UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2015

Commission file number 0-30752

AETERNA

ZENTARIS INC.

1405 du Parc-Technologique Boulevard

Quebec City, Québec

Canada, G1P 4P5

(Address

of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b): 82- .

DOCUMENTS INDEX

|

|

|

| Documents |

|

Description |

|

|

| 99.1 |

|

Press release dated September 21, 2015 |

|

|

| 99.2 |

|

Form of Consent to Amendment of Series B Common Share Purchase Warrant |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AETERNA ZENTARIS INC. |

|

|

|

|

| Date: September 21, 2015 |

|

|

|

By: |

|

/s/ Philip A. Theodore |

|

|

|

|

|

|

Philip A. Theodore |

|

|

|

|

|

|

Senior Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary |

EXHIBIT 99.1

Æterna Zentaris Inc. 1405 du Parc-Technologique Blvd.

Québec (Québec) Canada G1P 4P5 T 418 652-8525 F 418 652-0881

www.aezsinc.com

|

|

|

Aeterna Zentaris Announces Amendment to

Series B Warrants |

|

Press Release

For immediate release |

All amounts are in US dollars

Quebec City, Canada, September 21, 2015 – Aeterna Zentaris Inc. (NASDAQ: AEZS; TSX: AEZ) (the “Company”) announced today that

it has entered into definitive agreements with the holders (the “Consenting Holders”) of approximately 90% of its outstanding Series B Common Share Purchase Warrants (the “Series B Warrants”) that are intended to reduce the

dilutive effect of the exercise of the Series B Warrants by establishing a cap on the number of shares issuable upon alternate net cashless exercise (“Net Cashless Exercise”) of the Series B Warrants until the close of business on

November 17, 2015 and by limiting the number of shares that the Consenting Holders may sell until the close of business on October 9, 2015. The Company was advised by Maxim Group LLC (“Maxim”) in its negotiations with the holders

of the Series B Warrants. The effectiveness of the amendments to the Series B Warrants is subject to the approval of the Toronto Stock Exchange.

David A.

Dodd, Chairman, President and Chief Executive Officer of the Company remarked regarding the agreements, “We believe that the agreements we reached with the Consenting Holders should temporarily reduce the selling pressure on our stock by

limiting the additional dilution from the Net Cashless Exercise of Series B Warrants. We appreciate the willingness of our Series B Warrant holders to work with us on this important step toward a resolution of the issues confronting our capital

structure. We also are grateful to Maxim for helping us to reach agreement with our Series B Warrant holders in an efficient manner.”

Under the

terms of the agreements, the number of Common Shares issuable per Series B Warrant with respect to Net Cashless Exercises prior to the close of business on November 17, 2015 may not exceed 33.23 based on a floor on the average volume weighted

average prices of $0.0541. The number of Common Shares issuable per Series B Warrant may be less than such number, however, if the price of the Company’s Common Shares recovers during the relevant period. In addition, during a

trading-limitation period that expires at the close of business on October 9, 2015, the Consenting Holders have agreed to limit their market sales of our Common Shares to an aggregate of 100 million shares, which limitation shall not apply

to any of the Company’s Common Shares sold at or above $0.10 per share.

As of September 21, 2015, approximately 10.8 million Series B

Warrants remained outstanding, representing approximately 36% of the number originally issued. In addition, the Company expects that, as of the close business on September 21, 2015, there will be approximately 363.5 million issued and

outstanding Common Shares.

The Company will pay Maxim an advisory fee and a success fee for each Series B Warrant that was amended. The Consenting

Holders were not compensated and did not receive any other consideration in connection with the amendments to be effected to the Series B Warrants.

About Maxim Group LLC

Maxim Group LLC is a full-service investment banking firm headquartered in New York. Maxim Group provides a full array of financial services including

investment banking; private wealth management; and global institutional equity, fixed-income and derivatives sales and trading as well as equity research. The investment banking group focuses on middle market and emerging growth companies within the

healthcare, technology, media, shipping, energy, retail, and business and financial services sectors. The institutional coverage of Maxim Group spans North and South America, Europe and Asia. Maxim Group LLC is a registered as a broker-dealer with

the U.S. Securities and Exchange Commission and is a member of the following: Financial Industry Regulatory Authority (FINRA); Municipal Securities Rulemaking Board (MSRB); Securities Insurance Protection Corporation (SIPC); NASDAQ Stock Market and

the NYSE Arca, Inc.

About Aeterna Zentaris Inc.

Aeterna Zentaris is a specialty biopharmaceutical company engaged in developing and commercializing novel treatments in oncology, endocrinology and

women’s health. For more information, visit www.aezsinc.com.

Forward Looking Statements

This press release contains forward-looking statements made pursuant to the safe harbor provisions of the US Securities Litigation Reform Act of 1995.

Forward-looking statements involve known and unknown risks and uncertainties that could cause actual events to differ materially from those in the forward-looking statements. Such risks and uncertainties include, among others, the effectiveness of

the above-described amendment of the Series B Warrants to temporarily reduce the selling pressure on our stock by limiting the additional dilution from the Net Cashless Exercise of Series B Warrants. Investors should consult the Company’s

quarterly and annual filings with the Canadian and US securities commissions for additional information on risks and uncertainties relating to forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking

statements. The Company does not undertake to update these forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained

herein to reflect future results, events or developments, unless required to do so by a governmental authority or by applicable law.

Contact:

Paul Burroughs

Director of Communications

(418) 652-8525 ext. 406

pburroughs@aezsinc.com

-30-

EXHIBIT 99.2

AETERNA ZENTARIS INC.

FORM OF CONSENT TO AMENDMENT OF

SERIES B COMMON SHARE PURCHASE WARRANT

THIS CONSENT TO AMENDMENT OF SERIES B COMMON SHARE PURCHASE WARRANT (this “Consent”) is dated as of September 18, 2015 (the

“Execution Date”) and is entered into by Aeterna Zentaris Inc., a Canadian corporation (the “Corporation”), and the undersigned holder (the “Holder”) of the Series B Common Share Purchase Warrant (the

“Warrant”) indicated below.

Section 1. Definitions. All capitalized terms used in this Consent without definition are

defined as set forth in the Warrant.

Section 2. Representations and Warranties of Holder. The Holder represents and warrants that

it is the registered and beneficial owner of the Warrant, free and clear of all liens, charges and encumbrances, and that it has the corporate power and authority to execute and deliver this Consent and to perform its obligations hereunder.

Section 3. Representations and Warranties of Corporation. The Corporation represents and warrants that it has the corporate power and

authority to execute and deliver this Consent and to perform its obligations hereunder.

Section 4. Amendment of Warrant. The

Holder hereby consents to the amendment and restatement of Section 1(c)(ii) of the Warrant as follows:

|

|

|

| Existing Provision |

|

Amended and Restated Provision |

| C=85% of the quotient of (A) the sum of the VWAP of the Common Shares for each of the five (5) lowest Trading Days during the fifteen (15) consecutive Trading Day period ending on and including the Trading Day immediately prior to

the applicable Exercise Date, divided by (B) five (5). |

|

C=85% of the quotient (the “Quotient”) of (A) the sum of the VWAP of the Common Shares for each of the five (5) lowest Trading Days during the fifteen (15) consecutive Trading Day period ending on and including the

Trading Day immediately prior to the applicable Exercise Date, divided by (B) five (5); provided, however, that if during the period commencing on September 18, 2015 and ending on November 17, 2015, the calculation set forth

above would result in the value of the Quotient being less than US$0.0541 (as adjusted for such events referred to and in accordance with Sections 2(b) and 2(d) hereof), the value of the Quotient shall be deemed to be exactly US$0.0541 (as adjusted

for such events referred to and in accordance with Sections 2(b) and 2(d) hereof). |

Section 5. Amendment Applicable to Subsequent Holders. The amendment of the Warrant pursuant to this

Consent shall apply to the Holder and to any and all subsequent holders of the Warrant.

Section 6. Covenant of Holder. During the

period commencing as of the close of business on September 18, 2015 and continuing through the close of business on October 9, 2015 (the “Restriction

1

Period”), the Holder shall not, and shall cause all Affiliates of the Holder acting on its behalf or pursuant to any understanding with such Holder with respect to the Common Shares not to

(i) sell, offer to sell, contract or agree to sell, hypothecate, pledge, grant any option to purchase, make any short sale or otherwise dispose of or agree to dispose of, directly or indirectly, more than an aggregate number of [●] Common

Shares (excluding, for greater certainty, any number of Common Shares issuable to the Holder pursuant to an Alternate Cashless Exercise, notice of which was given to and received by the Corporation at or prior to the close of business on or before

September 17, 2015) (collectively, the “Subject Shares”), or establish or increase a put equivalent position or liquidate or decrease a call equivalent position within the meaning of Section 16 of the Exchange Act and the rules and

regulations of the Securities and Exchange Commission promulgated thereunder with respect to the Subject Shares, or (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of

ownership of any of the Subject Shares, whether any such transaction described in clause (i) or (ii) above is to be settled by delivery of Common Shares or other securities, in cash or otherwise. The foregoing restriction is expressly agreed to

preclude the Holder, and any Affiliate of the Holder, during the Restriction Period, from engaging in any hedging or other transaction which is designed to or which reasonably could be expected to lead to or result in a sale or disposition of the

Subject Shares even if the Subject Shares would be disposed of by someone other than the undersigned. Such prohibited hedging or other transactions would include, without limitation, any short sale or any purchase, sale or grant of any right

(including, without limitation, any put or call option) with respect to any of the Subject Shares or with respect to any security that includes, relates to, or derives any significant part of its value from the Subject Shares.

Notwithstanding anything to the contrary, any Common Shares sold at a price at or above US$0.10 (as adjusted for such events referred to and

in accordance with Sections 2(b) and 2(d) hereof) shall not count toward the aggregate number of Subject Shares set forth above. For clarity, there shall be no limit on the number of Common Shares able to be sold by the Holder or any Affiliate of

the Holder at a price at or above US$0.10 (as adjusted for such events referred to and in accordance with Sections 2(b) and 2(d) hereof).

Section 7. Ratification of Warrant. The Corporation and the Holder hereby ratify the terms of the Warrant as amended and restated as

set forth above. For the avoidance of doubt, the Corporation and the Holder acknowledge that the amendment of Section 1(c)(ii) of the Warrant set forth in Section 4 of this Consent shall have effect only during the period of time set forth therein

and that after the expiration of such period of time, such amendment shall be inapplicable to exercises of the Warrant.

Section 8. TSX

Approval/ Effective Date. Notwithstanding anything to the contrary contained herein, the Corporation and the Holder hereby acknowledge and agree that, except as set forth in the following sentence, this Consent and the amendment and restatement

of the Warrant as contemplated hereby shall not become effective (the date of such effectiveness, the “Effective Date”) until (i) the Corporation shall have obtained the approval of the TSX in accordance with the terms of the Warrant and

(ii) the Corporation shall have received fully executed consents substantially identical to this Consent from holders of 90% or more of the aggregate number of Warrants issued and outstanding as at the close of business on the Execution Date

(including for purposes of such calculation, this Consent and the number of Warrants held by the Holder). Notwithstanding the foregoing, the Corporation and the Holder agree to abide by the terms of this Consent while the TSX is considering the

approval of this Consent. If (i) the TSX shall disapprove of this Consent or (ii) the Effective Date shall not have occurred on or prior to September 25, 2015, this Consent and any amendments to the Warrants shall automatically terminate.

Section 9. Public Announcement. On or before 9:30 a.m., New York City time, but in no event before 9:00 a.m., New York City Time, on

September 21, 2015, the Corporation shall (A) issue a press release (the “Press Release”) reasonably acceptable to the Holder disclosing all material terms of the

2

transactions contemplated hereby and (B) file a Current Report on Form 6-K describing the terms of the transactions contemplated by this Consent in the form required by the Exchange Act and

attaching the form of this Consent as exhibits to such filing (including all attachments), (the “6-K Filing”). From and after the filing of the 6-K Filing with the Commission, the Holder shall not be in possession of any material,

nonpublic information received from the Corporation, any of its Subsidiaries or any of their respective officers, directors, employees, affiliates or agents, that is not disclosed in the 6-K Filing. In addition, effective upon the filing of the 6-K

Filing, the Corporation acknowledges and agrees that any and all confidentiality or similar obligations under any agreement, whether written or oral, between the Corporation, any of its Subsidiaries or any of their respective officers, directors,

affiliates, employees or agents, on the one hand, and the Holder or any of their affiliates, on the other hand, shall terminate. The Corporation shall not, and shall cause each of its Subsidiaries and its and each of their respective officers,

directors, employees, affiliates and agents, not to, provide the Holder with any material, nonpublic information regarding the Corporation or any of its Subsidiaries from and after the date hereof without the express prior written consent of the

Holder. To the extent that the Corporation, any of its Subsidiaries or any of their respective officers, directors, affiliates, employees or agents delivers any material, non-public information to the Holder without the Holder’s consent, the

Corporation hereby covenants and agrees that the Holder shall not have any duty of confidentiality to the Corporation, any of its Subsidiaries or any of their respective officers, directors, employees, affiliates or agents with respect to, or a duty

to the Corporation, any of its Subsidiaries or any of their respective officers, directors, employees, affiliates or agents not to trade on the basis of, such material, non-public information.

Section 10. Governing Law. This Consent shall be governed by and construed and enforced in accordance with, and all questions

concerning the construction, validity, interpretation and performance of this Consent shall be governed by, the internal laws of the State of New York, without giving effect to any choice of law or conflict of law provision or rule (whether of the

State of New York or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of New York.

3

|

|

|

|

|

|

|

|

|

|

|

Corporation: |

|

|

|

Holder: |

|

|

|

|

|

|

Aeterna Zentaris Inc. |

|

|

|

[Name of Holder] |

|

|

|

|

|

| By: |

|

|

|

|

|

By: |

|

|

|

|

Dennis Turpin |

|

|

|

|

|

Name: |

|

|

Senior Vice President, CFO |

|

|

|

|

|

Title: |

4

Required Information

Warrant Number:

5

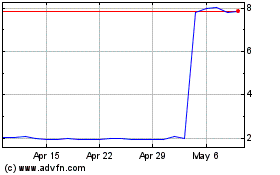

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

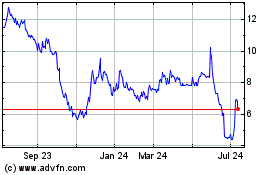

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024