UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2015

Commission file number 0-30752

AETERNA

ZENTARIS INC.

1405 du Parc-Technologique Boulevard

Quebec City, Québec

Canada, G1P 4P5

(Address

of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b): 82-__________.

DOCUMENTS INDEX

|

|

|

| Documents |

|

Description |

|

|

| 99.1 |

|

Press release dated March 11, 2015 |

|

|

| 99.2 |

|

Material Change Report dated March 11, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AETERNA ZENTARIS INC. |

|

|

|

|

| Date: March 11, 2015 |

|

|

|

By: |

|

/s/ Philip A. Theodore |

|

|

|

|

|

|

Philip A. Theodore |

|

|

|

|

|

|

Senior Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary |

EXHIBIT 99.1

Aeterna Zentaris Inc. 1405 du Parc-Technologique Blvd.

Québec (Québec) Canada G1P 4P5 T 418 652-8525 F 418 652-0881

www.aezsinc.com

|

|

|

| Aeterna Zentaris Announces Closing of US$37 Million Public Offering of Common Shares and Warrants |

|

Press Release

For immediate release |

Québec City, Canada, March 11, 2015 – Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZ) (the “Company”) today

announced the closing of its previously announced public offering of 59,677,420 units (the “Offering”) generating net proceeds of approximately US$34.5 million, with each unit consisting of one common share, 0.75 of a Series A warrant to

purchase one common share, and 0.50 of a Series B warrant to purchase one common share, at a purchase price of US$0.62 per unit. Investors whose purchase of Units in the Offering resulted in them beneficially owning more than the initial beneficial

ownership limitation included in the warrants following the consummation of the Offering had the opportunity to acquire Units with Series C pre-funded warrants substituted for any common shares they would have otherwise acquired over the initial

beneficial ownership limitation, paying the same price of US$0.62 per Unit. The Series A warrants are exercisable immediately and expire five years following issuance at an exercise price of US$0.81 per share. The Series B warrants are exercisable

immediately and expire 18 months following issuance at an exercise price of US$0.81 per share. The pre-funded Series C warrants are exercisable immediately and expire five years following issuance.

In connection with the Offering, the holders of approximately 21.1 million, or 96.5%, of the 21.9 million outstanding warrants issued by the Company

in previous public offerings of units in November 2013 and January 2014 entered into amendment agreements resulting in such warrants terminating upon closing of the Offering, in consideration for the Company making to the holders of such warrants a

cash payment in the aggregate amount of approximately US$5.7 million out of the proceeds of the Offering.

The Company intends to use the net proceeds

from the Offering to make the US$5.7 million payment to the holders of warrants in connection with the warrant amendment agreements described above, to continue to fund ongoing drug development activities, for the potential addition of

commercialized products to the Company’s pipeline, and for general corporate purposes, for working capital and to fund negative cash flow.

Canaccord

Genuity Inc. acted as the sole book-running manager, and Maxim Group LLC, H. C. Wainwright & Co., LLC and Roth Capital Partners acted as co-managers for the Offering.

This press release does not and shall not constitute an offer to sell or the solicitation of an offer to buy any of the Company’s securities, nor shall

there be any sale of the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Aeterna Zentaris Inc.

Aeterna Zentaris is a

specialty biopharmaceutical company engaged in developing and commercializing novel treatments in oncology, endocrinology and women’s health. For more information, visit www.aezsinc.com.

Forward-Looking Statements

This press release contains

forward-looking statements made pursuant to the safe harbor provisions of the US Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that could cause the Company’s actual

results to differ materially from those in the forward-looking statements. Such risks and uncertainties include, among others, the availability of funds and resources to pursue R&D projects, the successful and timely completion of clinical

studies, the risk that safety and efficacy data from any of our Phase 3 trials may not coincide with the data analyses from previously reported Phase 1 and/or Phase 2 clinical trials, the ability of the Company to efficiently commercialize one or

more of its products or product candidates, the ability of the Company to take advantage of business opportunities in the pharmaceutical industry, uncertainties related to the regulatory process, the potential of liability arising from shareholder

lawsuits and general changes in economic conditions. Investors should consult the Company’s quarterly and annual filings with the Canadian and US securities commissions for additional information on risks and uncertainties relating to

forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements. The Company does not undertake to update these forward-looking statements. We disclaim any obligation to update any such factors or

to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments, unless required to do so by a governmental authority or by applicable law.

Contact:

Paul Burroughs

Director of Communications

(418) 652-8525 ext. 406

pburroughs@aezsinc.com

-30-

Exhibit 99.2

FORM 51-102F3

MATERIAL

CHANGE REPORT

AETERNA ZENTARIS INC.

| 1. |

Name and Address of Company |

Aeterna Zentaris Inc. (the Corporation)

1405 du Parc-Technologique Boulevard

Québec City, Québec

Canada, G1P 4P5

| 2. |

Date of Material Change |

March 6 and 11, 2015

On March 6 and 11, 2015, the Corporation issued news releases

indicating the material change, which were disseminated in Canada on the Canada NewsWire service.

| 4. |

Summary of Material Change |

On March 5, 2015, the Corporation announced that it was

commencing an underwritten public offering of units (the Offering), consisting of common shares and warrants to purchase common shares.

On March 6, 2015, the Corporation announced that it had priced the Offering of 59,677,420 units (the Units), with each Unit

consisting of one common share, 0.75 of a Series A warrant to purchase one common share, and 0.50 of a Series B warrant to purchase one common share, at a purchase price of US$0.62 per Unit. Investors whose purchase of Units in the Offering would

have resulted in them beneficially owning more than the initial beneficial ownership limitation included in the warrants following the consummation of the Offering had the opportunity to acquire Units with Series C pre-funded warrants substituted

for any common shares they would have otherwise acquired over the initial beneficial ownership limitation, paying the same price of US$0.62 per Unit. The Series A warrants are exercisable immediately and expire five years following issuance at an

exercise price of US$0.81 per share. The Series B warrants are exercisable immediately and expire 18 months following issuance at an exercise price of US$0.81 per share. The pre-funded Series C warrants are exercisable immediately and expire five

years following issuance.

In connection with the Offering, the holders of approximately 21.1 million, or 96.5%, of the

21.9 million outstanding warrants issued by the Company in previous public offerings of units in November 2013 and January 2014 entered into amendment agreements resulting in such warrants terminating upon closing of the Offering, in

consideration for the Company making to the holders of such warrants a cash payment in the aggregate amount of approximately US$5.7 million out of the proceeds of the Offering.

The Offering was completed on March 11, 2015. At closing, the Corporation issued an aggregate of 25,048,065 common shares, Series A

warrants exercisable to purchase 44,758,065 common shares, Series B warrants exercisable to purchase 29,838,710 common shares, and pre-funded Series C warrants exercisable to purchase 34,629,355 common shares for aggregate net proceeds of

approximately US$34.5 million. The Offering was conducted pursuant to the terms and conditions of an underwriting agreement dated March 6, 2015 among the Corporation, as issuer, and Canaccord Genuity Inc., Maxim Group LLC, H.C.

Wainwright & Co., LLC and Roth Capital Partners, as underwriters.

| 5. |

Full Description of Material Change |

On March 5, 2015, the Corporation announced

that it was commencing the Offering, consisting of common shares and warrants to purchase common shares.

On March 6, 2015, the

Corporation announced that it had priced the Offering of 59,677,420 Units, with each Unit consisting of one common share, 0.75 of a Series A warrant to purchase one common share, and 0.50 of a Series B warrant to purchase one common share, at a

purchase price of US$0.62 per Unit. Investors whose purchase of Units in the Offering would have resulted in them beneficially owning more than the initial beneficial ownership limitation included in the warrants following the consummation of the

Offering had the opportunity to acquire Units with Series C pre-funded warrants substituted for any common shares they would have otherwise acquired over the initial beneficial ownership limitation, paying the same price of US$0.62 per Unit. The

Series A warrants are exercisable immediately and expire five years following issuance at an exercise price of US$0.81 per share. The Series B warrants are exercisable immediately and expire 18 months following issuance at an exercise price of

US$0.81 per share. The pre-funded Series C warrants are exercisable immediately and expire five years following issuance.

In connection

with the Offering, the holders of approximately 21.1 million, or 96.5%, of the 21.9 million outstanding warrants issued by the Company in previous public offerings of units in November 2013 and January 2014 entered into amendment

agreements resulting in such warrants terminating upon closing of the Offering, in consideration for the Company making to the holders of such warrants a cash payment in the aggregate amount of approximately US$5.7 million out of the proceeds of the

Offering.

The Offering was completed on March 11, 2015. At closing, the Corporation issued an aggregate of 25,048,065 common shares,

Series A warrants exercisable to purchase 44,758,065 common shares, Series B warrants exercisable to purchase 29,838,710 common shares, and pre-funded Series C warrants exercisable to purchase 34,629,355 common shares for aggregate net proceeds of

approximately US$34.5 million. The Offering was conducted pursuant to the terms and conditions of an underwriting agreement dated March 6, 2015 among the Corporation, as issuer, and Canaccord Genuity Inc., Maxim Group LLC, H.C.

Wainwright & Co., LLC and Roth Capital Partners, as underwriters.

| 6. |

Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

Not applicable.

Further information regarding the matters described in this report

may be obtained from Philip A. Theodore, Senior Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary. Mr. Theodore is knowledgeable about the details of the material change and may be contacted at

(843) 900-3211.

March 11, 2015

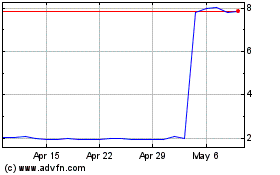

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

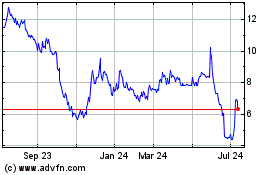

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024