WINDSOR, ON / ACCESSWIRE / May 6, 2015 /

The Wealthy Biotech Trader, an Investment

Newsletter focused on showing everyday Investors new opportunities

in rapidly growing little-known Biotech stocks, would like to

highlight several oncology (or cancer) focused biotech stocks

providing investors with greatest opportunity for significant

growth potential.

2015 has so far been the year of the biotech company and

investors are presented with a growing list of potential investment

opportunities. Here's a look at four of the companies that have

been stand-out so far this year and present investors with

significant upside opportunity. All have witnessed strong

developments operationally and have experienced a surge in investor

interest.

Propanc Health Group Corporation (OTC: PPCH), a

development stage healthcare company that is currently focused on

developing new cancer treatments for patients suffering from

pancreatic and colorectal cancer, leads a very interesting field of

companies that are making significant progress in the oncology

space.

Propanc recently announced the first set of results from its

animal studies using its treatment called PRP. According to the

company's announcement, PRP is showing no adverse clinical signs at

the maximum tolerated dose (MTD) in mice when administered by I.V

injection. Propanc has concluded that the findings are significant,

showing that PRP is safe and tolerable when administered

intravenously at higher doses. Follow-up to this news should report

on its efficacy, or simply how well PRP works on tumors.

The successful testing of PRP in animals paves the way for the

next step in the process of bringing a safe and effective treatment

solution to market. Indeed human clinical trials are an important

measure for the growth potential of any biotech opportunity and so

far Propanc looks poised to make the next big leap.

Since being featured in the NY Times Sunday Edition Magazine

under Health Essentials: Cancer Prevention & Treatment, April

19th, Propanc has eclipsed both its first and second resistance

levels. Trading at just a shave over 5 cents in a recent session,

the company has shown that investor interest is rising steadily and

confirms that PRP could be an effective treatment solution for

cancer, showing remarkable progress.

Investors should pay close attention to the underlying

infrastructure of Propanc's leading treatments which, for the most

part, are based on the company's novel formulation that either

involve or employ proenzymes - essential clinical components and

inactive precursors of enzymes.

Of course, there are several other players in the oncology space

providing investors with significant growth opportunity. Most

notable is Galena Biopharma, Inc. (GALE), a

company that recently completed enrollment in the NeuVax(TM)

(nelipepimut-S) Phase 3 PRESENT (Prevention of Recurrence in

Early-Stage, Node-Positive Breast Cancer with Low to Intermediate

HER2 Expression with NeuVax Treatment) clinical trial. The news is

significant because NeuVax(TM) is a first-in-class, HER2-directed

cancer immunotherapy which is currently being evaluated for its

efficacy in preventing the recurrence of breast cancer.

Considering that breast cancer is the most frequently diagnosed

cancer in the US for women, progress being made on the ground by

Galena is potentially life-saving news. The company which found

support at $1.37 has once again put itself on the investing radar

courtesy of healthy pullbacks. Currently the stock has a second

resistance point of $1.41 and there's a general belief that the

strong sector news could be a catalyst for a potential

breakout.

Unlike the previously mentioned two biotech companies,

Aeterna Zentaris Inc. (AEZS) is on a more advanced

path clinically. The company recently announced that the

independent Data Safety Monitoring Board (DSMB) for its important

late-stage study on zoptarelin doxorubicin has been given the

go-ahead for the continued phase III clinical study for the

treatment of women suffering from advanced metastatic endometrial

cancer. Again, this development shines the light on the importance

of the continued development of treatment for women affected by a

plethora of cancers. Investors have treated Aeterna Zentaris with

no less optimism and the stock has reached as high as 1.54 in the

last 12 months.

Consolidation for Aeterna Zentaris has been pretty steady over

the last few weeks where the stock has found support at around 54

cents. Incidentally, resistance at the upper level is currently 58

cents which suggests that at current levels investors who take

action could be looking at a potential breakout opportunity.

Finally, investors looking for the best of breed in terms of

biotech upside shouldn't ignore the exploits of Threshold

Pharmaceuticals Inc. (THLD). The developer of Evofosfamide

(previously known as TH-302), an investigational hypoxia-activated

prodrug, has announced intent to initialize phase II clinical

trials for its newly acquired cancer candidate, TH-4000.

Threshold Pharmaceuticals licensed TH-4000 (formerly known as

PR610 or Hypoxin) from the University of Auckland of New Zealand

back in September 2014. The drug holds promise because when it

enters the tumor cells, it diffuses to the hypoxic zone, in which

the TH-4000 effector (TH-4000E) is selectively activated and blocks

hypoxia-induced EGFR signaling and tumor cell survival. In a very

basic sense, TH-4000 is able to help in combatting the survival of

cancer-protracting EGFR.

Threshold Pharmaceuticals has enjoyed very strong consolidation

below 4.00 but investors have enjoyed rallies as high as 5.41 in

the last year. The stock is trading just above support of 3.42 and

with resistance not very far north at 3.74, investors could be in

line for another major delivery of profits on a potential

breakout.

The biotech industry presents incredible growth potential for

investors savvy enough to seize the opportunity today. Companies

like Propanc Health Group Corporation (PPCH) are

solid growth candidates as they combine the best of both worlds -

solid fundamentals and very robust technicals.

The Wealthy Biotech Trader is researching several new trade

ideas which have the makings for large market moves. Active traders

are urged to follow our parent outlet, The Wealthy Venture

Capitalist on social media to stay

apprised. We are an anti-email media outlet, and

as such will only be releasing our reports/ updates/ news through

our Twitter and Facebook accounts, as well as newswire.

TO GET BREAKING NEWS FROM US:

Add us on twitter: @Wealthy_VC

Like us on Facebook:

www.facebook.com/groups/TheWealthyVentureCapitalist/

FOR FURTHER INFORMATION PLEASE CONTACT US

AT:

Email: TheWealthyVentureCapitalist@Gmail.com

This report/release/profile is a commercial

advertisement and is for general information purposes only. We are

engaged in the business of marketing and advertising companies for

monetary compensation unless otherwise stated below.

The Wealthy Biotech Trader and its employees are not a

Registered Investment Advisors, Broker Dealers or a member of any

association for other research providers in any jurisdiction

whatsoever and we are not qualified to give financial advice.

The information contained herein is based on sources which we

believe to be reliable but is not guaranteed by us as being

accurate and does not purport to be a complete statement or summary

of the available data. The Wealthy Biotech Trader encourages

readers and investors to supplement the information in these

reports with independent research and other professional advice.

All information on featured companies is provided by the companies

profiled through their website, news releases, and corporate

filings, or is available from public sources and The Wealthy

Biotech Trader makes no representations, warranties or guarantees

as to the accuracy or completeness of the disclosure by the

profiled companies. Further, The Wealthy Biotech Trader has no

advance knowledge of any future events of the profiled companies

which includes, but is not limited to, news & press releases,

changes in corporate structure, or changes in share structure.

Our website and newsletter are for Entertainment purposes only.

This newsletter is NOT a source of unbiased information. Never

invest in any stock featured on our site or emails unless you can

afford to lose your entire investment.

Release of Liability: Through use of this email and/or website

advertisement viewing or using you agree to hold The Wealthy

Biotech Trader, its operators owners and employees harmless and to

completely release them from any and all liability due to any and

all loss (monetary or otherwise), damage (monetary or otherwise),

or injury (monetary or otherwise) that you may incur. The Wealthy

Biotech Trader sponsored advertisements do not purport to provide

an analysis of any company's financial position, operations or

prospects and this is not to be construed as a recommendation by

The Wealthy Biotech Trader or an offer or solicitation to buy or

sell any security.

COMPENSATION: The Wealthy Biotech Trader's

parent company has been compensated ten thousand dollars cash via

bank wire by Propanc Health Group Inc. (OTC: PPCH)

for an Investor Relations Contract and the Company will continue

these services in the future for roughly $5,000 per month. The

Wealthy Biotech Trader's owner / controlling parent entity has also

been compensated $60,000 by the Company in the form of a

convertible note and readers should understand they will convert

this note into common shares and sell them into the market as soon

as the statutory 144 hold period has lapsed. This compensation

constitutes a conflict of interest as to our ability to remain

objective in our communication regarding the profiled company.

None of the materials or advertisements herein constitute offers

or solicitations to purchase or sell securities of the companies

profiled herein and any decision to invest in any such company or

other financial decisions should not be made based upon the

information provide herein. Instead The Wealthy Biotech Trader

strongly urges you conduct a complete and independent investigation

of the respective companies and consideration of all pertinent

risks. Readers are advised to review SEC periodic reports: Forms

10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

The Wealthy Biotech Trader further urges you to consult your own

independent tax, business, financial and investment advisors.

Investing in micro-cap and growth securities is highly speculative

and carries and extremely high degree of risk. It is possible that

an investor's investment may be lost or impaired due to the

speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides

investors a 'safe harbor' in regard to forward-looking statements.

Any statements that express or involve discussions with respect to

predictions, expectations, beliefs, plans, projections, objectives,

goals, assumptions or future events or performance are not

statements of historical fact may be "forward looking statements".

Forward looking statements are based on expectations, estimates,

and projections at the time the statements are made that involve a

number of risks and uncertainties which could cause actual results

or events to differ materially from those presently anticipated.

Forward looking statements in this action may be identified through

use of words such as "projects," "foresee," "expects," "will, "

"anticipates," "estimates," "believes," "understands," or that by

statements indicating certain actions "may," "could," or "might"

occur. Understand there is no guarantee past performance will be

indicative of future results. Past Performance is based on the

security's previous day closing price and the high of day price

during our promotional coverage.

The Wealthy Venture Capitalist is a media, marketing and

advertising outlet which consists of several sector-focused outlets

collectively referred to as the Wealth Series: The Wealthy Biotech

Trader, The Silicon Valley Insider and the Radical Consumerist

(other may be added in the future). All of these outlets are named

as "pen names" for the parent Company that owns and controls them,

Circadian Group.

In preparing this publication, The Wealthy Biotech Trader has

relied upon information supplied by various public sources and

press releases which it believes to be reliable; however, such

reliability cannot be guaranteed. Investors should not rely on the

information contained in this email and website. Rather, investors

should use the information contained in this website as a starting

point for doing additional independent research on the featured

companies. The advertisements in this email and website are

believed to be reliable, however, The Wealthy Biotech Trader and

its owners, affiliates, subsidiaries, officers, directors,

representatives and agents disclaim any liability as to the

completeness or accuracy of the information contained in any

advertisement and for any omissions of materials facts from such

advertisement. The Wealthy Biotech Trader is not responsible for

any claims made by the companies advertised herein, nor is The

Wealthy Biotech Trader responsible for any other promotional firm,

its program or its structure.

SOURCE: The Wealthy Biotech Trader

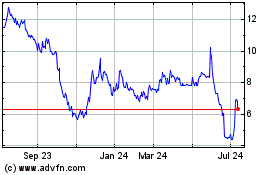

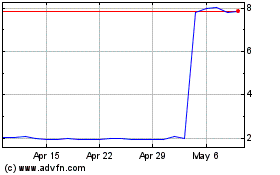

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024