UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_______________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May 2015

Commission file number 0-30752

_______________________________

AETERNA ZENTARIS INC.

_______________________________

1405 du Parc-Technologique Boulevard

Quebec City, Québec

Canada, G1P 4P5

(Address of principal executive offices)

_______________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No ý

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

DOCUMENTS INDEX

| |

99.1 | Press release dated May 7, 2015: Aeterna Zentaris Reports First Quarter 2015 Financial and Operating Results. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| | | | |

| | | | |

| | AETERNA ZENTARIS INC. |

| | | |

Date: May 7, 2015 | | By: | | /s/ Dennis Turpin |

| | | | Dennis Turpin |

| | | | Senior Vice President and Chief Financial Officer |

Aeterna Zentaris Inc. 1405 du Parc-Technologique Blvd.

Québec (Québec) Canada G1P 4P5 T 418-652-8525

www.aezsinc.com

Press Release

For immediate release

Aeterna Zentaris Reports 1st Quarter 2015 Financial and Operating Results

Company to hold annual and special meeting of shareholders on May 8, 2015

All amounts are in US dollars

Quebec City, Canada, May 7, 2015 - Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZ) (the "Company"), a specialty biopharmaceutical company engaged in developing and commercializing novel treatments in oncology, endocrinology and women's health, today reported financial and operating results for the first quarter ended March 31, 2015.

Research and development ("R&D") costs, were $4.5 million for the three-month period ended March 31, 2015, compared to $5.8 million for the same period in 2014. This decrease is attributable to lower comparative employee compensation and benefits costs, facilities rent and maintenance as well as other costs. A substantial portion of this decrease is due to the realization of cost savings in connection with the Company's global resource optimization program as well as the lower comparative exchange rate of the EUR against the US dollar. This decrease was partly compensated by higher third-party costs, mostly related to the Company's ZoptEC Phase 3 clinical trial in endometrial cancer.

Selling, general and administrative ("SG&A") expenses were $5.1 million for the three-month period ended March 31, 2015, as compared to $2.4 million for the same period in 2014. This increase is attributable to the Company's increased selling activities, associated with the co-promotion efforts related to EstroGel®, with $1.1 million of first quarter 2015 expenses being related to higher costs associated with Aeterna Zentaris' contracted sales force and its own sales and marketing staff. Additionally, approximately $0.8 million of the quarter-over-quarter increase is attributable to transaction costs incurred in connection with the completion of the March 2015 Offering. Other increases are attributable in large part to lower comparative foreign exchange gains.

Net loss for the three-month period ended March 31, 2015 was $9.7 million, or $0.13 per basic and diluted share, compared to $4.4 million, or $0.08 per basic and diluted share, for the same period in 2014. This increase in net loss is due largely to higher comparative SG&A expenses and to higher comparative net finance costs, partially offset by lower comparative R&D costs.

Cash and cash equivalents totaled $53.3 million as at March 31, 2015, as compared to $34.9 million as at December 31, 2014.

David Dodd, Aeterna Zentaris Chairman and CEO, commented, "During the quarter and in recent weeks, both of our late-stage drug development programs reached important milestones. As for zoptarelin doxorubicin, we received the DSMB's recommendation to continue our ZoptEC Phase 3 clinical trial in endometrial cancer as planned, following its first interim analysis. Now, with over 90% of patients enrolled, we are well on our way to completing patient recruitment earlier than expected, and look forward to achieve a second interim analysis by year-end. Regarding Macrilen™, after recommendations from the FDA and a panel of endocrinology experts, we announced our decision to proceed with a confirmatory Phase 3 efficacy clinical trial for the evaluation of adult growth hormone deficiency that we expect to initiate by year-end. At the commercial level, we've initiated the field selling, in specific US territories, of EstroGel®, Ascend Therapeutics' leading non-patch hormone replacement therapy product. Our selling efforts associated with EstroGel® are expected to result in successfully exceeding pre-established unit sales baseline thresholds on a total Aeterna Zentaris national basis. Furthermore, we just added another marketed product, EMD Serono's Saizen®, for the treatment of growth hormone deficiency, that we expect to shortly start promoting in specific US markets. As part of our strategy to become a

growth-oriented, commercially operating specialty biopharmaceutical organization, we expect to continue to evaluate potential in-licensing and/or acquisition opportunities, as well as additional promotional or co-promotional arrangements related to targeted commercial products, while continuing to develop our key product candidates in our existing pipeline. Finally, we accentuated the implementation our global resources optimization program which has resulted in significant personnel reduction and increased overall flexibility."

Dennis Turpin, Chief Financial Officer of the Company added, "With our cash and cash equivalents position of $53.3 million as at March 31, 2015, and our controlled burn rate, the Company has a solid financial position upon which it can advance its strategic initiatives."

1Q 2015 Highlights

Product Candidate Developments

Zoptarelin Doxorubicin

| |

• | On April 27, 2015, the Company announced that an independent Data and Safety Monitoring Board ("DSMB") for the pivotal Phase 3 ZoptEC (Zoptarelin Doxorubicin in Endometrial Cancer) clinical trial in women with advanced, recurrent or metastatic endometrial cancer, had completed a pre-specified first interim futility analysis. The DSMB has recommended that the Phase 3 clinical trial continue as planned. Site initiation for this trial has been completed with over 120 sites currently in operation and over 465 of the expected 500 patients have been entered into the trial. |

| |

• | Also, subsequent to quarter-end, the Company announced filing of an application for a European Patent on a novel method of manufacturing zoptarelin doxorubicin. The claimed manufacturing process is expected to result in a significant reduction in cost of goods sold, providing a stronger competitive position for the Company. |

Macrilen™ (macimorelin)

| |

• | On April 13, 2015, subsequent to quarter-end, the Company announced plans to conduct a new, confirmatory Phase 3 clinical trial to demonstrate the efficacy of Macrilen™, a novel orally-active ghrelin agonist for use in evaluating adult growth hormone deficiency ("AGHD"), as well as a dedicated thorough QT study to evaluate the effect of Macrilen™ on myocardial repolarization. |

Discovery Library

| |

• | On March 31, 2015, the Company announced the transfer of its discovery library of roughly 100,000 unique compounds to the South Carolina Center for Therapeutic Discovery and Development (the "Center") which is part of The Medical University of South Carolina. The Center has agreed to conduct screening and pre-clinical activities with respect to the library with a view toward submitting to the Company at least one development candidate per year in its areas of therapeutic interest over a ten-year period beginning in 2018. The Company will also have a right of first refusal to license the development candidates. |

Commercial Developments

| |

• | During the first quarter, the Company's contract sales representatives initiated calling on prescribing physicians in their respective US territories as part of Aeterna Zentaris' co-promotion activities for EstroGel®. Subsequent to quarter-end, Aeterna Zentaris' sales force began exceeding pre-established unit sales baseline thresholds on a total nation basis. |

| |

• | On May 7, 2015, subsequent to quarter-end, the Company announced that it had entered into a promotional services agreement with EMD Serono, Inc., allowing Aeterna Zentaris to promote Saizen® [somatropin (rDNA origin) for injection] to designated medical professionals in specified US territories. Saizen® is a recombinant human growth hormone registered in the US for the treatment of growth hormone deficiency in children and adults. Under this agreement, Aeterna Zentaris will detail Saizen® to designated medical professionals, representing an important incremental field promotion activity in support of the EMD Serono's product. Payment to Aeterna Zentaris will be based on new, eligible patient starts on Saizen® above an agreed-upon baseline. Aeterna Zentaris has subcontracted with ASCEND, pursuant to the co-promotion agreement, to detail Saizen® in territories not covered by the Company's contracted sales force. |

Corporate Developments

Public Offering

| |

• | On March 11, 2015, the Company completed a public offering of 59.7 million units, generating net proceeds of approximately $34.4 million, with each unit consisting of either one common share or one warrant to purchase one common share, 0.75 of a warrant to purchase one common share and 0.50 of a warrant to purchase one common share, at a purchase price of $0.62 per unit. |

Conference Call

Management will be hosting a conference call for the investment community beginning at 8:30 a.m. (Eastern Time) tomorrow, Friday, May 8, 2015, to discuss the 2015 first quarter results. Individuals interested in participating in the live conference call by telephone may dial, in Canada, 514-807-9895 or 647-427-7450, outside Canada, 888-231-8191. They may also listen through the Internet at www.aezsinc.com in the "Newsroom" section. A replay will be available on the Company's website for 30 days following the live event.

For reference, the Management's Discussion and Analysis of Financial Condition and Results of Operations for the first quarter 2015, as well as the Company's consolidated financial statements, can be found at www.aezsinc.com in the "Investors" section.

Annual and Special Shareholders Meeting

The Company will hold an Annual and Special Shareholders Meeting also on Friday, May 8, 2015, starting at 10:30 a.m., Eastern Time, at the offices of Norton Rose Fulbright Canada, 1 Place Ville-Marie, Suite 2500, in Montreal, Canada.

About Aeterna Zentaris Inc.

Aeterna Zentaris is a specialty biopharmaceutical company engaged in developing and commercializing novel treatments in oncology, endocrinology and women's health. For more information, visit www.aezsinc.com.

Forward-Looking Statements

This press release contains forward-looking statements made pursuant to the safe harbor provisions of the US Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that could cause the Company's actual results to differ materially from those in the forward-looking statements. Such risks and uncertainties include, among others, the availability of funds and resources to pursue R&D projects and clinical trials, the successful and timely completion of clinical studies, the risk that safety and efficacy data from any of our Phase 3 trials may not coincide with the data analyses from previously reported Phase 1 and/or Phase 2 clinical trials, the ability of the Company to efficiently commercialize one or more of its products or product candidates, the ability of the Company to take advantage of business opportunities in the pharmaceutical industry, uncertainties related to the regulatory process, the ability to protect our intellectual property, the potential of liability arising from shareholder lawsuits and general changes in economic conditions. Investors should consult the Company's quarterly and annual filings with the Canadian and US securities commissions for additional information on risks and uncertainties relating to forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements. The Company does not undertake to update these forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments, unless required to do so by a governmental authority or by applicable law.

Contact

Paul Burroughs

Director of Communications

(418) 652-8525 ext. 406

pburroughs@aezsinc.com

-30-

Attachment: Financial summary

Condensed Interim Consolidated Statements of Comprehensive Loss Information

|

| | | | | | |

| | Three months ended March 31, |

(in thousands) | | 2015 | | 2014 |

| | $ | | $ |

Revenues | | | | |

License fees | | 73 |

| | — |

|

Operating expenses | | | | |

Research and development costs | | 4,466 |

| | 5,830 |

|

Selling, general and administrative expenses | | 5,143 |

| | 2,365 |

|

| | 9,609 |

| | 8,195 |

|

Loss from operations | | (9,536 | ) | | (8,195 | ) |

Finance income | | 1,374 |

| | 4,919 |

|

Finance costs | | (1,474 | ) | | (1,028 | ) |

Net finance (costs) income | | (100 | ) | | 3,891 |

|

Net loss from continuing operations | | (9,636 | ) | | (4,304 | ) |

Net loss from discontinued operations | | (100 | ) | | (52 | ) |

Net loss | | (9,736 | ) | | (4,356 | ) |

Other comprehensive income (loss): | | | | |

Items that may be reclassified subsequently to profit or loss: | | | | |

Foreign currency translation adjustments | | 1,775 |

| | 23 |

|

Items that will not be reclassified to profit or loss: | | | | |

Actuarial loss on defined benefit plans | | (1,301 | ) | | (959 | ) |

Comprehensive loss | | (9,262 | ) | | (5,292 | ) |

Net loss per share (basic and diluted) from continuing operations | | (0.13 | ) | | (0.08 | ) |

Net loss per share (basic and diluted) from discontinued operations | | — |

| | — |

|

Net loss (basic and diluted) per share | | (0.13 | ) | | (0.08 | ) |

Weighted average number of shares outstanding: | | | | |

Basic | | 71,653,626 |

| | 54,921,459 |

|

Diluted | | 71,653,626 |

| | 54,921,459 |

|

Condensed Interim Consolidated Statement of Financial Position Information

|

| | | | | | |

| | As at March 31, | | As at December 31, |

(in thousands) | | 2015 | | 2014 |

| | $ | | $ |

Cash and cash equivalents1 | | 53,259 |

| | 34,931 |

|

Trade and other receivables and other current assets | | 2,292 |

| | 1,286 |

|

Restricted cash equivalents | | 674 |

| | 760 |

|

Property, plant and equipment | | 529 |

| | 797 |

|

Other non-current assets | | 8,520 |

| | 9,661 |

|

Total assets | | 65,274 |

| | 47,435 |

|

Payables and other current liabilities2 | | 6,078 |

| | 7,304 |

|

Current portion of deferred revenues | | 239 |

| | 270 |

|

Warrant liability | | 22,151 |

| | 8,225 |

|

Non-financial non-current liabilities3 | | 16,425 |

| | 17,152 |

|

Total liabilities | | 44,893 |

| | 32,951 |

|

Shareholders' equity | | 20,381 |

| | 14,484 |

|

Total liabilities and shareholders' equity | | 65,274 |

| | 47,435 |

|

_________________________

| |

1 | Of which approximately $2.4 million was denominated in EUR as at March 31, 2015 ($3.6 million as at December 31, 2014) |

| |

2 | Of which approximately $0.5 million is related to our provision for restructuring costs as at March 31, 2015 ($1.5 million as at |

December 31, 2014).

| |

3 | Comprised mainly of employee future benefits and provisions for onerous contracts. |

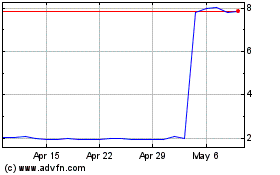

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

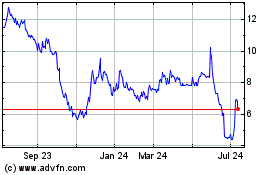

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024