or indirectly, in one or more related transactions, (1) consolidate or merge with or into (whether or not the Corporation is the surviving corporation) any other Person, or (2) sell, lease, license,

assign, transfer, convey or otherwise dispose of all or substantially all of its respective properties or assets to any other Person, or (3) allow any other Person to make a purchase, tender or exchange offer that is accepted by the holders of

more than 50% of the outstanding Voting Shares of the Corporation (not including any Voting Shares of the Corporation held by the Person or Persons making or party to, or associated or affiliated with the Persons making or party to, such purchase,

tender or exchange offer), or (4) consummate a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with any other Person whereby

such other Person acquires more than 50% of the outstanding Voting Shares of the Corporation (not including any Voting Shares of the Corporation held by the other Person or other Persons making or party to, or associated or affiliated with the other

Persons making or party to, such stock or share purchase agreement or other business combination), or (5) the Corporation shall, directly or indirectly, in one or more related transactions, reorganize, recapitalize or reclassify the Common

Shares, or (ii) any “person” or “group” (as these terms are used for purposes of Sections 13(d) and 14(d) of the Exchange Act and the rules and regulations promulgated thereunder) is or shall become the “beneficial

owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of 50% of the aggregate ordinary voting power represented by issued and outstanding Voting Shares of the Corporation.

(l) “Options” means any rights, warrants or options to subscribe for or purchase Common Shares or Convertible

Securities.

(m) “Parent Entity” of a Person means an entity that, directly or indirectly, controls the

applicable Person and whose Common Shares or equivalent equity security is quoted or listed on an Eligible Market, or, if there is more than one such Person or Parent Entity, the Person or Parent Entity with the largest public market capitalization

as of the date of consummation of the Fundamental Transaction.

(n) “Person” means an individual,

corporation, partnership, limited liability Corporation, trust, business trust, association, joint stock Corporation, joint venture, sole proprietorship, unincorporated organization, governmental authority or any other form of entity not

specifically listed herein.

(o) “Subsidiary” means any Person in which the Corporation, directly or

indirectly, (i) owns any of the outstanding capital stock or holds any equity or similar interest of such Person or (ii) controls or operates all or any part of the business, operations or administration of such Person.

- 18 -

(p) “Successor Entity” means the Person (or, if so elected by

the Holder, the Parent Entity) formed by, resulting from or surviving any Fundamental Transaction or the Person (or, if so elected by the Holder, the Parent Entity) with which such Fundamental Transaction shall have been entered into.

(q) “Termination Date” means the date that is the fifth (5th) anniversary of the Initial Exercise Date

or, if such date falls on a day other than a Business Day or on which trading does not take place on any Trading Market (a “Holiday”), the next date that is not a Holiday.

(r) “Trading Day” means any day on which the Common Shares are traded on the NASDAQ Global Market or the

NASDAQ Capital Market (“NASDAQ”) or, if NASDAQ is not the principal U.S. trading market for the Common Shares, then on the principal securities exchange or securities market in the U.S. on which the Common Shares are then traded.

(s) “Voting Shares” of a Person means share capital of such Person of the class or classes pursuant to

which the holders thereof have the general voting power to elect, or the general power to appoint, at least a majority of the board of directors, managers or trustees of such Person (irrespective of whether or not at the time share capital of any

other class or classes shall have or might have voting power by reason of the happening of any contingency).

(t)

“VWAP” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Shares are then listed or quoted on NASDAQ, the daily volume weighted average price of the Common Shares for

such date (or the nearest preceding date) on NASDAQ as reported by Bloomberg (based on a Trading Day from 9:30 a.m. (prevailing Eastern time) to 4:02 p.m. (prevailing Eastern time); (b) if the Common Shares are not then listed or quoted on

NASDAQ, the daily volume weighted average price of the Common Shares for the period of five Trading Days ending on such date (or the nearest preceding date) on The Toronto Stock Exchange (the “TSX”) as reported in the TSX’s

Historical Data Access database (based on a Trading Day from 9:30 a.m. (prevailing Eastern time) to 4:02 p.m. (prevailing Eastern time), with the values used in the VWAP being calculated in Canadian dollars and then converted to United States

dollars based on the Bank of Canada’s nominal noon exchange rate for Canadian to United States dollars on such date; (c) if the Common Shares are not then listed or quoted on either NASDAQ or TSX (each, a “Trading

Market”), the volume weighted average price of the Common Shares for such date (or the nearest preceding date) on the OTC Bulletin Board; (d) if the Common Shares are not then listed or quoted on a Trading Market or the OTC Bulletin

Board and if prices for the Common Shares are then reported in the “Pink Sheets” published by OTC Markets, Inc. (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of

the Common Shares so reported; or (e) in all other cases, the fair market value of a Common Share as determined by an independent appraiser selected in good faith by the Corporation and reasonably acceptable to the Holders of a majority in

interest of the Warrants then outstanding, the fees and expenses of which shall be paid by the Corporation.

- 19 -

********************

(Signature Page Follows)

- 20 -

IN WITNESS WHEREOF, the Corporation has caused this Warrant to be executed by its officer

thereunto duly authorized as of the date first above indicated.

|

|

|

| AETERNA ZENTARIS INC. |

|

|

| By: |

|

|

|

|

Name: |

|

|

Title: |

NOTICE OF EXERCISE

| TO: |

AETERNA ZENTARIS INC. (the “Corporation”) |

| (1) |

The undersigned hereby elects to purchase Warrant Shares of the

Corporation pursuant to the terms of the attached Warrant of the Corporation (the “Warrant”) (only if exercised in full), and tenders herewith payment of the exercise price in full, together with all applicable transfer taxes, if

any. |

| (2) |

Payment shall take the form of (check applicable box): |

| |

¨ |

lawful money of the United States; or |

| |

¨ |

the cancellation of such number of Warrant Shares as is necessary, in accordance with the formula set forth in Section 1(c) of the Warrant, to exercise this Warrant with respect to the maximum number of Warrant

Shares purchasable pursuant to such cashless exercise procedure set forth in Section 1(c) of the Warrant. |

| (3) |

Notwithstanding anything to the contrary contained herein, this Exercise Notice shall constitute a representation by the Holder of the Warrant submitting this Exercise Notice that after giving effect to the exercise

provided for in this Exercise Notice, such Holder (together with its affiliates) will not have beneficial ownership (together with the beneficial ownership of such Person’s affiliates) of a number of Common Shares which exceeds the Beneficial

Ownership Limitation (as defined in the Warrant) of the total outstanding Common Shares of the Corporation as determined pursuant to the provisions of Section 1(f) of the Warrant. |

| (4) |